Summary:

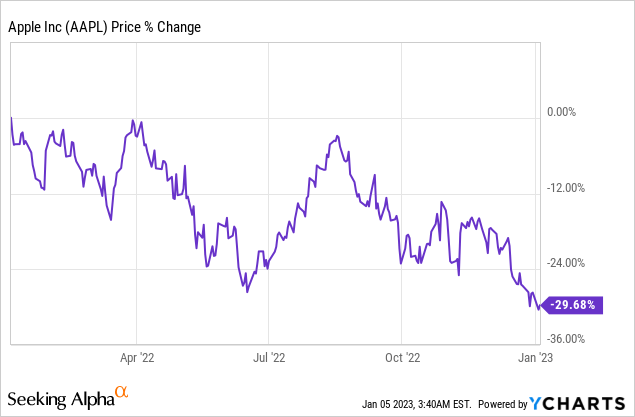

- Apple Inc.’s shares have dropped into a new down-leg lately.

- Weakening consumer demand and soaring COVID-19 infection could drive Apple’s shares to further lows.

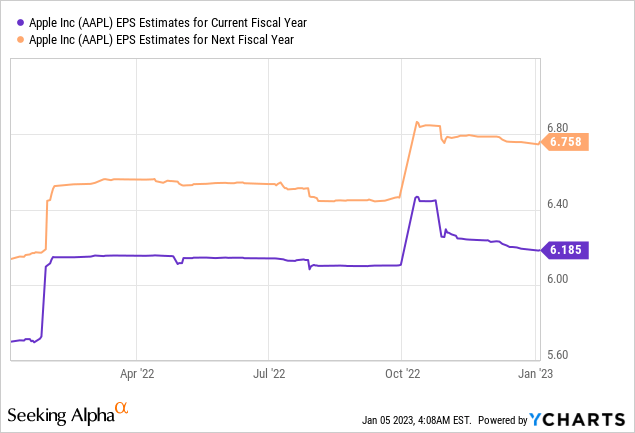

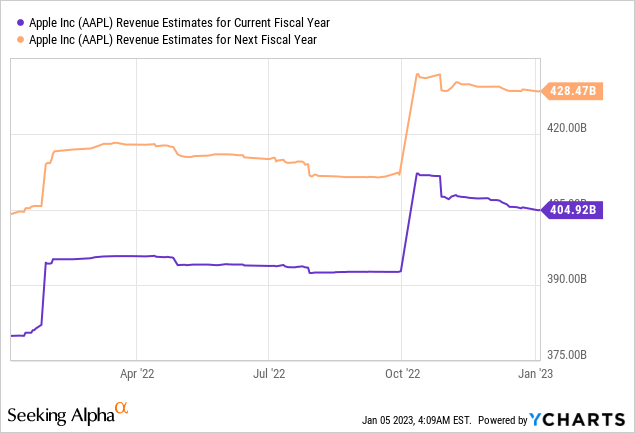

- EPS and revenue estimate trends are now profoundly negative for Apple.

Shahid Jamil

Shares of Apple Inc. (NASDAQ:AAPL) skidded to a new 1-year low on Tuesday due to growing concerns about the impact of rising Covid-19 infections in China as well as potentially weakening demand for consumer electronics in 2023. Concerns over softening consumer demand are linked to an accelerating decline of device shipments in Q3’22, lower expected iPhone shipments in Q4’22 and uncertainty surrounding China’s economic reopening. Apple’s EPS and revenue estimate trends are negative and the market now expects Apple to see weak growth in FY 2023. With risks to consumer demand growing, investors buying the pullback too early risk buying a falling knife!

Fragile market setup likely lead to weak top line growth for Apple in FQ1’23

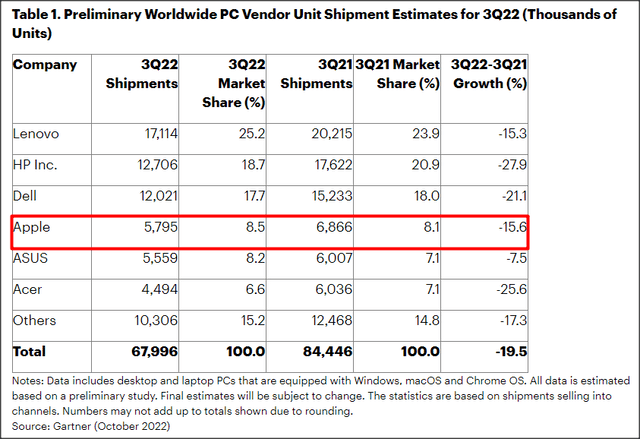

According to data compiled by Gartner, a consulting company, worldwide PC shipments declined 19.5% in the third-quarter with major OEMs, including Apple, seeing considerable volume declines in the PC, laptop and mobile device segments. Apple’s device shipments declined 15.6% year-over-year in Q3’22 and most major manufacturers saw steep, double-digit volume declines in shipments as well.

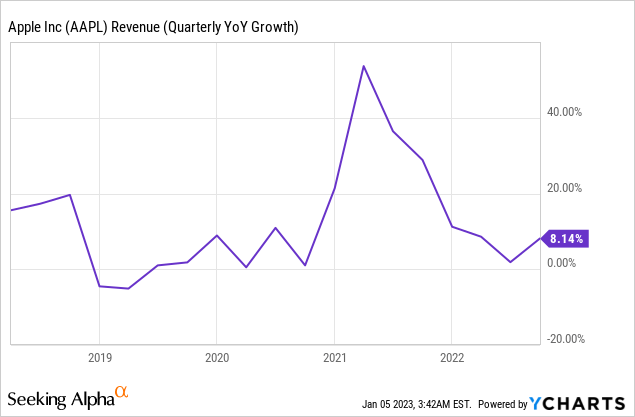

Gartner hasn’t released its estimate for Q4’22 global device shipments yet, but chances are that the numbers are not going to look great due to high inflation, weakening consumer demand and high inventory levels in the industry. As a result, Apple’s revenue growth has started to slow down dramatically: in the September-quarter, Apple reported only an 8.1% increase in revenues to $90.1B with hardware growth especially slowing down hard.

Trendforce, a market intelligence provider, estimates that slowing demand as well as labor shortages in China could result in a 22% year over year decline in iPhone shipments in Q1’23. The iPhones segment is the largest business for Apple, responsible for 47.3% of net revenues in the last quarter, and a slowdown in this business is likely to have an outsized impact on Apple’s valuation going forward.

Back in November 2022, Bloomberg already reported that Apple overestimated iPhone demand. Apple reacted to cooling demand for the iPhone 14 and was said to expect to produce 87M iPhones in 2022, 3M iPhones less than initially expected.

Muted growth expectations: analysts don’t expect much from Apple in FY 2023

Apple is going to report earnings for its first fiscal quarter of FY 2023 on February 2, 2023 and the estimate trend indicates that analyst are increasingly bearish on the company’s growth prospects. In the last 90 days, EPS estimates for Apple’s FY 2023 have declined consistently due to growing worries about China’s reopening prospects and down-ward EPS revisions outmatch up-ward EPS revisions by a ratio of 37:2. For FY 2023, analyst expect only 1.2% EPS growth for Apple.

The picture doesn’t look much better for Apple’s revenue estimate trend: Analysts now expect Apple to grow its top line only 2.7% in FY 2023 to $404.9B. If the reopening in China does not go well and COVID-19 infections continue to soar, I believe that Apple’s estimate trend could get worse in Q1’23.

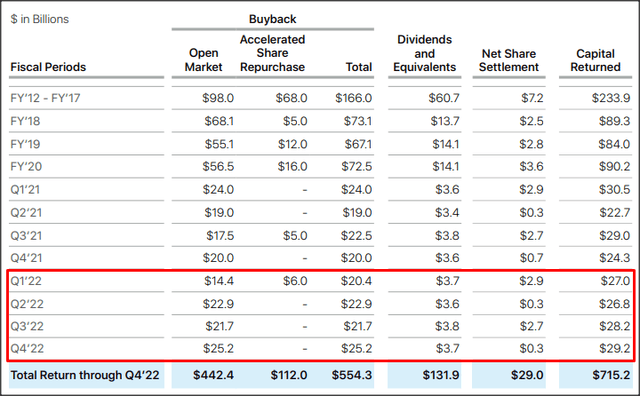

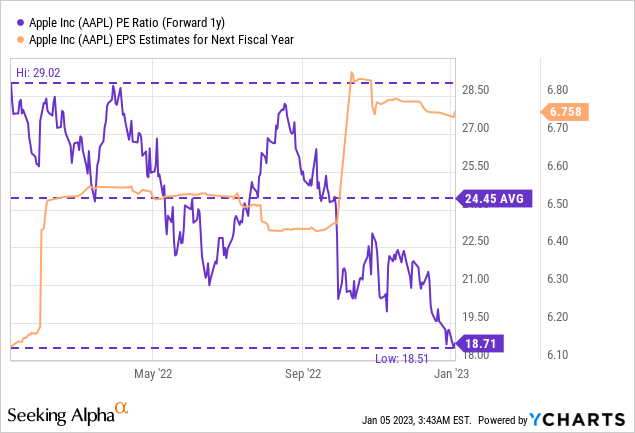

Stock buybacks and Apple’s valuation

Stock buybacks could make a difference for Apple in light of increasing down-side risks and also help stabilize the stock in an increasingly unpredictable operating environment. Apple has a history of financing generous stock buybacks. In the fourth-quarter, Apple repurchased $25.2B of its shares in the market and buybacks in FY 2022 totaled $84.2B. With Apple’s stock making a new 1-year low this week (and the valuation becoming more attractive), stock buybacks now make more sense than at any time in the last year.

Apple has lost about 30% of its value in the last year and the company’s market cap most recently dipped below $2T. Based off of earnings, Apple is trading at a forward P/E ratio of 18.7 X which is 24% below its 1-year P/E ratio. Given that Apple is expected to grow its EPS just about 1% this year, I don’t believe that Apple is especially cheap.

Risks with Apple

Right now, I believe that slowing consumer demand and a delayed reopening of the Chinese economy due to soaring COVID-19 infections could further weigh on Apple’s volume shipments in all device segments in the near term. As a result, Apple is looking at a potentially serious slowdown in hardware sales and top line growth with margins also likely to come under pressure in FY 2023. China accounted for about 18.8% of Apple’s consolidated sales in fiscal 2022 so a delayed reopening of the Chinese economy and weakening consumer spending could create valuation headwinds for Apple’s shares.

Final thoughts

Apple currently has all the hallmarks of a falling knife: (1) The stock recently slumped to a new 1-year low, (2) Negative sentiment overhang has been created as reflected in declining EPS and revenue estimates, and (3) Consumer spending headwinds in a high-inflation world strongly indicate that Apple’s stock has further to fall. While shares of Apple have become much cheaper lately, the operating environment is challenged and it could get worse if device shipment estimates indicate that the down-turn in the consumer electronics market accelerated in the fourth-quarter. Although stock buybacks could help Apple offset weakness in operating conditions, the overall setup indicates that Apple is going to see a revaluation to the down-side!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.