Summary:

- We do not recommend that anyone chase AMT now, due to the massive 19.47% stock rally from recent rock-bottom levels since mid-October.

- Though AMT seems fairly valued at current levels, its massive debt could put more downward pressure on its forward performance, depending on the Fed’s December meeting.

- Assuming a lasting pivot, AMT will sustainably recover, as with most stocks and REITs, significantly aided by its data center strategy.

- Otherwise, we can expect more of a bloodbath ahead, due to the deceleration in its top- and bottom-line growth.

Olemedia

American Tower (NYSE:NYSE:AMT) has moderately reduced its FY2022 AFFO guidance by $40M, mostly due to 4% headwinds from FX impact and Vodafone Idea Limited in India. The latter has triggered the company’s lower international growth over the past few years, due to the ongoing consolidation and massive churn of mobile users in India. However, things seem to be slightly improving, due to management’s projection of 6.5% in international organic growth for FY2022, compared to FY2020 levels of 5.1% and FY2017 levels of 9.7%.

Furthermore, with AMT’s expanding exposure in the data center REIT segment through the CoreSite acquisition, the stock might outperform expectations ahead. Global capex investments in data centers continue to grow aggressively, despite the peak recessionary fears. Global cloud providers such as Amazon (AMZN), Google (GOOG), and Microsoft (MSFT) continue to splash billions on their cloud infrastructure while commanding the lion’s share of 63% in global cloud revenues in Q2 2022. Infrastructure-as-a-service (IaaS) reported massive growth of 33% YoY in Q2 2022 as well, given the ongoing digital transformation and robust demand for IoT post-reopening cadence.

Though AMT only reported $585M in revenues from data center properties over the last 12 months, accounting for a nominal 5.59% of its revenues then, we’re optimistic that the company’s offerings will continue to grow in relevance. That would, therefore, point to the stock’s massive runway for growth over the next decade.

AMT Continues to Execute Well, Despite Elevated Long-Term Debt

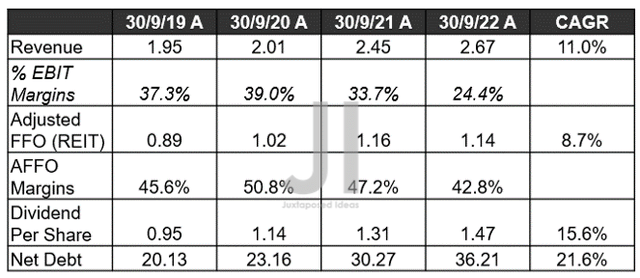

During its recent FQ3 2022 earnings call, AMT recorded decent top- and bottom-line growth. The company reported revenues of $2.67B and AFFO of $1.14B, representing YoY growth of 8.8% – though -1.2% in moderation, respectively, due to the tougher YoY comparison among others. Meanwhile, the elevated operating expenses aggressively expanding by 24.1% YoY and share-based compensation expenses by 39.5% YoY, notably impacting its EBIT and AFFO margins by the latest quarter.

While AMT’s top-line growth has been accelerating at a CAGR of 11% against pre-pandemic levels of 9.4%, there are some signs of deceleration in its AFFO expansion. For example, it went from 12.2% between FY2016 and FY2019 to 8.7% between FY2019 and FY2022, and dividend growth went from 20.3% to 15.6%, respectively.

Furthermore, AMT continued to rely on long-term debts at an eye-watering sum of $35.31B by FQ3 2022, though this number represents an excellent reduction of 8.71% from peak levels of $38.68 by FY2021. As much as we wanted to include the maturity table here, the list was simply too long; interested investors can refer to pages 13 and 14 here for more details. Approximately $7.44B worth of notes and term loans will be due through FY2024, thereby indicating AMT’s need for massive liquidity ahead. This is due to its current cash and equivalents of $2.24B, elevated interest expenses of $1.05B, and growing dividends paid out at $2.54B over the last 12 months.

AMT Projected Revenue

S&P Capital IQ

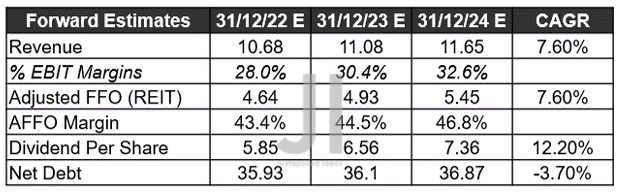

However, we are not overly concerned for now. AMT is projected to rake in a total of $10.38B AFFO in FY2023 and FY2024, despite the $1.94B of projected annual capital expenditure, thereby sustaining the company through the worsening macroeconomics ahead. In addition, its EBIT/AFFO margins are expected to recover to 32.6% and 46.8%, respectively, by FY2024, nearer to pre-pandemic levels of 35.5% and 46.4%, respectively.

AMT will also continue growing its excellent dividends at a CAGR of 12.2%, with a projected yield of 3.35% by FY2024 based on current stock prices. Otherwise, it’s at an excellent 3.92% for those who had loaded up at recent rock-bottom levels, against its 4Y average of 1.86% and sector median of 4.31%. Not too bad, given the nine years of consecutive dividend growth.

Is AMT Stock a Buy, Sell, or Hold?

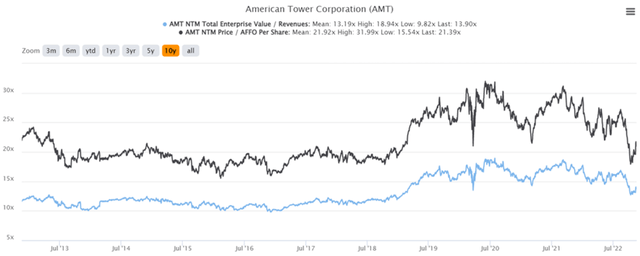

AMT 10Y EV/Revenue and P/E Valuations

AMT is currently trading at an EV/NTM revenue of 13.90x and NTM price/AFFO per share of 21.39x, higher than its 10Y EV/revenue mean of 13.19x, though slightly moderated vs. its 10Y price/AFFO per share mean of 21.92x. Otherwise, on a YTD basis, the stock looks relatively attractive, against the YTD mean of 15.39x and 24.03x, respectively.

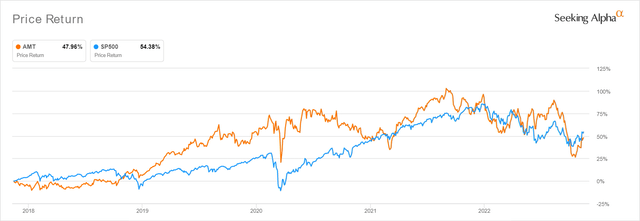

AMT 5Y Stock Price

Shares of AMT are also trading at $219.58, down 25.41% from their 52-week high of $294.40, though at a premium of 23.24% from their 52-week low of $178.17 and above their 50-day moving average of $218.87. Nonetheless, consensus estimates remain bullish about AMT’s prospects, given their price target of $238.00 and an 8.39% upside from current prices.

Depending on investors’ risk tolerance level and investing trajectory, AMT is trading at fair value now due to its recent 19.47% stock rally in mid-October 2022. Because of its minimal margin of safety, investors who nibble at current levels might face more retracements in the short term. That’s assuming the Fed does not pivot as expected by 85.4% of market analysts, thereby triggering more uncertainty in the stock market and prompting another October rock-bottom test by the Dec. 14 meeting.

Therefore, we rate AMT stock a hold. Now is the time to enjoy the dividends while remaining patient during the next few weeks of volatility.

Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.