Summary:

- A. O. Smith Corporation saw its sales peak in China in 2018. A return to those levels would be a huge boost to the stock.

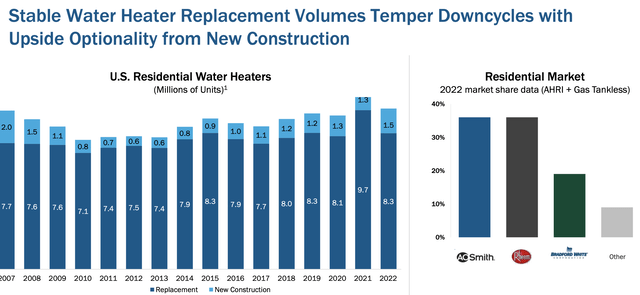

- The core North American business is a solid, replacement driven business.

- A. O. Smith Corporation stock looks moderately undervalued, but I’d prefer to be a buyer on a price dip.

JulNichols

A. O. Smith Corporation (NYSE:AOS) is a solid company whose stock has potential upside if it can reinvigorate its business in China.

Company Profile

AOS manufactures and sells water heaters, boilers, water treatment, and other products for the residential and commercial markets. In North America, it sells through both the wholesale and retail channels.

In the wholesale channel, it sells water heaters under the A. O. Smith and State brands. It also sells water heaters in four of the six top home center retailers, and exclusively sells its A. O. Smith branded products at Lowe’s Companies, Inc. (LOW). It also sells A. O. Smith branded water treatment products through LOW and Amazon.com, Inc. (AMZN), and its Aquasana branded products primarily through e-commerce sites. With its Lochinvar brand, it sells both boilers and water heaters. About 60% of the brand’s sales are boilers, and 40% water heaters.

The company also sells water heaters and water treatment products internationally, with the bulk of sales coming from China. In the Chinese water heater market it sells electric wall-hung, gas tankless, combi-boiler, heat pump and solar water heaters. Its products are sold in approximately 12,000 locations in the country. It also sells its products in India, Europe, the Middle East, and other countries in Asia.

Opportunities and Risks

China remains both an opportunity and risk for A. O. Smith Corporation. Unlike in North America, the water heater market is considered a bit of a luxury market in China. AOS was able to capitalize on this trend to become a well-known, popular brand in China with its own specialty stores.

However, sales peaked in the country in 2018 at $1.07 billion, with the company seeing a -19% decline in sales, excluding currency, in 2019, which was before Covid hit. Covid and subsequent restrictions didn’t help the matter, sending Chinese sales to $701.0 million in 2020. Sales improved to $922.4 million in 2021, before falling back to $839.1 million in 2022, a -5% decline in local currency as well as a $36 million hit from currency translation.

AOS saw its Chinese sales once again fall in Q1, dropping -10% in local currency. However, it does expect China to return to growth later this year.

On its Q1 earnings call, CEO Kevin Wheeler said:

“Our China business performed as expected in the first quarter. We believe it will take time for consumer confidence to strengthen and for the economy to improve in China. We reaffirm our guidance that our sales in China will grow 3% to 5% in local currency in 2023. Our guidance assumes volumes in China improved throughout the year. Our forecast assumes the Chinese currency will devalue approximately 2% in 2023 compared to 2022. We are adjusting our outlook for our boiler business. …

“In China, we saw sequential monthly improvement in our sales through April, and we expect that to continue through the year. We are pleased with our free cash flow through March, and we expect a strong rebound in free cash flow for the full year, as China emerges from COVID-19-related disruptions, and our dedicated focus on inventory reduction across our North America operations.”

The big question for AOS is whether it can get back to peak China sales and then grow from there. Covid and subsequent restrictions have distorted the picture over the past few years. The big drop in sales before Covid is a bit worrisome, and there is no indication what a more normalized China may look like. India is an opportunity, but is still small.

In North America, AOS’s business is much more of replacement business. And while it has diversified its product lines, water heaters are still 82% of its North American revenue, and the bulk of that is residential. If a water heater breaks, people generally tend to fix it pretty quickly. The company also has some exposure to new home construction, as well as proactive replacements, where people replace older heaters before they break. But overall, this is a nice, steady business that benefits from improved product innovations and price increases.

The water treatment market, meanwhile, is a nice growing market. As a fragmented market, this is one place AOS has done and continues to look at acquisitions to help drive growth. Within the space the company has made a number of deals, including for Aquasana in 2016, Hague in 2017, Water-Right in 2019, Master Water in 2021, and Atlantic Filter in 2022.

When looking at risks, the impact of commodity costs, particularly steel, is one area to be wary of for AOS. The company said it recently saw a spike in steel prices that will see its steel costs rise 20% in the second half, hurting North American margins. The company also wasn’t immune to some of the over-ordering and subsequent de-stocking that many companies in various industries had to deal with last year.

The economy could hurt preventive sales a bit, but isn’t likely to have a big impact on overall North American sales. International is a bit more at risk, but the bulk of that market is still China, which is coming out of Covid restrictions and seeing spending improve.

Valuation

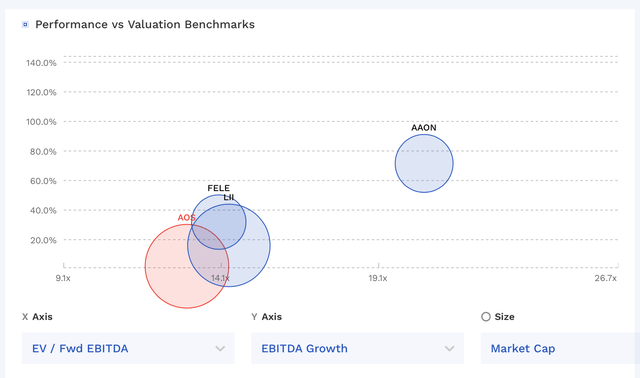

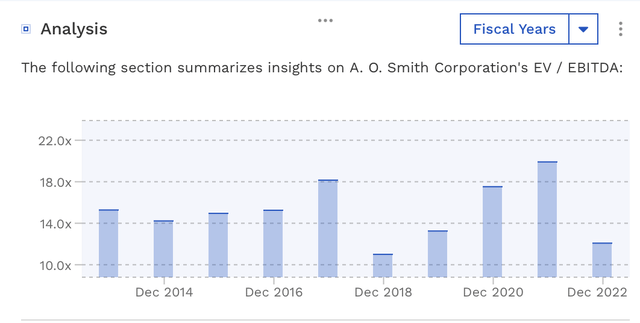

A. O. Smith Corporation trades at 12.9x the 2023 consensus EBITDA of $776.1 million and 12.3x the 2024 consensus of $816.0 million.

It trades at a forward P/E of over 19x the 2023 consensus of $3.47. Based on 2024 analyst estimates of $3.70, it trades at over 18x

The company is projected to grow revenue 1% this year and nearly 4% next year.

The company trades towards the low end of its peer group and toward the low end of its historical averages.

AOS Valuation Vs Peers (FinBox) AOS Historic Valuation (FinBox)

Conclusion

A. O. Smith Corporation has a nice, solid, steady business in North America, with the potential for increased growth if it can return to prior level sales in China. The business generates solid free cash flow that can be used to pay the dividend and buy back stock. Operating cash flow has average around $500 million the past five years, with CapEx around $70 million. It guided for free cash flow (“FCF”) of between $575-$625 million, which would be a record and surpass the $566 million in FCF it generated in 2021, but that year had a lot of inventory reductions. Q1 of 2023 had a pretty large inventory drawdown, and so I’d expect FCF to return to more that $500 million level in 2024. Nonetheless, that’s a lot of money it can put to work and return to shareholders.

I’d also expect some continued bolt-on acquisitions in the water treatment business to continue to help build out that business. M&A should be a nice growth driver in that part of the business.

At its current valuation, A. O. Smith Corporation stock looks moderately undervalued versus peers and historically. The stock has had a strong start to the year, up nicely. As such, I think A. O. Smith Corporation stock is a solid “Hold.” If China can turn around, there should be some good upside left in the name. However, for new money buyers, I’d prefer to be a buyer of A. O. Smith Corporation stock on a price dip.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.