Summary:

- American Tower shares have underperformed as higher rates and inflation weigh on real estate related stocks, but now is too early to buy.

- While the fundamentals of the sector are strong given increased data usage, American Tower has the wrong business profile for this environment.

- 45% of its revenue comes from overseas, and its debt load has significant near-term maturities that will lead to higher costs.

- I would wait until a 4% yield to buy shares, and investors should consider Crown Castle instead.

BackyardProduction/iStock via Getty Images

Shares of American Tower (NYSE:AMT) have been hit hard over the past year, nearly falling one hundred straight points since mid-August as higher interest rates weigh on real-estate centric stocks. While AMT has the capacity to continue growing its dividend thanks to the secular growth in data usage. There are several reasons I don’t like the stock, and I would wait for a 4% yield or $147 before buying.

In the company’s second quarter, revenue increased by 16% to $2.67 billion with adjusted EBITDA up 13% to $1.67 billion. As a real estate investment trust (REIT), adjusted funds from operations (AFFO) is the key measure to watch as these funds determine what is a sustainable dividend. AFFO growth was 5%, from $2.39 to $2.51, lagging EBITDA and revenue growth as the company faces currency headwinds and higher interest costs. Overall, currency was a 1.2% headwind to the topline in Q2.

Alongside these results, American Tower lowered revenue guidance $15 million to $10.37 billion due to a $99 million currency headwind. This also led to a $20 million reduction in EBITDA to $6.59 billion. On the bright side, AFFO was revised up $0.02 to $9.74, though this was due to less share issuance rather than better operating results. The dividend consumes around 61% of AFFO, screening as sustainable.

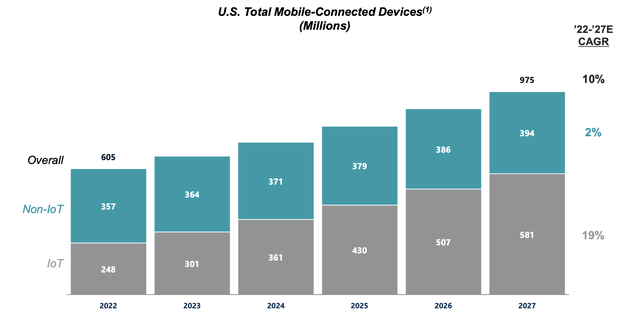

Now, over the long-term, AMT has been a very strong performer. From 2011 to 2021, adjusted funds from operations have risen at a 13.8% pace. This has driven a 5-year dividend growth rate of 17.9% with 9 straight years of increases. Underpinning this growth has been the strong growth in mobile data usage, which has required more wireless towers. This trend remains intact with data usage expected to grow at a 20% per annum pace the next five years.

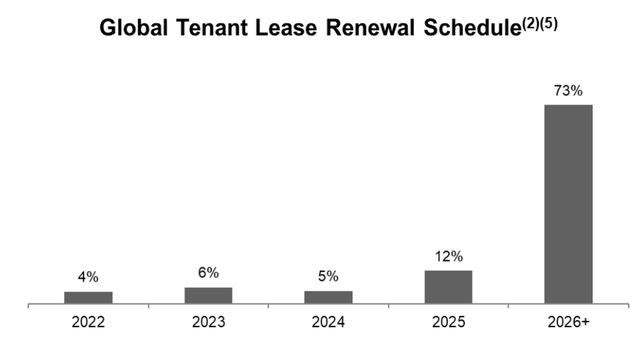

Beyond the benefit from growing wireless demand, the tower business is a fundamentally good one in my view. Contracts are structured to generally be 10 years, providing predictable free cash flow. While T-Mobile’s (TMUS) purchase of Sprint has caused some attrition, as you can see below, less than 10% of its leases are up for renewal in any year until 2025. This helps to insulate the company somewhat from the emergence of a new technology that could displace towers as very little of its revenue is exposed at any given time. Additionally, its contracts generally have local CPI based price escalators, and overseas, many markets have energy pass-through provisions that protect the company from inflation risk.

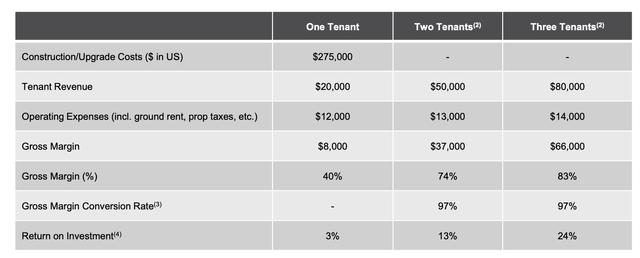

The tower business is relatively capital intensive, requiring a large upfront investment that is earned back over time as tenants pay rent for using the tower to operate their network. However, there is tremendous operating leverage because so much of the cost is fixed. As you can see below, when the company is able to place a second or third wireless carrier onto its tower, its return on invested capital becomes extremely attractive.

Given this backdrop, it is understandable why income and growth-oriented investors would be interested in the tower sector. It is a very cash-flow generative real-estate play within a secular growth industry, and I doubt any of us expect wireless data usage to decline. If anything, as we stream more content wirelessly, the upside is significant and can last well beyond the next five years. The problem is that American Tower just does not have the right asset mix and balance sheet to thrive in an environment of a strong dollar and higher interest rates.

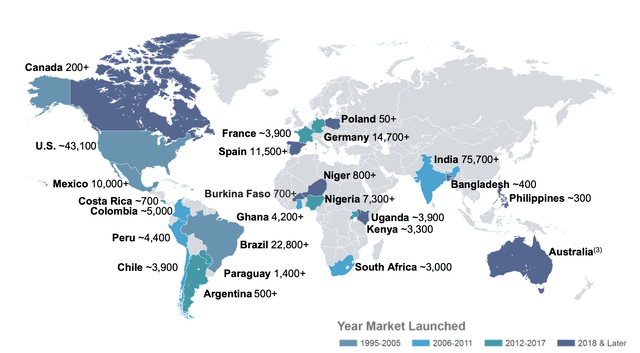

Arguably, the company should really be called “Global Tower” because most of its footprint is overseas after two decades of aggressive international expansion. In fact, AMT gets 45% of its revenue from overseas. Its overseas margins are lower, but still 38% of gross profits come from outside of the United States. India and Brazil are its two largest foreign market, and Europe as a whole is about 7% of its business.

The US dollar has risen strongly over the past year, and with a Federal Reserve that remains hawkish and high energy prices that are worsening Europe and India’s trade balance, the fundamentals argue for continued dollar strength in my view. This has made me generally more cautious on multinationals vs US-centric companies as currency is likely to remain a headwind for cash flow growth. Deteriorating overseas economic growth may also slow the cap-ex spending wireless carriers commit to. While being a global company has benefitted AMT the past decade, it is more likely to be a headwind the next 12-24 months.

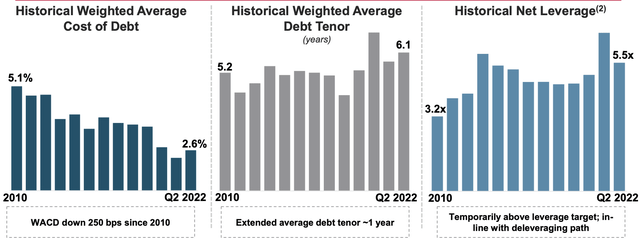

Additionally, AMT, like many companies, has been a long-term beneficiary of falling interest rates the past decade. As you can see, its borrowing costs have steadily fallen, though they started to tick up in Q2. As debt became cheap, American Tower relied on more of it with its leverage now 5.5x, above its long-term goal. Carrying more debt than you target as the Federal Reserve and others are dramatically raising interest rates is not ideal balance sheet positioning.

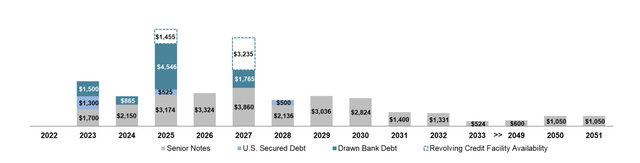

Its 6.1 year average weighed debt maturity also means that the company has significant near-term maturities. In fact, there is $5.5 billion in debt due before the end of 2024. On top of this, only 77% of the debt is fixed-rate, the rest moves up as central banks raise interest rates, which is why the cost of debt jumped last quarter. As these rate hikes filter through, AMT’s interest expense will continue to rise. Over the next two years as this debt is refinanced and variable-debt is priced higher, interest expense could increase by $150-$250 million or reduce AFFO by about $0.40. Combined with currency headwinds, there is 5-7% potential hit to the company’s earnings profile.

I was also concerned to read reports AMT is rumored to be looking at Vodafone’s (VOD) wireless tower unit, which could cost $13 billion. Given Europe’s challenges, it is debatable whether shareholders should want AMT to dramatically increase its exposure to that region. Regardless of that question, given the company’s debt levels are already above target at 5.5x, now appears to be a time to prioritize balance sheet repair and debt paydown over further M&A, particularly with economic uncertainty increasing.

I understand that investors may feel that underlying growth dynamics in wireless data usage are so appealing that they want exposure to the sector. I feel the same way, but that is why I recommend Crown Castle (CCI), which is a US-centric tower company with an 8.7 year debt maturity schedule that is 84% fixed rate. It is less exposed to currency, global growth, and higher interest rates, and it offers an over 4% yield today. Of the two companies, CCI strikes me as the better risk/reward unless you expect the Fed to do an about-face on rate hikes soon, in which case AMT’s overseas exposure and high leverage would be much smaller liabilities.

At a 3.1% yield, AMT stock is unattractive because CCI is a much cleaner story in this macroeconomic environment and offers an over 4% yield. If AMT traded down to $150 or a 4% yield, the risks would be more factored into the price, but that is still about 20% lower from here. For now, I would recommend selling AMT to buy CCI.

Disclosure: I/we have a beneficial long position in the shares of CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.