Exxon Mobil: Outperformance Not Likely To Last

Summary:

- Exxon Mobil bulls refuse to back down, eagerly buying the dips and propelling XOM’s momentum from its recent lows.

- Amidst the hype around XOM, investors must not overlook the stark divergence in price action between XOM and the underlying energy futures market.

- Investors need to consider the projected earnings decline of Exxon Mobil through 2024 and how it could impact buying sentiments.

- Don’t wait until it’s too late. Instead, trim some exposure now and brace for a deeper pullback.

JHVEPhoto

Exxon Mobil Corporation (NYSE:XOM) bulls continue to defy gravity as the company reported a record FY22, outperforming the S&P 500 (SPX) (SPY) since our last update in December.

Buyers believe that the “supercycle” will likely lift buying sentiments further, with Goldman Sachs (GS) oil strategists seeing a $100 Brent (CO1:COM) by 2024. However, the investment bank revised its 2023 forecast down to $92, expecting a “supply surplus of 150,000 barrels per day in 2023,” impacted by macroeconomic headwinds and higher production levels.

Moreover, China’s COVID reopening is expected to intensify the demand outlook for energy and also lift the prospects on refining margins. Coupled with the structural underinvestment themes that have hobbled global energy markets since reopening from the COVID pandemic, bulls argue that the upcycle is far from over.

Exxon Mobil believes it’s a beneficiary in these trying times by investing judiciously in the previous downcycle. As such, it has been able to leverage the remarkable recovery from its COVID lows, posting record profitability above the consensus estimates.

Moreover, it expects to continue investing in 2023, posting CapEx closer to the high end of its $23B to $25B guidance range. Management highlighted that the industry is still underinvesting in oil and gas, suggesting that the medium-term outlook remains robust.

The company is also driving increased production levels on its Permian assets, with production expected to reach 1M barrels by 2027.

However, some bulls could have been disappointed with the company’s share repurchase guidance which wasn’t upgraded following the record performance.

Despite that, its commitment to a $35B repurchase through 2024 is still substantial, representing more than 7% of its market cap. Coupled with an NTM dividend yield of 3.2%, we believe it’s still a relatively attractive capital allocation strategy that should keep XOM bulls onside.

In addition, the company highlighted that it’s focused on a “balanced approach” in its capital allocation while allowing the company to capitalize on “a very rich portfolio of advantaged projects.”

We believe CEO Darren Woods & his team have done a marvelous job for XOM shareholders over the past two years. It has prudently paid down its debt, with XOM’s net debt-to-EBITDA ratio declining to just 0.11x at the end of FY22.

As such, the company is in a position to leverage opportunities in the lower-carbon space moving ahead, with plans to invest about $17B through 2027.

With Europe’s energy crisis in 2022 providing another near- and medium-term tailwind on the need for energy security, the world will need more oil. President Biden’s acknowledgment of the critical role that oil and gas companies play over the next decade bolsters the structural underpinnings of what was previously a cyclical boom-and-bust story.

Furthermore, with the world not expected to fall into a debilitating recession, the headwinds against a significant collapse in oil & gas stocks are not likely in the near term.

We recognize the secular drivers undergirding the bullish thesis to support a continued advance in underlying oil prices. However, the bifurcation in the strength of XOM’s price action is in stark contrast to the weakness in the underlying futures market.

As such, we think investors have likely pinned high expectations on Exxon Mobil to continue delivering and outperforming to justify XOM’s valuation premium relative to its peers.

Accordingly, XOM last traded at an NTM EBITDA multiple of 5.5x, ahead of its peers’ median of 4.9x (12% premium), according to S&P Cap IQ data.

However, investors should also consider the revised consensus estimates projecting an earnings decline for Exxon Mobil through FY24. As such, the uplift from higher realized prices could dissipate moving ahead if underlying energy prices continue to remain tepid, despite the prospects of favorable supply/demand dynamics.

Moreover, it appears the market is still unconvinced about the sustained recovery of energy prices in the medium term, which could impact XOM’s upward momentum moving ahead.

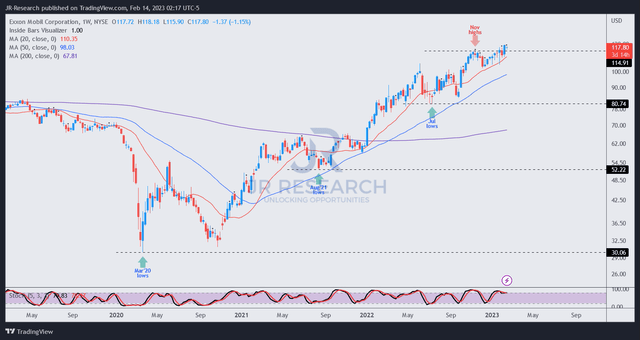

XOM price chart (weekly) (TradingView)

There’s little doubt that XOM is still in a medium-term uptrend, as it re-tested its November highs and appears to have broken through.

Therefore, the return of significant dip-buying activity at its recent lows have bolstered the fundamental thesis in Exxon Mobil, despite the bifurcation with the underlying energy markets.

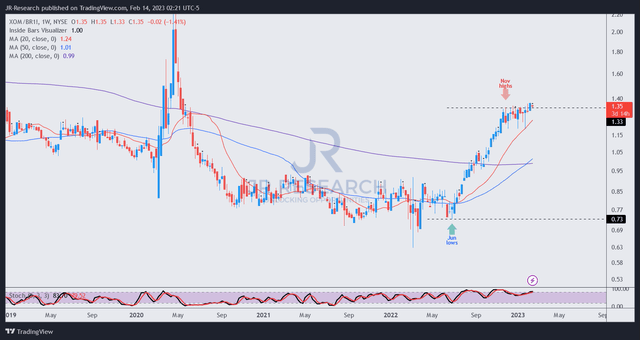

XOM/BR1 price chart (weekly) (TradingView)

However, a closer look at the price action of XOM against the Brent futures suggests that the outperformance has slowed after a rapid surge from its June 2022 lows.

It seems to be consolidating but could also suggest a distribution phase if the price action fails to regain upward momentum.

As such, we believe caution is still warranted. Investors need to consider why XOM can continue to drive outperformance against the underlying market, even as its earnings are expected to decline through 2024.

Hence, we believe a deeper pullback is healthy that should help eradicate some of the recent late-buying momentum, improving the reward-risk levels for investors willing to wait for a better entry point.

Rating: Sell (Reiterated).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!