Apple: Alternative App Stores Could Eat Into Profitability

Summary:

- The EU is set to enact the Digital Markets Act, which will force gatekeepers like Apple to allow third-party app stores and alternative payment options.

- This could eat into profitability in Apple’s highest-margin Services segment.

- Apple is still expensive, trading at 23.4x Fwd P/E.

Michael M. Santiago

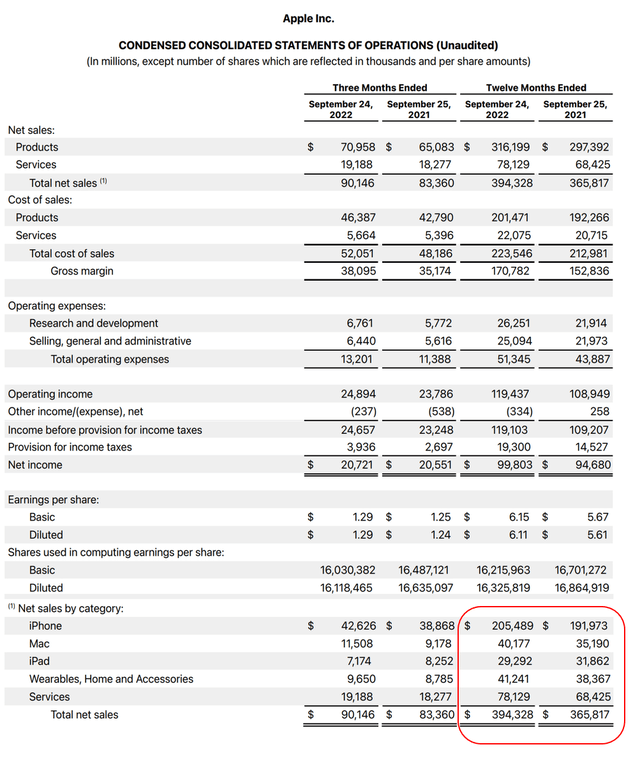

Most analysts who follow Apple, Inc. (NASDAQ:AAPL) have to keep a close eye on iPhone production and sales, since the iPhone remains Apple’s biggest business, accounting for over 50% of revenues.

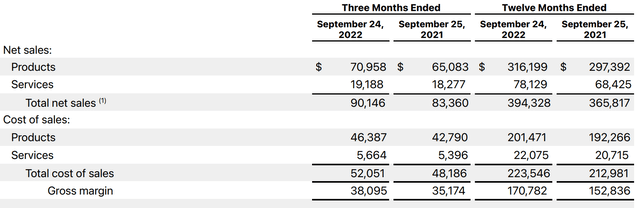

However, they often neglect the Services segment, which includes the App Store, Apple TV, Apple Music, and a host of other businesses and services. Together, Apple’s Services business accounts for $78 billion or 19.8% of LTM revenues. In fact, while services only account for a fifth of revenues, they add up to 32.8% of gross profit, as services have a 71.7% gross margin (Figure 1).

Figure 1 – Apple Services have higher gross margin (AAPL Q4/F22 Financial Statements)

Services Margin Fueled By Monopolistic Rents

Apple’s incredible Services margin is mostly due to the ‘walled garden’ of the Apple ecosystem and Apple’s monopoly on the app store that loads apps and services onto iOS devices. This monopoly has allowed the Apple to charge up to 30% commissions, despite Apple adding zero value to the apps or services in question.

For example, in 2019, Spotify Technology S.A. (SPOT) filed a complaint with the European Commission over the ‘Apple Tax’ whereby Apple charges a 30% fee for use of Apple’s in-app purchase system (“IAP”). Apple also restricted app developers from communicating with consumers about alternative payment systems (i.e. consumers pay directly to Spotify) within the iOS app. Similar complaints have been filed against Apple by other notable developers such as Epic Games.

Ultimately, the European Commission sided with consumers and app developers and decided to open a formal anti-trust investigation against Apple in June 2022.

Alternative App Stores Could Hurt Services Margin

While the anti-trust investigation is ongoing, it appears Apple may be preparing for the worst, as a recent Bloomberg news article noted that Apple software engineers have been working on opening up the iOS platform to third-party app stores.

This is likely in anticipation of the EU’s Digital Markets Act (“DMA”) that is set to come in force by May 2023. The act’s main goal is to force ‘gatekeepers’ such as Apple to offer alternative payment systems and third-party app stores on its platforms.

Importantly, the DMA will allow many subscription-based apps like Spotify to bypass Apple’s IAP and sell their services directly to consumers.

While the DMA will only apply to countries in the European Union, there is no reason why global anti-trust regulators will not demand Apple provide a similar alternative to consumers once it becomes readily available.

How Much Revenue Is At Risk?

According to Business of Apps, iOS apps and games generated $85 billion in revenues in 2021. Assuming Apple charges a flat 30% fee (note, this estimate could be high, as Apple charges a lower fee for smaller developers), $25 billion in revenues could be at risk as third party app stores may cause Apple to cut the 30% fee it currently charges.

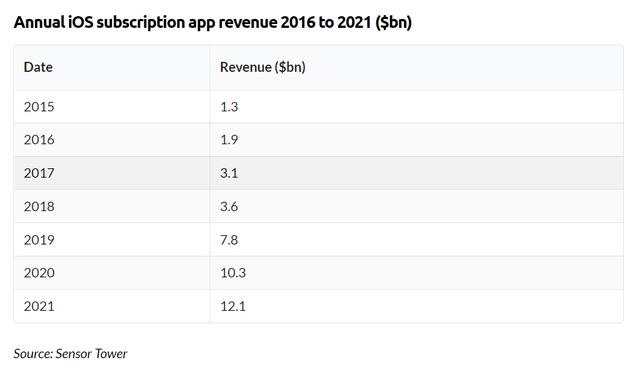

More importantly, Business of Apps estimate iOS subscription app revenues of $12 billion in 2021 (Figure 2). Assuming these refer to revenues from subscription services such as Netflix, Inc. (NFLX) and Spotify that have alternative forms of payment available to consumers, a large percentage of this revenue may go away as consumers migrate to payment outside of Apple’s IAP.

Figure 2 – Annual iOS subscription app revenues estimate (businessofapps.com)

Will The Revenue Hit Matter?

From figure 1 above, we see that Apple is a behemoth generating almost $400 billion in LTM revenues. Will losing a few billion in Services revenue really move the needle for Apple? Why should investors care?

Investors should care because Services have been one of Apple’s fastest growing segments with a 14.2% YoY growth rate (Figure 3). Coupled with 71.7% gross margin, Services have actually added more to Apple’s F2022 gross profits than the iPhone (Services added $9.7 billion in revenues in F2022, at a 71.7% gross margin, this is $7.0 billion in gross profits. iPhone revenues grew $13.5 billion in F2022, assuming product gross margin of 35.3%, iPhones would have added $4.8 billion in gross profits).

Figure 3 – Apple Financial Summary (AAPL Q4/F22 Financial Statements)

Estimates May Be Too Rosy

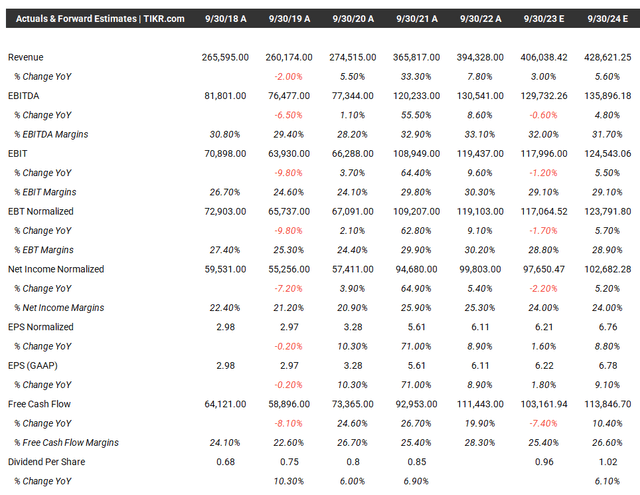

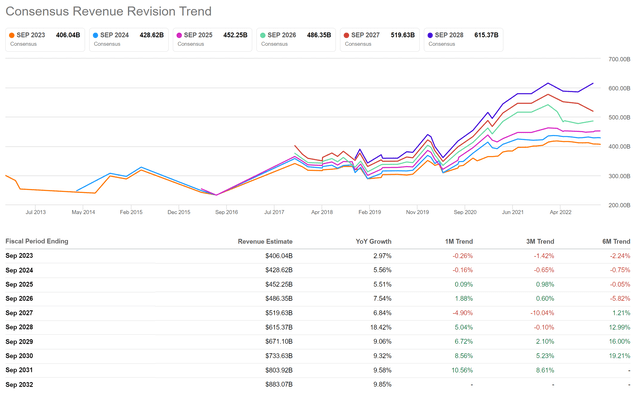

Currently, Wall Street analysts are expecting Apple to report low-single-digit (“LSD”) revenue and EPS growth in Fiscal 2023. This is followed with a ramp up to mid-single-digit (“MSD) top line and high-single-digit (“HSD”) EPS growth for F2024 (Figure 4).

Figure 4 – Apple estimates (tikr.com)

However, I think these estimates may be too rosy. First, assuming the alternative app store threat causes Apple to reduce its app store fee globally from 30% to 25% (I believe this is realistic as Apple has already started reducing its fee in the Netherlands earlier this year to 27%). This could reduce non-subscription app revenues by $3.7 billion ($73 billion in non-subscription iOS app and game revenues x 5%).

Next, over time, I think it’s realistic that a significant percentage of subscription app revenues will bypass Apple’s IAP. Every 10% could reduce revenues by $1.2 billion. For F2023/2024, I believe Apple could see ~$5 billion in revenue declines from the high margin Services segment due to the alternative app store threat.

In fact, it appears Wall Street analysts and investors are overall too complacent on Apple’s financial model. Despite recent iPhone production disruptions in China that will curtail upcoming shipments and increasing macro uncertainty hurting demand, analysts have only reduced their F2023 revenue estimates by 0.3% in the past month and 1.4% in the past 3 months (Figure 5 ).

Figure 5 – Analysts have hardly reduced F2023 estimates despite headwinds (Seeking Alpha)

Furthermore, with soaring wages and inflation, we have already seen Apple’s operating expenses climb 16.8% in F2022. As Apple has maintained prices on its new handsets in response to flagging demand, a tiny 1% decline in EBITDA margins for F2023 appears far too optimistic.

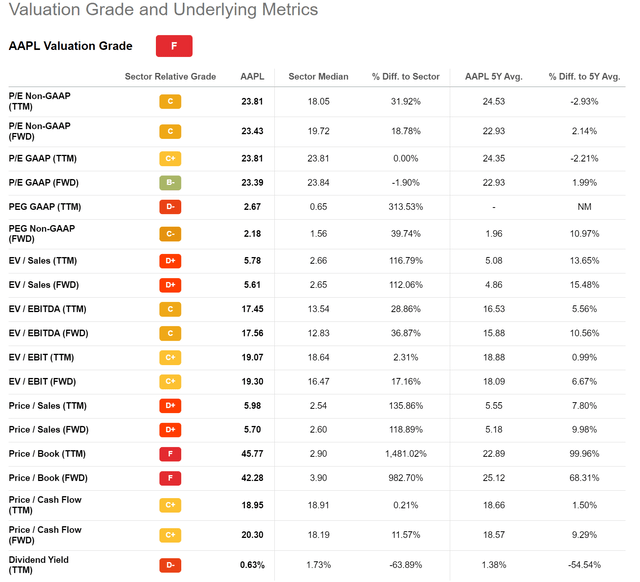

Valuation Still Too Rich…

While Apple may be a fantastic company with products many consumers love, one thing investors shouldn’t love about the company is its valuation. Seeking Alpha grades Apple’s valuation an “F” as it trades at a significant premium to the sector median on most valuation metrics such as 23.4x Fwd P/E and 17.6x Fwd EV / EBITDA (Figure 6).

Figure 6 – Apple trades at a significant premium (Seeking Alpha)

…Especially Compared To History

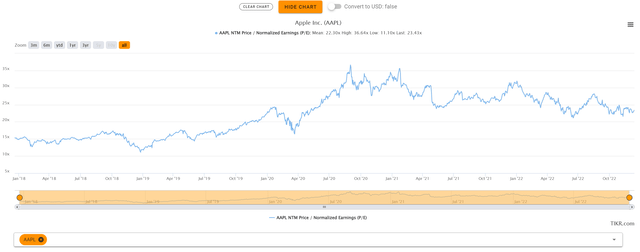

This is especially true if we look at Apple’s historical valuation multiple. Prior to the COVID pandemic, Apple only traded at ~15x Fwd P/E, which is fair for a company growing at LSD to MSD rates (Figure 7).

Figure 7 – Apple historical Fwd P/E multiple (tikr.com)

However, the COVID pandemic and subsequent stock rebound turbocharged Apple’s valuation to as high as 35x Fwd P/E, before settling back to the low 20s in recent quarters.

A lot of the COVID rally was fueled by the Fed’s decision to cut Fed Funds rates to effectively zero, which boosted valuation multiples for all asset classes. As interest rates are normalizing, investors should expect valuation multiples to also return to historical norms.

For Apple, even if valuation simply returned to the top end of the previous range, 20x Fwd P/E, we could see significant stock downside. Based on consensus Fwd EPS estimate of $6.22 for F2023, a 20x Fwd P/E would argue for a $124 stock price, 15% below where Apple’s stock is currently trading at.

Risk To My Call

The key upside risk to my cautious call is if Apple can forestall or apply the EU’s DMA rules on a country by country basis, then the negative revenue impacts can be smoothed out and masked by underlying growth in Services. Regulators in America and other countries may drag their feet in requiring Apple to open up its ecosystem, which can prolong its monopoly earnings.

Furthermore, perhaps the global economy can escape a recession and / or consumers will continue to purchase Apple products at a rapid pace. This can provide upside to revenue estimates.

Finally, many analysts are beginning to expect the Fed to cut interest rates in 2023 (even though they are still in a raising regime!). If the Fed cuts interest rates back to stimulative levels, then Apple’s extended valuation may become the norm.

Conclusion

The upcoming EU regulations on digital market access may cause Apple to loosen its monopoly on the iOS app store. While the revenue impact may not be overly significant, Services revenue do come at higher gross margins and Apple is not a high growth company to begin with. Furthermore, Apple’s current valuation multiple of 23.4x Fwd P/E is still rich historically, especially with normalizing interest rates.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.