Summary:

- Apple reported a very weak holiday quarter with sales plunging 5.5%.

- The tech giant guided to a weak March quarter in what investors expected to be a snapback rebound following iPhone production issues in the December quarter.

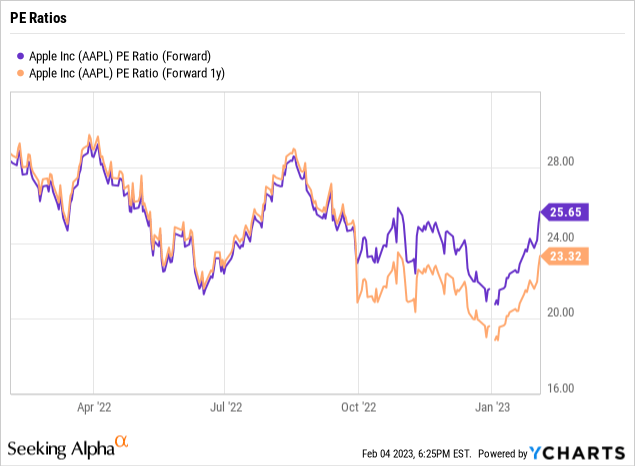

- The stock is incredibly expensive considering the limited growth plans ahead and the valuation disconnect trading at 26x FY23 EPS estimates.

prospective56/iStock via Getty Images

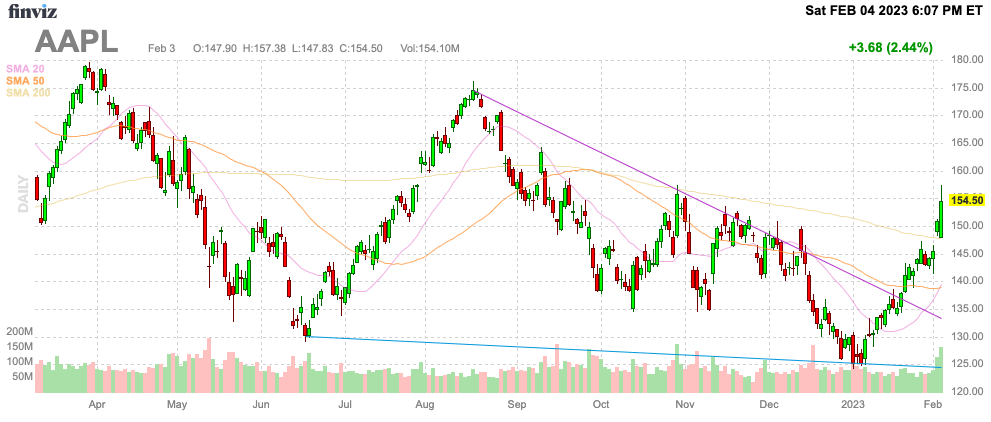

Despite reporting quarterly results consistent with a business in a deep freeze, Apple (NASDAQ:AAPL) has already rallied back above $150. For some odd reason, the market has cheered paying a premium price for a tech giant struggling to deliver sales growth. My investment thesis remains Bearish on the stock with investors pricing in serious rebound hopes into the premium valuation while the company guided to another weak quarter.

Source: Finviz

Miserable March Ahead

Coming into the quarterly print, the market knew Apple was set to report a horrible holiday quarter. The company faced production issues in China due to Covid shutdowns and the market for technology has run into a tough headwind.

What the market didn’t know is that Apple was going to suggest the March quarter is going to be equally bad. Investors had thought the millions of iPhone units pushed out from the December quarter would show up in the March quarter and this doesn’t appear the case here.

For FQ1’23, Apple reported revenues fell a rather large 5.5% to $117 billion. The tech giant saw EPS miss analyst estimates by $0.07 and dip $0.22 from the prior FQ1, even though Apple only grew operating expenses by $1.6 billion YoY with total costs actually falling from FQ1’22 levels.

Even with the iPhone production issues, Apple would’ve reported a revenue increase, if not for the 800 basis point currency impact. The flip side of this currency impact is the upside potential in FQ1’24 when the tech giant likely benefits from a currency tailwind.

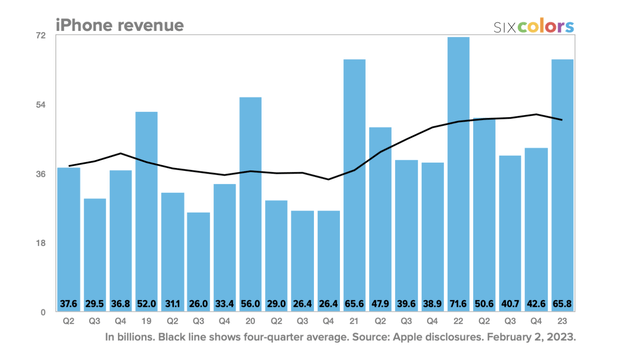

While the December quarter iPhone sales were disappointing, the sales level wasn’t off the charts weak as true supply chain issues would set up a strong March quarter. Apple reported iPhone revenues of $66 billion, down 8% and flat on a currency neutral basis, though the company did benefit from a 14th week in FQ1.

Despite the reported issues at Foxconn in China, Apple didn’t face the level of disruption the market was led to believe. On the FQ1’23 earnings call, CFO Luca Maestri was highly negative on the outlook for the March quarter as follows:

In total, we expect our March quarter year-over-year revenue performance to be similar to the December quarter. This represents an acceleration in our underlying year-over-year business performance as the December quarter benefited from an extra week. Foreign exchange will continue to be a headwind, and we expect a negative year-over-year impact of 5 percentage points.

The CFO forecasts a 5% sales dip for the current quarter with offsets from not having the extra week in the March quarter while currency headwinds will have a lighter 300 basis points impact. The financial executive guided to improving iPhone sales, but investors were expecting a bigger snapback considering the smartphones accounted for 56% of December quarter sales.

CEO Tim Cook couldn’t even provide a clear answer on the demand deferral or destruction from Apple not having sufficient iPhone 14 Pro supplies during the December quarter:

In terms of what we’re seeing in January, we’ve included in our color that Luca provided kind of our thinking. It’s very hard to estimate the recapture because you have to know exactly what would have happened and how many people bought down. And it takes a while to get that — to get those reports in during the quarter. And so we’ve made our best guess at it.

All of these data points suggest iPhone demand isn’t as strong as expected as consumers loaded up on 5G iPhones in the prior year. Apple wasn’t as impacted by the inability to sell iPhones in the holiday quarter and the company won’t recapture lost sales during the March quarter. In addition, the tough comps in the Mac and iPad product lines will contribute greatly to the weak March quarter.

Low Growth Mode

As the market gets lost on the FQ1 results and some commentary around a weak March quarter, investors need to understand Apple is in a low growth mode going forward. Any iPhone sales lost in the December quarter and potentially recaptured in FQ2’23 won’t solve any of the problems plaguing the stock valuation.

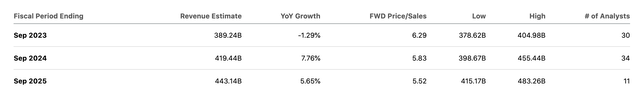

Analysts currently forecast total sales to slip in FY23 followed by a snapback in FY24 due primarily to the currency reversal. After that, Apple earnings will struggle in the sub-10% growth range without any new product hits.

Oddly, the stock has rallied back to top $150 without Apple providing any financial metrics to support this rally. A lot of the bullish commentary doesn’t amount to much when looking deep into the numbers.

In fact, the stock is already back to the premium multiples causing the valuation problems leading to Apple diving back to $125 in early January. The stock trades at 26x FY23 EPS targets and the company needs a big 12% boost in FY24, helped by a currency reversal, in order to reduce the forward PE multiple to only 23x.

As highlighted in the past, the commentary from bullish analysts don’t match the actual financial projections. The tech giant even sounded very bullish about the year ahead and one had to parse the commentary from the CFO to understand the miserable expectations for the March quarter.

A prime scenario of this situation propping up the stock was the bullish call by the Jefferies analyst with a $195 price target. Analyst Kyle McNealy lowered FY23 and FY24 earnings and revenue projections, yet the analyst has the stock valuation at 30x FY24 targets.

Not to mention, the FQ1 miss on both the topline and bottom line should remind investors that meager growth targets for the next few years are as likely as not to be accurate. Pre-Covid, Apple had a history of barely exceeding analyst estimates by a few pennies at most and only during the wild Covid boost period did the tech giant regularly exceed consensus targets by a wide margin.

The last quarter’s results should remind investors the real risk isn’t to the upside questioning the point of paying a large premium for Apple.

Takeaway

The key investors takeaway is that Apple shareholders should ignore all of the positive commentary on the business and focus on the actual financial projections. The stock remains highly disconnected with the financial realities of slowing product demand for Apple.

Investors should immediately sell the stock and wait for a spring frost to end before purchasing Apple at much lower levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.