Summary:

- Salesforce is aging gracefully, with still a hint of steel behind its increasingly watery eyes.

- Revenue growth is slowing, though, and we don’t believe the restructuring underway is material enough to really raise the cash flow margin game.

- That said, we remain in a bull market, and this is a high beta stock, so we believe it can rise from here.

- We rate at Hold accordingly.

Vertigo3d

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Still Too Much Wetware And Too Much Stuff

Righto. Salesforce (NYSE:CRM). Here goes.

Your author here is old and remembers the 2004 Salesforce IPO. And a very exciting thing it was too. Veterans of the pre-IPO Salesforce.com (as it was then known, because the very addition of dot-com was once worth a few dollars on the share price!) will tell you that deferred revenue accounting was a royal headache to explain to the SEC, that recruiting sales executives from perpetual license-driven competitors was tough because those fat ole license sales paid for some fine jolly boys’ outings to Maui and such, and that when you started talking to people in general about multi-tenanted database security models, their eyes glazed over right before they found something more interesting to do right over there in the room next door. It was, in short, Hard Work as the new kid on the block with a product approach that Nobody Liked and a set of commission plans that Nobody Liked and a set of accounting principles that Nobody Familiar With GAAP Before SOP97-2 Liked.

Despite which the thing mooned.

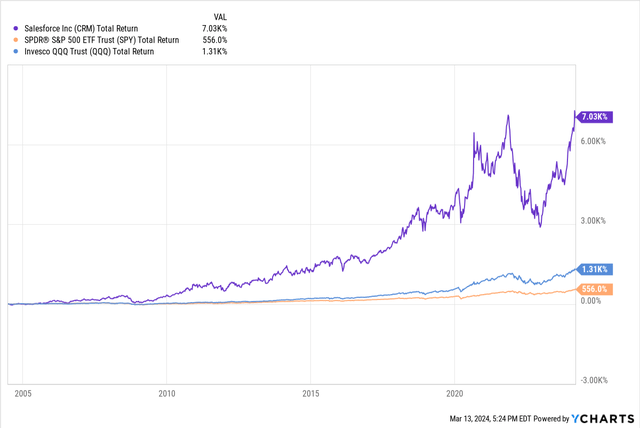

CRM vs SPY vs QQQ, Total Return Since CRM IPO (Ycharts.com)

Salesforce though is no longer the enfant terrible of enterprise software; it’s now more cuddly grandpa on the outside with still a glint of veteran steel underneath the cardigan. The company has, with at least some justification, begun trumpeting its AI credentials (but remember even AT&T (T) is an AI stock these days because, you know, AI means more datacomm and all). But the question is, is the name in its dotage, or does it still have a little spring in its step and a glint in its eye?

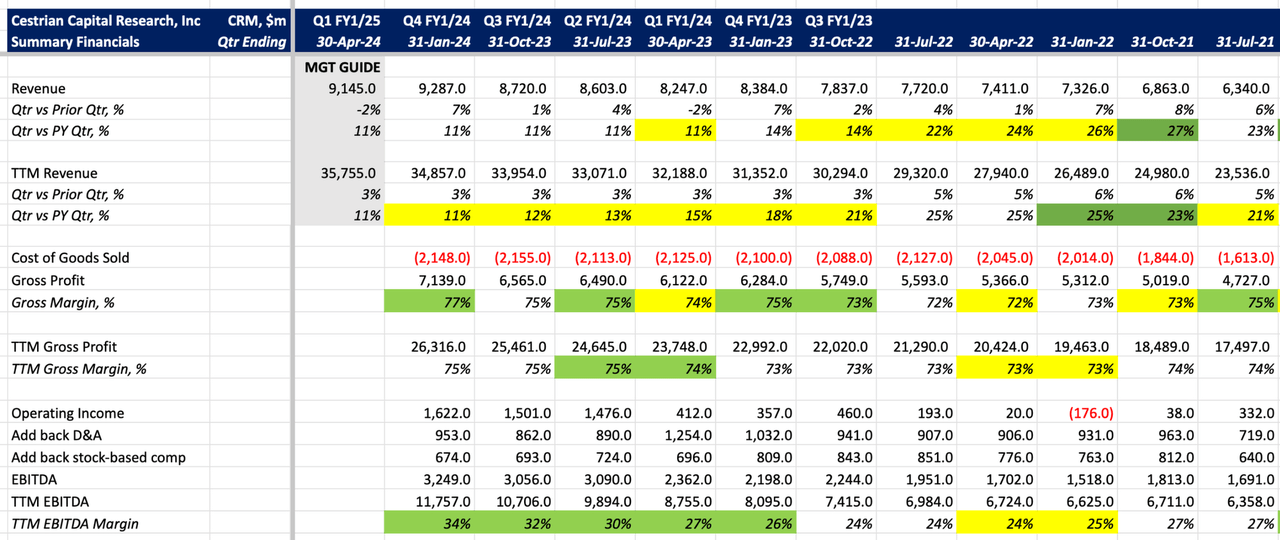

Headline Financials

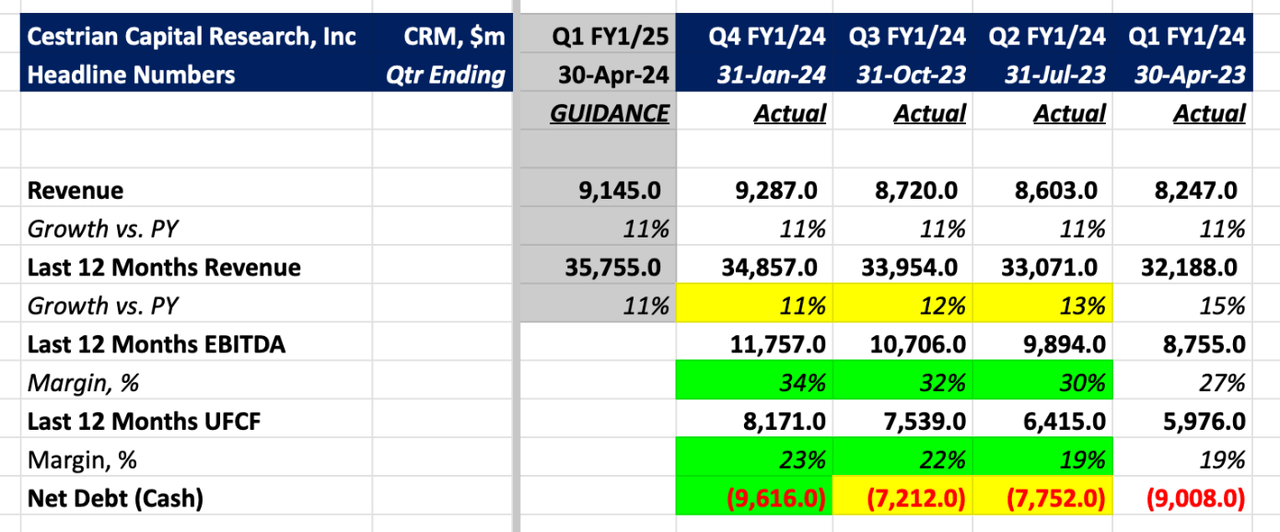

The most recently reported quarter was for 31 January 2024, this being Q4 of their FY1/24. Here are the headlines.

CRM Summary Financials (Company SEC Filings, YCharts.com, Cestrian Analysis)

In short:

- Revenue growth remains at 11% vs. previous year this quarter … the same growth rate for the last three quarters … and the guide for next quarter is … you guessed it … 11%. That is an unusual level of consistency.

- EBITDA and cashflow margins are climbing nicely, but note the meaningful gap between them. For me, this means I tend to disregard EBITDA and focus on cashflow, and those cashflow margins are rather low for the level of growth.

- The balance sheet is safe as houses, with almost $10bn of net cash now (if you deduct the value of their long-term equity investments, a more cautious measure, you can say there is around $6bn net cash).

My own view on the fundamentals is, meh. The company is in the middle of further restructuring – see the recent Wall Street Journal coverage here – but this is nothing truly major, and if you sit back, you may well conclude that 11% growth at 23% cashflow margins is nothing particularly special.

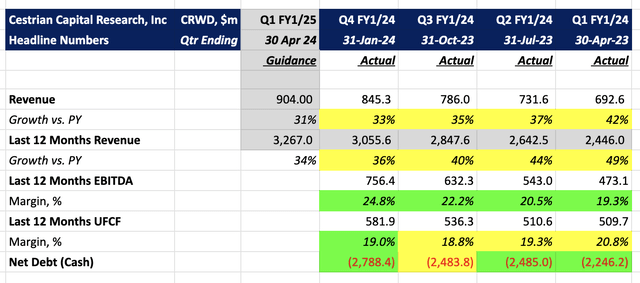

You might look at younger companies like CrowdStrike (CRWD) which are able to grow at +36% on a TTM basis whilst clocking in +19% TTM UFCF margins and conclude that’s a better balance.

CRWD Summary Financials (Company SEC Filings, YCharts.com, Cestrian Analysis)

But, as everyone knows, fundamentals are merely one input into the stock price, not even the most important input. So let’s turn to analysis of the stock (the output material), as opposed to analysis of the company (the input).

Technical Analysis

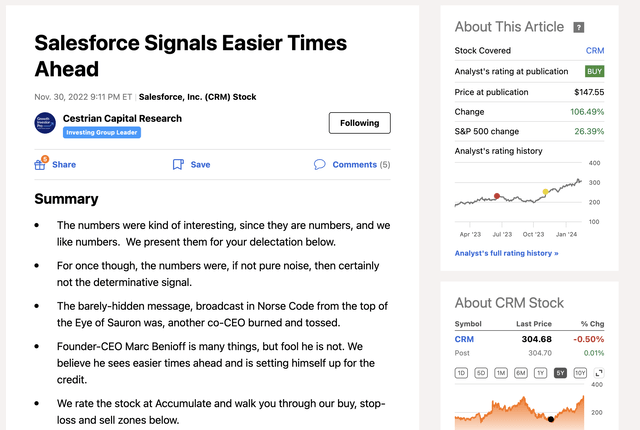

CRM stock was truly brutalized in 2022, overly so in my opinion. The stock bottomed in December 2022, just a few dollars above its late 2018 low. The recovery was equally sharp. We rated CRM at Accumulate between $138 and 166/share, reflecting the concentration of institutional buying at the time; the stock is now sat at around $305, having recovered from a modest selloff on earnings. So, an opportunity to have doubled your money in not much more than a year, in a stable software business with a solid balance sheet. Not too shabby. This was our note back in November 2022.

CRM Note, November 2022 (Seeking Alpha, Cestrian Capital Research)

And now?

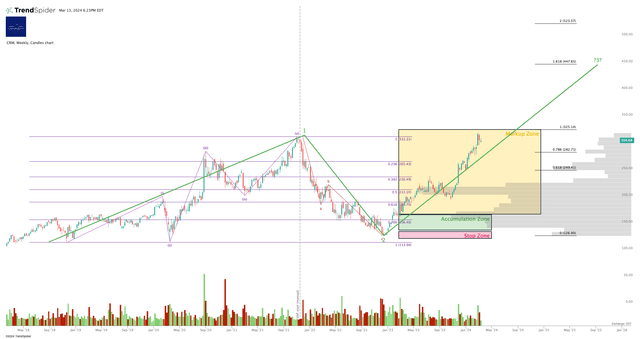

Well, here’s how we see the stock longer term. You can open a full page version of this chart, here.

CRM Stock Chart (TrendSpider.com, Cestrian Analysis)

The stock should be able to hit $325 with ease; we’re in a bull market and that is only the 100% extension of the prior Wave 1 placed at the Wave 2 low. For now, we extend our Markup Zone only to that level.

But with a wind behind the stock – and we think we’re in a bull market with plenty of wind in its sails yet – $447 isn’t a silly target – that’s the 1.618 Wave 3 extension of that prior Wave 1 placed at the Wave 2 low. Which is a fairly normal Wave 3 high. CRM might be boring for software, but it’s high beta vs. the indices, as you can see with one glance at the chart above, so its potential to reach 1.618 extensions isn’t really in question for us. Potential, of course, is no certainty; that’s not my point – my point is a stock this volatile can surprise to the upside in a bull market just as it can surprise to the downside in a bear.

On a shorter-term basis, the stock has hit resistance and is in a consolidation pattern right around the 100% extension of the prior Wave 1. Again, that’s a modest extension at which to sell off in a bull market, so more upwards movement may be expected. I would be surprised if the stock climbed past around $374 (the 1.618 extension of the prior Wave 1) before a material retracement, but at the moment most surprises are to the upside, so as always one should let price say what price is and not try to second guess.

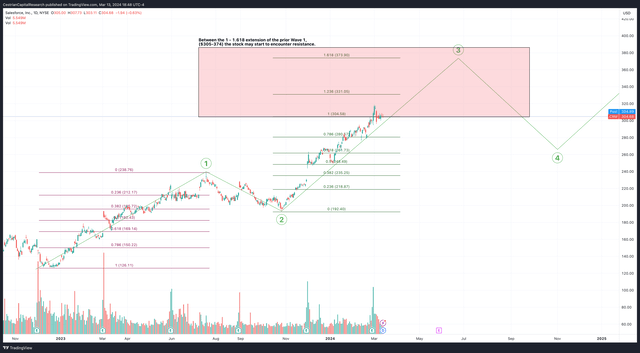

You can open a full page version of our shorter-term chart, here.

CRM Shorter Term Chart (TradingView.com, Cestrian Analysis)

Fundamental Analysis

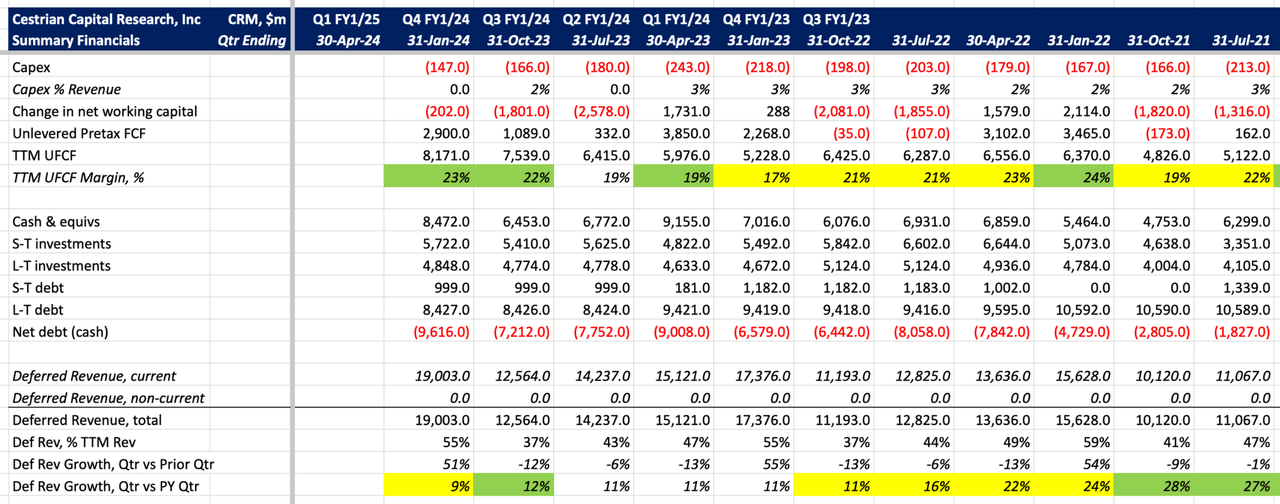

Let’s take a look at the detailed numbers before we move on to valuation analysis.

CRM Fundamentals I (Company SEC filings, YCharts.com, Cestrian Analysis) CRM Fundamentals II (Company SEC filings, YCharts.com, Cestrian Analysis)

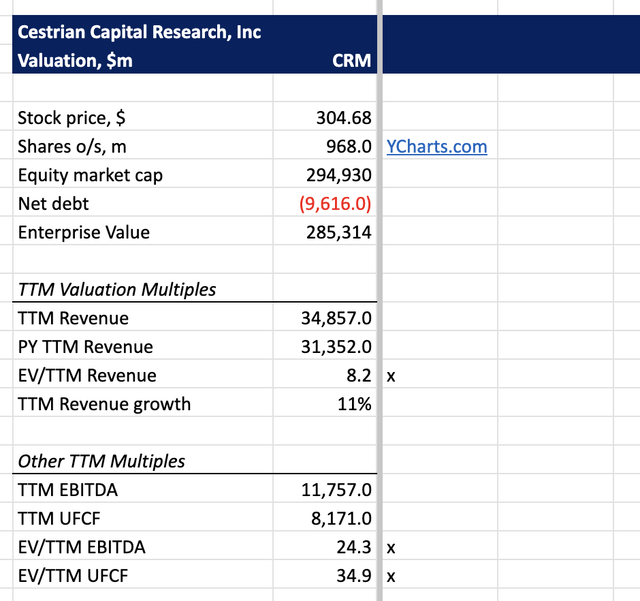

Valuation Analysis

The stock is a little pricey in my view – nothing silly, but if I was paying 35x cashflow for this thing, I would hope to see a more aggressive restructuring plan in place so that cashflow growth would be faster than is currently the case. The current valuation though is not a reason to buy or sell in my view – it’s not close to extreme lows or highs.

CRM Valuation Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

Stock Rating

Formally speaking, we rate the name at Hold because if the market keeps moving up – which we think it will, see our long-term take on markets here – then most likely CRM can tag along, per our charts above.

Personally, though, I hold no position in the name because I can think of other places I would prefer to have my capital put to work. On fundamentals, the company is neither fish nor fowl; not high growth, and not high margin either. As growth drops below 10%, which it likely will in due course, a well-managed mature software business ought to be clicking in 35-50% unlevered pretax free cashflow margins. CRM is achieving only 23% TTM UFCF, which says that there is still a lot of wasted spending in the business. Spending is fine if it ramps up the growth rate, but if growth doesn’t respond to spending, then at this stage of a company’s lifecycle it should be cut, in my view. There is something of a restructuring program afoot at Salesforce but not, as far as I am aware, one that will deliver Microsoft-style cashflow margins, and AI-washing won’t deliver higher growth either in my opinion. So, hold, as a high-beta stock in a bull market.

Any questions or comments, have at it in the comments field below. We read them all and endeavor to respond promptly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, TQQQ either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article.

Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ and T

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Our Investor Community.

Our Growth Investor Pro service is one of the most highly-respected and most popular services on all of Seeking Alpha. If you’d like to get our best work, you can choose from the basic tier at just $199 for your first year, or the full real-time service. You can learn all about it here including the wall of 5-star reviews we’ve received in bear and bull markets alike.