Summary:

- PepsiCo’s earnings were very strong, and guidance was raised.

- I like the stock for a multi-week bounce from here.

- Longer-term, the valuation and yield may become a problem.

JHVEPhoto

Crunchy snack legend PepsiCo (NASDAQ:PEP) reported third quarter earnings yesterday, and Wall Street rewarded the company with a gap higher and buying throughout the day. In a market where investors seem to be in a sell-first-ask-questions-later kind of mood, the strong performance of the stock was noteworthy to say the least.

The stock has vastly outperformed the broader market this year, and to my eye, it looks like it has some more upside in the coming weeks. I don’t see the stock as particularly cheap for the longer-term, but coming off of a strong earnings report, the intermediate term looks favorable.

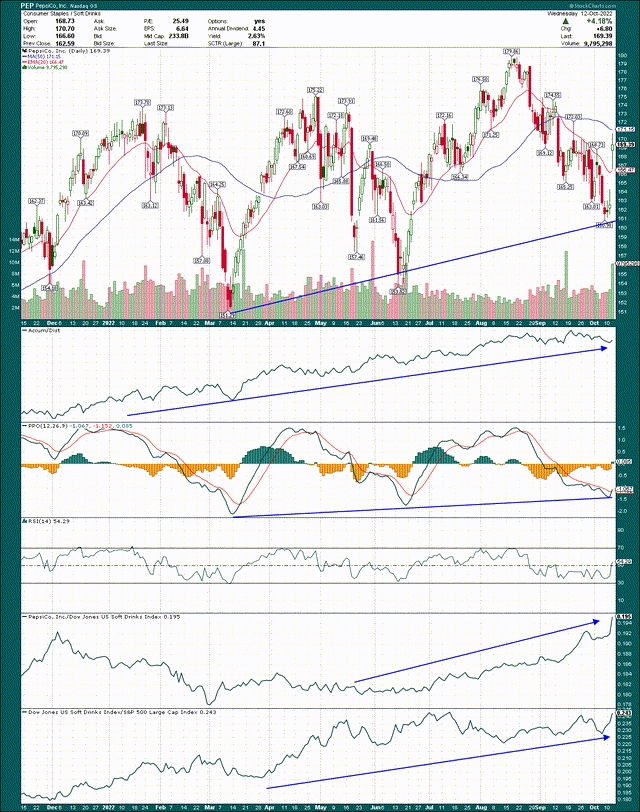

We’ll start with the price chart, and as we can see, the move yesterday abruptly ended a protracted downtrend the stock found itself in since mid-August. That downtrend was marked by repeated failures at the 20-day exponential moving average, but yesterday, that was all taken care of. The first hurdle to any uptrend is the 20-day EMA, so as long as the stock remains higher than that – currently $166 – the bias is upward.

In addition, PepsiCo is carving out a broad channel, the bottom of which was formed earlier this week before the earnings report came out. That means there’s upside to the top of the channel, which would project to about $185 (give or take) in the next couple of months. We’ll see if we get there, but all indications right now are that this is more likely than not.

The accumulation/distribution line – which measures whether investors are buying or selling the stock throughout the trading day – is outstanding. It remains right at its highs for the year, so big money is buying dips in this name.

The PPO bottomed at a higher level than the prior two bottoms, giving the same look as the price chart. That’s a good sign for this bounce sustaining, so look for this rally to take the PPO to something like +1.5 from the current -1 before momentum is susceptible to losing steam.

Finally, relative strength has been truly exemplary this year as beverages have outperformed, and PepsiCo is outperforming its peers. That’s an ideal relative strength situation, and given we now have a very strong earnings report, there’s no reason to think that’s going to end just yet.

Bullish fundamentals, but is it enough?

The third quarter report was great, and it’s hard to see any cause for pessimism. This, of course, is why the stock was rewarded with a 4% gain off the report in a terrible market, which is why I noted it was significant above. Beating expectations doesn’t seem to be enough right now, as guidance has to be strong as well, and PepsiCo simply delivered.

Revenue was up 9% year-over-year to $22 billion, as Frito-Lay North America posted a 20% boost to its top line, and the company’s Latin America business followed suit. Obviously, one of the advantages of PepsiCo is that it is not only split between drinks and snacks, but that its portfolio is extremely diverse both in terms of SKUs and geographies.

Of course, that diversification geographically opens PepsiCo up to currency translation risk, and given the US Dollar has managed to obliterate just about every other currency around the world this year, PepsiCo is facing some currency headwinds today.

Revenue was up 9% on a reported basis, but rose 16% on an organic basis in Q3. The AMEA segment, for instance, saw a 14% headwind from currency translation in Q3. The total headwind companywide was 3%, given PepsiCo’s massive US-based business that has little currency risk, but so long as the dollar is strong, this will continue to be an issue.

On the flip side, I happen to think the rally in the US dollar looks pretty tired, and if I’m right and it rolls over in the coming months, PepsiCo stands to reap the benefit via higher reported revenue. Investors rightly focus on organic revenue, but if PepsiCo picks up another 2% or 3% to reported revenue via currency tailwinds, that’s meaningful for earnings. Just something to keep in mind.

Gross margins were down fractionally in Q3 as just about everything in the world is more expensive than it was a year ago. That includes freight, labor, packaging, food commodities, you name it. However, the decline of ~40bps is something PepsiCo can manage, and was much smaller than the growth rate of revenue. Margins are a huge concern for Wall Street at the moment given relentless inflationary pressures, but PepsiCo managed it beautifully, so I don’t have any concerns from that perspective.

The only caveat to these positive results is that snack volumes were down 1.5% companywide, while beverages were up 3%. With organic growth at 20%, that implies volume and mix were responsible for almost all of the top line gains. That’s fine, because it demonstrates PepsiCo has pricing power, but pricing increases cannot last forever. We mustn’t extrapolate these massive pricing increases out into the stratosphere because at some point, PepsiCo will need to drive the top line with volumes. Not an issue for today, but something to keep in mind going forward.

Guidance was boosted off of the strong report, and PepsiCo is looking for full-year organic revenue to rise 12% (was 10%) and for constant currency EPS to be +10% (was +8%). That correlates to ~$6.73 in EPS, and management said they will return $7.7 billion to shareholders through dividends, primarily.

Looking forward

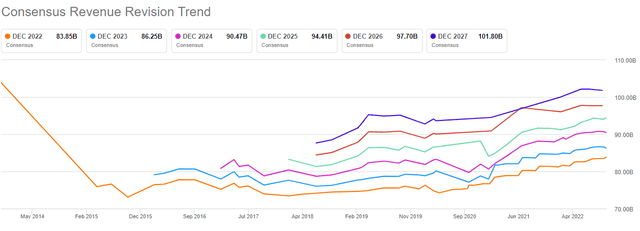

Let’s take a look at analyst expectations in light of this strong earnings report. Below we have revenue revisions for the past few years and it is a telling picture.

This is exactly what you want to see from a stock you own; there’s plenty of space between the years, indicating year-over-year growth, and the lines are all moving up and to the right. That’s the sign of a company with durable advantages and strong execution, and PepsiCo is certainly one of those companies.

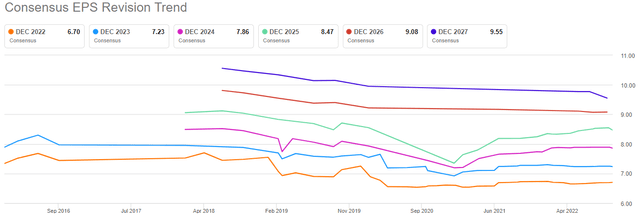

We see somewhat different behavior, however, when it comes to earnings.

We’ll likely see at least the orange line for 2022 move a bit higher in the coming days off of boosted guidance, but this is a decidedly less bullish picture. Essentially, EPS estimates started declining in 2018 and haven’t looked back, which is not exactly bullish.

The company has drastically slowed its share repurchases in recent years, and margins have drifted lower. Neither of those is good for EPS growth, so that’s a potential issue going forward.

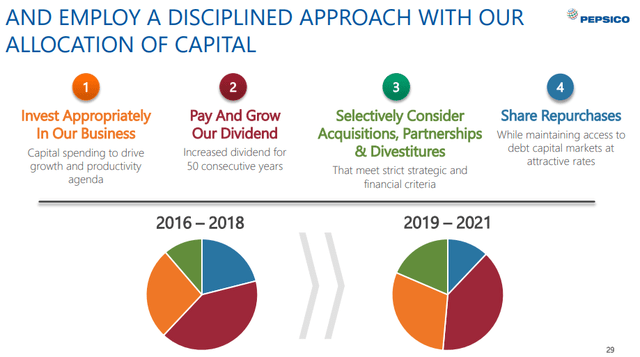

On the issue of capital returns, PepsiCo provides this handy guide for investors on how the company intends to use its cash.

We can see the proportions of spending have shifted pretty drastically in recent years, with much more going to acquisitions and growth spending, at the expense of dividends and share repurchases. Now, PepsiCo is a Dividend King and the dividend is going to grow every year; that’s a given. But the amount of dividend growth PepsiCo is allocating cash for is much smaller, and the share of the pie for repurchases has drastically dwindled. That’s a negative for EPS given the share count reduction potential has been, well, reduced.

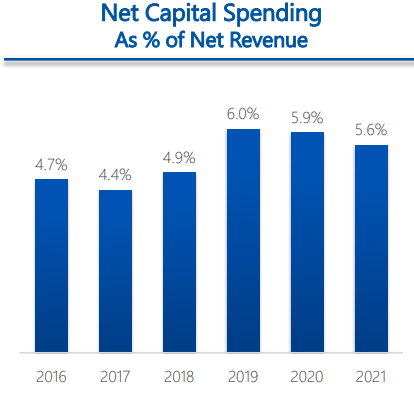

Investor presentation

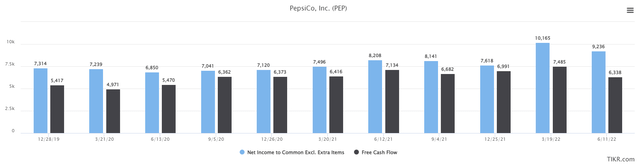

We can see capex is now a meaningfully larger proportion of revenue than it used to be due to the above allocation strategy, and interestingly, free cash flow hasn’t matched net income on a trailing-twelve-months basis for years.

FCF conversion hasn’t been particularly great for PepsiCo, which means that if you’re evaluating how much cash the company can return via dividends and/or share repurchases, you should use FCF rather than earnings. PepsiCo’s FCF conversion is relatively poor, as the best companies – particularly in consumer staples – are in excess of 100% of earnings when it comes to FCF. PepsiCo is nowhere close to that, so that’s something to keep in mind. In terms of tangible outcomes, this is why the company has reduced share repurchases; it isn’t producing enough cash to keep them going while paying the ever-rising dividend.

Let’s value this thing

We’ll start the valuation discussion with the tried-and-true forward price-to-earnings ratio, and I’ve plotted the period starting after the initial COVID panic selling episode.

The average forward P/E is 24 in this period, exactly in the middle of the range of 21X to 27X earnings. We find the stock at 24X earnings today, so it’s pretty easy to call this one fairly valued. I don’t see any catalysts for a higher valuation, but given the strong earnings/guidance, it shouldn’t be lower, either. It’s right where it should be from my point of view.

But since PepsiCo is a Dividend King, we can also value it on the yield, which paints a rather different picture.

We can see that the stock’s yield is pretty close to the bottom of the range when it comes to the past five years, even if we ignore the initial COVID panic selling period. On this basis, I’d argue that PepsiCo could see some downside to the share price, particularly if interest rates go even higher, as the value of the dividend falls if risk-free rates rise. This is not a primary reason to buy or sell the stock, but it is something worth keeping in mind, particularly if you’re investing for income.

Final thoughts

PepsiCo’s earnings report was great. It showed outstanding revenue growth and pricing power, and that helped keep its margins intact. I’d like to see higher volumes in the coming quarters, but for now, that will do.

I like the chart as well, because the stock bounced off the bottom of the channel and crested the 20-day EMA, meaning the bias is now up. There are levels of resistance overhead, but for now, I like the stock to rally in the coming weeks. If it closes below the 20-day EMA, however, all bets are off and I would use stop-loss protection in that case.

The valuation is where it gets tricky for me, because the stock looks pretty fully valued when combining the forward P/E ratio and the yield. It’s not necessarily expensive, but PepsiCo has outperformed this year, and the valuation reflects that.

On the whole, I like PepsiCo’s bounce as I think it has great potential to turn into a multi-week rally. Longer-term, the stock is probably a hold given the valuation situation, as well as potential volume and margin headwinds that could crop up.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.