Summary:

- With tech stocks in rally mode, the battle of safe havens is heating up once again.

- In today’s note, I provide an update on recent market action and risk/reward dynamics for treasury bonds, Apple and Microsoft.

- As of now, I continue to prefer short-duration bonds for parking my cash. Also, I rate Apple “Neutral/Hold/Avoid” at $160 and Microsoft a “Sell” at $280.

SARINYAPINNGAM/iStock via Getty Images

Introduction: The Flight To Safety

In recent weeks, treasury bonds, Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT) have caught a bid as investors flock into “safe-haven” assets amidst a (somewhat contained) banking crisis in the US and Europe. So far in 2023, the bank runs here in the US have been limited to regional banks; however, fears of contagion in the financial system are currently elevated, with most banks holding underwater assets (treasuries and other commercial paper) in their “held-to-maturity” portfolios.

After nearly fifteen years of zero to low-interest rates, the Fed has caught several financial institutions off-guard by hiking the Fed Funds rate to 5% in just about a year or so. Such a radical shift in monetary policy is bound to cause real pain in the economy, and we look set to experience a credit crunch in coming quarters as banks tighten up their lending activities. While the equity markets are showing little to no signs of stress at the moment, bond market volatility (ICE BofAML MOVE Index) is at the highest level it’s been since the Great Financial Crisis of 2008-09.

TradingView

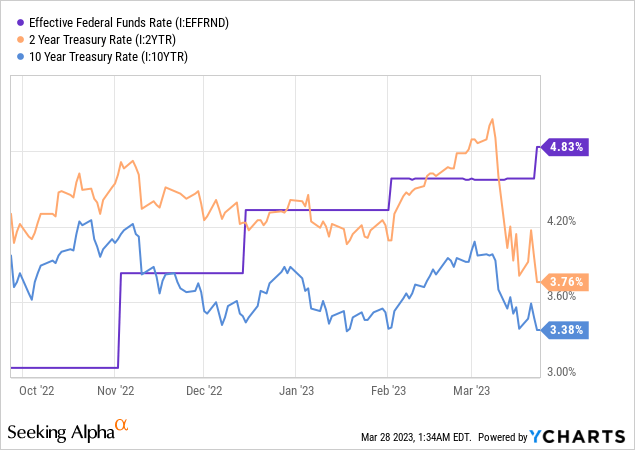

Volatility is a double-edged sword, and the ongoing bout of bond volatility has led to a sharp surge in bond prices across different durations. With higher bond prices, treasury yields are showing a sharp decline. In about two weeks, the 2-yr treasury yield has collapsed from ~5.1% to ~3.75%.

Now, declining interest rates and falling inflation represent a bullish macro setup for long-duration assets like growth-tech stocks. In 2023, the tech-heavy Nasdaq-100 (QQQ) index has been outperforming other major equity indices, and a bulk of this strength is coming from mega-cap tech companies like Apple, Microsoft, Alphabet (GOOG) (GOOGL), Amazon (AMZN), Tesla (TSLA), Meta Platforms (META), and Nvidia (NVDA).

Over the last few weeks, fears around the safety of bank deposits seem to have triggered a rush into these mega-cap tech names in what appears to be a flight to safety trade. With mega-cap tech stocks in rally mode, many of our investment community members at The Quantamental Investor have been re-evaluating their positioning among safe haven assets. And this is why I decided to provide an update on the battle of safe havens.

As you may know, our discussion in this series is limited to risk-free treasury bonds, Apple and Microsoft. If you haven’t followed our coverage on the battle of safe havens, please feel free to read:

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-2

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-3

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-4

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-5

In today’s note, we will discuss recent market action and risk/reward dynamics to decipher the better investment among treasury bonds, Apple, and Microsoft at this point in time.

AAPL Vs. MSFT Vs. SHY Vs. TLT: Recent Market Action

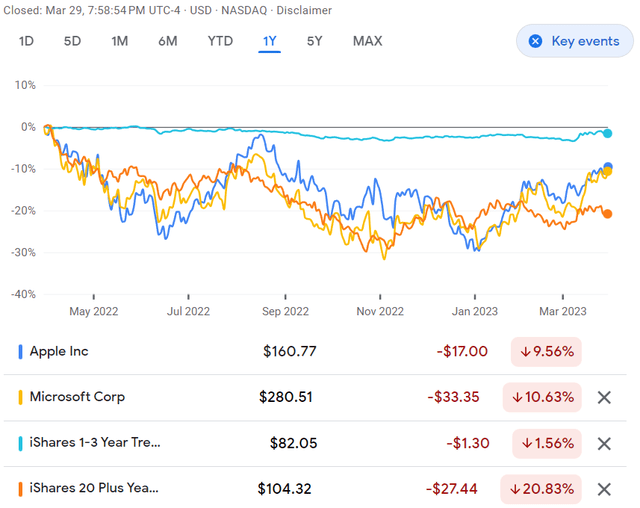

Since my first report on the battle of safe havens was released on 20th April 2022, Apple and Microsoft’s stock prices have decreased by roughly 10% each, with long-duration treasuries (TLT) sinking by ~20%. My picks, i.e., short-duration treasury or cash, have held up quite well during this period.

Google Finance

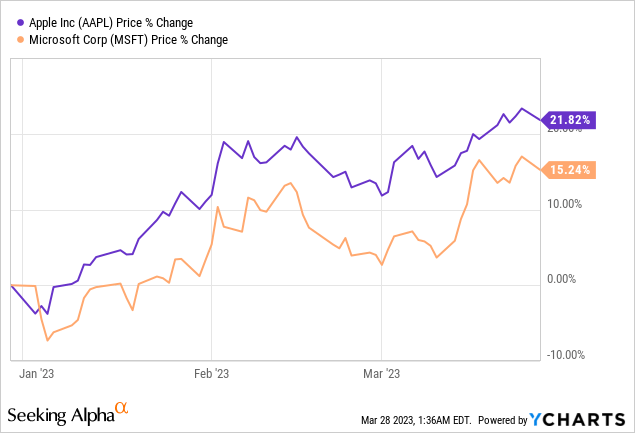

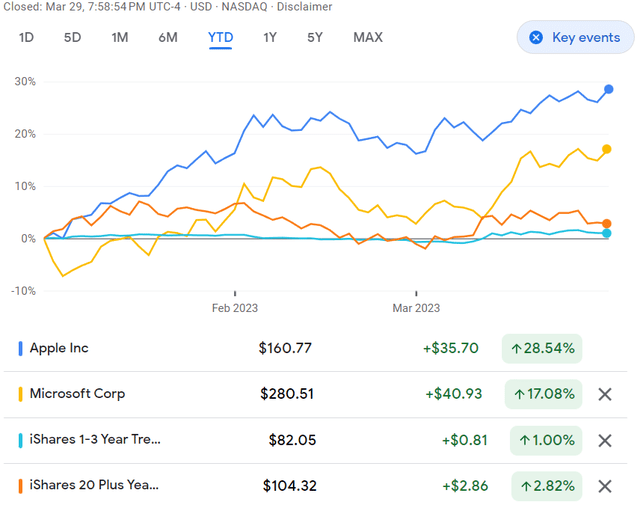

However, the market action in 2023 is looking very different from what we saw last year, with Apple and Microsoft gaining ~28% and ~17% year-to-date. Also, treasury bonds are experiencing tremendous volatility due to the knock-on effects of the Fed’s most-aggressive monetary policy tightening cycle ever.

Google Finance

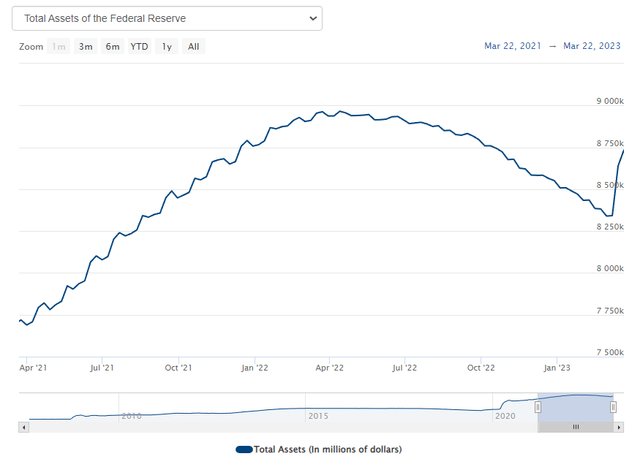

In response to the regional banking crisis, the Fed moved smoothly to avoid the spread of contagion – expanding its balance sheet by ~$400B in 10 days. By doing so, the Fed has reversed nearly 60-65% of the balance sheet reduction [QT (quantitative tightening)] it had achieved over the past several months. Now, we could argue all day if the Fed expanding its balance sheet to lend money at par for deeply underwater treasury portfolios to failed banks is quantitative easing [QE] or not; however, let’s leave that topic for another day. For now, we should acknowledge that the Fed is printing new money and injecting it into the financial system once again.

Federal Reserve

While the Federal Reserve raised rates at its March FOMC meeting and guided for “higher rates for longer” [maintaining a commitment to the 2% inflation target], the bond market is already pricing in rate cuts in the second half of this year. For months, the bond market has been screaming “Recession Ahead” through an inverted yield curve, and with the regional banking crisis likely to trigger a credit crunch, most investors are now bracing for a hard landing in the economy!

Here’s what I wrote about the Fed’s latest FOMC statement:

Despite acknowledging the possibility of tighter credit conditions for households and businesses due to recent bank runs at Silicon Valley Bank and Signature Bank, the federal reserve raised funds rate by 25 bps to 4.75-5% and maintained terminal rate expectations for 2023 at 5.1%. The FED’s monetary policy stance resonates with the move we saw from European Central Bank last week, which means the fight against inflation continues with higher interest rates for longer. On one hand, the FED is providing liquidity to failed banks by backstopping deposits, and then on the other hand, the FED is also making the liquidity problem worse with higher rates! In my view, monetary policy is all over the place, and markets do not like such uncertainty. The bond market is pointing towards a recession, and equities may start pricing one too in the aftermath of this FOMC meeting.”

Source: Federal Reserve hikes rate by 25 basis points, more firming may be coming

With banks paying far less interest on checking and savings deposits than what one could get in a money-market fund today, the flight to safety into short-term treasury bonds has a sound rationale. However, investors flocking into expensive mega-cap technology stocks like Apple and Microsoft are making a big mistake right now.

Apple And Microsoft Are Not Safe Haven Assets

Over the last fifteen years or so, Apple and Microsoft’s strong execution history has enabled these mega-cap tech giants to earn the status of safe haven assets in the eyes of the investing world. Today, Apple and Microsoft make up more than 13% of the S&P500 index and more than 25% of the Nasdaq-100, which is the highest concentration these indices have had in a pair of stocks ever. Fundamentally, both Apple and Microsoft are two of the strongest businesses on the planet. However, Apple and Microsoft are not immune from the macroeconomic environment, and this fact is clearly visible in their recent financial performance:

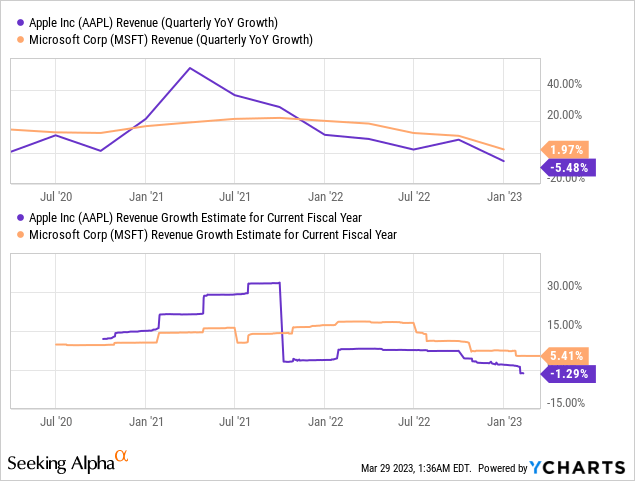

As you can see above, both Apple and Microsoft have recorded drastic revenue growth slowdowns over the last several quarters. Apple delivered -5.5% y/y growth in Q4 2022 and is projected to have negative revenue growth in 2023! And Microsoft is barely growing at a positive rate, with some acceleration expected to help the company to +5% y/y growth in 2023. While I think revenue growth rates at these tech giants will re-accelerate again at some point in the future; however, at this moment in time, we see little to no growth from both Apple and Microsoft.

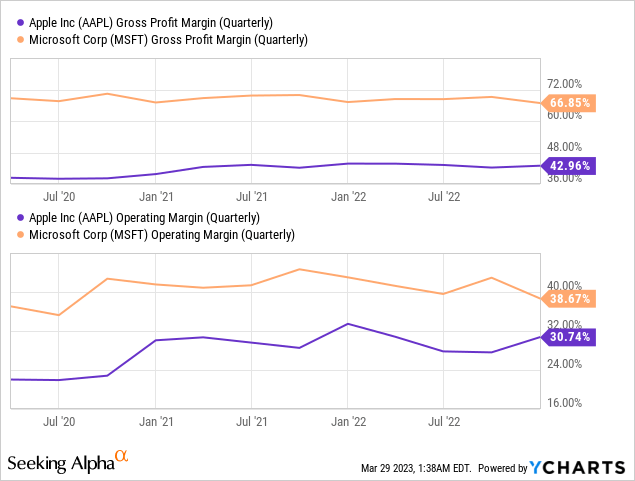

So far in this cycle, Apple and Microsoft have managed to hold onto their healthy margins (with only some signs of deterioration); however, as we move further into an economic downturn, we are likely to see a sharp drop off in margins at both of these tech giants.

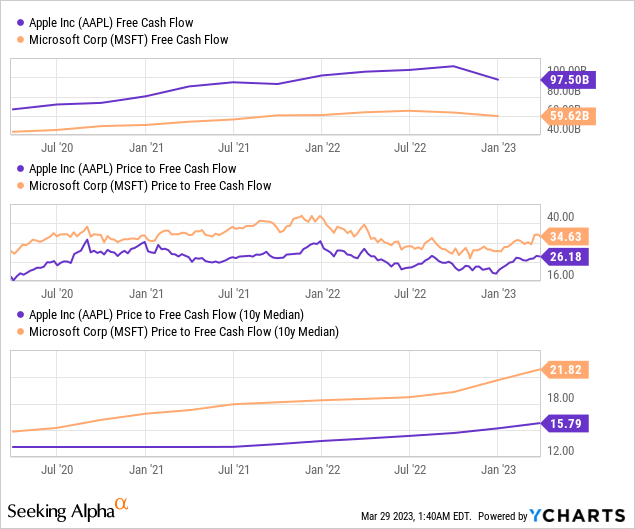

Over the years, Apple and Microsoft have become free cash flow printing machines and infinite buyback pumps. However, both Apple and Microsoft are now seeing significant pressure on free cash flow generation. And as we have discussed in recent notes, Apple and Microsoft’s balance sheets are not as strong as they used to be in the past.

While Apple and Microsoft are losing business momentum, their stocks continue to trade at premium valuations of 26x and 35x P/FCF, respectively. To provide some context, Apple and Microsoft’s 10-yr median P/FCF multiples stand at 16x and 22x, respectively. Heading into a recession, I don’t like the idea of paying multiples that only make sense in a ZIRP-fueled liquidity boom.

Concluding Thoughts: Trade or Fade The Flight To Safety?

With an earnings recession looking inevitable, Microsoft and Apple’s premium valuations (relative to Treasuries (SHY)(TLT) and S&P 500 (SPX)) make little to no sense to me. As we have seen in this note, these so-called “safe haven” stocks still have three major headwinds:

- High starting valuations

- Revenue growth slowdown & earnings contraction

- Buybacks becoming ineffective & balance sheets getting less robust

For detailed coverage of Apple and/or Microsoft, head over to my research coverage on SA:

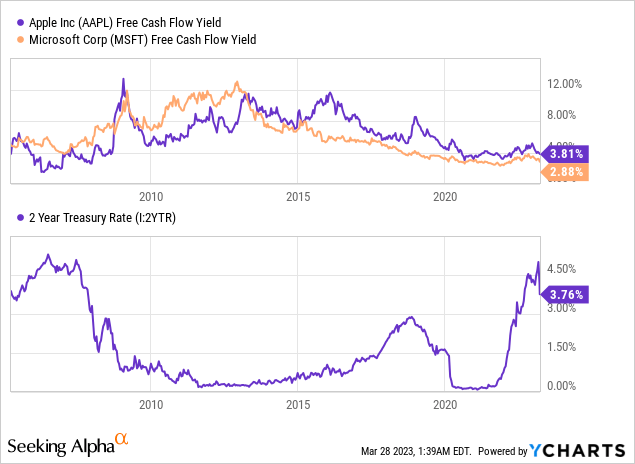

The era of free money is over, and so the lack of a margin of safety in Apple and Microsoft’s stocks is simply unacceptable. Despite a sharp decline in the 2-year treasury rate to ~3.75%, the equity risk premium on offer from Apple (FCF yield: 3.8%) and Microsoft (FCF yield: 2.9%) remains non-existent in the aftermath of a befuddling rally in these stocks.

In my view, the risk/reward for a near to medium-term investment in Apple and Microsoft has gotten far worse than our last update from late December 2022, and even then, I viewed the risk/reward on offer as highly unfavorable.

Today, I want to reiterate my investment pick:

In the “Battle of Safe Havens” cash has been the winner so far; however, surging treasury rates are making treasury bonds a viable alternative to equities. If I had to choose between Apple, Microsoft, and the 2-yr treasury bond, I would go with the 2-yr treasury bond for the medium term.

Source: Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-4

With the Fed still contemplating additional rate hikes and intending to hold interest rates higher for longer, I continue to like the idea of buying short-term treasuries over long-term treasury bonds, Apple, and/or Microsoft to ride out an inevitable economic recession.

We are most likely heading into a risk-off environment, and US treasuries are the closest thing to a truly risk-free asset on this planet. In the past, I have suggested buying 2-yr treasury bonds; however, the gap between 2-yr treasury yields and Fed’s forward rate guidance means we are better off buying 3-month or 6-month T-bills yielding >4.5%.

Key Takeaway: I continue to prefer short-duration bonds to park my cash (earmarked for future equity purchases). Additionally, I rate Apple “Neutral/Avoid/Hold” and Microsoft a “Sell” at current levels.

Thanks for reading, and happy investing. Please share your thoughts, questions, and/or concerns in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOGL, TSLA, AMZN, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month). New users can also avail of a special introductory pricing deal!