Summary:

- Apple’s stock has declined by 11% in the past three months, which looks fair amid the apparent creativity crisis in the company.

- The company continues exploiting Steve Jobs’ legacy, but this will not last infinitely, and there are red flags proving this.

- The stock is still overvalued and there is potential for further decline, leading to a “Sell” rating for AAPL.

Justin Sullivan

Investment thesis

My bearish thesis about Apple (NASDAQ:AAPL), which I shared in December, aged well. The stock price declined by around 11% over the last three months, while the broader market moved in the opposite direction. Recent developments suggest that my key idea from the previous thesis regarding creativity crisis in Apple seems to be correct. The company’s extremely expensive Vision Pro did not become a banger, the iPhone continues struggling in China and it looks like Apple is a laggard in the artificial intelligence [AI] revolution. Moreover, my valuation analysis suggests that the stock still has the room to tank due to the current overvaluation. All in all, I reiterate my “Sell” rating for Apple’s stock.

Recent developments

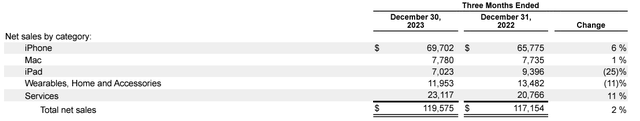

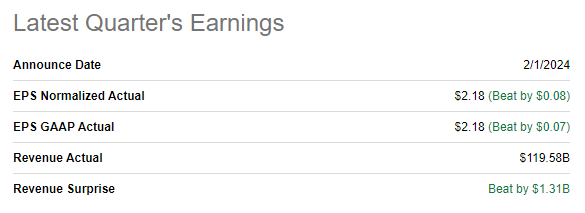

Apple reported its latest quarterly earnings on February 1, when the company topped consensus estimates. Revenue grew by 2.1% on a YoY basis and the adjusted EPS expanded notably, from $1.88 to $2.18. The EPS improvement was insured by the expansion of the gross margin by almost three percentage points.

Seeking Alpha

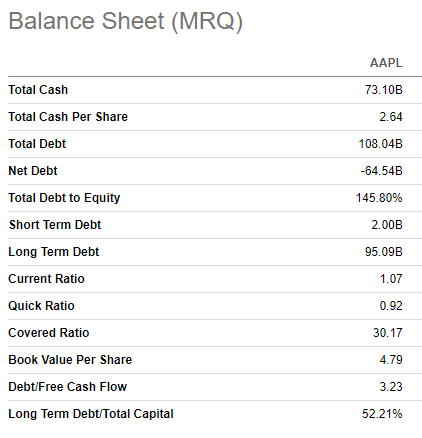

Apple’s profitability is stellar and the company generated five billion dollar more in levered FCF in the previous quarter compared to the same quarter last year. Therefore, I am not surprised that the balance sheet kept improving as the cash pile expanded by more than $10 billion and the net cash position is now $64 billion. Apple’s legendary buyback volumes are still massive, as the company returned to shareholders $22 billion via stock repurchase in FQ1.

Seeking Alpha

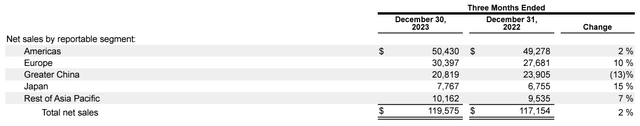

However, the company’s extensive profitability and its fortress balance sheet is mostly thanks to the legacy of the iconic founder, Steve Jobs. I think so because the iPhone which was introduced during the Jobs era, and Services ecosystem around it, continues driving the company’s financial performance. These two revenue streams are the largest ones and cumulatively represent around 78% of the total revenue. Furthermore, these two revenue streams, which were built under Steve Jobs’ tenure as a CEO, were the only ones in previous quarter to deliver notable growth. Mac sales are stagnating and the iPad together with Wearables/Accessories [most of them were introduced after Mr. Jobs passed away] revenues fell sharply in December 2023 quarter.

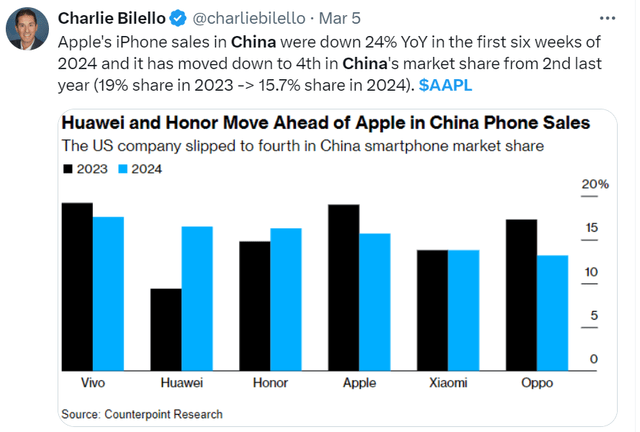

The net change YoY increase in revenue was 2%, meaning that the top line is not growing in real terms if we consider inflation. Apple continues driving most of the revenue growth by exercising pricing power in Services, but this cannot last infinitely and sooner or later will likely have adverse effect on the brand loyalty. The company’s major star’s prospects are also becoming cloudy as the iPhone is losing competition to Huawei in China with a massive pace.

In the above chart, we can see that Huawei expanded its market share aggressively, meaning that the smartphone market in China is still robust and reasons of Apple’s market share decline are company-specific and not cyclical. The big red flag to me is that Apple not also losing market share to a widely known Huawei brand, but is also losing to much less famous names like Vivo and Honor. I realize that geopolitical tensions between China and the U.S. might adversely affect not only Apple, but the company’s revenue concentration in China is significant. Since relationships between the U.S. and China are in a “Cold War” mode for more than five years, I consider this to be a secular issue, which means that around 17% of the company’s revenues is under threat.

In my previous thesis, I have also emphasized my doubts about the potential success of a $3,500 Vision Pro virtual/augmented [VR/AR] reality headset because the offering does not look like a good value for money for consumers. But my previous thesis went live before Vision Pro sales launched, and now we can see how my doubts aged. Considering the company’s huge fan base and limited supply, the fact that Vision Pro failed to sell out on first day of release is another huge red flag. This fact reinforces my confidence that Vision Pro is very unlikely to become a banger at the $3,500 price. Statista projects that Apple Vision Pro shipments will increase by around tenfold between 2025 and 2028, leading to approximately $44 billion in revenues by 2028 [if the current selling price remains]. But I have another question in this case: if we are indeed in a new era of AR/VR, does not it mean that Apple will disrupt itself and the Vision Pro will cannibalize revenues of its legacy products? Why someone will need a phone if he or she is using a new headset with almost the same functions? it is difficult to reliably estimate how much of the company’s revenues Vision Pro might cannibalize, but it looks apparent to me that most of the functionality the new headset offers overlaps with Apple’s legacy products.

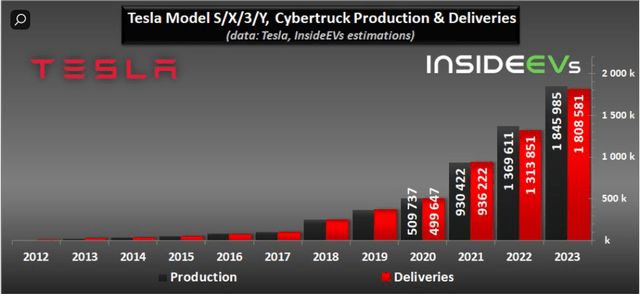

Another evidence of a creativity crisis in Apple is recent news that the company discontinues its decade-long electric vehicle [EV] project and reallocates human capital to artificial intelligence [AI]. First question I have to Apple’s strategic decision making process is why it took Apple a decade and billions dollars spent on R&D to realize that the project is not viable. In the current rapidly evolving world testing business hypothesis for a decade does not look like a good business practice. Moreover, it has been apparent for around three years that Tesla’s rapid scaling pace is unlikely to be matched by any new entrant [even Apple] making Apple’s decision to halt its EV project look outdated by at least a couple of years. I think so because Apple’s image of one of the largest and most innovative companies in the world does not allow it to be a laggard no matter what the new venture is. Since Tesla already delivered nearly one million vehicles in one year in 2021 and Apple highly likely still did not have any clear vision around its final EV product, I think that Apple’s decision to halt the EV project is way outdated.

Shifting employees from the halted EV project which produced nothing over a decade to AI also does not look very strategically sound to me. Generative AI is the hottest topic at the moment with OpenAI releasing its jaw-dropping Sora video generator and Google (GOOG) attempting to keep up in image generation with its Gemini. Meanwhile, Tim Cook is teasing with an “incredible breakthrough potential for generative AI” for the iPhone, which, as of now, remains just words. Last October, there were news that Apple is investing $1 billion per year to catch up in generative AI. The figure might sound massive out of context, but one billion is just mere 3% of the total Apple’s R&D spending in FY2023 [around $30 billion], according to the company’s P&L provided by Seeking Alpha. This amount also looks extremely low compared to rivals, considering Microsoft’s commitment of $10 billion to invest in OpenAI and Amazon’s $4 billion bet on Anthropic.

With each quarterly earnings rolling out my conviction in Apple’s overreliance on Steve Jobs’ legacy grows. The company’s iconic founder is not with us for more than a decade, and Apple still the iPhone and its ecosystem is the only driver which allows the company’s financial performance to avoid stagnation. However, this reliance in unsustainable indefinitely and rapid market share loss in China is a first big warning sign for the iPhone’s future sales growth. Vision Pro is very unlikely to be a success at this selling price and attempts to appear active in the generative AI race seem awkward, in my opinion.

Valuation update

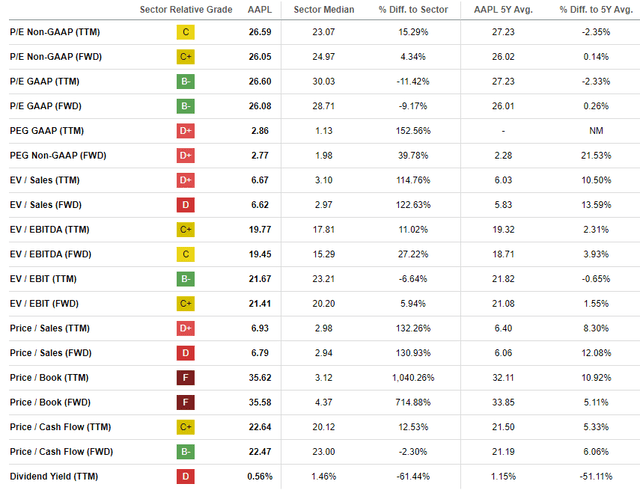

The stock price declined by 11.1% year-to-date, significantly lagging behind the broader U.S. market. Even after a notable stock price decline, valuation ratios are still higher than AAPL’s historical averages across the board. I am not comparing AAPL’s multiples to the sector median because despite all the headwinds and challenges, the company’s scale and profitability are still unmatched.

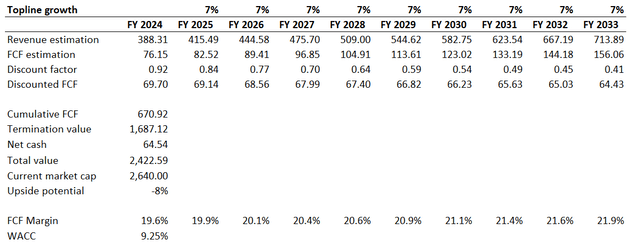

I want to proceed with the discounted cash flow [DCF] model update. I am using a softer WACC now, since Fed announced three rate cuts in 2024. Therefore, I incorporate a 75 basis points decrease in the discount rate compared to the 10% I used in my previous analysis. I think that a 9.25% is fair enough since this level aligns with the recommended WACC range for AAPL from FinBox and valueinvesting.io. Given all the problems I have highlighted in the above passage, I am downgrading my revenue CAGR expectations for the next decade from 9% to 7%. I also now expect less aggressive FCF margin expansion, by 25 basis points yearly instead of 50 basis points I used in December. The base year FCF margin is the TTM ex-SBC level. I am not downgrading revenue growth rate or FCF expansion pace deeper because I want to be conservative enough in my bearish thesis. Conversely, my conservative approach should employ optimistic key metrics, to demonstrate that the valuation is not very attractive even under optimistic scenario.

According to my DCF simulation, the business’s fair value is $2.4 trillion. This means that there is still room for AAPL to decline as the stock appears to be around 8% overvalued. While I typically say that a large scale company with unmatched profitability deserves some premium, I cannot agree in case of Apple’s stock due to multiple red flags I highlighted in “Recent developments”.

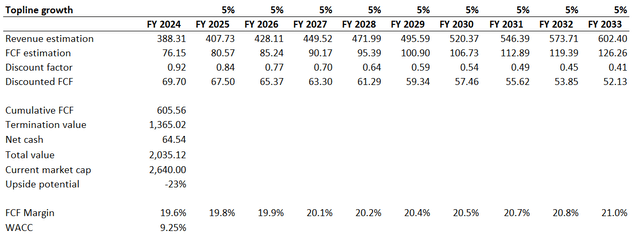

I also want to emphasize that with less optimistic revenue growth and FCF margin expansion assumptions, the business’s fair value falls notably. With a 5% revenue growth [which looks more fair considering the big threat in China] together with 15 basis points yearly FCF margin expansion, the fair capitalization falls much closer to $2 trillion, which represents a 23% downside potential.

Risks to my bearish thesis

Betting against one of the most successful companies of the last two decades is inherently risky. Apple still has a massive brand loyalty in the U.S. and the company converts it into a robust pricing power. Moreover, Apple theoretically still has potential to drive new revenue streams. The company is still one of the best places to work for which means Apple is able to recruit brightest and creative professionals to build strong development teams. The robust financial position also adds confidence that the company is able to finance multiple large R&D projects simultaneously, one of which might eventually become a new rockstar.

According to demandsage.com, there are around 1.5 billion active iPhone users worldwide. With such a massive user base, Apple has large potential market to monetize via new features, especially considering the company’s announced focus on AI. While I think that the company lags far behind generative AI leaders, the possibility that a jaw-dropping app might be released by Apple should not be discounted as well.

Due to the company’s robust brand loyalty, its ecosystem and profitability, its stock is likely to be perceived by investors as a safe harbor. While currently it seems that funds from around the world are flowing into semiconductor stocks, a correction in the hottest chipmaking names could trigger panic and investors will likely start seeking for a safe haven like Apple. This might lead to a spike in the share price, which will contradict my bearish thesis.

Bottom line

To conclude, I reiterate my “Sell” rating for AAPL. The company continues relying mostly on its legacy products, and strategic moves to develop new significant revenue streams are lagging, in my opinion. The creativity crisis is apparent to me and recent developments add to my conviction in the thesis. Moreover, the stock is still overvalued and there is the room for the share price to decline further.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.