Summary:

- Back in September 2021,Moderna’s and Merck’s market cap valuation were only a few billions apart at ~$175bn and ~$182bn, respectively.

- As the more diversified, future-proofed pharma, it makes sense that Merck’s valuation has increased while Moderna’s has tanked.

- Merck announced yesterday that it will take up an option to partner with Moderna on development of a cancer vaccine used as an adjuvant alongside Keytruda.

- Results from a Phase 2 study of the vaccine / Keytruda combo in melanoma will be available before the end of the year.

- Positive results would validate Moderna’s technology outside of COVID and likely make the company much more valuable. Merck would benefit from another blockbuster asset and ongoing superiority of Keytruda.

DNY59/iStock via Getty Images

Overview

The share prices of Moderna (NASDAQ:MRNA), the messenger-RNA drug developer behind the SpikeVax COVID vaccine, and Merck (NYSE:MRK), the US’ fifth-largest pharmaceutical company by market cap, have experienced very different fortunes over the past 12 months.

Merck stock is up +14%, to $90, which values the company at $229bn. Moderna stock is down -59%, valuing the company at $51bn. When Moderna stock hit its all-time peak price of $450 in early September 2021, the company was valued at ~$175bn. At that same time, Merck stock traded at $72, meaning its market cap was just a few billion dollars higher than Moderna’s – $182bn.

The reality has always been that in a non-pandemic environment Merck is the far more valuable company. Consider the two companies’ portfolios. Merck has earned revenues of ~$40bn or more in every year since 2012, earning operating income of $8bn or more in every year.

The Pharma markets and sells seven blockbuster (sales >$1bn per annum) products across six different divisions – Oncology, Vaccines, Hospital Acute Care, Immunology, Cardiovascular, and Other Pharmaceuticals. Merck even has a thriving Animal Health Division that drove ~$5.5bn sales last year.

Moderna markets and sells just one product – SpikeVax, and although SpikeVax is – alongside Pfizer’s (PFE) Comirnaty – the most widely used COVID vaccine in the US and Europe, making sales of $18.5bn in 2021, and on track for sales of ~$21bn in 2022, now that the pandemic has been declared “over,” SpikeVax sales will fall dramatically.

Moderna’s sale of 70m vaccine doses to the US government, with the option to buy up to 230m more – worth up to ~$4.8bn based on a price of $16 per dose – may have been the company’s last to a government. Now the company is looking ahead to the formation of a private market, in which its vaccine may cost up to $100, but there will be less demand.

My best guess, as outlined in a previous post I wrote on Moderna and BioNTech (BNTX) for Seeking Alpha – is that Moderna would earn ~$7bn per annum at best from a private COVID vaccine market.

While Moderna looks ahead to 2023 anticipating sales of its vaccine to fall by as much as half (I estimate), and maybe more, Merck can look forward with much more confidence.

The company is guiding for FY22 revenues of $57.5 – $58.5bn of revenues – up 18% year-on-year, driven by sales of its mega-blockbuster cancer drug Keytruda, human papilloma virus (“HPV”) vaccine Gardasil, and diabetes drugs Januvia and Janumet – which respectively made sales of $17.2bn, $5.7bn, $3.3bn and $2bn in 2021 – ably supported by 20 more major products making sales in the triple-digit millions.

Although Keytruda’s and Gardasil’s patent is due to expire in 2028, as I have discussed in a previous note on the company, management is confident it can offset falling sales of these products with new product launches, and my estimate is the company can target revenues of ~$60.5bn in 2030, having hit highs of ~$68.5bn in 2027.

Merck is also a dividend payer – $0.68 per quarter presently, for an annual yield of ~3%, whilst Moderna pays no dividend, although management announced on its Q222 earnings call that it has set aside $3bn for share buybacks. Merck reported current assets of ~$32bn as of Q222, with current liabilities of ~$23bn and long term debt of $28.7bn, whilst Moderna reported current assets of $13.6bn, non current investments of $10.2bn, and total liabilities of just $8bn.

Merck and Moderna Join Forces On Melanoma Vaccine

In an announcement yesterday, Moderna said that Merck had:

exercised its option to jointly develop and commercialize personalized cancer vaccine (PCV) mRNA-4157/V940 pursuant to the terms of its existing Collaboration and License Agreement. mRNA-4157/V940 is currently being evaluated in combination with KEYTRUDA, Merck’s anti-PD-1 therapy, as adjuvant treatment for patients with high-risk melanoma in a Phase 2 clinical trial being conducted by Moderna.

As a result, Moderna received a $250m payment from Merck – a small sum for either company – but of much more significance is the fact that Moderna says the two companies are:

on track to report data from the ongoing Phase 2 trial of mRNA-4157/V940 in combination with KEYTRUDA® as adjuvant therapy in high-risk melanoma in 4Q 2022

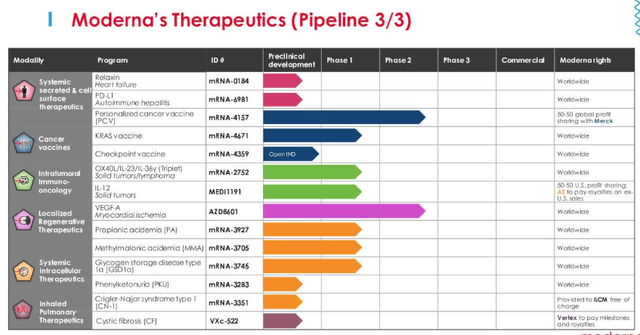

Outside of its vaccine division – in which it has eight COVID candidates under development, three of which target the Omicron variant and are in late stage trials, plus an influenza, respiratory syncytial virus (“RSV”) and cytomegaolvirus (“CMV”) vaccine in Phase 3 trials, Moderna is developing drugs focused on 6 different “Therapeutic Modalities.”

These modalities are Systemic Secreted and Cell Surface Therapeutics, Cancer Vaccines, Intratumoral Immuno Oncology, Localised Regenerative Therapeutics, Systemic Intracellular Therapeutics, and Inhaled Pulmonary Therapeutics.

When SpikeVax was discovered to have such strong efficacy against COVID it was initially felt that the vindication of messenger-RNA technology – using MRNA preprogrammed in a lab to instruct cells to manufacture specific proteins – would lead to breakthroughs in a range of different diseases.

Progress has been slow on all fronts except COVID however, and only the RSV, flu and CMV vaccines are anywhere near ready to be approved for commercial use. These 3, together with COVID vaccines, could be worth ~$10bn in peak sales to Moderna (if all 3 are approved), but to stimulate the kind of growth the market once expected of Moderna, and drive its share price, the company needs to make successes of some the assets in its Therapeutics pipeline.

Moderna Therapeutics division pipeline (Moderna Q222 Earnings Presentation)

As we can see above, amid a wide variety of opportunities, the personalized cancer vaccine MRNA 4157 stands out since it is the only one besides the Astra-Zeneca partnered, VEGF-A stimulating heart failure drug to have reached Phase 2 trials (AZD6401 met endpoints in its Phase 2 but may still be years away from commercialization due to the complexity of the therapy, which has been in development since 2013).

Although you might expect Merck to have a large portfolio of oncology assets, given the runaway success of Keytruda, the Pharma has just 2 other cancer drugs on the market – ovarian cancer drug Lynparza, and thyroid cancer drug Lenvima. The former is marketed and sold in partnership with AstraZeneca (AZN), and the latter in partnership with Japanese Pharma Eisai. Merck earned ~$1bn from the former and $700m from the latter in 2021.

Keytruda is used in combo with multiple drugs and dozens of biotechs are attempting to trial their drugs with the immune checkpoint inhibitor (“ICI”), which blocks the PD-1 pathway.

The drug is the current standard of care in melanoma, and in its Phase 2 trial alongside MRNA-4157, which has enrolled >150 patients, MRNA-4157 is being used as an adjuvant (additional therapy complementing the main drug), with some patients receiving only Keytruda and others Keytruda plus adjuvant for up to 1 year after surgical resection, with the primary endpoint being recurrence-free survival, and secondary endpoints being metastasis free survival and overall survival.

What Success (Or Failure) Would Mean For Both Companies

Moderna has not had great success in oncology to date but scientists believe there is plenty of promise in this field. According to Cancer.gov:

The investigational mRNA vaccines are manufactured for individuals based on the specific molecular features of their tumors. It takes 1 to 2 months to produce a personalized mRNA cancer vaccine after tissue samples have been collected from a patient.

Moderna has had some limited success with a Head and Neck cancer vaccine, with 2 of 10 patients treated with an ICI plus vaccine adjuvant experiencing a complete response, and 5 experiencing tumor shrinkage, but attempts to treat colorectal cancer in the same way fell flat, with no patients responding to the treatment. The head and neck study has apparently been expanded to enroll 40 patients.

The MRNA-4157 Phase 2 results have the potential to either strongly validate the vaccine adjuvant approach, confirming the response seen in head and neck patients, or force Moderna to go back to the drawing board if responses are not detected. If it is the former, the exciting part for Moderna is that the approach may be repeatable across other indications – and given Keytruda is approved to treat most type of solid tumor, there is a potentially massive opportunity in play.

From Merck’s perspective, it will share in the commercial success of MRNA-4157 should it prove successful enough to be approved, plus it has the right to develop further vaccines alongside Moderna. The market opportunity may not be vast for either company, certainly in the initial stages – Keytruda earns the bulk of its revenues in non-small cell lung cancer which I suspect would be a much trickier target – but it could be long-term and grow exponentially if it can work in other solid tumors.

To summarize, Moderna may commercialize 3 new vaccines in the next 12-18 months – targeting flu, RSC, and CMV, and this ought to make the company a powerful player in the global vaccine markets, however unlike with SpikeVax, its new generation of vaccines may not be indisputably standard of care, as SpikeVax was.

The likes of Sanofi (SNY), GSK (GSK), Pfizer (PFE) and Merck itself control ~75% of the global vaccine markets, and it is interesting to note that Merck opted against taking up an option in Moderna’s RSV vaccine program in 2020, opting to develop its own vaccine in house.

As such, Moderna needs its Therapeutics pipeline to deliver, and first in line is MRNA-4157, reading out Phase 2 data before the end of the year. A positive set of results would help validate Moderna’s technology and would likely do wonders for its share price.

From Merck’s perspective, the risk is much lower. Since it already has Keytruda – the current standard of care – positive data will be a boon since it will share in commercial sales of an adjuvant vaccine, whilst negative data will confirm Keytruda as unsurpassable on the efficacy and safety front.

With that said, Merck will be hoping that Moderna – with whom it is partnered – has a better adjuvant in development than its MRNA rival BioNTech (BNTX), which has thrown most of its resources into oncology, and which has a partnership with rival Big Pharma Regeneron (REGN) to develop its FixVac adjuvant PCV to treat melanoma alongside Regeneron’s Keytruda rival Libtayo.

BioNTech is also developing an intra-tumoral mRNA therapy alongside French Pharma Sanofi (SNY), so it is very much in Merck’s interest not to lose this development race, since it risks losing Keytruda’s standard-of-care status. BioNTech has already initiated clinical studies of FixVac in NSCLC.

Conclusion – Phase 2 MRNA-4157 Data Could Be Critical For Both Companies – A Bet On Positive Data May Pay Off

Merck represents a solid “BUY” opportunity as a large Pharma in possession of what will soon become the world’s best selling drug. Keytruda, plus a host of other blockbuster assets across autoimmune, diabetes, and oncology, as well as a promising pipeline – most notably of oncology and cardiovascular assets.

Although Keytruda and Gardasil go off patent in 2028, that is a long time in the life of a share price, and Merck has plenty of time to plan for these events, as I shared in my last note on the company. It is also a dividend payer.

Nevertheless, Merck’s share price will likely be affected by the MRNA-4157 data, since a successful readout may enable the company to realize a new blockbuster sales opportunity via an adjuvant to accompany therapy with Keytruda, whilst an unsuccessful one may open the door for a BioNTech / Regeneron partnership to challenge Keytruda for standard of care status in melanoma, and perhaps even NSCLC, its most lucrative market.

From Moderna’s perspective, positive data could serve as strong evidence that there is life outside of vaccines for its mRNA technology, which may be critical to the way that analysts value the company. If, on the other hand, Moderna can’t make its technology work in its other “Therapeutic Modalities”, its market cap may be “capped” at ~$50bn, given the total addressable market opportunity in vaccines may not be much more than ~$20bn, Moderna’s share is likely to be 50% in the most optimistic of scenarios, and Pharma’s are typically valued at no more than 5x price to sales.

Ultimately, Moderna has the funds to go back to the drawing board if MRNA-4157 fails, but Merck’s decision to exercise its co-development option appears to be a positive sign, and the status of being Keytruda’s preferred adjuvant vaccine partner in melanoma, and possibly, in time, other solid tumors too, ought to be worth $10 – $20bn in additional market cap.

Moderna’s stock price jumped from $120, to $140, on yesterday’s announcement. That represents a climb of ~$7bn in market cap valuation. Positive data ought to have twice as strong effect on the market cap, and there is a feeling that Moderna’s technology is good enough to succeed outside of COVID. If that proves to be the case then shareholders in Merck and Moderna will doubtless reap the rewards.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRNA, MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.