Summary:

- Lucid disclosed its factory output for the third-quarter yesterday.

- The Lucid Air production ramp is now progressing according to plan.

- Reservation value could have climbed to $3.8-3.9B in Q3’22.

jetcityimage/iStock Editorial via Getty Images

Lucid Group (NASDAQ:LCID) cut its production outlook due to supply chain problems twice this year but it looks as if the EV company finally managed to get its act together and excel regarding its Lucid Air production ramp, based on Q3’22 production figures. In February, Lucid cut its production forecast from 20 thousand electric vehicles to 12-14 thousand EVs due to a limited supply of car parts. Lucid further cut its production outlook by 50% to 6-7 thousand EVs in August due to ongoing supply challenges which I called a game-changer at the time.

Now, Lucid confirmed that it is ramping up production according to plan and disclosed that its factory in Arizona produced more than 2,200 of the company’s Lucid Air electric vehicles in the third-quarter. Although Lucid has considerable production and timeline risks, I believe Lucid remains one of the most promising electric vehicle companies in the long term!

Production update Q3’22

Lucid gave an update about its third-quarter production accomplishments yesterday saying that it produced 2,282 electric vehicles during the third-quarter at its manufacturing plant in Arizona. For comparison, Lucid produced 1,405 in the first six months of FY 2022, meaning the EV company ramped up its production significantly in the third-quarter: Q3’22 production exceeded the first half of the year total by 62%. In total, Lucid produced 3,687 electric vehicles in the first three quarters of FY 2022 which calculates to 57% of the company’s mid-point full-year production goal.

In Q3’22, Lucid also delivered 1,398 electric vehicles, which calculates to a delivery share of 61% (deliveries calculated as a percentage of total Q3 production volume). In Q2’22, Lucid delivered just 679 Lucid Air electric vehicle models to its customers, meaning deliveries roughly doubled quarter over quarter.

Production risks have a bit decreased after Lucid confirmed its FY 2022 production target and the company has more than enough money to finance the ramp of its current product line-up, although the ramp will take longer than initially expected. Lucid had $4.3B in liquidity at the end of the last quarter and the company should be able to finance its operations until the end of next year without any major problems.

My expectations for Q3’22 reservation and order book value

Lucid has an installed production capacity of 34 thousand units at its manufacturing facility in Arizona and the company had more than 37 thousand pre-orders for the Lucid Air base model as well as models with better performance and range packages.

Lucid is set to submit its earnings sheet for the third-quarter on November 8, 2022 at which point the EV company is also going to give an update about its reservations. I estimate that Lucid will have grown its reservation book to about 40-41 thousand reservations in the third-quarter which calculates to at least 8% quarter over quarter growth. Assuming an average purchase price of ~$95 thousand per electric vehicle — which was Lucid’s average in the second-quarter — the company’s order book, not including the purchase commitment from Saudi Arabia, could reach a value of $3.8-3.9B, up from $3.5B in Q2’22.

Lucid’s valuation has become more sensible

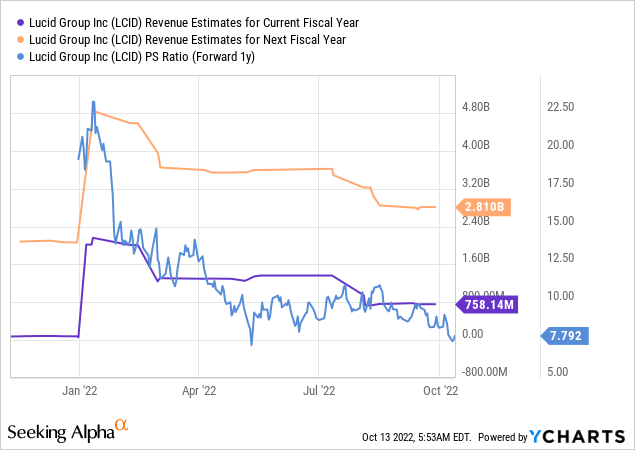

Lucid’s share price has declined 67% in 2022 due to a variety of factors including profit taking, supply chain and logistics issues as well as the EV company cutting its forecast twice this year which has created negative sentiment overhang for the stock. Based off of current revenue expectations for FY 2023, Lucid has a revenue valuation multiplier of 7.8 X which is significantly below past valuation factors.

Risks with Lucid

Lucid still has production and timeline risks as they relate to the ramp up the Lucid Air. The EV manufacturer had to cut its production guidance twice in FY 2022 due to supply chain problems and challenges with its manufacturing ramp… and it had a huge impact on the pricing of Lucid’s shares. Going forward, the only way an upside revaluation can take place is if the company significantly increases its factory output, ramps up deliveries and expands internationally.

Final thoughts

Lucid has removed uncertainty for the stock with its Q3’22 production update which resulted in a 3.5% increase in the stock price on Wednesday. The third-quarter has seen a significant ramp in production, with Q3’22 manufacturing volume exceeding the total of the first half of FY 2022 by 62%. I believe that Lucid is now on the right track and can reach its production target for FY 2022 without further disappointments. However, because of the disappointments delivered earlier this year and because of the relatively high valuation relative to output, I am still rating Lucid as a hold!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.