Summary:

- In the near term, the company’s revenue should benefit from higher price realization, easing supply chain challenges, and volume growth in the water treatment and boiler businesses.

- The margins should benefit from the pricing actions taken and the mix of the business.

- Valuation is cheap.

niphon

Investment Thesis

A. O. Smith (NYSE:AOS) is experiencing softness in demand for commercial and residential water heaters, however, the order rates and backlog levels in the boilers and water treatment businesses remain strong. This should benefit the volumes in 2H FY22, partially offsetting the decline in volumes in the water heater business. The pricing actions should also contribute meaningfully to the revenue growth in the back half of FY22. Further, the company’s margin should benefit from these pricing actions and the mix of the business is also expected to improve with good growth in the boiler business in 2H FY22. The stock looks attractive, trading at a meaningful discount to its historical levels.

AOS Revenue Outlook

AOS’s sales growth in Q2 FY22 was driven by pricing actions, the acquisition of Giant Factories in October 2021, and volume growth in North America’s water treatment, boilers, and commercial water heater businesses. The sales growth was partially offset by the COVID-related lockdowns in China and lower sales of residential water heaters. The order rate of the residential water heater declined due to tougher comps. Further, the order rates in July declined as customers were rightsizing their inventory levels. Commercial gas water heater shipments in the quarter improved sequentially with the improvement in the supply chain constraints. The order rate for commercial electric water heaters greater than 55 gallons has also improved sequentially after being impacted by the regulatory change at the beginning of the year but still hasn’t recovered completely. In North America, the boiler business ended the quarter with a strong backlog, largely composed of commercial condensing boilers. The order rates for these energy-efficient boilers remained healthy. AOS’s strategy to focus on innovation and decarbonization contributed to strong demand for high-efficiency condensing boilers.

In China, consumer demand in the second quarter was down 20% Y/Y, but sales improved sequentially throughout the quarter as covid-related lockdowns eased and consumer demand improved. In the first half of July, consumer demand was down 5% to 10% Y/Y, and management is expecting demand levels to be in a similar range for the rest of FY22.

AOS is moving forward with its strategy, which focuses on expanding its water treatment business through innovation, new product development, and strategic acquisition. In May, the company launched its redesigned Aquasana clean water machine with four different methods of filtration technology. In addition, the company acquired Atlantic Filter, making its fifth acquisition in North America since 2016 in the water treatment business. Atlantic Filter is a water treatment company in South Florida and provides a good opportunity for A. O. Smith to expand in the region.

Looking forward, the demand for residential and commercial water heating is expected to soften. The residential water industry’s unit volumes in the U.S. are expected to be down 4% to 6% Y/Y as the demand is stabilizing after the strong last couple of years. Last quarter, the company updated its commercial water heater industry volume growth guidance range from prior flat to slightly down to between -7% and -9% Y/Y primarily due to the decline in light service commercial electric heaters. The light service commercial business, though sequentially improving, has not yet fully recovered from the slow start at the beginning of the year due to regulatory changes.

But the good news is pricing actions and the strength in the boiler and wastewater business should offset this weakness in the water heater business. In the boiler business, the stable order rates and healthy backlog, higher pricing, and strong demand for energy-efficient products should drive sales in the range of 20% to 25% Y/Y. The boiler backlog levels are in the three to four months range, with mainly commercial orders in the backlog. Pricing is expected to contribute 8% to 12% in 2H FY22 in the boiler business. The North American water treatment sales growth is expected to be ~15% in FY22, with mid-single digits to 10% contribution from pricing in 2H FY22. The total sales growth of the company is expected to be in the range of 12% to 14% in FY22, driven by pricing actions, easing supply chain challenges, and volume growth in water treatment and boiler businesses. Given the company’s high teen revenue growth in the first half of this year, this guidance looks easily achievable. In the medium to long term, while there are certainly some macroeconomic concerns, product innovation, easing lockdown in China, and strategic acquisitions are expected to help the company offset macroeconomic headwinds.

One thing which I like about the company is its solid balance sheet, with a net cash position of $161 million. So, even during a macroeconomic slowdown, the company can focus on attractively valued acquisition targets and inorganic growth to increase sales.

Margins

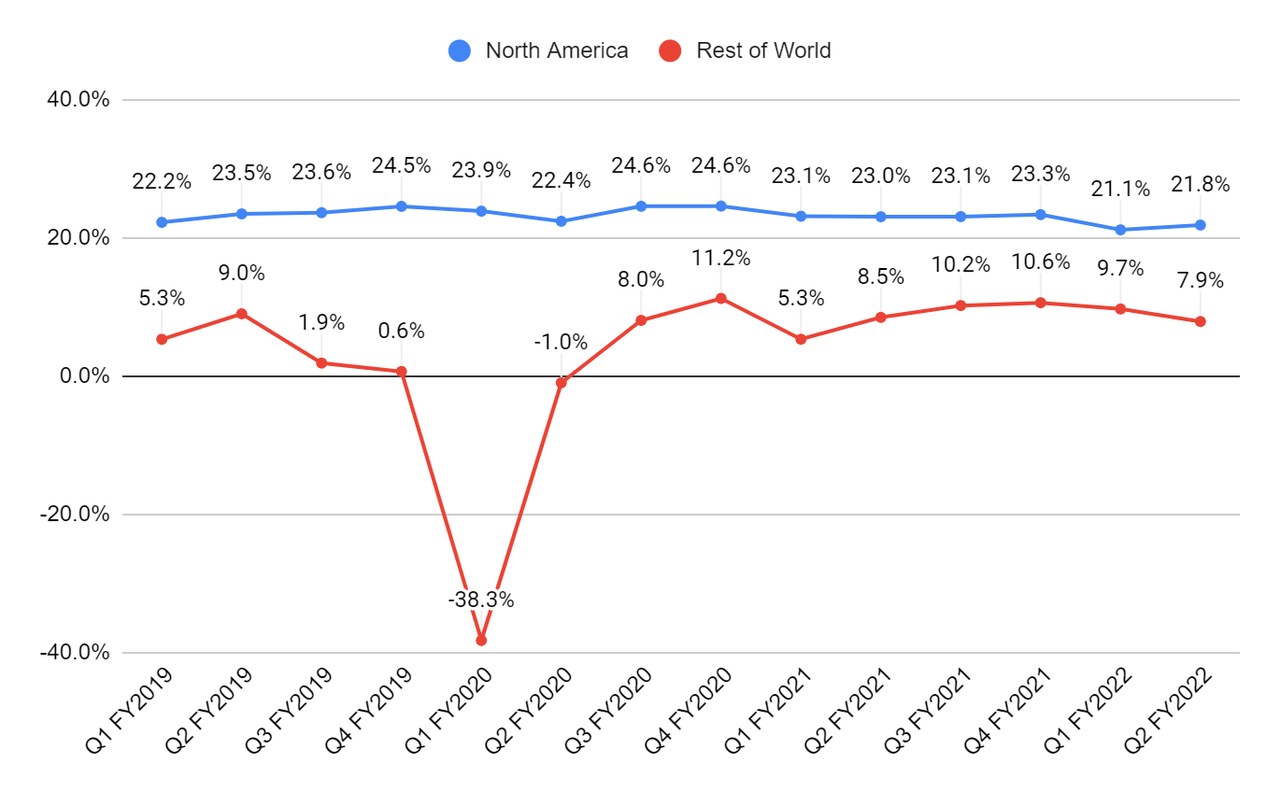

The adjusted segment margin in the North America segment was impacted in Q2 FY22 due to higher material and logistic costs, plant production inefficiencies, and the inclusion of the lower margin Giant Factories business. The margin in the Rest of World segment was down 60 bps Y/Y and 180 bps sequentially at 7.9% due to lower volumes, partially offset by lower selling, advertising, and engineering expenses. The lower discretionary spending was due to the COVID-related lockdowns in China.

AOS adjusted operating margins (Company data, GS Analytics Research)

Looking forward, the steel prices in 2H FY22 are expected to moderate, which should benefit the margins. The company also plans to control its discretionary spending in China in 2H FY22 to improve its margin. Management started taking pricing actions in late FY21, and those higher-priced orders are currently in the backlog. As the company starts to deliver those higher-priced orders, and the benefits from recent price hikes in Q2 FY22 start flowing through P&L, margins should improve in the back half of FY22. Additionally, the strong volumes in the boiler business should improve the mix of the business, supporting the margin growth. Management has guided for the full-year adjusted segment operating margin in the North America segment to be between 22.5% and 23%, and for the Rest of the world segment to be between 9.5% and 10% which looks achievable.

Valuation & Conclusion

The stock is currently trading at 14.67x FY22 consensus EPS estimate of $3.49 and 13.94x FY23 consensus EPS estimate of $3.68, which is lower than its five-year average forward P/E of 22.69x. In 2H FY22, the company’s revenue should benefit from the pricing actions and volume growth in the boiler and water treatment businesses. The company’s margin should also benefit from the pricing actions and mix of the business. Attractive valuation and good growth prospects make AOS a good buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.