Summary:

- Apple Inc. reached 2 billion installed base, a great foundation for future expansion of the Apple ecosystem.

- Supply chain issues have been solved with their diversification strategy.

- Apple Inc. TV is getting ready for a leap.

Apple revealed three things that investors should appreciate Apisorn

Apple Inc. (NASDAQ:AAPL) released fiscal Q1-23 earnings on 2/2. AAPL slightly missed the consensus estimate ($117.15B vs $121.67B in revenue, and $1.88 vs $1.93 in EPS). The revenue miss was mainly due to FX headwinds. According to the company, FX had a nearly -800 bps impact on YoY growth. On an FX-neutral basis, AAPL was able to grow in most of their markets.

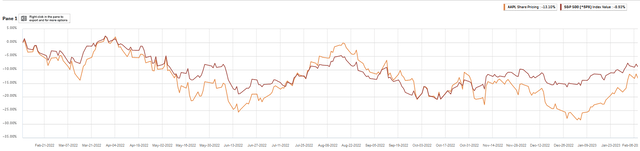

If we look at AAPL price in the last 12 month, it has been tracking closely to the S&P 500 (SP500). In my previous article, 3 Myths To Debunk About Apple, I discussed Apple’s revenue mix shift to higher-margin Service business, and future potentials of Apple TV. In this article, I want to focus on what the company covered in the latest earnings call, and highlight several things that I think investors should appreciate more.

Apple reached 2 billion installed base (2x of Samsung’s, two-thirds of Android’s)

Apple Inc. reported its installed base crossed 2 billion active devices, up by +10% YoY, and +8% QoQ. This represents a great foundation for Apple to expand its future ecosystem.

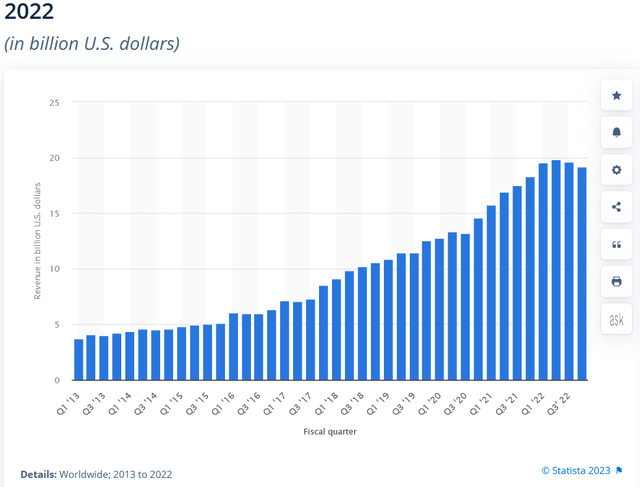

First, the installed base represents a key input to APPL’s service revenue. As shown in the following figure, AAPL’s service revenue have enjoyed great growth in the last decade. Higher mix and higher margin of service revenue helped AAPL accelerate value creation for shareholders.

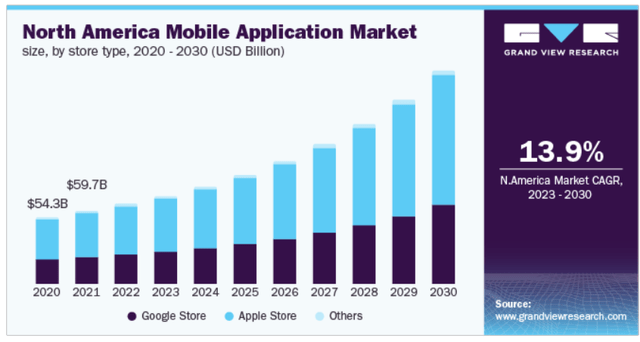

Second, the mobile app market is growing rapidly (’23-’30 CAGR of 13.9%). This is not surprising, as smart phones can fulfill more and more user needs, and every industry is on their way of digitization. According to Statista (emphasis added):

“On average, people spend 3 hours and 15 minutes on their phones per day. Individuals check their phones an average of 58 times each day. 3 in 4 Gen Zers claim to spend too much time on their smartphones.”

Third, AAPL service revenue likely will outpace the market growth.

AAPL products continue to gain traction on the globe. Known evidence includes: 1) AAPL saw record-high growth rates in a number of international markets; 2) half of IPAD buyers are new; 3) AAPL’s pace of innovation to improve user experiences is fast (check out Freeform if you haven’t).

Supply chain issues are gone

Supply chain issue due to China’s lockdown in 2022 slowed down AAPL’s growth. 2022 was like a stress test for AAPL’s supply chain management. The company executed on their diversification strategy:

“We build our products everywhere. There are component parts coming from many different countries in the world, and the final assembly coming from three countries in the world on just iPhone.”

During the earnings call the company confirmed “we’re in decent supply on most products for the quarter currently.”

To me, the supply chain for Apple is a key aspect for their infrastructure which powers all other forms of monetization. Being able to source component parts across many countries, and then assemble them in three countries, sounds convincing. Also, the company mentioned Mac Book production was moved from China to Vietnam, expecting production starting Q2 2023. Its India-based plant is also expected to produce 25% of iPhones, up from less than 10% currently.

AAPL TV+ is getting ready for a leap

Apple Inc.’s ads revenue was $4B in 2022, representing a really tiny portion of what their potentials could be. Apple has been making efforts building a differentiated Apple TV. In my opinion, Apple TV+ is getting ready for a leap soon.

First, Apple TV is known for its entirely original programming around TV shows, limited series, and movies, when all other players are prioritizing on extensive libraries of existing TV shows or movies. This is a great differentiator in an increasingly crowded streaming TV market.

Second, Apple TV is well positioned to gain more users globally. This year Apple launched Major League Soccer Season Pass in 10-year partnership with MLS. It’s worth mentioning that the MLS Season Pass will be available to audience in over 100 countries and regions. This follows Apple’s Friday Night Baseball, representing a continued movement towards advertising.

Third, with 2 billion installed base, Apple has unprecedented advantage in contextual advertising. As stated in Apple’s website:

“Contextual information may be used to serve ads, such as Device Information, Device Location, App Store Searches, Apple News and Stocks. We create segments to deliver personalized ads for users leveraging user information such as Account Information, Downloads, Purchases & Subscriptions, Apple News and Stocks, and Advertising Interactions.”

A very quick way to calculate Apple’s ads potential would be, 1.5 billion users * blended WW ARPU (let’s say $20) = $30B in gross revenue.

Conclusion

Apple Inc. is currently trading at $154, 26x P/E, and its price is roughly in the middle of its 52-week low/high. As a market leader running a highly durable business and operating an ecosystem with 2B installed base, I expect Apple to continue accelerating its revenue growth, and add value creation for shareholders. Apple Inc. stock in my opinion is a great long-term investment, and its runway in digital advertising should help boost the AAPL stock price in the near term.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.