Summary:

- American Tower is one of the largest REITs in the world with a $94B market cap. Their international assets are an irreplaceable part of our communication infrastructure.

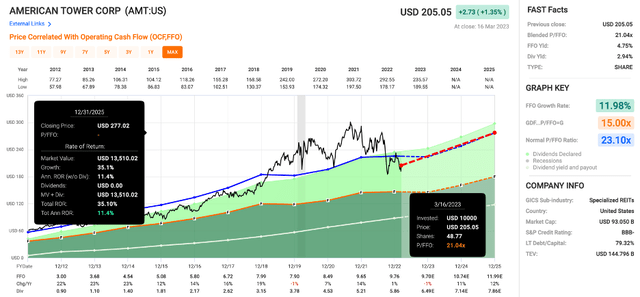

- Shares trade at a price/FFO of 21x, which is a couple turns below the average multiple.

- With shares just over $200, the yield is just over 3%, which is a rarity for American Tower.

- This quarter is the first quarter in over a decade that they did not hike the dividend, but I don’t think it breaks the bull case. Investors should also keep an eye on rising borrowing costs.

- I have added shares of American Tower and Crown Castle in recent weeks, and I think now is an opportune time to buy shares at a discount.

coffeekai/iStock via Getty Images

The last couple weeks in the market have been turbulent after the collapse of Silicon Valley Bank (SIVB) and the panic of potential knock-on effects through the financial system. While I have been focused outside of the tech sector, there are still a couple REITs with exposure to the tech space that I find attractive at current prices. Companies like American Tower (NYSE:AMT) and Crown Castle (CCI) are an important part of the communication infrastructure, and I have been adding shares of both in recent weeks. I try to space out my articles on each company that I cover, but I wanted to write an update on one of my favorite REITs, American Tower, after the release of their 10-K.

Investment Thesis

American Tower is one of the largest REITs available to public investors, with a market cap just over $94B. Despite the massive size, the company still has room to grow due to its international footprint and tailwinds for cell service and data usage. With shares trading just above $200, the current price/FFO sits at 21x, which is a couple turns below the average multiple. The 10-K pretty much showed it was business as usual, but I point out a couple things that I noticed after reading the annual report. One reason for caution is the rise in interest rates, which will probably lead to an increased interest expense in coming years.

American Tower has been hiking their dividend each quarter for years, and I was surprised to see that their most recent dividend was in line with the previous quarterly payout. I don’t think it is reason to be alarmed, but I will be watching the company closely to see if things change. I think the dividend growth will resume at some point (hopefully next quarter), but I think the chance to buy shares with a yield over 3% is still a great buying opportunity given the long-term tailwinds behind American Tower’s business.

Three Things That Stood Out In The 10-K

Over the last couple years, American Tower has made several acquisitions, most notably CoreSite’s data center assets in the US. We will see if they look to add more data center assets, but for now, they accounted for 7% of American Tower’s revenue in 2022. In 2022, they also made several smaller acquisitions, adding to their footprint in Spain, New Zealand, and other various locations. I’m assuming the acquisitions will continue but I don’t know if we will see any large acquisitions like Telxius Towers and CoreSite in 2021.

One of the things that sets American Tower apart from most REITs is their international footprint. Cell service and data usage continue to grow at impressive rates, which is a trend I expect we will see for years to come. They typically have lease terms starting at 5 to 10 years, and approximately 30% of their leases are up for renewal before 2027. Their rent escalators average 3% in the US and the international lease escalators are typically tied to inflation rates, which will probably lead to significant rent growth on existing assets.

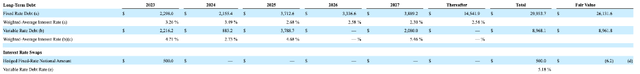

One reason for caution is the increase in interest rates, which will mean higher borrowing costs in the future. Right now, approximately three quarters of their debt is fixed rate. Based on the chart below from the 10-K, these rates currently sit between 2.3% and 3.49%.

Fixed vs. Variable Debt (10-K (sec.gov))

If you just look at a couple recent headlines for new borrowings (here and here), they have been priced at rates in the mid-5% range. While it’s not ideal, I don’t have an issue with that as a shareholder (especially considering where inflation has been over the last couple years). Unless interest rates fall dramatically where management can take advantage of lower borrowing costs, we will probably see a higher interest expense in coming years.

Valuation

American Tower has spent most of its time above the average multiple since the beginning of 2019. The average price/FFO multiple of 23.1x is definitely a premium valuation compared to many REIT sectors, but it makes sense if you consider the company’s investment profile and growth potential. Shares look very attractive today with a price/FFO of 21x, and investors can buy shares at prices near $200 that have only been available a couple times in the last several years.

Even if we don’t see multiple expansion, I think forward returns should be solid. Growth is projected to pick back up in 2024 and 2025, and I think the long-term tailwinds for data usage and cell service will continue for years to come. If we do get multiple expansion on top of American Tower’s FFO/share growth, I think shares will head back towards $300 in coming years. I find the American Tower’s valuation to be a buying opportunity for long-term investors, especially since there have only been a couple of chances to buy shares with a yield over 3%.

No Dividend Hike?

American Tower has a long track record of rewarding investors with double digit dividend growth. However, this quarter is the first time in over a decade that the company hasn’t hiked their quarterly dividend. While this is probably nitpicking, American Tower still yields over 3% today, which is a rarity if you look at the past decade. It has only reached that yield twice: October 2022 when markets were at a short-term bottom, and the last couple weeks. If you can pick up shares with a 3% yield, and the double-digit growth resumes, chances are high that forward returns will look pretty good three to five years from now. There haven’t been many opportunities to buy the cell tower REITs with their current dividends. American Tower has rarely yielded 3%, and Crown Castle’s yield is pushing towards 5%. This is part of the reason why I added shares of both in recent weeks.

Conclusion

While I have spent a lot of time over the last week trying to figure out how the Silicon Valley Bank collapse will impact my investments moving forward, I keep coming back to same ideas that I have been looking at over the last couple months. Finding real assets with real cashflow at attractive valuations is what I have been focused on, and I plan to continue to focus on companies that fit that description. While American Tower probably isn’t as cheap as some of the other ideas on my watchlist, there are a lot of reasons to like the cell tower REITs in the current environment.

I recently added shares of American Tower and Crown Castle, and I think dividend growth investors might want to add shares today as well. There are long-term tailwinds for the sector, and I find the valuation on both REITs compelling today. With American Tower, I was surprised to see the absence of a dividend hike this quarter, and the rise in interest rates could be a drag in coming years. I don’t think these things break the bull thesis, but it is worth keeping an eye on. With shares of American Tower just over $200 and a yield over 3%, I think the risk/reward for long-term investors is very favorable.

Disclosure: I/we have a beneficial long position in the shares of AMT, CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.