Summary:

- Unity continues to perform strongly in the gaming segment as it attracts increasing number of creators and brings in customers from large studios to independent freelancers.

- The company looks set to expand into non-gaming segments as more customers gain awareness of new use cases of its software engine, in sectors like film and automotive.

- With a strong ecosystem made of multiple partnerships and a large user base, Unity is set to continue to benefit from the competitive advantages that it has built through scale.

- My 1-year target price for Unity is $49.45, implying an upside potential of about 60% from current levels.

Marko Geber

At a time when growth companies are currently out of favour, I think that investors can potentially benefit from buying Unity Software (NYSE:U), given that valuations are more reasonable today compared to the sky high valuations during the earlier stock mania. I aim to take a deeper dive into Unity, provide readers with a better understanding of its business, where its competitive strengths lie and what are the key opportunities and risks ahead for the company.

Investment thesis

Unity has rather promising prospects in the future in both its gaming and non-gaming sector. In the gaming sector, I think that Unity will continue to remain a market leader in the segment, becoming a game engine of choice for game developers around the world as it continues to invest in its capabilities and innovate. For its non-gaming segments, there are signs that other non-gaming companies are increasingly seeing the benefit of incorporating Unity’s software engine to create 3D content that suits different industries’ needs. Furthermore, I think that the scale that Unity has built over the years through entering into new strategic partnerships with new partners and continuous push for new creator growth, the strong ecosystem that has been created brings stronger engagement levels and a strong network effect that will likely benefit Unity for the years to come, in my view. As such, I think that Unity looks interesting at the current valuation level.

Overview

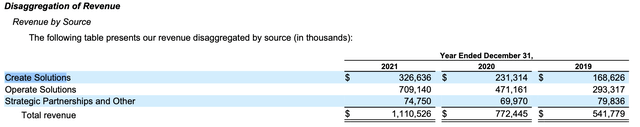

Unity started off as a game engine for game developers. It provides a platform for creating as well as operating interactive real-time 2D and 3D content. It software. Its platform comprises of 2 segments, the Create Solutions and the Operate Solutions. As can be seen below, approximately 30% of its revenues comes from Create Solutions, while 64% of its revenues comes from Operate Solutions. While Create Solutions has traditionally started off as more targeted at the gaming industry, it is shifting the focus to other industries other than gaming. On the other hand, Operate Solutions is typically only applicable to the gaming industry. I think it’s important to note also that while the 2 segments are distinct, they are connected in that most of the customers that are using Unity’s Create Solutions are also using its Operate Solutions and vice versa.

Revenue mix (Unity annual report)

Create Solutions

As of end 2021, Unity has 1.6 million monthly active creators that uses its platform to develop and design interactive real time 2D and 3D content. The pricing structure varies from a free personal account to 3 other tiered paid subscription plans. The revenues from the segment are derived on a per-seat basis. With Unity plus, the company aims to target smaller businesses as well as independent customers, with a price of $40 per month per seat, while with the Unity pro plan, it targets customers with annual revenues more than $200,000 and provides more tools and services and has a price tag of $150 per month per seat. Lastly, Unity Enterprise focuses on customers with larger times and greater need for customisation, and it costs $200 per month per seat. For both the Unity Personal and Student plans, these plans are meant to support creators that have less than $100,000 in revenues and are verified students, respectively.

Unity’s software engine helps to simplify as well as accelerate the creation of content and allows developers to port code easily across different devices like iOS, Xbox, and Android, amongst others. Unity’s engine was initially designed for developers of video games and it competes with other companies that also have game engines like Epic Games’ Unreal Engine, and Chukong Technologies’ Cocos2d-x.

Epic Games is commonly seen as Unity’s rival given its Unreal engine that competes with Unity’s own game engine. While Epic game’s Unreal Engine has a lower market share than Unity, it is regarded as the key engine competitor for games. Unreal engine is known to have better performance for three dimensions as it has better graphics, there is easier use of 3rd party developer tools and pricing is lower. On the other hand, Unity’s engine is known to perform better based on its larger community that uses it, the easier programming on the platform and a faster learning curve. As a result, I am of the view that Unreal engine is typically used for more sophisticated and complex games while Unity is typically used for mobile games and by smaller developers.

Furthermore, I think that Unreal Engine’s pricing is interesting as it does not charge a fee on its customers unless the lifetime revenue crosses the $1 million mark, and thereafter a 5% fee is imposed on the game’s annual revenues. As a result, I continue to think that Unreal Engine’s key motive is then to attract creators to create successful games on its platform that eventually becomes big, incentivising customers to potentially use its “free” platform to create new content that may eventually become fee paying if it generates enough revenues.

That said, Unity continues to attract large and global customers as its customers, like Electronic Arts (EA),Tencent (OTCPK:TCEHY), Take-Two (TTWO), Nintendo (OTCPK:NTDOY), amongst others. It also attracts other smaller and medium game studios as well as independent publishers to its platform. Some of the big game titles that have been developed on Create Solutions include Tencent’s Arena of Valor and Honor of Kings and Niantic’s Pokémon GO.

As a result of a growing number of use cases for real time 3D content, Create Solutions aims to target other industries outside of gaming like automotive, film and architecture. One of the automotive companies to work with Unity is Hyundai Motor (OTCPK:HYMLF), which is partnering with Unity to create a digital twin factory, while eBay (EBAY) is working with Unity to pilot a new 3D true view technology.

Lastly, for the film industry, Unity acquired Weta Digital in 2021 and with this acquisition, Unity bought capabilities needed to expand from game software to film software, further complementing its suite of offerings. As Weta Digital was founded by Peter Jackson, a very well regarded name in the film industry, the company’s software tools are also top tier, in my view. This is because they were actually used in many films like Lord of the Rings, Game of Thrones, King Kong and Avatar. Given that these films were all well received and award-winning films, I am of the view that Weta Digital will bring substantial benefit to Unity as it brings a world class film software capability to its business, as well as its film studio customers to Unity.

Operate Solutions

For Operate Solutions, this is a platform for its customers to grow their user base, monetise their content and maximise their in-app and ad-based revenues. Within Operate Solutions, most of the revenues comes from the bidding engine, where a mobile game developer who wants to advertise to get new downloads will use an Ad Tech platform to buy ad inventory on other games. Other segments include attribution software and mediation. Unity’s attribution software is called deltaDNA and what it does is that it helps game developers to adjust and tailor their games based on specific user behaviours. Mediation segment is a smaller percentage of ad revenues typically. What happens in the mediation segment is that the Ad Tech firm will help game developers to sell their ad inventory when their game has reached their targeted number of users.

Although revenue from industries beyond gaming is a minority of revenue (currently ~8% of Unity’s >$100k customers are in industries beyond gaming, ~10% of total revenue), management has commented that it is growing 15-20 percentage points more quickly than gaming revenue in Create Solutions. Management expects industries beyond gaming to become a much more substantial portion of revenue over the next 5-7 years.

Market leadership in gaming and growth in non-gaming segment

I think that there is no doubt that Unity is a market leader in the development of games. Its customers range from the large studios to smaller middle-sized companies to independent freelancers. During its IPO, it announced that 93% of the top 100 game development studios in 2019 were actually Unity’s customers. This shows the strong product suite offered by the Unity software engine as well as its Operate Solutions.

Also, it was estimated that 53% of the top 1,000 ranking mobile games on Google Play and Apple App Store in 2019 were developed using Unity’s software engine. As a result, this shows Unity’s leadership in mobile game development as it’s engine is used by the largest studios in the world, and able to produce the largest market share of top grossing mobile games in the world.

I think that with the scale that it has achieved in gaming, the Unity engine has created a strong brand name in being one of the leaders in 3D game development. This in turn drives more creators to come to its platform and drive somewhat of a network effect in its business. I think crucially, this means that it may drive more interest in non-gaming customers and industries as it looks to drive growth from other industries.

As a result, Unity continues to attract larger customer as the customers bringing in more than $100,000 in annual revenues increased to 1,085 in 2Q22. This is up 22% from 2Q21 and up 52% since 2Q20. What this shows me is that Unity continues to bring in customers that are willing to pay significantly more on its platform and drive growth in the larger customer segment.

Large ecosystem, strong partnerships, and a neutral platform

Unity is likely to continue to see market leadership and continued growth from the success it has seen in the past. One of the advantages of Unity is that it has created a platform that is neutral and formed strong partnerships with other platforms as well. As a result, we see that Unity’s software is thus able to enable game development for operating across more than 20 platforms like Nintendo Switch, AR/VR platforms, as well as on Windows, Mac, iOS, Android, amongst others. As a result of the create once and deploy anywhere business model, this allows its customers to push out its content to a large user base across platforms without using large amount of resources.

Also, as mentioned above, with more than 1.6 million active monthly creators, as well as the large range and number of games developed on the platform, this large customer base and community helps Unity achieve something more. It helps improve engagement on its platform and drive further stickiness and improvement in user acquisition as existing customers are more likely to recommend Unity to other potential customers.

Broader opportunities beyond gaming

I expect that while Unity’s revenues could grow approximately 30% on average until 2024, the non-gaming segment will see almost double that growth rate given the small base and the increased focus on the segment. As mentioned before, Unity has acquired Weta recently to bolster its film software offering. Other moves that Unity has taken include joint ventures with industry experts within their own space in sports like Endeavor and concerts like Live Nation (LYV). I think that we could see more use cases of Unity’s software engine for real time 3D content that is used in increasingly more industries as we increasingly move more from 2D experiences to 3D experiences.

As a result of its likely positive free cash flows by 2023, I think that we will continue to see Unity make strategic and tactical acquisitions to enhance the overall platform offering. Given that Unity has a rather small net debt position, I think with the positive free cash flows that I forecast in 2023, I think there is certainly room for acquisitions, given the improved valuations in the market.

Valuation

Unity is currently trading at 5.6x and 4.5x 2023F and 2024F EV/Sales. I expect Unity to grow at a 30% CAGR until 2024. My 1-year price target is based on an equal weight of DCF as well as EV/Sales methodology. For the DCF model, my assumptions include a terminal growth rate of 3%, WACC of 8%, while for the EV/Sales method, I assume an EV/Sales multiple of 8x on 2023 revenues.

13.6 47%I think that given that the multiples have adjusted downwards, this is a relatively reasonable multiple given that Unity is expected to grow at 30% CAGR, and it has a strong competitive positioning in the industry and a potential for sustained growth given the favourable tailwinds.

Using an equal weight for the EV/Sales method as well as that of the DCF method, my 1-year target price for Unity is $49.45, implying an upside potential of about 60% from current levels.

Slowing growth in mobile games sector

My assumptions are based on a revenue growth rate that would average to 30% for Unity until 2024. This may not materialise if the industry sees a slowdown in growth in the near term given the difficult macroeconomic environment. As such, if the growth rate of the industry slows down, there is a risk that I would need to revise my forecasts downwards.

Competition

As my forecasts take into account continued market share gains in the Create and Operate Solutions segment, if Unity somehow loses its competitive advantage to peers, this could result in Unity being unable to take market share from rivals. As a result, competition in both segments may contribute to more difficult operating conditions for Unity and will lead me to revise my estimates downwards.

Reliance on operating system platforms and app stores

As a result of a potential change in requirements, regulations or guidelines from either operating system platforms and app stores that are similar to Apple’s (AAPL) IDFA change on iOS 14, we could see a negative impact on Unity’s business.

Cash flow risk

As my forecasts take into account a positive free cash flow position in 2023 and beyond, given that the firm has never achieved a positive free cash flow position, there is a risk that this might not materialise. As a result, the company may need to issue equity or debt for the business operations or to make acquisitions. The potential dilution from an equity raise may thus affect the equity value of Unity.

Conclusion

I think that Unity looks interesting at the current valuation levels. With a strong leadership in the gaming segment, Unity is set to maintain and gain share within the gaming segment as it continues to bring innovations to its software engine. Furthermore, as the world shifts from 2D to more 3D content, we could see an expansion in the use cases for Unity’s software engine as it looks to grow into new verticals. Furthermore, the company’s strong partnerships neutral platform and large user base provides a strong foundation on which the gaming business can continue to expand and grow as engagements remain high and new user acquisitions continue. As Unity looks to expand into new markets, acquisitions that are strategic in nature will likely happen, funded by its free cash flow, which should turn positive in 2023, in my view. I think that the valuations for Unity skews to the upside now given that it has seen significant multiple contraction in the past year. My 1-year target price for Unity is $49.45, implying an upside potential of about 60% from current levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.