Summary:

- A. O. Smith Corporation specializes in residential and commercial water heaters and boilers.

- Replacement demand represents 80-85% of U.S. water heater and boiler volumes. This results in predictable and stable cash flows from year to year.

- Demand is further supported by an aged housing stock with homeowners likely to remain attached to their current homes in an era of rising interest rates.

- The company boasts of a balance sheet that includes a net cash position of nearly +$300M.

- For investors seeking stable income payments to ride out market volatility, AOS’s payouts are backed by a record of 82 consecutive years of dividend payments.

Jane Rubtsova/iStock via Getty Images

A. O. Smith Corporation (NYSE:AOS) is a leading manufacturer of water heaters and boilers with a broad line of products offered for sale in North America, China, India, and Europe. The company serves both residential and commercial end markets in two reportable segments: North America and the Rest of The World (ROW), which consists primarily of China.

Within North America, the company is one of the largest manufacturers and marketers of water heaters with a leading share in both the residential and commercial portions of the market. Aside from water heaters, AOS sells boilers, water treatment products, and other products, such as expansion tanks and commercial solar water heating systems.

At the end of the most recent fiscal year ended December 31, 2021, AOS reported total revenues of +$3.5B and net earnings of nearly +$500M. Additionally, the company generated over +$550M in free cash flow (FCF) and was in a net cash position of +$435M, with a cash balance of +$631M. For income-focused investors, the company is a reliable dividend-payer with 82 consecutive years of payments with a history of double-digit increases in the years prior to 2020 and increases of over 8% in the last two years.

Despite a solid earnings release at the end of April, shares in the company have retreated to new 52-week lows and are now down 30% YTD. For investors seeking to add a quality dividend-paying company to their portfolio, AOS is a fundamentally safe addition with reasonable upside potential.

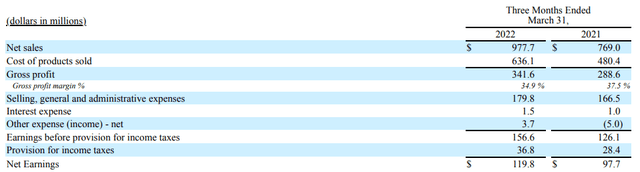

Earnings Review and Other Reportable Events

In the most recent quarter ended March 31, 2022, AOS reported total net sales of +$978M, which was up 27% from the same period last year and about +$10.7M better than expected. In the North American segment, sales were up 32%, while ROW was up 15%. From an overall basis, North America accounted for about 75% of net sales, which is about 300 basis points more than the prior year.

Earnings also came in stronger than expected, with a Non-GAAP EPS beat of $0.02. Overall, net earnings were up 22% from the prior year, with earnings up over 100% in the ROW segment. Additionally, margins in this segment were 9.7%, which was significantly better than the 5.3% reported in 2021. Higher volumes and lower advertising and selling expenses were the key factors driving this increase. Improvements in operating margins in China to over 11% was an additional tailwind for the increase.

In the current period, SG&A accounted for 18% of net sales versus 22% in the prior year. This improvement offset some of the weakness reported for gross profit margins. Interest expense also continues to be minimal, reflecting the company’s limited use of debt financing.

Q1FY22 Earnings Summary – Form 10-Q

Driving sales in the current quarter was inflation-related price increases initiated in 2021 and the impacts resulting from the acquisition of Giant Factories, Inc late last year. Excluding the acquisition impacts, net sales would have been up 23% as opposed to the 27% as initially reported.

In individual product lines, North American water heater sales grew 28%, due primarily to the favorable pricing environment. Additionally, the pricing strength in water heaters contributed to 89% of the increase in overall net sales in the North American region.

While the full year outlook in the residential water heater industry remains unchanged, the outlook for commercial water heaters is expected to be flat to slightly down, due to unfavorable regulatory changes.

Aside from water heaters, AOS continues to see strength in North America from their other products, such as boilers and water treatment products. Water treatment sales, for example, grew 17% in the first quarter. With an addressable market of over +$2.5B, water treatment is an exciting growth opportunity for AOS.

Looking ahead, AOS reaffirmed their 2022 outlook with an adjusted EPS range of $3.35 to $3.55 per share, assuming no further surges of COVID in the U.S. and an easing of COVID-related shutdowns in China. Revenue growth, however, was updated to be lower than their outlook in January due to volume headwinds in China and slower starts of commercial water heating. Still, revenues are expected to grow in the double-digit range of 14-16%.

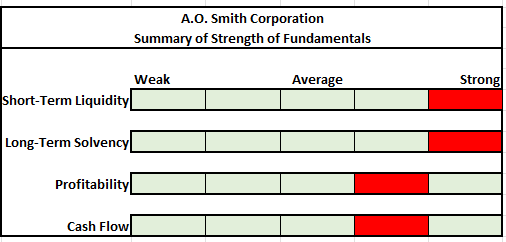

The Fundamentals

Author’s Summary of Strength of Fundamentals

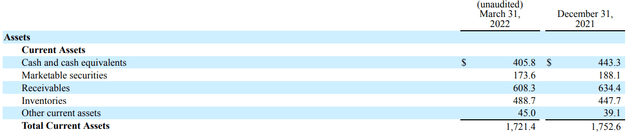

From a balance sheet perspective, AOS is in a very strong financial position, with a net cash position of +$284M, consisting of cash on hand of +$579M and minimal leverage that was just 14% of total capital at the end of the quarter.

Within the individual line items on the assets side of the balance sheet, cash on hand and receivables were down about 8% and 4% for the period, respectively, while inventories were up about 9%

Q1FY22 Partial Balance Sheet – Form 10-Q

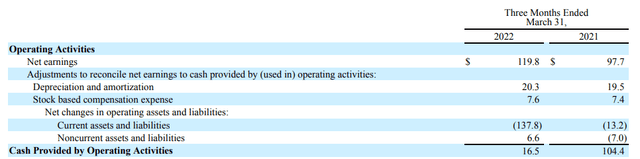

The working capital effects of inventories and receivables contributed partly to the significant decrease in operating cash flows during the period, which was +$16.5M in the current quarter versus +$104M in the same period last year. One factor driving the decline was increased purchases of inventory at higher costs. Another was higher incentive payments in 2022 due to record 2021 sales and earnings.

Q1FY22 Partial Cash Flow Statement – Form 10-Q

While FCF was just +$3.6M, management is expecting total FCFs in 2022 to be between +$500M and +$525M, which would not be too far off the +$566M reported in 2021, considering the Q1 headwinds. This will continue to support the safety of the annual dividend which is currently $1.12 per share. At less than 40% of net income, the payout is unlikely to be negatively impacted in subsequent periods.

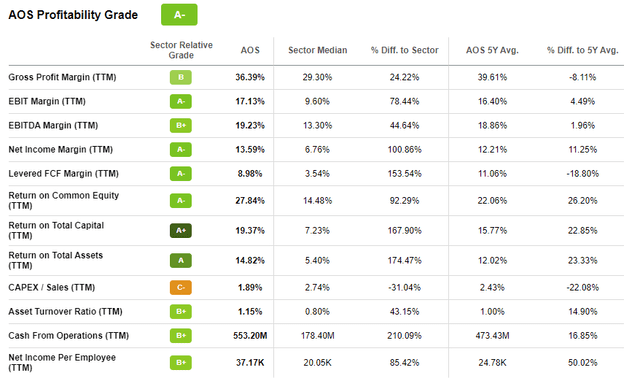

Declining margins are one concern, but the company’s overall profitability over the past twelve months still exceeds industry averages and is not too far off from their own historical averages. Given the strong balance sheet and cash flow projections of the company, AOS does have the cushion to weather any further operating headwinds that may arise.

Seeking Alpha – AOS Profitability Metrics

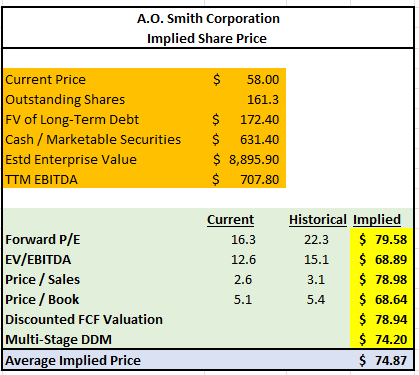

Currently, shares are trading at about 16.3x forward earnings, which is discounted to their five-year historical average but in-line with the broader index. At a 22x valuation, shares would be worth about $80. Other multiples-based approaches yield similar results. Furthermore, the use of models incorporating discounted cash flows also produce targets within range of the various pricing multiples.

Author’s Calculations of Intrinsic Share Price Using Various Valuation Metrics

All considered, at an average implied price of about $75, shares appear to be nearly 30% undervalued based on a current price of $58.

Two Risks to Consider

AOS is heavily exposed to China, with nearly 30% of net sales attributable to the country for the full 2021 fiscal year. While partnership with the country, over 25 years for AOS, has numerous benefits, such as market size, capable infrastructure, and favorable demographics, the partnership is also subject to the risks associated with the broader relationship with China and the U.S., which is at its lowest level in decades.

The ongoing trade war and increased sensitivities surrounding Taiwan, for example, are two geopolitical chokepoints that will continue to command attention in 2022 and beyond. Furthermore, continuing COVID-related lockdowns in China are further risks not just to AOS but other multinationals that operate in the country. In the case of AOS, their FY22 outlook is dependent on an eventual easing of containment measures in the second quarter. If the current outbreak lingers longer than expected, this could result in weaker earnings. Additionally, if the economic situation continues to deteriorate in the country, that could negatively impact future sales to the country.

Another factor driving AOS’ guidance for the year is the price of steel, which is a critical component of their products. In 2021, U.S. steel index prices increased over 100% and it continues to exhibit volatility through the start of the year. After stabilizing at the end of 2021, prices began to fall briefly to start the new year, before rising again in the weeks leading up to the earnings release. On an annual basis, the company is expecting prices to approximate prices seen in mid-April. If these estimates prove inaccurate, earnings would be negatively impacted in future quarters.

Conclusion

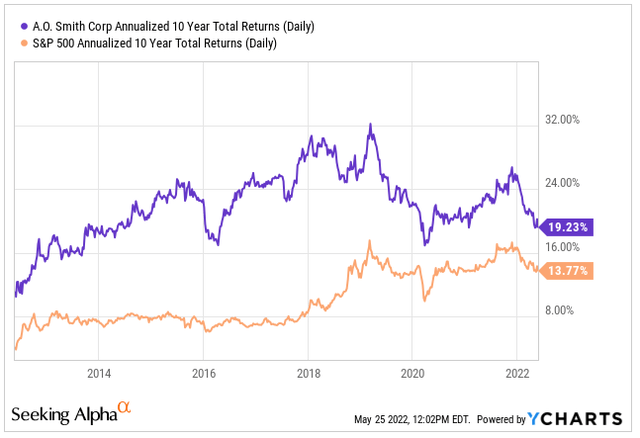

AOS has been declining along with the broader market despite posting strong first quarter results. The pullback, however, is significantly worse than the broader market. YTD, for example, the stock is down 30% compared to the S&P’s decline of 17% over the same period. This is despite a history of outperforming the index over the past ten-years.

YCharts – Annualized 10-YR Returns of AOS Compared to S&P 500

Fundamentally, AOS is a stock an investor can comfortably hold in their portfolios through challenging macroeconomic environments. The company maintains a net cash position and leverages that strength to invest in strategic growth opportunities, in addition to returning any excess back to shareholders in the form of dividends and buybacks.

At an estimated intrinsic share price of $75, shares are nearly 30% undervalued at current pricing. In return for waiting for the upside realization, prospective investors would receive stable dividend payments that have been paid out every year for the last 82 years. For this level of upside at moderate risk, AOS is one bargain-add for any long-term oriented portfolio.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.