Summary:

- Samsung sends Apple Inc. investors a warning message – I have my doubts that CEO Tim Cook will please investors on Thursday when it reports earnings.

- I expect Apple to report lower margins in Q4 FY2022 and most likely in the first 2 quarters of 2023 (at least) than currently priced in.

- Apple’s P/E multiple relative to the S&P 500 Index is equal to ~1.2 – that’s about the same as in 2008.

- The fair P/E for FY2023 that I see [22.18x] makes AAPL overvalued by 11-12%.

- I remain Neutral on Apple stock, mainly because the downside of the 11-12% potential I see today is not too big to downgrade to Sell.

Nikada/iStock Unreleased via Getty Images

Intro & Thesis

I have been writing about Apple Inc. (NASDAQ:AAPL) since December 2021, and since then all my 9 articles have been Neutral.

Writing a neutral thesis statement seems like a fairly simple task – just write about the positive long-term outlook of a company that is experiencing temporary difficulties. However, for this reason, it is difficult to add value to readers on an ongoing basis – most articles become neutral when the business cycle changes and everyone knows that the company is struggling.

This article of mine is Neutral – again – because I believe Apple stock is too high amid all the operational headwinds.

But I still hope to add a bit more to the discussion about AAPL stock – in particular, my thoughts and analysis may be useful to those trying to look into the near future and understand what to expect from the company when it reports Q4 FY2022 results on February 2nd (post-market). The recent quarterly results from Samsung Electronics (OTCPK:SSNLF) will help me with this. Let’s dive in.

Samsung Sends Apple Investors A Warning Message

As you probably know, $205.489 billion of Apple’s $394.328 billion in revenue in fiscal 2022 came from iPhone sales [i.e., over 52% of total revenue]. At the same time, Apple holds about 27% share of the global smartphone market [as of December FY22], according to Statcounter. The next competitor to keep an eye on is Samsung Electronics, which is roughly on par with Apple in terms of total sales, with a market share of 27.38%. Xiaomi (OTCPK:XIACF) is in 3rd place, but the company’s sales are more local and the gap to the first two companies is too big.

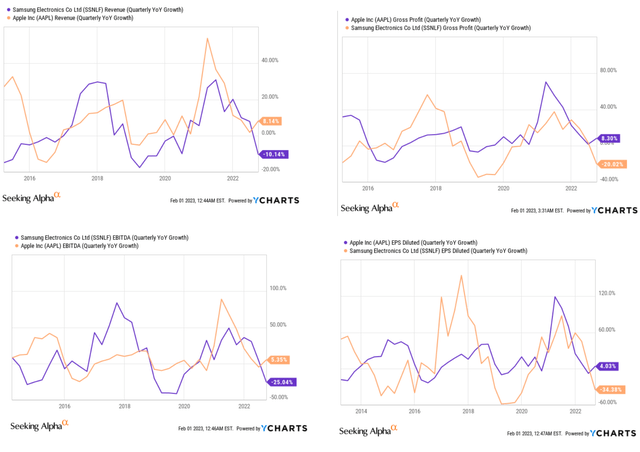

Fortunately, Samsung reports a bit earlier than Apple, and usually, the quarterly dynamics of the former’s financial performance can be used as a leading indicator for the latter:

The last data point you see in the chart above for Samsung seems to be from its latest Q4 FY2022 report released on January 31, 2023 [presented in U.S. dollars, hence the difference with the primary source]. YCharts shows Apple data for the previous quarter [Q3 FY2022].

Looking at this data, it’s easy to say, “Look, Apple is going to be down in revenue and earnings per share just like Samsung, one has to be bearish from here!” That would be a little wrong.

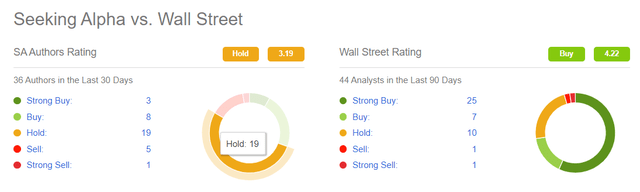

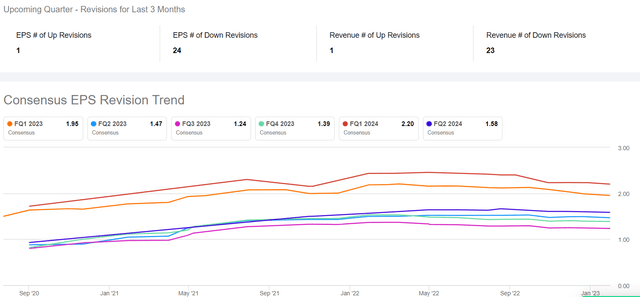

The fact is that the market has already priced in Apple to post a -1.77% and -7.01% [YoY] decline in Q4 FY2022 revenue and EPS, respectively – based on Seeking Alpha’s data. In addition, analysts have revised their forecasts 96% of the time in the last 3 months:

Therefore, the decline in revenue and EPS could even become a catalyst for growth – if Apple does not show such a bad drop as it is now expected to show. Everything will depend on CEO Tim Cook’s guidance for Q1 and the whole of FY2023 – that’s what investors and analysts will be looking at.

I have my doubts that Cook will please investors on Thursday.

First, the words of the head of Samsung are likely to be echoed in the words of Cook.

In a presentation to investors, the electronics maker confirmed that “mobile and PC demand was weak,” and its memory chip business had also suffered “as customers continued to adjust their inventories amid deepening uncertainties.”

Samsung expects some of those problems to continue in the coming months due to global economic uncertainty, though it anticipates overall demand to start recovering in the 2nd half of the year.

Smartphone demand will likely slide again this quarter [Q1 FY2023] compared to the same period a year ago, “due to the economic slowdown in major regions,” it said.

Source: CNN Business, emphasis added by the author.

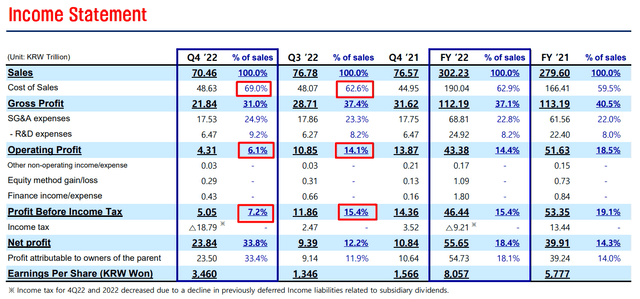

Second, Samsung experienced severe pressure on its margins in Q4 FY2022 – the gross profit margin fell by 640 basis points, and the EBT margin decreased by more than 2 times, YoY:

In absolute terms, the SG&A expenses fell by 1.27% year-on-year – which did not save the overall picture at all. It immediately occurs to me that Apple is the only FANGAM company that has foregone layoffs and instead decided to take a pay cut for its top management. Tim Cook himself will receive 40% less in 2023 than last year, according to Fortune.com. Okay, then Mr. Cook’s pay falls to $49 million in FY2023 – a drop in the bucket for a firm that generates almost $400 billion in sales annually.

Therefore, I expect Apple to report lower margins in Q4 FY2022 and most likely in the first 2 quarters of 2023 (at least) than currently priced in.

Major Banks Concur With My Conclusion

I was not specifically looking for confirmation of what I said – I was just scrolling through the latest files of the major investment banks and came across 2 studies in ZeroHedge’s premium repository.

On January 27th, Wamsi Mohan and Ruplu Bhattacharya from Bank of America (BAC) (“BoA”) published a deep dive report on how 2023 is setting up for AAPL. They expect the 1H 2023 to be difficult for Apple due to weak iPhone sales and supply and demand problems. The 2nd half of the year will depend on the success of the next iPhone cycle and the impact of AR/VR technology. Any improvement in services, such as a positive gaming environment and stable advertising, would have a positive impact, based on their study.

The cyclicality of the smartphone market – the recent dynamics in the relationship between supply and demand – has led analysts to lower their price target slightly from $154 to $153, leaving the implied EPS forecast well below Bloomberg’s consensus:

BofA [January 27th, 2023], with author’s notes![BofA [January 27th, 2023], with author's notes](https://static.seekingalpha.com/uploads/2023/2/1/49513514-16752464053736625.png)

I can’t get over BofA’s implied P/E multiples for 2023 and beyond – they seem too high to me. The last 2 times since 2007 when the company’s EPS declined year-over-year were the periods from 2008 to 2018 and 2012 to 2013 – the declines were 10.1% and 0.33%, respectively. During these 2 periods, the average annual P/E multiples behaved differently – the first time the valuation dropped from 12.8x to 11.8x and the second time it increased from 15.6x to 17.3x.

What was the reason for this discrepancy? I do not think anyone knows the exact answer, but in my opinion, it was due to the comparative valuation of the company – relative to the S&P 500 index, the company was in completely different dimensions during those periods:

Author’s calculations [ROIC.ai data]![Author's calculations [ROIC.ai data]](https://static.seekingalpha.com/uploads/2023/2/1/49513514-16752481774387665.png)

As multiples increased, the relative undervaluation of AAPL to the S&P 500 Index (SP500) decreased – the same principle worked in reverse. AAPL’s forwarding price-to-earnings ratio today is 23.62x, while the company’s valuation relative to the S&P 500 Index is equal to ~1.2 – about the same as in 2008. According to ROIC.ai data, from 2008 to 2009 Apple’s average annual P/E ratio dropped from 25.8x to 22.8x – about -11.6% year over year. If the company’s average P/E ratio declines by the same amount by the end of 2023 compared to 2022, we will see AAPL’s valuation of 22.18x earnings, which when combined with the current EPS consensus of $6.12 [based on Seeking Alpha] yields a year-end price target of $135.75 per share, down nearly 6% from yesterday’s close.

Analysts at another bank – Tim Long and George Wang from Barclays – note in their January 30, 2023 report that AAPL trades at a 20% premium to the S&P 500 Index, making it fairly valued at best, even after declining more than -17% over the past year. In addition, they see 5 risks that explain their downside projection of 7.8% [PT = $133 per share]:

If FY2023 EPS numbers keep getting revised down and BofA and Barclays estimates [$5.73 and $5.82], the fair P/E for FY2023 that I see [22.18x] makes AAPL overvalued by 11-12%.

Investors’ Takeaways Before 4Q FY2022 Release

Apple is clearly not in the best phase of its business development – demand for smartphones is declining, affecting the company’s revenue by more than 50%. It’s hard to compensate for this dynamic with other products – it’s even harder to maintain margins if you do not follow the general trends of the market when it comes to layoffs. It’s good to cut bonuses for management, but globally it will not do anything, it seems to me. The company has not been hiring much, unlike other big tech companies, but by cutting staff, Apple would have played into investors’ hands – unfortunately, that did not happen. Now, Q4 FY2022 and the next few quarters are likely to disappoint rather than delight – it will all depend on Cook’s guidance, which this time has no preconditions to be positive.

I remain Neutral on Apple Inc. stock, mainly because the downside of the 11-12% potential I see today is not too big to downgrade to Sell – at the same time, there is no upside and no margin of safety where we are today.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!

![Barclays [January 30th, 2023]](https://static.seekingalpha.com/uploads/2023/2/1/49513514-16752496286220908.png)