Summary:

- Supporting Apple Inc. is the capital-light business model, valuable brand, rich margins, strong balance sheet, and pristine management track record.

- That said, I ran the numbers in my discounted cash flow model and found it hard to justify the current share price of nearly $160.

- I remain an Apple bull, but I can certainly appreciate the bearish case that is supported by skepticism over rich valuations.

Scott Olson/Getty Images News

I am, and I have been for a while, an avid Apple Inc. (NASDAQ:AAPL) bull. I find the Cupertino company one of the most impressive in the tech and consumer spaces. Its brand value is second to none, in my opinion. The capital-light business model is highly supportive of high margins and strong cash flow generation. Also, the management team’s track record is about as good as one can find in Silicon Valley or elsewhere — maybe on par with that of Microsoft Corporation (MSFT), but not many others.

However, the more I look at my valuation calculations, the more I understand one of the key pillars of the bear case. Today, I explain how Apple seems to be priced for perfection using a flawed but still useful tool: the discounted cash flow model, or DCF.

Apple and the key bearish themes

A look around the web unveils a few common concerns shared by most Apple bears.

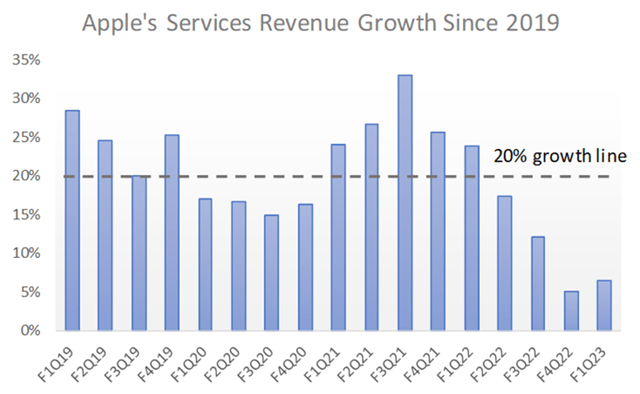

Some argue that the iPhone cycle is at risk, given supply chain disruptions that are slowly moderating, as well as the imminent slowdown in consumer spending and economic activity. Others see troubles with the services business, given the high expectations for 20%-plus growth that, while consistently achieved in quarters prior to mid-2022 (see chart below), seem unlikely to repeat in the foreseeable future. Apple’s overdependence on China, from both the supply and demand sides, is also cited as a reason to be cautious.

I think that these are good candidates for my list of “key risks to the bullish thesis.” However, I find it a bit speculative to base a bearish argument on these potential challenges. Historically, Apple has been able to navigate around similar issues very well, not only finding demand for its products and services but also being able to maintain pricing power.

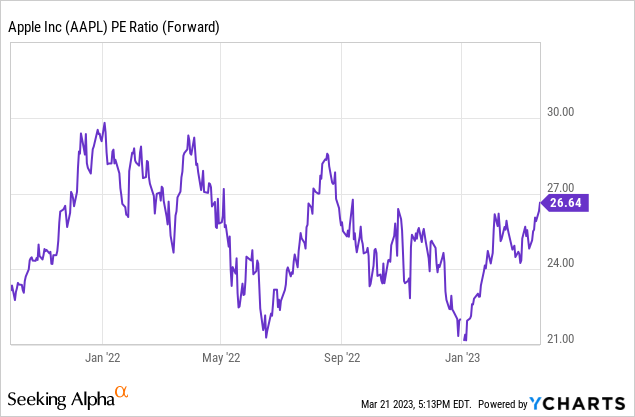

The bearish argument that I find more easily quantifiable and less dependent on anyone’s ability to predict Apple’s future P&L are rich valuations. Perhaps Apple’s current-year P/E of 26.6x, on par with the average of the past 18 months (see below), may not illustrate the issue as clearly. An analysis of the DCF model, however, does a better job.

Apple’s DCF looks ugly

For the benefit of those unfamiliar with the tool, a DCF model attempts to calculate a company’s enterprise or equity value by discounting future cash flows to the present using a certain discount rate.

In the case of enterprise value calculations, the rate to be applied is the WACC, or weighted average cost of capital. For Apple, it is largely a function of the risk-free rate (usually the ten-year treasury yield), the beta (a variable that changes from stock to stock), and the equity risk premium (a rate that rarely moves and that is 5.5% today). The higher any of these three factors, the higher the discount rate, hence the lower the value of the enterprise.

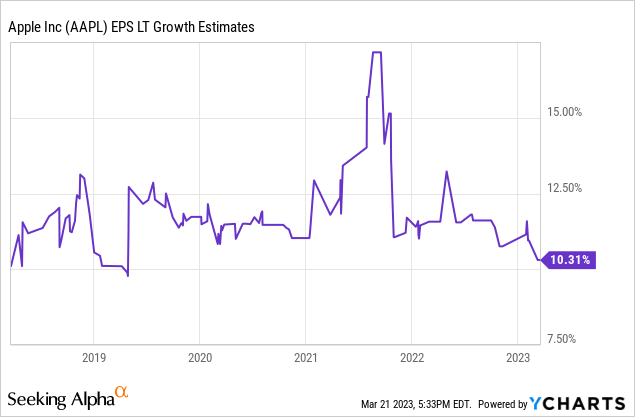

In my DCF calculation, I assumed future cash flow generation that is likely above the current consensus. I did so by being aggressive on how much Apple will produce in revenues and earnings through the next five years. For comparison, I estimate that EPS will grow at a long-term average of 11.2% per year, which is about one percentage point higher than the 10.3% that is currently reflected in the consensus expectations (see chart below).

As far as working capital is concerned, another important component of free cash flow, I assumed the status quo. That is, Apple is already very competent at operating on a relatively tiny working capital base. It is hard to imagine the company making much improvement on this front, but I also do not expect to see working capital rising significantly in the future.

After setting future cash flow projections at what I believe to be above-consensus levels, I turned to the WACC. It is a given that: (1) the ten-year treasury rate is currently 3.6%; (2) Apple’s beta is 1.24, according to Seeking Alpha; and (3) the equity risk premium is 5.5%, as mentioned above. Therefore, the WACC is 10.6%, considering Apple’s roughly $50 billion in net cash and cost of debt of 4.1%.

Regarding cash flow growth in perpetuity, I assumed 2.5% per year. This is roughly in line with (if not a few bps higher than) what I believe to be the long-term global GDP growth rate.

Once I plugged in the numbers using the assumptions above, which I believe to be realistic if not just a bit aggressive, I arrived at a fair value of $106 for Apple shares. The downside potential from current levels, in this case, would be a whopping 34%, enough to make AAPL bulls scratch their heads.

Bending over backward

In order to “force” my DCF to output at least Apple’s current price per share, I had to bend over backward. Because my cash flow projections already looked a bit stretched relative to consensus, I chose to focus instead on the discount rate and the growth in perpetuity.

Regarding the former, I changed my beta to 0.8. While it may seem unreasonable at face value to use a beta value below 1.0, doing so may be forward-looking and consistent with the idea that Apple could weather the macroeconomic challenges in 2023 better than the rest of the market. At least so far this year, this has been the case.

Regarding the latter, I increased the growth in perpetuity by 50 bps to 3%. Playing with this number is a slippery slope, in my opinion, as no company should be expected to grow cash flows forever at a rate that is higher than that of the global economy. Each percentage point change in this assumption changes my fair value calculation for Apple by $12 per share.

Why I am still a bull

The key takeaway from my exercise above is that Apple Inc.’s valuation may, indeed, be too rich for the taste of many (especially value) investors. Still, a DCF model alone is not enough to shake my bullish stance toward the stock.

Discounted cash flow has many flaws. For instance, I find it unreasonable to value a company based on my (likely incorrect) projections of how much cash it will produce in 2027, 2037, or 2057. The introduction of new products or even whole product categories, including metaverse-related gear and autonomous vehicles, could fundamentally change the profile of Apple’s P&L in as few as three or five years — for better or for worse. So, why bother looking so far ahead in the future?

Also, regardless of how mathematically correct this may be, I do not buy the idea that Apple’s discount rate should be any higher than 10%. The company’s capital-light business model, valuable brand, rich (and yet improving) margins, strong balance sheet, and pristine management track record suggest to me that the market probably has a low-risk perception of Apple stock. Perhaps a WACC of 7% to 8% may, in fact, be the most appropriate in this case.

That said, I always find it important to play the devil’s advocate and understand the market through the eyes of a bear. In the case of Apple Inc., I can certainly appreciate the bearish case that is supported by rich valuations.

Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.