American Airlines: Little Upside Left As Air Travel Returns To Pre-Pandemic Levels

Summary:

- Airline stocks rose quickly over the past month as the 2023 air travel outlook appears to be fully returned to pre-pandemic levels.

- Although recession risks loom large, investors are bracing for a broad “normalization” of the airline industry.

- Even if American Airlines’ operating income fully normalizes, I doubt its annual EPS will rise above $2 due to the sharp increase in its interest costs since 2020.

- With weakening liquidity and immense leverage, American Airlines could eventually face financial restructuring if a significant recession negatively impacts demand or costs rise disproportionately to sales.

- Based on the Altman Z-score, American Airlines carries the highest quantitative bankruptcy risk of all US airline stocks.

Nathan Howard/Getty Images News

Airline stocks have had a tremendous month, with many seeing 20-30%+ gains as holiday travel volumes were significantly above expectations. Total airline ticket demand appears to be firmly at-or-above pre-pandemic levels, with TSA checkpoint travel numbers consistently around 2019 seasonal levels. More recently, corporate travel, a key airline profit driver, has normalized despite the recession risk. Last week, United Airlines (UAL) posted above-expectations revenue and earnings, boosted by a combined increase in sales and a sharp decline in fuel prices. Later this week, American Airlines (NASDAQ:AAL) will release its earnings report, expecting an EPS of around $1.15 based on the company’s recent guidance.

I do not expect American Airlines to fluctuate dramatically on its earnings report since it published guidance two weeks ago and is supported by solid earnings from its competitors. While the stock has seen immense volatility over the past year, it is now near its 52-week high as the 2023 air-travel demand outlook improves. Last year, American Airlines saw some challenges as the sharp rise in fuel prices largely offset the increase in travel demand. This year, many investors expect the stock to see its EPS return to pre-pandemic levels as costs and demand factors fully normalize.

Data strongly suggest an economic recession will likely negatively impact businesses and households this year. Considering AAL is trading at around half its pre-pandemic price, normalizing its EPS may significantly boost its stock price – creating a potential catalyst for value investors. That said, it is also possible that AAL’s outlook is at a cyclical peak today. If so, air travel demand may fall below current peak levels. Additionally, although fuel prices are back down, American Airlines and its peers struggle with staffing shortages and are increasingly exposed to infrastructure risks due to outdated technology. American Airlines’ profit margins are fragile, and its debt is significant, so the continued strain on its profitability could negatively impact the stock in 2023.

Can American Airlines’ EPS Normalize?

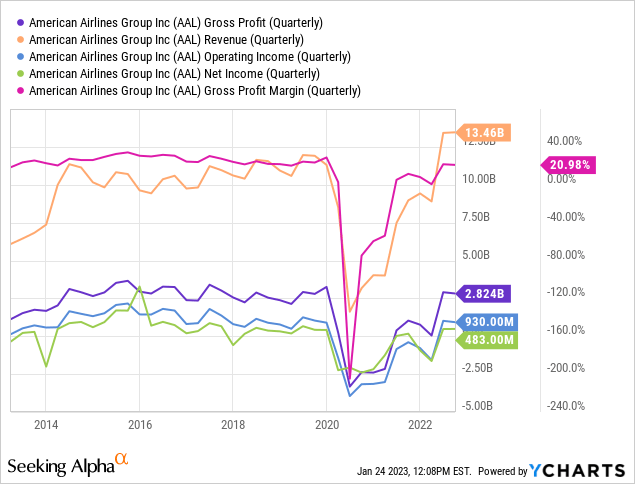

American Airlines has faced many challenges over the past decade due to the volatility in travel demand, fuel prices, and its significant leverage and operational overhead. The company earned around $1.17 in EPS in Q4 of last year, beating expectations and giving it the best quarterly earnings in years. This report almost put its earnings back within the normal before or during the pandemic. Additionally, it means American Airlines’ gross margins returned closer to the “normal” 25-30% level. See its historical profitability below:

The lockdown period led to massive declines in travel demand and extreme losses for American Airlines. The company utilized immense debt financing to maintain cash balances during the period, dramatically increasing its interest costs today. Assuming travel demand remains near pre-pandemic peak levels and its operating margins fully normalize, then American Airlines should generate a strong EPS this year despite the rise in interest costs.

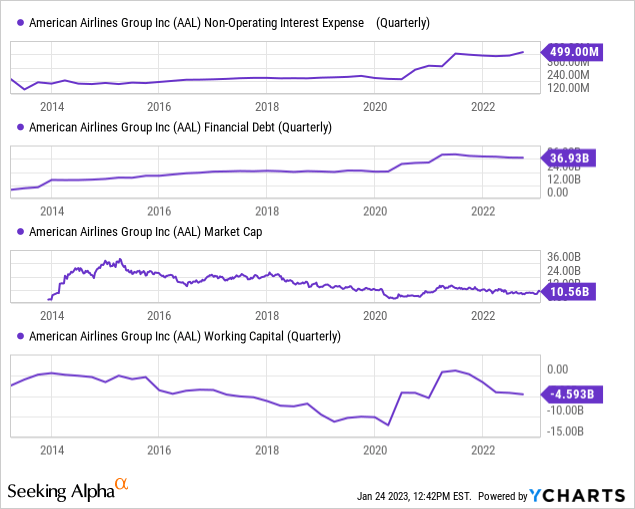

The consensus analyst estimate for American Airlines’ total 2023 EPS is $1.79 at $52B in total revenue. That figure is still well below the pre-pandemic level, giving the firm a forward “P/E” of 9.1X. Of course, the outlook for the airline industry has risen over recent weeks so the consensus outlook may be revised higher soon. At any rate, AAL is not trading at a very high valuation, but it will struggle to return to its previous position mainly due to the increase in interest costs. See below:

American Airlines was a high-risk stock before the pandemic but became far riskier during that period. The company entered 2020 with a vast working capital deficit and high debt leverage. Today, its functional capital level returns to pre-pandemic levels as it pays far more interest expenses. If its operational position completely normalizes (revenue and operating margins), we can expect the firm’s operating income returns to a quarterly average of around $900M. After deducting $499M in interest costs and accounting for a ~20% effective tax rate, the company’s potential average income per quarter is only around $320M, or $1.28B per year (~$2 per share). Of course, that estimate has considerable variability due to the volatility in American Airlines’ operating margins.

Thus, in a best-case scenario, AAL’s forward “P/E” today is likely around 8X. Historically, the stock trades at a “P/E” of around 10X, although that figure is likely lower today due to the increase in American Airlines’ debt. Its current outlook is nearly as strong as this potential, so there is potentially limited “recovery upside” left in the stock. I believe the maximum “fair value” for American Airlines is likely $20 or 10X the EPS target.

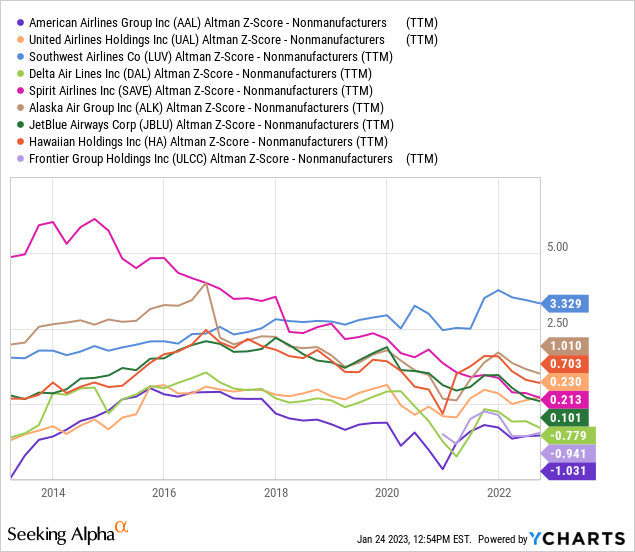

However, the company’s debt is worth over 3X more than its equity, and most of its operating income will likely go to paying debtors for a prolonged period. This situation is precarious as a recessionary decline in sales or a spike in operating costs could easily cause American’s profits to return to chronically negative levels – putting AAL at risk of financial restructuring if conditions turn unfavorable. Indeed, based on the Altman Z-score, American Airlines carries the highest quantitative “bankruptcy risk” of all US airline stocks today.

To be fair, no airline besides Southwest (LUV) is in a “low bankruptcy risk” zone. Airlines are notoriously high bankrupt-rate companies due to their capital intensity and cyclical nature. If we assume 2023 has a full recovery in sales, low fuel costs (boosting demand), and no declines in margins, then American Airlines should avoid this scenario. That said, with recession risks looming and the gas supply not fully restored, I would not assume the company can recover to pre-pandemic levels for years to come.

Airline Catalysts To Watch For In 2023

Based on various economic indicators, the technical odds of a recession this year may be as high as 96%. Of course, the environment is slightly different today because inflation is falling from a multi-decade high, creating some perturbations in the data. Indeed, if there is a significant increase in unemployment, American Airlines may not survive the year as air travel demand falls. Of course, this is not necessarily guaranteed since employment has remained very strong despite negative economic headwinds last year. That said, this is a moderate risk area for investors to consider.

Inflation, by itself, may be significant for American Airlines in the long run. The chief issue with the company is its vast debt compared to equity. Due to its immense leverage and interest costs, the company’s balance sheet looks more like a bank today than an airline. That said, unlike a bank, American Airlines will likely see its revenue rise similarly to inflation if prices rise moderately (above 3% but below 6%). At this point, inflation will likely decline rapidly this year due to the recent collapse in natural gas prices and the possibility of a business slowdown. However, a fall in inflation opens the door to interest rate reductions which could allow American Airlines to reduce its interest costs. If more QE is performed in a recession, it could cause inflation to return. This possibility is a central “grey area” today; However, moderate inflation could save American Airlines, which seems unlikely given today’s volatile monetary trends (the variance between extreme inflation and rapid disinflation).

Of significant risk to American Airlines is the general staffing shortage in the airline industry. This factor is leading to an immense increase in cancelations and reported complaints. Although Southwest is the current “cancelation king,” American Airlines consistently was throughout last summer. American Airlines also boasts the highest rate of mishandled bags. Although many blame the FAA’s outdated technology for cancelations, airlines’ technological issues and shortages are likely the leading culprit. Of course, the FAA’s significant technological gap that caused a strange national grounding weeks ago does add to the already-high systemic risk factors.

There are two critical issues associated with American Airlines’ persistent operating challenges. One, the shortage of pilots and airline workers, in general, is likely to increase employee wages disproportionately to the company’s revenue, negatively impacting operating margins. Notably, the firm has thin operating margins, so it would only take a slight wage increase compared to sales to jeopardize its equity. Secondly, American Airlines’ high cancelation and delay rate make it less attractive to consumers. If people are increasingly disappointed in American Airlines, more may flock to discount airlines, decreasing the company’s sales.

The Bottom Line

Overall, I believe AAL offers little upside in a best-case scenario and significant downside in most adverse outcomes. Today, the company is in the best condition since the pandemic, fueling a renewal in investor interest in the stock. That said, American Airlines was a high-risk company before the pandemic due to its significant debt. This issue became far worse during the pandemic and is further amplified by higher interest rates. Cost-push factors, such as airline labor shortages and fuel cost volatility, could exacerbate strain if these costs are not fully pushed onto consumers.

The consensus view for AAL appears to be that “the worst is over, and full recovery is around the corner.” At this point, there may not be immediate threats that could jeopardize the company. Further, demand for air travel is robust, so American Airlines may manage to generate sufficient profits to reduce its debt burden. However, it will likely take years before the company can reverse the damage that occurred in 2020 sufficiently to decrease its balance sheet risks. If a severe recession or other negative catalysts do occur before then, American Airlines may face sufficient liquidity strains that its equity is jeopardized. Fundamentally, due to its credit rating, I do not believe the company can borrow substantially more money if it needs to without paying an excessively high-interest rate (threatening its net income viability).

With this in mind, I do not believe the stock does not offer a solid risk-reward opportunity, particularly after its most recent rally. Since AAL seems slightly overvalued at its current price, I am moderately bearish on the stock. That said, the stock appears to have sufficient momentum and no immediate negative catalysts that I would not currently bet against it.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in AAL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.