Summary:

- Strong second quarter includes concerns and costs in China and at Cruise.

- GM’s forecast for BEV production capacity of 1 million vehicles in North America by the end of next year is no longer operative.

- GM scaling back and slowing down BEV projects, offering the PHEV option instead.

- Uncertainty around GM’s strategic pivot and potential costs, while maintaining a strong portfolio of gasoline-powered models.

Cruise (owned by General Motors) self-driving vehicle performing tests in San Francisco Sundry Photography

Last week, when CEO Mary Barra mentioned publicly that General Motors’ (NYSE:GM) forecast for battery electric vehicle (BEV) production capacity of 1 million vehicles in North America by the end of next year was no longer operative, the market seemed to welcome the news: GM shares closed higher, and the next day as well.

Initial excitement over the size of GM’s investments in electrification and bullish projections for consumer embrace of BEVs have definitely cooled.

Two years ago, GM disclosed it was investing $35 billion in BEVs and autonomous vehicles through 2025. Consumer reaction to the initial wave of BEV models manufactured by GM, Ford Motor Co. (F) and others – apart from Tesla – clearly indicated that demand was weaker than the industry anticipated.

GM also committed to electrifying 50% of its fleet by 2030 and 100% by 2035. Barra now says the automaker will be guided by “consumer demand.”

BEV slowdown

GM has responded by scaling back and slowing down projects and, presumably, investments. Barra, revealing few details, has said GM would be offering one or more plug-in hybrid electric vehicle (PHEV), a propulsion system that obviates range anxiety and lack of charging stations.

An enthusiast magazine theorizes that the PHEV – which is equipped with a gasoline engine that switches on when battery power is close to depletion – will be offered in North America in 2027 as an option on the Chevrolet Equinox crossover. GM already manufactures a PHEV for Equinox in China, which is offered in four variants selling between $20,000 and $24,000.

What investors don’t know – and may not be knowable anytime soon – is how much GM’s strategic pivot may be costing the automaker, in monetary terms and in disruption of product plans that could translate into lost market share – which has declined worldwide and remained strong in North America.

Among additional unanswered questions is how long and to what extent GM will continue to offer its conventional powertrains or, perhaps, to incorporate a gas-electric hybrid option. Toyota Motor Corp. continues to prosper with gas-electric hybrids, which first were introduced with Prius, and continue to win customers with successive versions across the Japanese automaker’s model line.

Political effect

Much could depend on the outcome of November’s election and what the regulatory regime looks like with regard to energy consumption and how long automakers will be given to transition to zero-emission propulsion.

What investors do know – and have responded to positively – are the accelerated share buybacks and dividend increase in last November. GM common stock is up more than 50% since the announcement and nearly double its closing price earlier in the same month. Barra and the GM board had little choice but to sweeten the return because the automaker’s BEV strategy was alienating investors and tanking share prices, driving them below the IPO offering of a decade earlier.

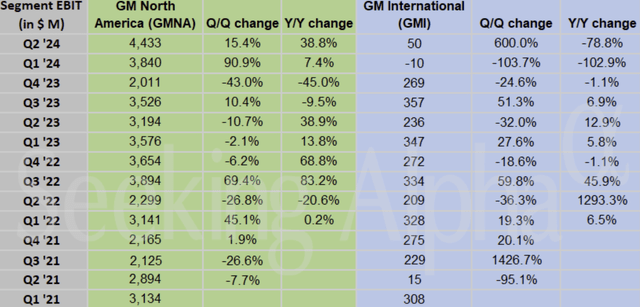

A strong second quarter financial performance confirmed what has been clear for some time, that GM maintains a strong portfolio of gasoline-powered models that resonate with consumers, especially its extremely profitable full-size pickups. Based on the financials, GM raised its profit guidance for the year.

Of the nearly 700,000 vehicles delivered in North America by GM in the second quarter, just under 22,000 were BEVs.

“We have an incredible portfolio of diverse vehicles, and we’re flexible, so we can win as more customers embrace EVs, and we can keep winning if they want to stay with the engine technologies they know,” said Marissa West, GM senior vice president and president, North America.

China is a different story. Like other western automakers, GM has watched the Chinese automotive market become dominated by local manufacturers and brands, especially in the BEV space. Q2 units sales in China declined to 373,000 for the quarter, down sharply from 526,000 units a year ago; market share stands at 6.4%, down from 8.6%.

“We had expected to return to profitability in China in the second quarter,” Barra said on the earnings call with analysts. “However, we reported a loss, and we expect the rest of the year will remain challenging because the headwinds are not easy. We are working closely with our (joint venture) partner to restructure the business to make it profitable and sustainable.”

Cruise loses

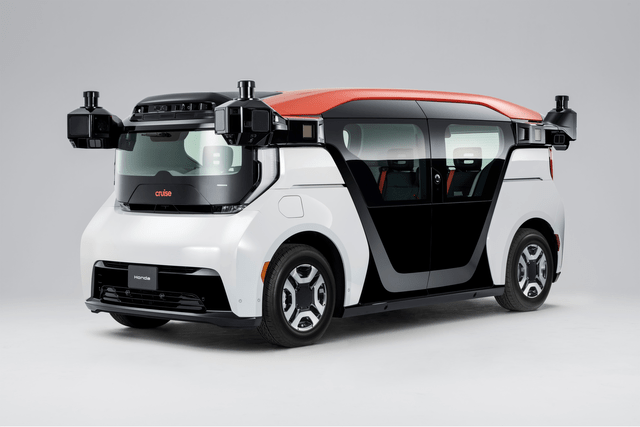

Barra also reported that GM Cruise, its self-driving venture, was dropping the Origin robotaxi and instead shifting self-driving tech to the next-generation Chevrolet Bolt. GM is writing off $583 million of its investment to reflect the change. Cruise posted a $1.14 billion operating loss for the quarter.

Cruise Origin robotaxi prototype (GM)

Barra and GM management, to their credit, have adopted a practical response to the evident reluctance of many consumers to switch to BEVs from models powered by internal combustion engines – ICE. The rhetoric coming from top management underscores the flexibility to stay with ICE engines as long as needed, and to switch to BEVs when and if consumers demonstrate they are ready.

A wild card is the U.S. government’s accelerating fuel efficiency standards. GM and other automakers faces hundreds of millions – and possibly billions – of dollars in fines for failing to comply with fleet average fuel efficiency standards. Depending on the next election, the standards may grow even more strict in order to hasten the transition to zero-emission BEVs. Or, the standards may be relaxed. Because the lead time for new models is long, GM and other automakers are stuck guessing what might happen and hedging their bets to prepare for the alternative.

The stock market’s reaction to GM’s second quarter results, a 6% price drop, suggests that the $50 level that some analysts were projecting for the company’s common shares had been reached and constituted fair value and a resistance level.

For months, analysts across the board have been recommending GM stock, citing the low price of shares and the company’s earning potential. It’s too soon to say the analysts are wrong – but it may be that the value that was spotted months ago has been realized. Until more data is available to demonstrate strong earnings growth, a reversal of losses in China and more substantive progress at Cruise, I remain neutral on GM.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.