Summary:

- Airline stocks have historically been a bad investment and there are multiple reasons for this.

- American Airlines is a prime example of the problems faced by airlines and there is little chance of this changing anytime soon.

- Any change in outlook could be short-lived and the ghosts of the past could come back to haunt this industry again.

kieferpix/iStock via Getty Images

Premise

Airlines have baffled even the savviest investors. It is a cyclical industry and as cyclical industries go, it has had its ups and downs over the years. But even among cyclical industries, the airline industry is a black sheep of the flock known for its unpredictability and complexity, making it a challenging sector for investors to navigate. From fluctuating fuel prices to shifting consumer preferences, airlines must constantly adapt to a range of external factors that can have a significant impact on their profitability. Additionally, the high fixed costs associated with running an airline can create significant financial pressure during times of reduced demand. Despite these challenges, some investors continue to see potential in the airline industry but this hope may be misplaced.

American Airlines (NYSE: AAL) is a prime example of an airline that not only faces all these challenges but fares much more poorly than many of its peers. In my write-up below we will examine its status and the hole it currently is in that makes the investment case very difficult.

Challenges of the airline industry

If a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it

– Warren Buffett in his annual letter

The challenges faced by the airlines have remained more or less the same in the last 50 years. If there is one industry that receives regular dislike it is the airline industry. And is this warranted? Certainly, consumers seem to think so.

Airlines have performed badly in customer satisfaction surveys with little evidence of improvement over the years. According to the 2018 ACSI report, the airline industry received a customer satisfaction score of 73, which places it among the lowest-ranked industries. The airline industry has consistently been ranked among the least satisfactory industries for more than two decades since the inception of ACSI.

But for all the hate received, are the airline companies at least making consistent bank? You guessed it right. That’s a no, too.

1. Too much competition

Ever since the deregulation in 1978, airline fares have been a boon to consumers but a bane for shareholders. Average round-trip fares after adjusting for inflation have fallen significantly (>50%) since 1980. There are more than 350 domestic airline businesses, about 60 scheduled carriers, and 18 major carriers but regulators and Congress have been reluctant to allow mergers that would at least allow some of them to survive better in adverse conditions. The recent news of the U.S. federal government moving to block JetBlue’s $3.8 billion merger with Spirit Airlines is another example of this fact.

2. Differentiation mostly by price

Customers have almost no brand loyalty when it comes to airlines. Speaking from personal experience, I always go by the cheapest airline that can get me from one place to another in the most cost-effective way that is possible.

Most of the time domestic airline brands are differentiated into two piles, cheap and not-so-cheap. Airlines have tried to be smart about pricing and have often been acknowledged as the pioneers of dynamic pricing. But they have only been able to get so far with it.

3. Held hostage by oil prices

A major cost for airlines is jet fuel which is dependent on oil prices. Oil prices are dictated by everything from war to supply shocks by OPEC to demand shocks by the macroeconomic environment. In many situations where oil prices are cheap, it is usually under a cloud of recession or as in the recent case when we had a pandemic. In both instances, airline industries already suffer from a low demand so it is not like they can take too much advantage of low oil prices either.

4. High costs

Airline companies must make significant investments in their aircraft, either through purchasing them or leasing them. This requires them to either raise funds by issuing equity (which can be challenging in an industry with low profitability, and thus less attractive to investors) or taking on debt. There are also significant costs in terms of staff and we are still quite far away in terms of reducing the number of pilots or reducing cabin crew (I feel the cabin crew is short-staffed every time I fly or maybe it could just be a feature of flying coach).

Post-pandemic there have been severe issues with pilot and airline crew shortages which only means increased salary/costs to attract or retain talent. The industry is also heavily dependent on organized labor which does not make things easy either.

If the Wright brothers were alive today, Wilbur would have to fire Orville to reduce costs

– Herb Kelleher, Southwest Airlines.

5. Where is the innovation?

Innovation has improved many things but feels like it hasn’t touched the airline industry in decades. Outside of the in-flight entertainment system, I feel everything else has changed for the worse. In fact, most agree that air travel has changed for the worse and old-timers yearn for the days when air travel felt like a good experience.

Performance

When we look at the performance of American Airlines it becomes easy to understand how these challenges have had a big effect on the top line, bottom line, and ultimately its effect on the share price.

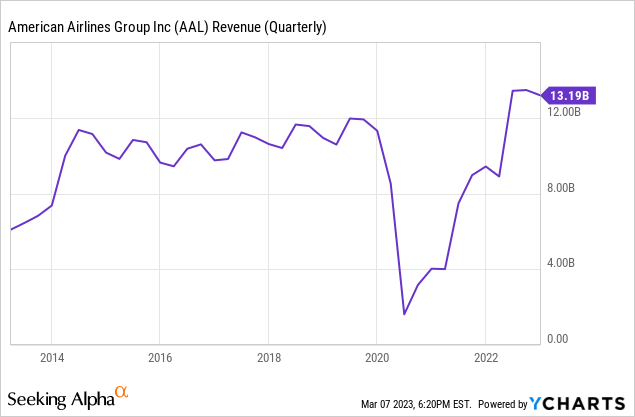

Topline Performance

During one of the best bull markets, I would have really expected their revenues to take off from 2014 – 2018 but it was not the case. My guess would be that competition played a major role in restricting their revenues.

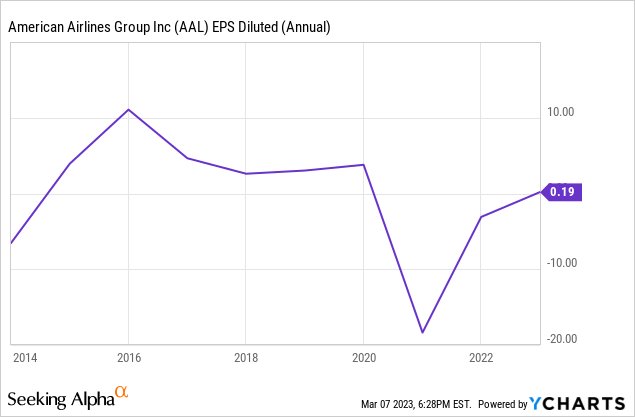

Bottom line performance

EPS has also flatlined over the past ten years. As we saw again, it is extremely hard for airlines to keep a lid on costs and the result is there for everyone to see. Covid-19 was a double whammy for airlines as the revenues dropped off but it’s difficult to shut down costs that fast when it comes to operating the airlines. A black swan event affecting airlines is not a one-off event. Airlines always had something dragging down their performance one way or the other (While Covid-19 and 9/11 are one-off events, recessions, and high oil prices are recurring instances).

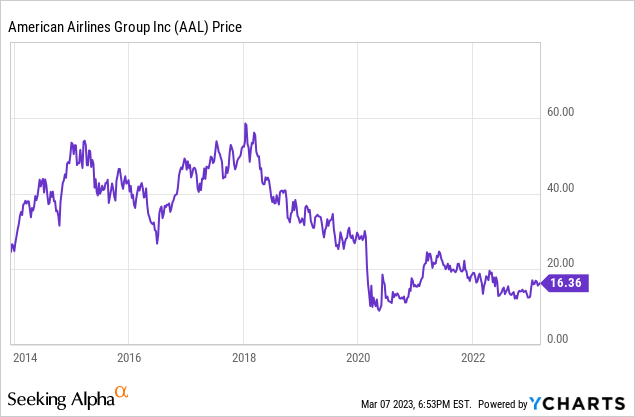

Share price performance

All of this has been well reflected in its stock price. Its returns from the last ten years are -30% and its maximum drawdown was during the height of the pandemic when many airlines could have faced bankruptcy. How long before we have another instance on our hands where airlines need to be bailed out again?

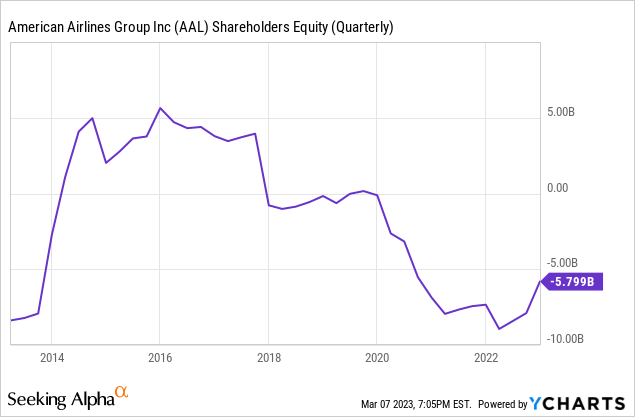

Balance sheet performance

American Airlines stock has negative shareholders’ equity which means that it owes more than what it has. The pandemic really did a number on them and although we see a recovery in 2022, it has a long way to go before it can dig itself out of this financial hole.

Looking closely, it was not that things were great before either. 2018 also saw their equity turn negative. At that time, its CEO said that it had its most challenging quarter since its merger in 2013 and its biggest challenge came from rising fuel prices.

As of now, its net interest expenses for 2022 are $1.7B and its EBIT came just above that number ($2.2B). The company has taken significant steps toward reducing its debt but they have significant ground to cover. From Dallas Business Journal:

The ratings agencies praised American’s planned refinancing but noted the company’s higher debt load relative to its peers continues to present risks. American’s stock price and credit ratings have been hit in recent years because it is more leveraged than its peers. American’s debt balance increased substantially in the years prior to the pandemic as it spent heavily on fleet renewal and share repurchases.

Valuation

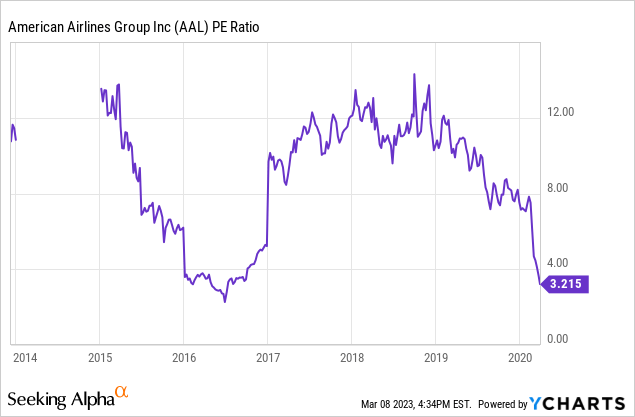

It has a forward PE ratio of 10.4 and a book value that is non-existent due to its high liabilities in relation to its assets. At its present valuation grade, within its sector, it is ranked 36 out of 636, and 5 out of 29 within its industry. It looks cheap compared to its peers within the sector and industry but it could get much cheaper if the worst-case scenario turns out to be true. Reviewing its multiples over the years, there have been significant contractions and expansions and a lot of this was due to its fluctuating earnings.

Risks to this thesis

Overall, my outlook for American Airlines is quite bearish but is there any possible upside to the stock at all? This one is hard to predict and it puts my mind back to what happened in 2020 – 2021 and the run-up to 2020.

Warren Buffet embarked on a mission to acquire a significant portion of the entire U.S. airline industry and American Airlines was one of his holdings (10% of the stock). Although there was a small profit between the years, at the outbreak of COVID-19, he immediately withdrew his investments and admitted that it was an error on his part. A year later, the airline stocks value surged significantly, with American Airlines alone experiencing over a 100% increase between May 1, 2020, and May 1, 2021.

Could we be at the start of another epic short-term run? It is impossible to time the market and we could very well see a bounce but it would be suitable mostly for short-term traders.

Outlook

My biggest fear for this stock is the kind of environment we are in. We just got out of a pandemic and we could be heading straight into a recession. Normally just one headache is enough for a cyclical industry such as airlines and it would take years for them to recover. For example, 9/11 was brutal for airlines and it is estimated that they lost $8B in 2001 and it took them six years to be profitable. Although 2022 saw a massive rebound in air travel, I cannot help but think about what would happen if we enter into a recession this year. American Airlines with its massive debt relative to its peers and slowing revenues would be hit much harder. As a medium to long-term investment, the risks far outweigh the benefits and I rate it as a Strong Sell.

A recession is when you have to tighten your belt; depression is when you have no belt to tighten. When you’ve lost your trousers – you’re in the airline business

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.