Summary:

- Amazon continues to dominate the western e-commerce and online retail marketplace with strong AWS growth further bolstering the firm.

- Softer than desired 2022 earnings have resulted in significant negative market sentiment which excessively discounts the firm’s long-term value.

- The company’s shares are currently undervalued with any further price decreases only increasing the margin of safety in my view.

- Amazon warrants a Buy rating, with a Strong Buy rating being initiated if shares reach the low $80s.

We Are

Investment Thesis

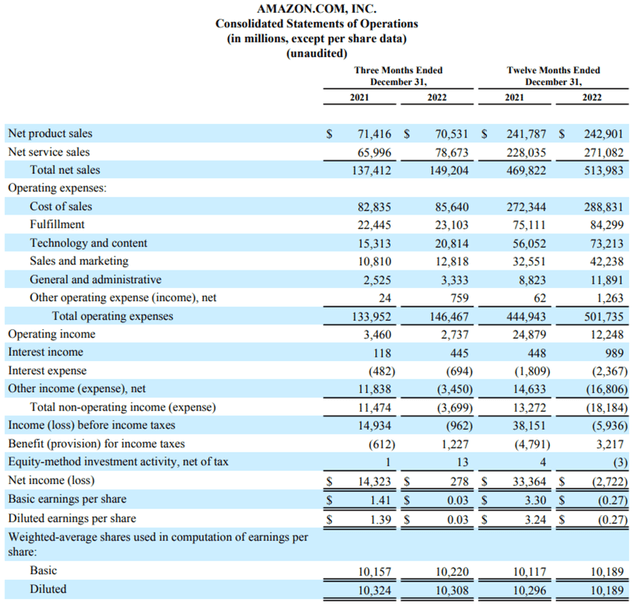

Amazon (NASDAQ:AMZN) has had a less than desirable start to 2023 with a weak 2022 earnings season. The company’s significantly increased COGS combined with an unfavorable FX environment has resulted in net operating profits decreasing compared to the previous year.

Nonetheless, Amazon’s core revenue and profit drivers are still present, thus ensuring their valuable economic moat has remained intact.

Therefore, an updated analysis into the situation currently facing Amazon both in the short- and long-term is necessary to deduce whether or not the company is still an attractive pick for value-oriented investors.

Company Background

Amazon is an American e-commerce and cloud/web service provider which dominates almost every market in which they operate. Their economic and social influence is realized across the globe through various business segments which gives the company significant breadth and in my opinion, an economic moat.

The bulk of Amazon’s revenues arise from their e-commerce sales with Amazon Web Services (AWS) being their second primary source of sales. Significant revenues are also realized through their Prime subscription service and through their offering of digital advertising solutions.

The immense scale on which Amazon operate has allowed the company to develop an ingrained presence in the lives of most Americans and Europeans. The breadth of services offered by the firm makes it almost impossible for the average person to live their life without benefitting from Amazon related products of services in one way or another.

Recent bearish sentiments combined with a significant previous overvaluation of the firm’s shares have left the company’s stock in ruins. After posting a YoY loss of -50% and weak overall 2022 earnings, does Amazon have any potential as a long-term value pick?

Economic Moat – March 2023 Update

Amazon harbors a true mega-moat status as their breadth of services and product offerings create significant long-term value opportunities for the company.

I conducted a full in-depth analysis of Amazon’s economic moat back in January 2023 which I still believe holds valid, which can check out here: “Amazon: Deep Dive Analysis Reveals Excellent Long-Term Value”.

Nonetheless, some elements of their economic moat deserve a small update which I will cover here. Particularly, it is to do with their primary profit drivers: AWS and e-commerce.

From an AWS perspective, investor sentiment has become more negative as some analysts believe the company is reaching a growth ceiling for their cloud computing IaaS platform. However, Goldman Sachs (GS) has only just reiterated their bullish sentiment towards Amazon with AWS being a particular focus for their thesis.

Eric Sheridan believes the increased rates of operational streamlining, cost-saving and efficiency-focused corporate improvements taking place at many firms will actually spur further AWS growth.

The product of AWS pay-as-you-go cloud infrastructure presents companies with the opportunity to significantly reduce their own IT department’s complexities. This incentivizes organizations to adopt AWS technologies.

Once incorporated in the AWS network, it would be almost prohibitively complex for a company to switch to a different product such as Azure by Microsoft (MSFT) or Google (GOOG) (GOOGL) Cloud. Furthermore, firms with significant online media presence who rely on AWS would risk potential disruptions to consumer user experiences if issues were faced during a change in provider.

Therefore, if Amazon is able to attract more customers into the AWS platform during 2023, the likelihood of these revenue streams remaining consistent and predictable is high. I believe this thesis model is sound and provides investors with tangible support that Amazon’s AWS growth will continue moving forwards through 2023.

From an e-commerce perspective, Amazon has been the market leader in e-commerce services in most western nations for a good portion of the past two decades. Their continued innovation in the sector and focus on providing customers with great value has allowed the firm to remain the flagship store most consumers pivot to when purchasing products online.

While the e-commerce sector is only expected to increase in sales by 9.4% in 2023 (the lowest increase since 2009), total sales in the segment are expected to move past the $1T mark. Furthermore, it is absolutely possible for Amazon to attract more consumers away from competing e-commerce platforms thus further bolstering their sales and revenue growth from the business.

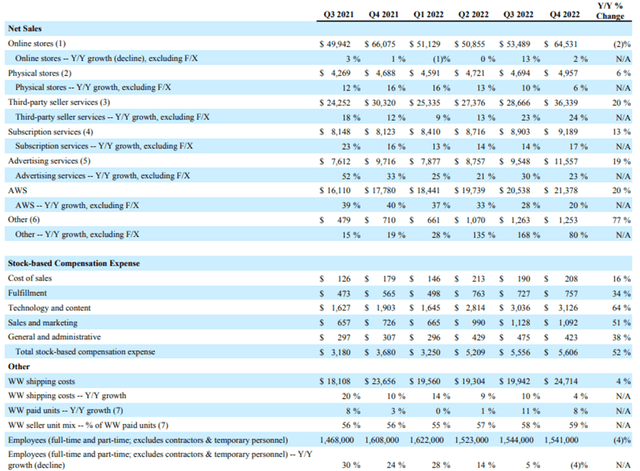

Amazon’s digital advertising business also continues to exhibit strong growth through the final quarter of FY22. The potential for Amazon to begin extracting significant value from this business could provide the firm with an even more diversified set of revenue streams thus further bolstering their already huge economic moat.

Considering the above and my previous thoughts in the full in-depth analysis, I fully believe Amazon’s economic moat remains intact moving further into 2023. The real possibility of strengthening e-commerce sales combined with steady AWS growth means Amazon should continue to grow their net margins and profits in FY23.

Financial Situation – Q4/FY22 Update

The final quarter for Amazon in FY22 was probably not necessarily what investors were hoping for. Operating income decreased 22% to $2.7 billion in Q4, compared with $3.5 billion in the same period during FY21.

However, this was largely due to approximately $2.7 billion of charges for changes in estimates related to self-insurance liabilities, impairments of property and equipment and operating leases, and estimated severance costs. These charges primarily impacted the North America segment.

These severance costs in particular are due to Amazon trimming its workforce by around 18,000 workers in January, 2023 to reduce operating costs and increase profitability in the long-run.

It is important to note that total net sales still grew by about 9% in FY22 compared to FY21 which is positive news given the incredibly restrictive inflationary macroeconomic conditions which prevailed through 2022.

Excluding the $15.5B unfavorable impact the company’s net sales faced as a result of changes in FX, net sales actually would have increased by 13% compared to 2021.

The company’s total operating expenses increased 13% to $502B primarily as a result of the aforementioned inflationary market environment and increase in transportation costs. When compared with the constant-currency net sales growth, it is impressive how Amazon has managed to contain the increase in their operating revenues.

Amazon’s AWS segment saw sales increase 29% YoY to over $80B in the twelve months leading up to December 31, 2022. This strong growth was due to an increase in the total customer base for AWS’s IaaS solutions along with continued expansion into new geographical regions for the business.

The core e-commerce business responsible for online store sales did see a 2% YoY decrease compared to 2021, but this is largely to be expected given the decrease in spending power of average consumers across the globe. A weaker than usual Christmas shopping season also contributed to the softer than expected Q4 net online sales results.

Amazon Webpage | Virginia Headquarter

While many have been quick to critique Amazon’s halted expansion of their brick and mortar Amazon Go stores along with construction of their second HQ in Virginia, I actually believe this is welcomed news.

To value-oriented investors, this conscientious cost-cutting and delaying of capital intensive projects to focus on operational efficiency is fantastic to see. While ideally such a requirement to halt expansion should never come-about, given the prevailing macroeconomic conditions I believe Amazon’s management is making responsible, investor-oriented decisions.

In Amazon’s Q4 teleconference, Amazon also stated that they would be culling physical shops with “low-growth potential”. This is another great illustration of Amazon finally taking the necessary steps to streamline their business operations, particularly after the huge growth spurt the firm undertook during and post-COVID 19 pandemic.

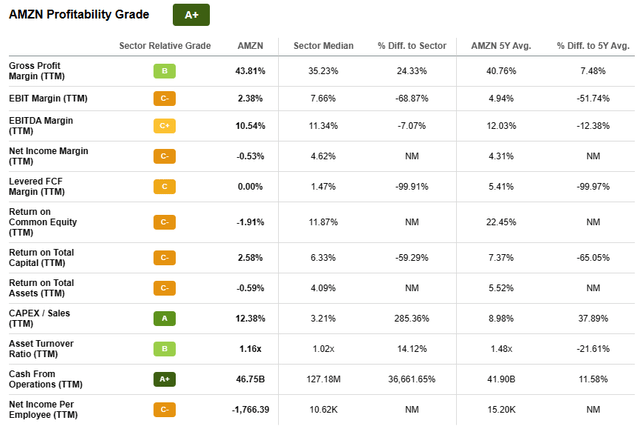

Amazon has been a hugely profitable firm for much of their existence. Their consistent EBITDA margins of 12% combined with a 10Y average ROIC of 12.7% are just the first indicators of the profit generating prowess the company holds.

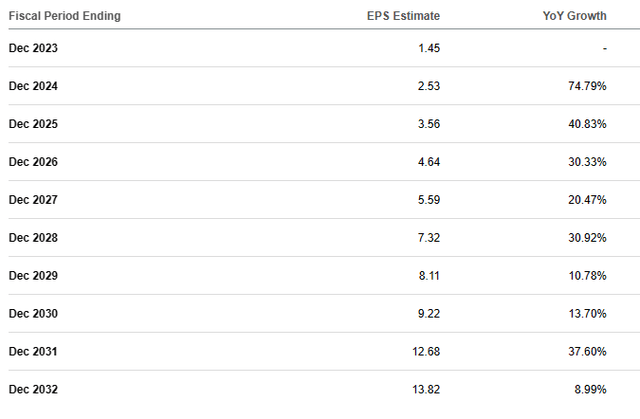

Seeking Alpha | AMZN | Earnings Expectations

Estimates for future EPS growth moving into 2030 still predict YoY growth rates of about 35%. While revenue growth is expected to be soft moving into 2023, the average YoY growth rates of approximately 13% will most likely return moving closer to 2024.

It is also important to note that should the expected 2023 recession be avoided, it is widely expected that technology and consumer discretionary stocks will bounce back with rapid force as spending picks up once more.

Seeking Alpha | AMZN | Profitability

Seeking Alpha’s quant continues to rate Amazon with an “A+” profitability metric which I believe still accurately represents the company’s long-term profit generating abilities.

While short-term headwinds could result in weaker than anticipated 2023 results, I believe the company’s new devotion to operational excellence combined with a robust economic moat means Amazon will continue to return excellent results to shareholders.

Valuation

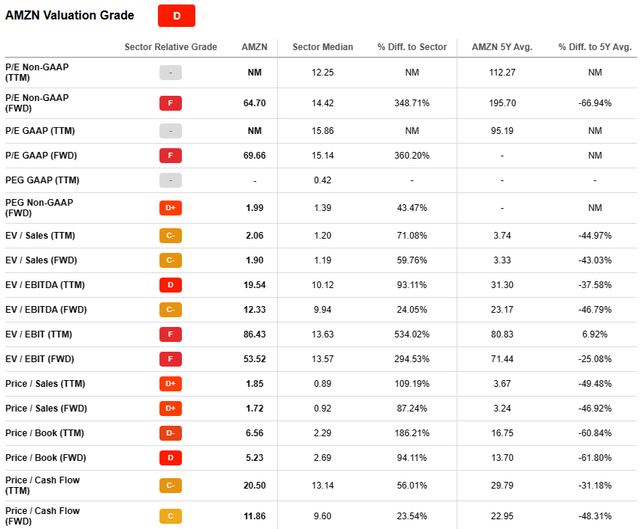

Seeking Alpha | AMZN | Valuation

Seeking Alpha’s quant has upped their valuation rating from a “D-“ in January 2023 to a “D” Valuation rating for Amazon.

I still find this to be rather pessimistic. Their current P/E GAAP FWD ratio of just 69.66 (a historical low) combined with an equally low P/CF FWD of 11.86 suggest the company may not be as overvalued as the quant believes.

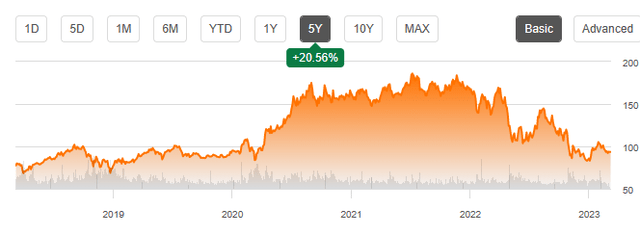

Seeking Alpha | AMZN | Summary Chart

From an absolute perspective, I think Amazon shares are still incredibly cheap. The last time stable stock prices for the firm were around the $90 mark was back in 2018. At the time, revenues were less than half of those earned in 2022.

The future for Amazon’s revenue streams looks different depending on what timescale one chooses to analyze.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe the stock will exhibit some bearish tendencies moving towards the first quarter of FY23 and towards the summer. However, much depends on the abilities for global economies to skirt a significant hard recession.

Luckily for long-term value investors, any short-term drop will most likely be due to negative investor sentiment rather than sound fiscal reasoning. Any decrease in share prices would only increase the possibility for a value-oriented position to be initiated.

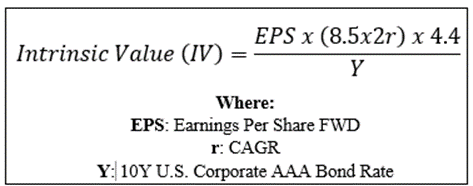

By accomplishing a simple financial valuation based on the calculation below and using an average of the expected EPS for 2024 of $2.53, an ultra-conservative r value of 0.11 (11%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive an IV for Amazon of $74.50.

The Value Corner

With this ultra-conservative CAGR value for r, Amazon appears to be intrinsically overvalued by about 25% (given a current share price $93.55).

When using a marginally more optimistic CAGR value of 0.20 (20%), we see an undervaluation of 21% with an implied intrinsic value of $118.40.

In the long-term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique industry knowledge combined with the potential for significant future growth places little doubt in my mind over the potential returns the company should be able to provide to shareholders.

When combined with a current undervaluation when evaluated using more realistic growth estimates, Amazon could be a potentially lucrative value-oriented pick for many investors. While a 21% undervaluation does not provide much margin of safety, if shares were to fall to around $82, a 30% undervaluation would be present.

From a pure value perspective, it is absolutely possible to argue a historic undervaluation is present in Amazon. I believe the negative sentiment currently present in the marketplace is largely unfounded and rooted in outdated information and speculation.

If shares drop closer towards the low $80 mark, a real deep-value proposition would be present for a historical growth stock.

Risks Facing Amazon

The primary risks facing Amazon remain largely unchanged compared to my January 2023 analysis.

The risk of failed execution of future innovations and development strategies remains a threat along with the potential for a recession in 2023, which could particularly hurt their e-commerce sales.

From an ESG perspective, Amazon must continue to ensure their employees are better protected moving into the future to avoid negative social sentiment towards the company.

Recent allegations of warehouse worker mistreatment and poor employment conditions have placed the company in hot waters with pro-union social groups.

AWS also harbors some more unique risks for Amazon due to the incredible amounts of data their servers process both on individual shoppers and their commercial customers. Ensuring the possibility of a cyber-security breach is mitigated should remain a top priority for the firm.

Summary

While the last year has been less than impressive for the company, their robust business fundamentals, huge economic moat and significant scale still remain significant drivers for future economic growth.

In the short-term Amazon may continue to see stagnating operating profits along with softening retail sales. Nonetheless, their undeniable position as the market leader in the e-commerce market combined with strong AWS growth should position the company for a much awaited comeback as we move closer to 2024.

Current share prices have left the company trading at a relative undervaluation to the company’s past and expected future value. The promise of strong cashflow generation combined with a diversified revenue generation portfolio should mean significant returns are on the horizon.

I will most likely begin building my position in Amazon if share prices hit the $82 mark as it would then provide me with a satisfactory margin of safety. If you are looking for a blue-chip stock trading at discount prices, Amazon is still a pretty good choice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.