Summary:

- Increased mobile penetration and data demand to drive growth.

- Dip in earnings per share is short term; 2024 rebound is expected.

- Investors need to watch debt levels as interest expenses are squeezing margins.

- American Tower is priced for a 7% stock price CAGR based on DCF valuation.

Bill Oxford

Investment Thesis

American Tower Corporation (NYSE:AMT) is well positioned to experience growth, taking advantage of the increasing mobile penetration and data demand. The expansion of voice and data networks, along with the growing adoption of devices (excluding IoT), indicates a demand for AMT’s infrastructure services worldwide. From my perspective, AMT has consistently shown revenue growth despite some fluctuations in earnings per share due to factors only effecting the business in the short term. Although it’s important to monitor the debt situation, AMT’s stable revenue should enable effective management of it. Based on valuations, it seems reasonable to expect a projected return of 7% making it hold for investors despite the company’s fundamentals and growing demand.

Company Overview

American Tower Corporation is a real estate investment trust (REIT) that specializes in owning and operating infrastructure, for broadcast communications. Their main focus is leasing out space on their network of cell towers and rooftop sites as well as other communication structures to tenants, including wireless carriers and broadcasters. The primary source of revenue for American Tower comes from these leasing agreements, which provide a recurring income stream for the business.

With the increasing demand for connectivity with the expansion of 5G networks American Towers infrastructure becomes even more valuable. Moreover the company has a presence globally ensuring diversification of revenue streams.

In the telecommunications infrastructure sector notable competitors include Crown Castle (CCI) and SBA Communications Corporation (SBAC). These companies also like to lease their own communication infrastructure assets in a similar way.

Long-Term Demand Drivers

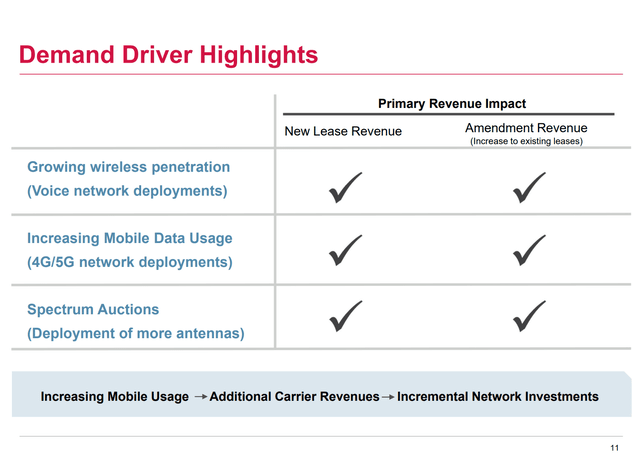

American Tower Corporation should experience sustained growth, supported by what I expect for be a steady increase in total mobile usage, higher revenues from carriers and an overall higher demand for mobile data. These factors are expected to drive long term growth for the business. As we can see below, factors including the expansion of the voice networks, the establishment of 4G/5G networks pushed by higher global data usage and spectrum auctions (i.e. antennas) all have a positive impact on revenue streams which lead to new and renewed leases.

American Tower Investor Relations

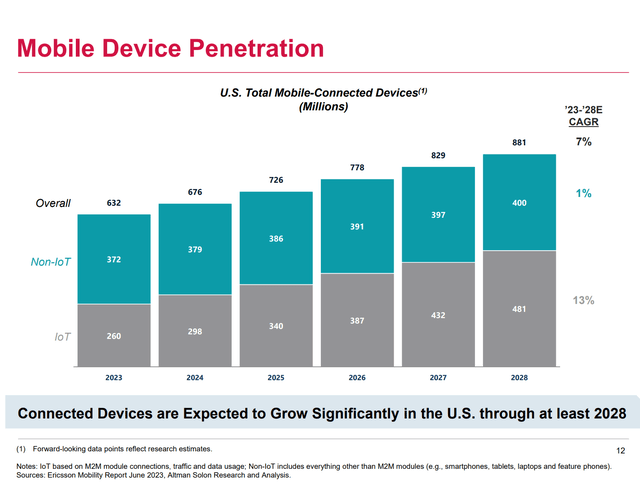

Further supporting AMT’s future demand is the projected growth in mobile device penetration in the United States. The total number of connected devices is expected to increase at a compound annual growth rate of 7% from 2023 to 2028 for overall devices. Non IoT devices, such as smartphones and tablets are projected to grow at a CAGR of 13% indicating a strong expansion in traditional mobile devices.

American Tower Investor Relations

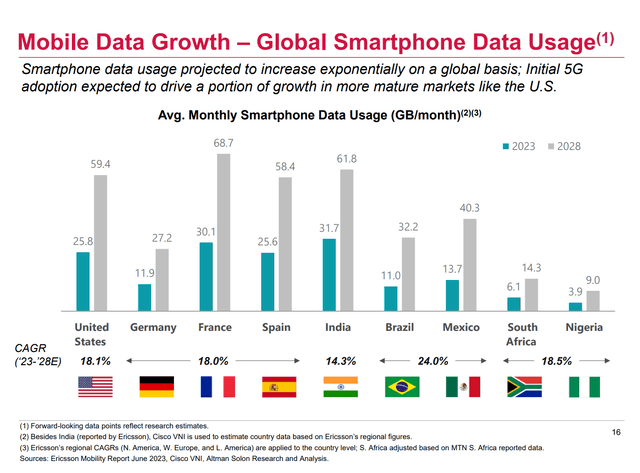

The next image below offers a perspective on the growth of mobile data usage specifically focusing on smartphone data usage. It is forecasted that there will be an increase in smartphone data usage in the U.S. from 59.4 GB in 2023 to 68.7 GB by 2028, with an impressive CAGR of 18.1%. We can also see Latin American countries such as Mexico and Brazil, expected to grow mobile data usage at a CAGR of 24% over the next five years. The huge market of India is also expecting to see growth of about 14% annually. The growth across multiple regions, clearly show that there should be continued growing demand for AMT’s infrastructure.

American Tower Investor Relations

These pieces of information create a story that highlights how AMT is in a position to take advantage of the current and future need for mobile connectivity. As more people adopt devices and use data it becomes undeniable that we need strong, widespread and efficient wireless infrastructure. AMT’s business model, which involves leasing space on their network of towers is well suited to benefit from these trends. With the increasing reliance on networks for business communication there should be demand for communication towers for plenty of years to come.

Financial Analysis

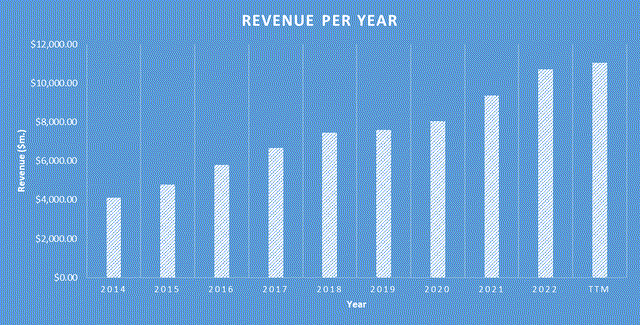

From my perspective AMT has demonstrated solid performance from 2018 to 2023. The firm’s top line increased from $6,663.90 million in 2018 to $11,062.50 million over the last twelve months, this is a CAGR of 9.7%. From my perspective, this goes to show that the demand for telecommunication towers are rising steadily over the trailing five years. Interestingly we saw a saw weakening in earnings per share which decreased from $2.67 in 2018 to $1.46 in the LTM. It should be noted that in 2022, EPS was $3.82. This decrease in EPS that we saw in the last year will be short-term in my opinion as it was driven by short-term factors such as an impairment charge related to Vodafone Idea in India not being able to meet their financial obligations as well as higher interest rates leading to a higher interest expense. As the impairment charge is put to bed and as interest rates will likely start to fall this year, I see AMT’s EPS getting back to growth this year.

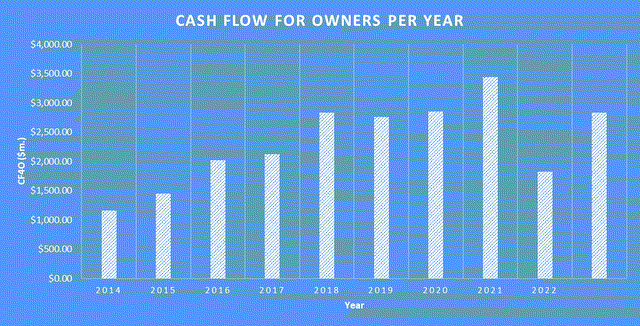

Created by Author

In terms of diluted shares outstanding, it has gone from 431.69 million in 2018 to 467.16 million in the past twelve months. This shows owners of the stock have been slightly diluted, but this is nothing to be concerned about in my opinion. American Tower has grown shareholders’ equity per share has gone backwards over the last 5 years, going from $14.46 in 2018 to $9.70 in the last twelve month. On paper this looks bad, but we need to realize that this is mostly due to an increased debt load, which will consequently lead to stronger book value in the future has the tenants of the towers help the business pay down the debt. When considering free cash flow, the company has compounded at a rate of 5.4%, increasing from $2,122.00 million in 2018 to $2,833.80 million in the last twelve month. This demonstrates that the company is producing more cash after factoring in capital expenditures than it used to five years ago. I think growth here will accelerate into the future as most of the capital expenditure currently is growth capex, therefore if the business was to pull back on reinvestment, the actual free cash flow would be significantly higher.

Created by Author

It is my stance that ROIC is a good measure in determining whether a business is efficient in reinvesting company profits. Through the previous 5 years, American Tower’s five-year median ROIC was 7.5%, hence this is an indication that the management team have below average ability to reinvest funds back into the business for future growth.

Regarding the balance sheet the recent quarterly report reveals cash and cash equivalents amounting to $2,118.90 million. The overall debt that the business is liable for is $35,421.30 million. Since the cash on the balance sheet covers only 6 percent of the debt load and that overall debt will take 13 years of free cash flow to pay off, this is something investors should keep an eye on. American Tower’s current ratio stands at 0.56, signaling that the company may require refinancing to cover the current liabilities over the next 12 months. Overall, I believe the businesses debt level should be watched by investors to ensure the debt loading on the company does not worsen, though for the time being the revenue of this business is stable and recurring so the debt is currently not a burning fire.

Valuation

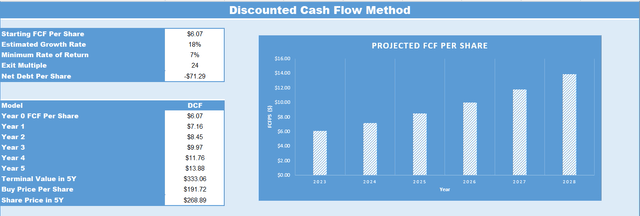

As of Q3 2023, AMT’s current TTM cash flow per share stands at $6.07. Considering the long-term growth opportunities discussed in this article, I anticipate a growth rate of 18% for AMT’s cash flow per share over the five years. Taking this growth into consideration it can be projected that AMT’s cash flow per share, by Q3 2028 would amount to $13.88.

Based on an exit multiple of 24 which is based on where AMT has traded at on a free cash flow basis over the past five years, it is estimated that the stock’s price target, in five years would reach $268.89. Consequently, if you decide to invest in AMT at its share price of $193.51 you can expect a Compound Annual Growth Rate of 7% over the five years according to these calculations. Since I like to aim for annual returns of 15% or higher, I recommend holding this stock for now.

Created by Author

Conclusion

The future prospects of American Tower appear promising as there is an expected increase in mobile penetration as well as overall data usage, which will likely drive long term growth. The expansion of voice and 4G/5G networks along with spectrum auctions is set to boost revenues from leases well as lease renewals. With the projected rise in mobile device adoption in the United States for IoT devices at a compound annual growth rate (CAGR) of 13% it indicates a thriving market for AMT’s infrastructure. Additionally there is growth in smartphone data usage in the U.S. well as high CAGRs in countries like Mexico, Brazil and India showing a global surge in demand.

After conducting analysis, it is evident that AMT’s top line revenue has shown a CAGR of 9.7% from 2018 to 2023. However there has been a recent decline in earnings per share due to short term factors. Despite increased debt load caution should be exercised regarding the level of debt. Unfortunately for AMT, they have stable and recurring revenue streams suggesting that the company should be able to manage its debt. Based on my valuation, I would recommend AMT stock as a hold at the moment. Based on current valuations, the stock is too expensive for a buy as it is only projected to deliver a 7% return currently despite bright fundamentals.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.