History Says Don’t Buy The Dip As The Tesla Bubble Deflates

Summary:

- Tesla shares are down 70% from their peak and I see comments on Twitter from people who are mortgaging their house to buy the dip.

- History has not been kind to those who buy as a price bubble deflates.

- Tesla shares are not a bargain, buying the dip with the expectation that the bubble will re-inflate is a high-risk move.

jetcityimage

I am old enough to remember the dot.com bubble and its subsequent collapse. Online trading had been introduced a few years before the bubble, and that had brought in a lot of new and inexperienced investors dabbling in the stock market, many of them firmly believing it to be their ticket to unlimited riches.

When you first open that trading account, as many people did during the dot.com bubble, you must decide what to buy. Most of those new investors were clueless, they knew nothing about price discovery or valuation, so they chased what the media said was the next big thing and they mostly bought companies that were in the news.

Sell-side analysts fed the frenzy with ridiculous target prices for companies that had no income, no profits, and no chance of ever becoming a real business. But the dot.coms weren’t the only companies to be caught up in the bubble, quality companies with profits and solid prospects also saw their shares shoot up to prices way above their true value. Microsoft (MSFT) gained a near monopoly on personal computer operating systems and office utility software but didn’t see its share price hit a new high until 17 years after the bubble burst. Cisco Systems (CSCO), a leading manufacturer of telecommunications equipment still trades below its 2000 high.

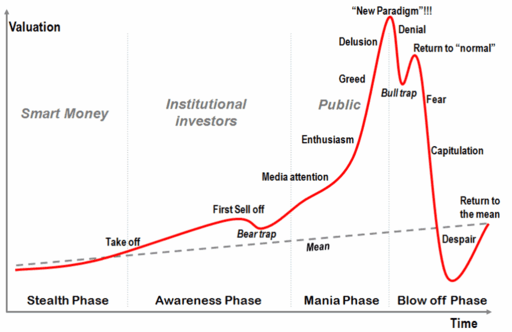

This well-known chart from Wikipedia describes the typical stock price bubble.

The phases of a stock price bubble (Wikipedia)

If this sounds familiar, it should. Another bubble, inflated by a huge influx of retail investors is quickly deflating. This bubble has been much bigger than the dot.com bubble. Back in the 1990s, few retail investors traded on margin, and hardly anyone traded options, the fees were high and most accounts restricted options trading to covered calls and cash-covered puts. Margin trading, option trading, and extremely low interest rates have magnified the effect of the buying frenzy this time around, instead of a multi-million dollar bubble, it has been a multi-billion dollar bubble.

Tesla (NASDAQ:TSLA) has been the poster child of this bubble, nobody has ever grabbed as much media attention as Tesla CEO, Elon Musk, and all that attention created a massive burst of enthusiasm among retail investors, as the stock price rose greed and fear of missing out inflated the bubble further.

But the mania phase is now over, we are on the steep downslope, the blow-off phase, the region of fear and capitulation.

Tesla’s stock price chart (Yahoo Finance)

Tesla has fallen 70% from its peak, but retail investors have continued to “buy the dip”, pouring $15.4 billion into the stock this year while insiders, mostly CEO Elon Musk, have taken out $39 billion.

History shows that buying the dip during the collapse of a bubble is not a good strategy, history tells us that Tesla will eventually return to a stock price that reflects the true value of the company, and that price is significantly lower than its current $350 billion market cap.

Tesla has recently published its Q4 and year-end delivery numbers. A new record was set for both production and deliveries, but the numbers fell well short of expectations. Year-over-year growth was 40%, which is tremendous for an automotive company, but a deeper look into those numbers paints a less optimistic picture for 2023.

The record Q4 deliveries were accompanied by price cuts and incentives of 8 to 15% in China and cuts of $3,750 per car, later increased to $7,500 per car plus $1,000 worth of free charging for US customers. But even with those price cuts, Tesla burned through most of its backlog in its major markets and had more than 70,000 cars in inventory at the end of the quarter.

The excuse Tesla made for the higher inventories was to claim that they are moving towards a more even distribution of sales throughout the quarter. I see that as an indication of a declining backlog. If you have a 3-month backlog, you can organize your deliveries to send cars to the furthest points first and deliver local cars in the final weeks of the quarter, minimizing the quarter-end inventory. If you don’t have a backlog, you can only send the cars to where you think there might be demand, if that demand fails to materialize you are left with excess inventory.

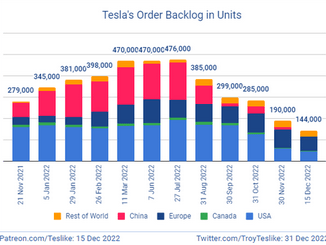

A chart published by Tesla guru @TroyTeslike on Twitter shows a backlog of 476,000 cars in July falling to 144,000 cars in mid-December. The chart is compiled from an analysis of delivery times, I think he overestimates the backlog, but I am more interested in the rate at which that backlog has been falling.

Estimate of Tesla’s order backlog (@TroyTeslike Twitter)

The falling backlog indicates a net new order rate of only 417,000 cars for the second half of 2022, or 834,000 per year. (749,000 sold minus 332,000 that came from the backlog). That is well below Tesla’s current sales rate, a long way below its factory capacity, and a clear indication that growth in 2023 will be difficult to achieve.

Expectations of a tax credit starting in 2023 may have put the brakes on US sales, we will have to wait for Q1 results to see what effect the new subsidies have in the USA.

However, starting in 2023, subsidies were eliminated in China, Germany cut its subsidy by $3,000 per car, and Norway added 25% VAT to all prices above 500,000 Kroner ($49,500). Those subsidy moves should have brought sales forward from 2023 into 2022, so we should expect to see a drop in Q1 sales in those countries.

These numbers suggest that Tesla’s high growth period may be ending and there is no reason to value Tesla any differently from its peers in the automotive business.

The one piece of software that might have added value to Tesla and justified its valuation as a technology company rather than an automotive company is “Full Self Driving”. But it is already six years late and shows no signs of ever being capable of driving a car without assistance. It is the subject of several consumer lawsuits, an NHTSA investigation, and an investigation by the Department of Justice. I believe it is not an asset, it is a massive liability.

Some analysts claim an advantage for Tesla in their batteries. I would like to see some real evidence for that. Elon Musk setting targets for the cost and performance of the 4680 battery, and those targets being picked up and repeated endlessly by media do not make the targets achievable. So far there has been no real evidence to show that the 4680 battery is anything more than a scaled-up version of the 2170 battery. Certainly, there is no reason to think that it will be in any way superior to GM’s Ultium, BYD’s blade battery or CATL’s Quilin battery. I have seen no independently produced tests or data to indicate that one battery will be better than any of the others.

Nor is there any real evidence, in my opinion, that Tesla has any advantage in manufacturing.

Tesla has been able to grow its business by selling into an EV market where demand has exceeded supply. It has taken the market a few years to catch up with the hype and subsidy-driven demand, and during that time Tesla has been able to charge luxury prices for cars that don’t have luxury components or quality and don’t get luxury service.

But over the long term, the EV business will be the same as the rest of the auto business, capital intensive, highly competitive, low margin manufacturing. In fact, it will likely be even more competitive than the ICE car business because EVs are easier to make and the barriers to entry are lower, as can be seen by the influx of prospective new entrants.

Given the likely reduced growth rate, a slowing economy, and increasing competition, I believe Tesla’s share price has room to fall another 70% or more before it reaches a price that I would call a buying opportunity.

Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have a very small put option position