Summary:

- The company generates 80-85% of the residential revenue from the replacement market, which is less cyclical and should limit the downside despite tough macros.

- The company’s margin should benefit from the moderation in commodity prices, price hikes, and cost-saving actions.

- The stock is still trading below its historical valuation.

niphon

Investment Thesis

A. O. Smith’s (NYSE:AOS) stock is up over 19% since our last bullish article in September. Over the last couple of quarters, the company has experienced inventory destocking by its channel partners in its residential water heater business in North America. I believe this destocking is nearing its end, which should benefit near-term sales. While the weakening housing market is a concern, the company generates 80-85% of its revenue from the replacement market, which is less cyclical. The demand in the commercial boiler business remains healthy as the order rate and backlog level remain strong. The revenue in 2023 should also benefit from the pricing actions taken over the last few quarters. The company’s margin should benefit from the moderation in commodity prices, price hikes, and cost-saving actions, partially offset by volume deleverage. I believe 2023 should be a much better year for the company than feared, and the stock can continue its outperformance.

Revenue Outlook

After seeing good growth post-Covid, the company started seeing a decline in order rates in its residential water heater business in the second quarter of 2022 due to the slowdown in the housing industry caused by rising mortgage rates. This led to inventory destocking in the North American residential water heater market in the last couple of quarters. Further, the international markets were also challenging, with the Chinese sales getting impacted by the Covid-19-related lockdowns and negative FX translation. The only bright spot in the recent quarters was the company’s commercial water heater and boiler business, which grew in North America due to the sequential improvement in the supply chain.

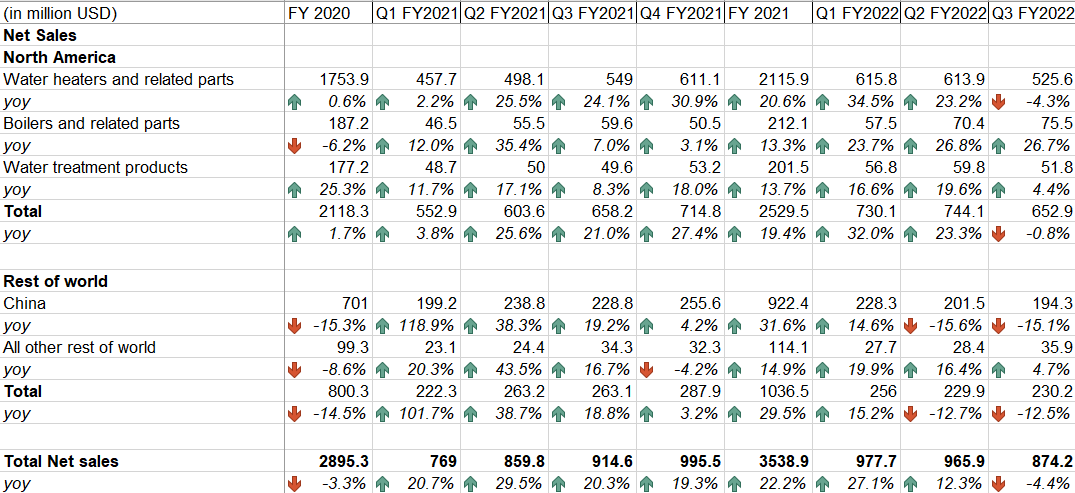

AOS historical sales (Company data, GS Analytics Research)

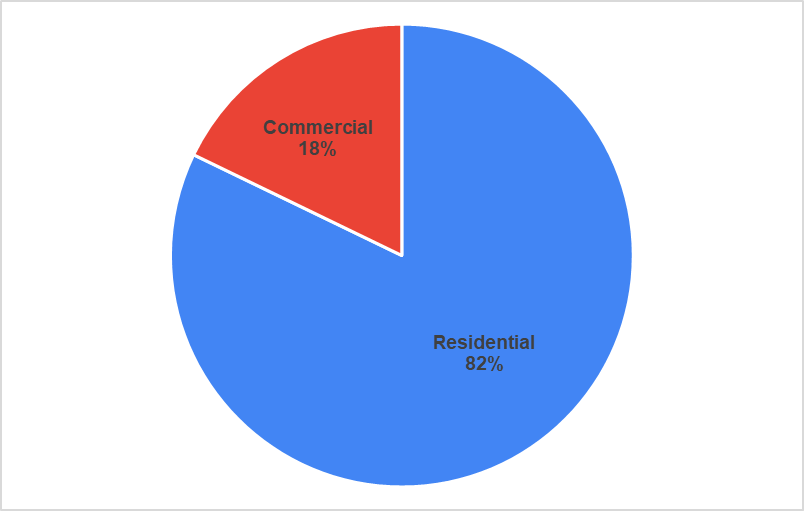

AOS end market distribution (Company data, GS Analytics Research)

Looking forward, I believe the destocking in the residential water heater business in North America should be completed by Q4 2022. On its last earnings call, management talked about seeing some rebound in residential water heater orders in October 2022, which indicated the inventory situation is improving. I am anticipating further positive commentary on the next earnings call regarding the inventory levels at dealers/distributors.

Further, while many investors are worried about the housing slowdown, the company generates approximately 80-85% of the revenue in the residential business from replacement demand, which is less cyclical compared to new construction. This should limit the downside in 2023.

In the commercial boiler business, the company is seeing healthy demand in the hospitality and institutional end markets. The order rates are solid, and the backlog is up ~2x to 3x higher than in the past. This should benefit the company’s revenue in the near term. Internationally, China is also reopening, which should benefit sales. Additionally, the pricing actions taken by the company to offset inflationary costs should benefit sales growth.

AOS’ strategy of focusing on innovation and decarbonization is also contributing to strong demand for its products. The company recently launched its Voltex AL residential heat pump water heater to expand its decarbonization portfolio. The Vortex AL is a highly efficient product with integrated leak detection, smart connectivity, and updated water connections. This product puts AOS in a strong position to capitalize on the trends in decarbonization and energy efficiency. In addition to good organic growth prospects, I believe the company’s strong balance sheet should enable it to pursue inorganic growth opportunities. As of its last reporting period, the company had cash and cash equivalents and short-term investments of ~$417 mn versus long-term debt of ~$281 mn.

I believe the company’s Repair & Remodel exposure, pricing actions, healthy demand in the commercial boiler, and the completion of inventory destocking should help its sales in FY23 and beyond, despite tough macros.

Margin Outlook

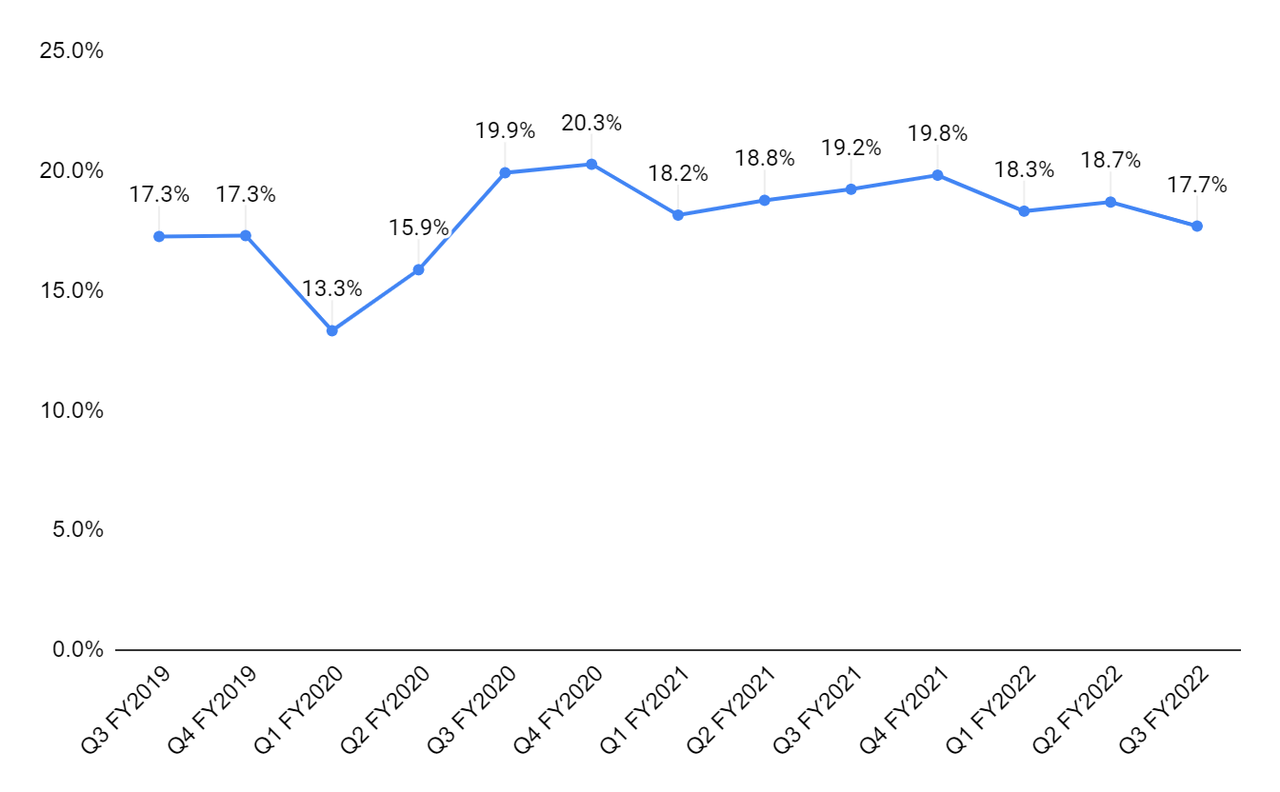

The company’s adjusted segment operating margin has been impacted due to volume deleveraging and production inefficiencies from supply chain constraints and higher material and freight costs, which has impacted its margins in recent quarters.

AOS adjusted segment operating margin (Company data, GS Analytics Research)

Looking forward, I believe the moderation in steel prices as well as the pricing actions taken over the past few quarters should benefit the company’s margins in 2023. In response to the softening volumes in the North American residential market, the company took some cost-saving actions, such as rebalancing and aligning its manufacturing facilities to line up with lower volumes. Additionally, the company is streamlining its stores in Tier 1 and Tier 2 cities in China, which has helped reduce costs and made these stores more efficient. The company plans to continue this in 2023. While non-steel material and transportation costs still remain elevated, I believe they should also start seeing some normalization in FY23, with supply chain constraints continuing to ease and inflationary headwinds improving due to the Federal Reserve’s hawkish stance. So I expect the margins to improve in FY23.

Valuation & Conclusion

The stock is currently trading at 18.76x FY23 consensus EPS estimate of $3.19, which is lower than its five-year average forward P/E of 22.03x. It also has a forward dividend yield of 2.00%. While most of the investors are worried about the company’s housing exposure, I believe the company’s results may surprise them with AOS’ exposure to replacement demand, pricing actions, healthy commercial boiler backlog levels, and the completion of destocking more than offsetting new construction headwinds. The company’s margin should also benefit from the moderation in commodity prices, price hikes, and cost-saving actions. With the stock trading below its historical levels, I believe it is still a good buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Sanket B.