Summary:

- Apple Inc. is gearing up to unveil its highly-anticipated mixed reality device at the WWDC in June, with a hefty price tag ranging between $3K and $5K.

- Meta Platforms is preparing for battle and just lowered the pricing of its Oculus devices, indicating its fierce determination to defend its turf.

- Analysts expect Apple’s services business growth to reaccelerate in FY23 and FY24, potentially reaching double-digits.

- Apple Inc.’s valuation is still too high, setting the stage for a potentially massive disappointment if the company fails to deliver as expected.

Michael M. Santiago

Apple Inc. (NASDAQ:AAPL) investors are likely looking toward June’s worldwide developers conference, or WWDC, when the company is expected to unleash its highly-anticipated mixed reality device.

Before anyone gets too excited over Apple’s “moonshot” attempt to redefine the AR/VR space, Meta Platforms, Inc. (META) just lowered its price tag for its Oculus devices.

Meta is committed to leading this space and likely wants to cement its first-mover advantage against Apple’s upcoming foray. It has suffered tremendously at the hands of Apple’s ATT, as CEO Mark Zuckerberg saw META suffer its worst-ever drawdown in recent times.

Furthermore, Apple’s initial mixed reality device, expected to be priced between $3K to $5K, is likely targeted at pro users, suggesting enthusiasm over its initial uptake needs to be moderated. With Apple’s supply chain partners expecting 1.5M shipments over the first year, Apple could garner revenue of just $6B. Relative to Apple’s FY23 revenue estimates of $389.2B, it represents a share of about 1.5%. Is it more hype than reality? Investors are urged to be cautious.

Wall Street analysts have high expectations over Apple’s ability to drive growth in subscriptions and services to justify the current consensus price target, or PT, of $168.4.

Apple bull Morgan Stanley (MS), which has an above-consensus PT of $180, envisages the health of its services business could bolster Apple’s recovery. It highlighted:

Apple’s services business, meanwhile, is expected to return to double-digital revenue growth in the 2023 and 2024 fiscal years. That performance will be driven in part by a re-acceleration in app store popularity, price increases and easing headwinds related to foreign currency. Those price increases could be seen in products such as Apple Music, Apple TV+, Apple One and international apps. – CNBC Pro.

Investors need to question whether that thesis is realistic? Why is Morgan Stanley banking so much on services growth? Investors should note that its services segment is Apple’s main profitability driver, with an average EBIT margin estimate of 66%, well above iPhone’s 25% average EBIT margin estimate.

Keen investors should recall that Apple has a corporate EBIT margin profile of 30.7% in its most recent quarter. Hence, it’s easy to see why MS sees the reacceleration of Apple’s services business as critical to an upward re-rating of its valuation.

However, the average analysts’ estimates suggest that Apple’s corporate EBIT growth could fall in FY23, down 5.9%, based on a revenue decline of 1.3%.

Moreover, Trefis’ sum-of-the-parts, or SOTP, valuation suggests that Morgan Stanley could be over-optimistic, with services revenue expected to increase by 8.5% in 2023.

As such, we believe investors must be cautious in expecting its high-margin services segment to drive double-digit growth to mitigate the slowdown in iPhone shipments growth.

Apple’s Android competitors will also launch new premium smartphones to compete with the Cupertino company, shifting their focus from their lower-end segments.

Despite that, Apple’s grip on Gen Z is firm, suggesting that Apple’s installed base among the younger consumers could help expand iOS market share against Android OS moving ahead. Hence, as Apple expands its ecosystem of devices and works on leveraging its massive installed base, it could help mitigate the slowdown in its iPhone shipments growth.

But, the critical concern has not changed. With analysts expecting Apple’s services growth normalization to inflect upward significantly over the next two years, we believe the stage could be set for disappointment if Apple’s execution falters.

Moreover, AAPL’s NTM EBITDA multiple of 18.5x has not resolved its overvaluation headwinds, sitting well above its 10Y average of 11.4x.

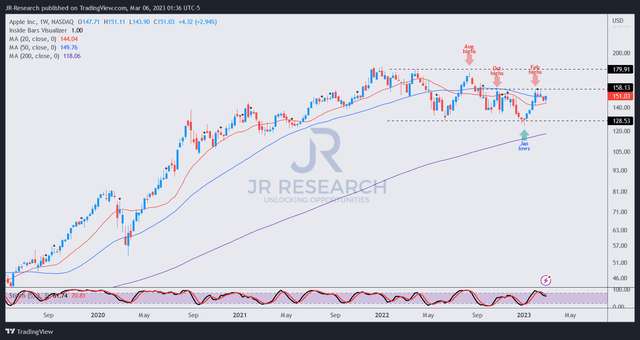

AAPL price chart (weekly) (TradingView)

Apple Inc.’s price action also seems to be stalling since its recent earnings release. Therefore, sellers could be distributing further and taking profits after January’s surge.

AAPL has also been making lower highs, and its momentum has weakened further.

The challenges discussed above, coupled with analysts hopeful of a sharp reacceleration in its growth drivers, are not constructive.

Apple Inc.’s reward/risk profile looks unattractive for buyers to consider. Sellers sitting on solid gains should consider taking profits and moving on.

Rating: Sell (Reiterated).

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!