American Tower Is Well Positioned To Grow, But Crown Castle Could Keep Up

Summary:

- Demand for wireless services is expected to grow by 20% per year until 2027, fuelled by increased data usage and increasing availability of lower cost phones in emerging markets.

- Cell tower providers will be the first ones to benefit from this trend. Both AMT and CCI are very well positioned to take advantage of this uptrend.

- Let’s see which one is a better buy based on their differences.

energyy

Dear readers/followers,

Cell towers have become an essential part of our daily lives as they provide the infrastructure that powers the wireless communications we depend on. As a result, investing in companies that own and operate cell towers can be a smart choice for investors looking for a safe and steady long-term growth in their portfolios. There are many reasons why I consider including stocks that own and operate the cell tower infrastructure in my portfolio:

-

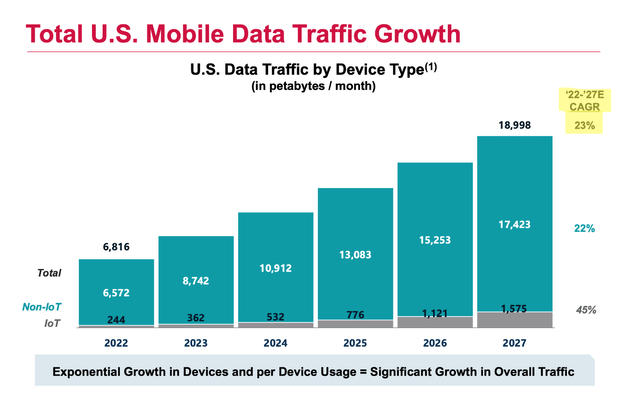

Growing Demand for Wireless Services globally – in the US the number of mobile-connected devices is expected to grow by 10% annually, while data usage by device is expected to grow even faster at 20% annually, partially driven by increased adoption of 5G. Combined these two should drive data traffic growth with a CAGR of 23% until 2027. Growth is expected to be even higher in emerging markets, mostly fuelled by increasing availability of lower cost phones.

- Long-Term Contracts: Cell tower companies often sign long-term contracts with wireless carriers, providing a very predictable stream of revenue over many years. This stability makes cell tower companies a relatively low-risk investment, particularly compared to other industries

-

Infrastructure as a Necessity: Cell towers are critical infrastructure and are required to support wireless communications. As a result, the demand for cell tower space is unlikely to decline (contrary to other types of REITs), providing investors with a stable investment opportunity.

The sector has performed well historically and given the tailwinds above I believe it will continue to do well in the future as our society becomes even more dependent on technology. Moreover, the cell tower sector allows investors to participate in this growing trend without investing into traditional Telecommunication operators such as Verizon (VZ) and AT&T (T), which can be preferable to some investors. This is not an article on VZ, but let’s just say that investing in the infrastructure is often safer (and sometimes even more profitable) than investing in the business that uses that infrastructure.

In this article I want to analyze two competing mega REITs in the cell tower industry, in particular American Tower Corporation (NYSE:AMT) and Crown Castle (NYSE:CCI), highlight the differences between the two and decide whether they make a good investment or not.

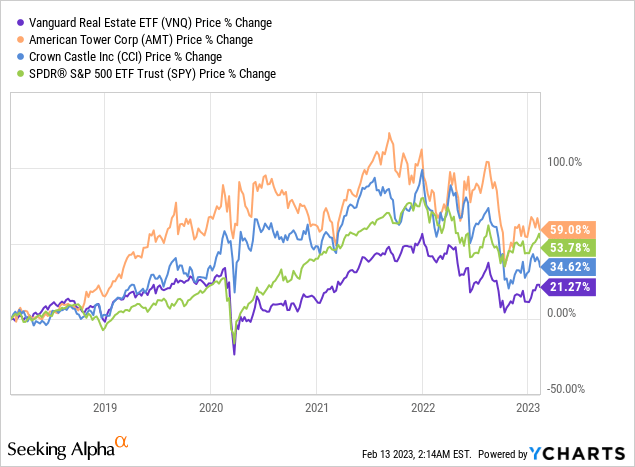

Over the past 5 years, both REITs have performed well, outperforming the Real Estate Index (VNQ) and returning 59% and 35%, respectively. AMT even managed to outperform the S&P 500, thought only marginally.

Key Differences

Both REITs operate similarly, but there are some important differences to consider in their geographic focus, their choice of secondary assets and their debt structures.

Geographical Focus

American Tower has a global presence, with a portfolio of over 200,000 towers across 6 continents, while Crown Castle primarily operates in the United States. This has its pros and cons.

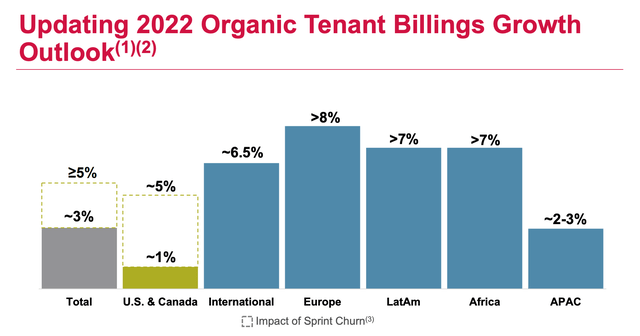

Emerging markets offer far better growth prospects than mature markets such the US or Europe where 4G is already widely available and any growth will have to come from increasing 5G coverage. In comparison emerging markets still lack infrastructure for 3G and 4G, therefore leaving much more space for cell tower companies to expand. With emerging markets being at least 5-10 years behind in terms of building infrastructure, it is quite easy to forecast the expected growth in the region which will likely be double digit. The higher organic growth can already be seen in the chart below.

Note on the Sprint Churn: this was caused by the merger of T-Mobile and Sprint. As one telco operator buys another, it has no use for the additional newly acquired equipment on the tower (since it already has its own) and therefore will not renew the lease. AMT’s Sprint lease termination dates are spread over the next couple of years so it will feel the churn gradually, while pretty much all of CCI’s leases expire in 2025.

On the flip side, this higher emerging market growth comes at an expense. Emerging markets have less developed law standards and in some cases less trustworthy governments. This means that it can be harder to reinforce collecting 100% of rents. AMT has already faced this, most recently with an Indian Telecom operator Vodafone Idea which refused to pay some of its rent due. CCI doesn’t have to deal with this issue as rents are quite easily reinforced in the US. Personally, I think the higher potential growth outweighs the risk of rent leakage, putting AMT one step ahead of CCI based on its geographical focus, mainly because it will likely enable it to grow faster.

Assets

Both companies own cell towers, but it’s the secondary type of product that makes them different. In addition to cell towers, AMT also owns and operates data centers (which it acquired through its recent CoreSite acquisition), while CCI focuses on fibre cable networks that connect to their towers. Personally, I consider data centers a bit riskier, as argued in my recent article on Equinix (here), due to the potential risk of big tech companies developing their own data centers in-house rather than leasing them from REITs (such as AMT, DLR or Equinix). At the same time, I can see significant growth in the data center sector fuelled by AI and similar new technologies. With that said both of these types of secondary assets should provide synergies to the existing business in the future, and while I slightly prefer the fibre network exposure, the difference is not material in my opinion.

Debt

When analyzing REITs in the current difficult macroeconomic environment with increasing interest rates, I pay special attention to debt. In particular, I pay attention to the maturity profile and ideally want to see little to no debt due over the next two years (if any is due I want to see enough cash – on hand or from operations – to cover the repayment). I also like to look at the % of fixed debt and the average interest rate.

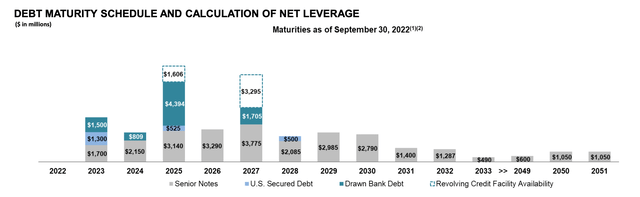

AMT has $38 Billion of debt with maturities of $4.5 Billion and $3 Billion in 2023 and 2024, respectively. The company has $2 Billion in cash and annual cash from operations stands around $3.3 Billion. That will likely not be enough to repay all debt due over the next two years, but given that AMT is a cell tower REIT with a BBB rating, I am willing to relax this criteria a bit (compared to say an office REIT), because I think the company will be able to refinance the debt without a problem – though most likely at a higher rate.

Only 77% of AMT’s debt has a fixed rate – that means that over $8 Billion of debt will suffer from increasing interest rates. Add to this the debt that the company will have to refinance in 2023 ($4.5 Billion) and we have a total of $12.5 Billion exposed to interest rate fluctuations. In Q3 2022 Earnings release the floating base rate (3-m LIBOR) was just above 3%. Now it stands at 4.87%. This increase on the $12.5 Billion of floating rate debt will mean $233 Million of additional interest expense per year. That’s a lot (about a 20% increase per quarter), considering that the company’s total interest expense in Q3 2022 was $294 Million. To be fair, the weighted average interest rate stood at just 2.8% in Q3 2022 – mainly due to European exposure with sub-1% rates so even with increasing rates and a large portion of debt unfixed, the overall cost of debt will still be significantly below treasury yields.

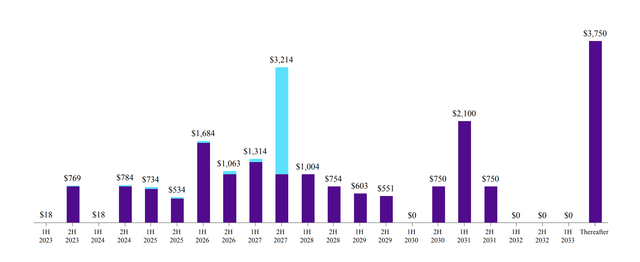

CCI has $21 Billion of debt with maturities of about $0.8 Billion in both 2023 and 2024. The company has $150 Million in cash and annual cash from operations stands around $2.8 Billion. This might actually be enough to repay the debt due over the next two years and even if not, with a BBB rating, the company should also be able to refinance its debt quite easily.

88% of debt is fixed rate – that leaves 12% floating rate (light blue below) which translates to around $2.5 Billion of floating rate debt. CCI has already reported Q4 results and since weighted average LIBOR increased significantly between Q3 and Q4, CCI’s results already reflect a large part of the interest rate increase on their floating rate debt. Because of this (and because all of their debt is in USD), their average rate stands higher at 3.6%. Still, this is really good and below treasury yields.

Summary of key differences

That’s it for the key differences. I think AMT wins on the geographic location point due to their exposure to higher growth emerging markets that have a much longer runway due to their immaturity and relatively less advanced roll-out of 3G and 4G. On the secondary asset I have a slight preference towards CCI’s fibre networks (as opposed to AMT’s data centers) but call it a draw. Finally with regards to debt, AMT has a significantly lower cost of debt due to their European exposure, but will face significant interest expense increases due to a large portion of floating rate debt. On this point the two are also very close. So it will all come down to valuation to determine whether one is better than the other and whether we should invest at all.

Valuation

Let’s start with AMT. I currently trades at a P/FFO multiple of 21.85x. Historically (since IPO) it has traded closer to 23x and more recently (since 2018) closer to 25x. I expect FFO to reach $12 per share in 2025 (+22% from today but slightly lower than analysts’ estimate of $12.20) and assuming the market values the stock at a multiple of 24x the price target would be $288 per share. This translates into 10% a year in price appreciation in addition to a dividend of 2.9%, giving us a total return of 12.9% over the next several years.

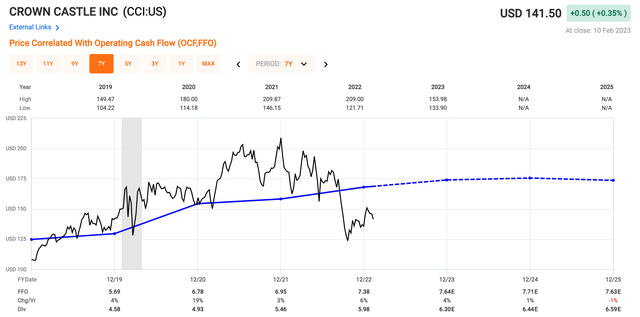

On a relative valuation basis, CCI currently trades at a P/FFO multiple of 19.1x. Historically (since IPO) it has traded closer to 22x and more recently (since 2018) closer to 22.8x. With FFO forecasted to reach $7.41 per share (based on analysts’ forecast and already reflecting the significant Sprint churn) in 2025 and assuming the market values the stock at a multiple of 22.5x the price target would be $166 per share. Over three year, this would imply a return of 5.6% in addition to a 4.4% dividend resulting in a total return of 10% per year. This is lower than the expected return from AMT, but it should be noted that since we picked 2025 as our valuation date, which happens to be the exact year when CCI will feel the full effect of the Sprint churn, the return for CCI is likely understated as FFO will be lower that year due to a one-time event and should pick up significantly going forward. For this reason I rate the two company’s valuations on par, at least from a relative valuation perspective and adjust my PT for CCI upwards to $175 (normalized FFO of $7.8 per share)

Comparing the two, AMT’s multiple is higher. I think that is fair though, due to their exposure to data centers, that tend to have higher multiples. Equinix, for example, which operates a business very similar to that of CoreSite, trades at a P/FFO of 24x. Therefore it makes sense that AMT trades at a slight premium when compared to CCI and I think the premium is worth paying in order to get exposure to data centers.

Verdict

We’ve seen that AMT and CCI are very similar. Both companies are well positioned in a growing market, have stable track records and very solid BBB rated balance sheets. Both companies are investable at the current valuation and should generate a solid return of 10-12% per year over the next three years. The differences are minor and essentially come down to the following:

- AMT’s global exposure will likely allow it to grow faster

- AMT’s data center exposure justifies a slight premium compared to peers, but also brings added risks which fibre networks may not

- CCI’s debt structure is more conservative with a larger portion of fixed debt (12% vs 23%) and less debt maturities until 2024. On the flip side, AMT enjoys a lot lower average interest rate (2.8% vs 3.6%) due to their EUR exposure

For those reasons I rate both AMT and CCI as a “BUY” here. If I had to choose one, I would choose AMT for its exposure to emerging markets and its very low average interest rate of 2.8% which is considerably below treasury yields.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.