Summary:

- McDonald’s announced a new target to grow its restaurant count at a CAGR of 4-5% until 2027 at the beginning of December 2023.

- This is bullish for SBUX because it shows that mature restaurant peers can keep growing their restaurant count at a fast pace.

- After updating my store growth outlook, I upgrade my rating for SBUX.

- SBUX will report results for Q2 ’24 on April 30, 2024, after the market closes.

- Major things to look out for in the report will be (1) traffic, especially in North America, and (2) margin improvements.

Wachiwit

Introduction

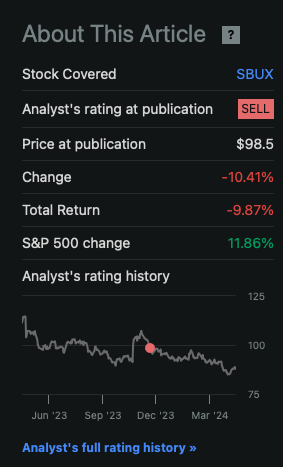

My first article on Starbucks (NASDAQ:SBUX), called “Starbucks: Some Reasons To Rethink Your Position“, was published on December 1, 2023. Back then, I assigned a “sell” rating to SBUX because of three main reasons:

- SBUX store growth targets seemed overly optimistic, especially compared to the store growth over the past decade we have seen at McDonald’s (MCD), a peer at a more mature stage than SBUX.

- SBUX customers who were lost during the pandemic were not coming back. Using the traffic metrics SBUX is giving us, traffic at existing stores in 2014 was 7% lower in 2023. This indicates that the brand is not as strong as people may think.

- Using reasonable growth expectations, SBUX looked overvalued and I estimated the fair value per share somewhere in the $75 per share range.

Since the publication of that article, SBUX has underperformed the broader market:

SBUX Performance since Author’s last article (Seeking Alpha)

Only a few days after my article, a major announcement from McDonald’s countered some of the arguments I made against SBUX. I want to address that announcement and the implications for SBUX in this article. I will also go over the most recent same-store sales trends and highlight what to look out for in the upcoming earnings report, which is scheduled to be released on April 30, 2024, after the market closes.

I won’t go over every detail as I did in my introductory article, so I will just refer you back to that article if you want a complete deep dive into every aspect of SBUX.

Recent Results

Let’s start by taking a look at the last earnings report for Q1 24 (October-December 2023).

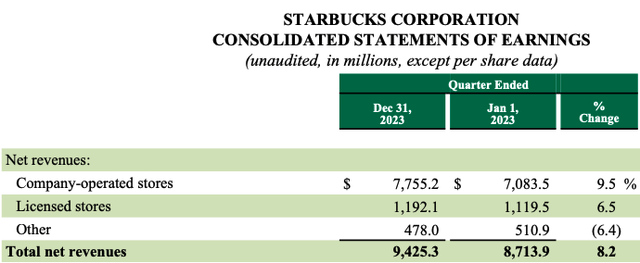

Q1 24 Revenue (Q1 24 Earnings Release – Page 7)

SBUX increased total revenue by 8.2% YoY, with company-operated stores leading the way with YoY growth of 9.5%.

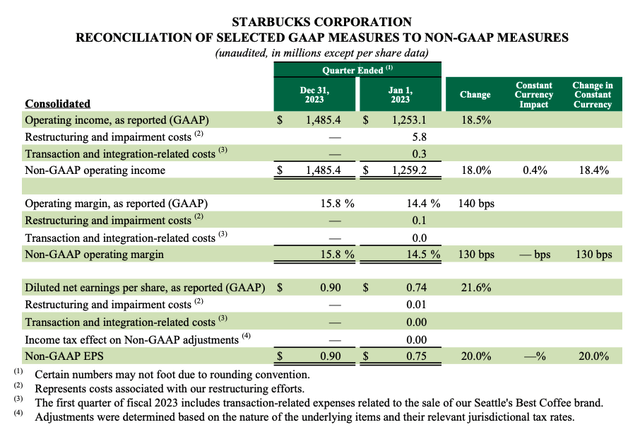

Q1 24 Earnings (Q1 24 Earnings Release – Page 15)

EPS and operating income grew way faster than revenue due to margin expansion, with EPS growing 20% YoY to $0.90 per share. The possibility for margin expansion was one of the major themes at the “Starbucks 2023 Reinvention Update and Holiday Launch”, the investor presentation that took place in November 2023. I will come back to the margin topic later.

The most important metric for SBUX, in my opinion, is the development of same-store traffic or as SBUX calls it “comparable transactions”. For Q1 24, same-store traffic came in at +3%, up YoY from -2% in Q1 23 but down sequentially from the previous quarters. Here is a table showing SBUX same-store traffic over the past five quarters:

| Q1 23 | Q2 23 | Q3 23 | Q4 23 | Q1 24 | |

| Global Comparable Transactions | -2% | +6% | +5% | +3% | +3% |

For SBUX’s single biggest market, North America, same-store traffic was much lower over the three most recent quarters:

| Q1 23 | Q2 23 | Q3 23 | Q4 23 | Q1 24 | |

| NA Comparable Transactions | +1% | +6% | +1% | +2% | +1% |

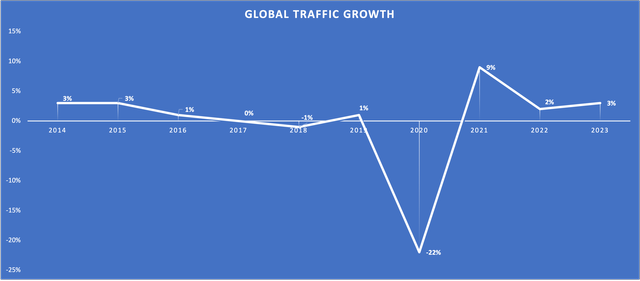

I highlighted SBUX’s weakness regarding traffic growth in my prior article. I will use the chart again:

Global “Traffic” Growth (Company Reports – Compiled by Author)

Here we can see that SBUX achieved no same-store traffic growth in the past. Here is what I wrote in my last article:

Here we can see that Traffic growth has been close to non-existent over the past decade. Let’s assume SBUX made 1,000 transactions in FY2014. If we apply the above Traffic YoY growth rates, FY2023 transactions would be 929, 7% lower than FY2014. This means that over the long term, traffic for older stores declined. This is not healthy at all. We can also see that the customers SBUX lost due to the pandemic restrictions in FY2020 didn’t come back (at least not all), indicating that the SBUX brand might not be that strong after all and that a cup of coffee from SBUX might be a discretionary expense for some. In conclusion, declining same-store traffic is a bad sign for the future.

Source: Author’s introductory article

After achieving heightened traffic growth in 2021 (but not nearly enough so that we can say the customers that were lost during the pandemic closures are back), traffic growth is already back at historic levels of 0-2%. The global traffic numbers in the table above (+3%) are skewed to the upside because the reopening in China led to very high traffic growth in the China segment, which won’t be sustainable.

I will not discuss pricing here since I discussed it in length in my prior article and there are no changes regarding the outlook for pricing. For your convenience, I will repeat my take on pricing here:

The years since the pandemic were years of heightened inflation and commodity prices. If we look at the pre-pandemic numbers, SBUX pricing power seems to be in the range of 3-4%, exactly 100 basis points above the estimated GDP growth of 2-3%. In conclusion, growth through pricing power should track or slightly exceed GDP growth.

Source: Author’s introductory article

McDonald’s Store Growth Initiative

On December 6, 2023, only five days after my initial SBUX article was published, McDonald’s announced a new target for net new restaurant unit growth of 4-5% annually until 2027:

MCD’s New Restaurant Growth Target (MCD’s Press Release from December 6, 2023)

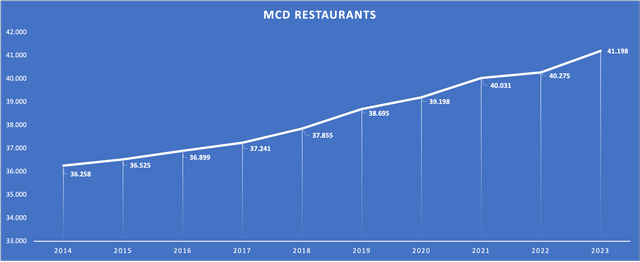

This surprised me because MCD’s store growth has been much lower than that number in the past decade, as can be seen in the following chart:

MCD Restaurant Count since 2014 (MCD 10-K – compiled by Author)

From 2014 to 2023, MCD grew the number of stores at a CAGR of only 1.4%, at a rate of one-third compared to the new target of 4-5% until 2027. In my past article on SBUX, I argued that SBUX store growth targets were too optimistic and that store growth would eventually need to come down to the levels we have seen at more mature peers like MCD. So while SBUX promised store growth in the range of 6% until 2030, I took a more cautious approach and calculated 5% until 2030. I also assumed store growth of “only” 1.5% CAGR thereafter.

In light of the news from MCD, I have to revise my assumptions to the upside. If a company as mature as MCD can still grow its restaurant count at a rate of 4-5% for several years, I see no reason to hold on to my lower store growth assumptions for SBUX. Hence, I will have to update my store growth outlook to 6% until 2030 (in line with SBUX’s outlook) and 2.5% thereafter.

What To Look Out For

SBUX will report earnings for Q2 24 on April 30, 2024, after the market closes. In my opinion, there are two major things to look out for:

- The ongoing trend of traffic growth, especially in North America. After seeing traffic growth in North America of only 1-2% in the last three quarters, SBUX needs to find a way to reignite traffic growth in that region. With the reopening effects from China fading in the upcoming quarters, the possibility that we will see global traffic growth of only 0-2% in the upcoming quarters, as we have seen historically, is very high.

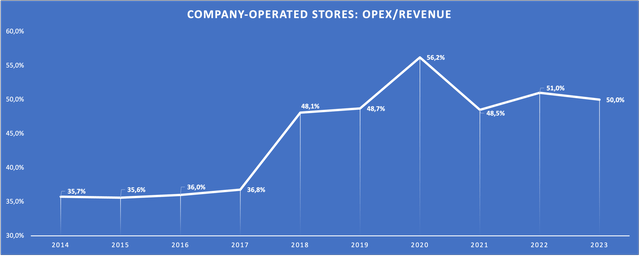

- The ongoing margin trend. The Margin is one of the topics I wrote extensively about in my prior article. While SBUX promised margin expansion in the future (without giving us any numbers, something that still concerns me because it indicates that they have no clear path how to achieve that), this isn’t backed at all by history. SBUX margins have deteriorated at a steady pace over the past decade, as can be seen in the chart below. It will be interesting to see if SBUX can manage to get margins back up again

OPEX/Revenue for Company-Operated Stores (Company Reports – Compiled by Author)

Valuation Update

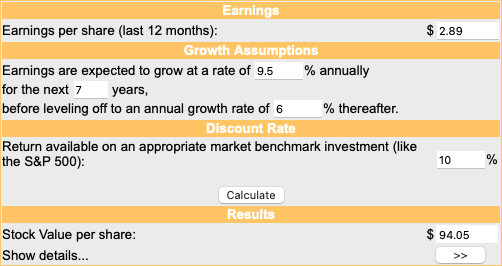

SBUX’s adjusted net income for the trailing twelve months (TTM) came in at $4.1 billion. Historically, SBUX managed to convert around 80% of adjusted profits into Free Cash Flow (FCF). So normalized FCF should be somewhere in the range of $3.3 billion. With 1,140,600,000 shares outstanding as of the Q1 24 earnings release, this would translate to $2.89 FCF per share or an FCF yield of 3.3% (using the current share price of $88.25).

In my prior article, I assumed a 5% store count CAGR until 2030 and price increases of around 3.5% per year, for a growth rate of 8.5%. I also assumed 5% growth into perpetuity, consisting of 3.5% pricing and 1.5% store growth. As I mentioned earlier, I have to update these assumptions to 6% store count growth until 2030 + 3.5% pricing = 9.5% total growth rate until 2030 and 6% into perpetuity, consisting of 2.5% store growth and 3.5% pricing. In my opinion, these are rather bullish and optimistic assumptions.

I tend to say that the long-term results for any stock should be the sum of the growth rate (in our case 9.5% until 2030 and 6% thereafter) and the FCF yield (in our case 3.3%). So in conclusion, SBUX should be set up for low double-digit returns over the long term.

As I always do, I will use a supplemental DCF valuation to gauge potential headwinds/tailwinds from a valuation rerating. I will use the aforementioned growth assumptions, $2.89 FCF per share as a starting point and a discount rate of 10%. Here is the result:

DCF Valuation (moneychimp.com)

With my updated assumptions, SBUX looks close to fairly valued at the current price of $88.25, with an upside potential of $6 per share. In my prior article, I arrived at a fair value of around $75 per share. The new fair value of $94 per share is the result of (1) some earnings growth and (2) increasing the long-term store growth outlook by 1%.

Conclusion

It took me some time to decide on a rating for SBUX, as I am torn between “hold” and “buy”. I will ultimately rate SBUX a “hold” for now, up from my prior “sell” rating, despite my DCF valuation indicating that SBUX is undervalued. The main reason is that I still have concerns about the strength of the brand because comparable transactions (or traffic) still haven’t recovered from the huge decline we saw in 2020. This means that customers who didn’t visit SBUX anymore because of the pandemic decided to not come back when the stores were open again.

Besides that, the growth assumptions I used seem optimistic, even when there are good reasons for them. Limited clarity about how SBUX wants to achieve the promised margin expansion is another concern for me.

Summing it up, I upgrade my rating for SBUX to “hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.