Is AbbVie A Buy Following The Share Price Slump?

Summary:

- AbbVie has seen its shares pull back in recent weeks.

- Humira has gone off patent in the US, but other assets are generating strong growth.

- AbbVie is not expensive and offers a compelling dividend yield.

JHVEPhoto

Article Thesis

AbbVie (NYSE:ABBV) has seen its shares pull back by close to 20% over the last couple of weeks. This coincides with the rollout of biosimilars to AbbVie’s blockbuster drug Humira. But that was a very well-known factor for years, thus it doesn’t make too much sense that the market is suddenly selling off ABBV. Following this share price decline, the valuation has become attractive again, and the yield has risen to more than 4% as well.

It’s Happened: Humira Went Off Patent

Over the last couple of years, AbbVie’s biggest drug, and, in fact, the biggest drug in the world, has been Humira (adalimumab), an immunology drug that is used against different illnesses such as rheumatoid arthritis, psoriasis, Crohn’s, and so on. In Europe, Humira lost its patent protection a couple of years ago, and due to the drug’s high sales, it’s not surprising that several other pharma companies brought biosimilars to the market. That did, however, not make sales disappear in Europe — while revenue pulled back 46% in the first year after competitors came to the market with their respective biosimilars, Humira continued to generate billions of dollars in revenue for AbbVie in the EU.

This year, Humira has gone off patent in the United States as well — which was well-known for a long time, thus most investors will have known about this already. Nevertheless, ABBV’s share price slumped over the last couple of weeks, dropping by more than 10% so far in 2023, and by 17% from the 52-week high. Considering that an efficient market would have priced the patent expiration into AbbVie’s shares in the past, this is somewhat surprising, especially since AbbVie has recently announced strong guidance numbers for its next-level, Humira-replacing drugs upa and risa, or Rinvoq and Skyrizi. Those target essentially the same indications that are targeted by Humira, but their more modern formulation promises better effectiveness and fewer side effects. AbbVie has thus, not surprisingly, built its future growth strategy in the immunology space around these two drugs that should generate significant growth in the coming years.

But let’s get back to Humira first. I do believe that there is a good chance that Humira’s revenue in 2023 and potentially the next couple of years will be better compared to what many investors and analysts seem to believe. What we have seen in the EU suggests that revenues aren’t vanishing, despite biosimilars being available. There are several reasons for that, including the fact that some doctors are reluctant to switch their patients to another drug — when patients are stabilized via their current Humira regime, switching to a competitor’s product bodes some risk that the (severe) diseases that are currently being treated by Humira aren’t treated as well. Some doctors and patients will opt to continue with their Humira treatments to reduce risks, even if that means that expenses might be higher compared to a peer’s biosimilar product. AbbVie’s management has guided towards a 45% revenue pullback for Humira in the US, which would be marginally less than the pullback seen in the EU when the drug went off patent there. Investors should know, however, that AbbVie has a history of underpromising and overdelivering — I thus wouldn’t be too surprised to see ABBV generate a better Humira sales performance in the US this year.

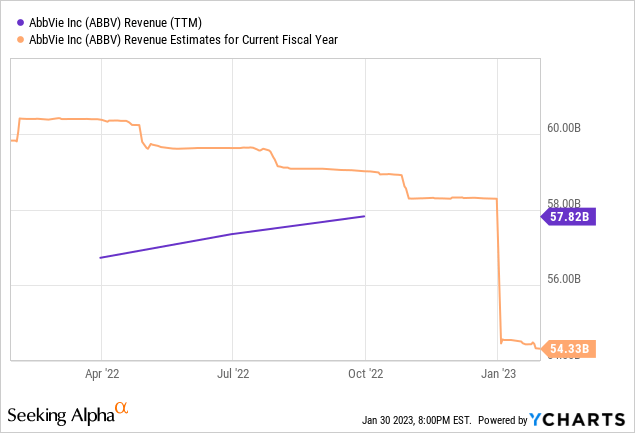

It is pretty clear that Humira’s revenue will decline this year, of course, even though the decline might be less pronounced compared to what the market forecasts right now. But luckily, AbbVie is not all-dependent on Humira, as Humira isn’t the sole source of revenue and since many other drugs in its portfolio are growing. That’s why the overall sales impact will not be too massive:

Analysts are predicting that AbbVie will generate a little more than $54 billion in revenue this year, which would represent a decline of 6% versus the trailing twelve months period. That’s not great, all else equal, but far from a disaster. While Humira’s revenue will likely continue to pull back in 2024 and beyond, the impact on AbbVie will be smaller — revenues will be declining from a smaller base, resulting in a less pronounced hit in absolute terms. That’s why analysts are predicting that revenue will be flat in 2024, relative to current 2023 estimates. From that level, AbbVie can then start to grow again in 2025 and beyond, via new drugs coming to the market by then and via growth from existing assets that are still in their growth phase — such as Skyrizi and Rinvoq. Management has been pretty bullish on ABBV’s longer-term outlook, showcased, for example, by a recent presentation at the JP Morgan Healthcare Conference in January:

“Strong” revenue growth in 2025 sounds encouraging, and a high-single-digit revenue growth rate in 2026-2029 would be great. If that does happen, AbbVie could easily hit $70+ billion in revenue in 2029. In fact, that would be possible with annual revenue growth of 5% in 2025-2029, off a forecasted $54 billion in 2024. What exactly AbbVie means with “strong” is not known, but it doesn’t sound like they are talking about a low-single-digit revenue increase in 2025. And a high-single-digit CAGR in the second half of the 2020s suggests that the 5% revenue growth in the above scenario is too bearish — a $70 billion estimate for revenues in 2029 could thus be too bearish as well, and we might see $75 billion to $80 billion in revenue if everything goes as expected by management right now. In short, the growth story seems to be far from over, even though 2023 will be a temporary setback.

Skyrizi and Rinvoq will be two of the growth drivers — management is forecasting risk-adjusted sales of $18 billion or more in 2025, with sales seen growing further over the following years. Price increases, new patient starts in indications these two are already approved for, and new approvals in additional indications will be the deciding factors for the future revenue these two drugs will bring in.

Other growth drivers include AbbVie’s oncology portfolio, where several assets are in phase III studies or phase III-ready right now, in both hematology-oncology and in solid tumors. On top of that, AbbVie also continues to expand its neuroscience portfolio, e.g. in migraine prevention and in acute migraine treatment.

Profits will also benefit from AbbVie’s ongoing debt reduction, as this will result in lower interest expenses in the future. So far, AbbVie has already paid down $34 billion of the Allergan-related debt since the acquisition closed, and additional debt will be paid down in the future. All in all, it looks like AbbVie will perform reasonably well in the 2020s on an operational basis, at least if everything goes as planned. It is possible that some pipeline assets don’t get approved, or that competitors come up with better products that gain market share from AbbVie. But since AbbVie’s management has hit or beaten its own goals and guidance in the past, I believe that there is a good chance that ABBV will deliver on its promises.

Price Decline, Valuation, Dividend

Following the recent share price decline, AbbVie is now attractively valued again. Based on expected earnings per share of $11.70 AbbVie is trading at 12.5x forward earnings right now, for an earnings yield of 8%.

Around half of those profits are paid out to shareholders via dividends — AbbVie currently offers a dividend yield of 4.1%. That means that the dividend is well-covered, with a coverage ratio of 1.97. When we consider AbbVie’s non-cyclical business model — patients require care, no matter how well the economy is doing — the dividend cut risk seems pretty low. Since 2023’s earnings will be the nadir, or pretty close to it (2024’s profits might be a tad lower), it is likely that dividend coverage will start to improve in the next two years or so. That will make the dividend even safer, and dividend growth will likely pick up again as well.

Shares are currently trading 9% above the 52-week low and 17% below the 52-week high, thus from a timing perspective, shares are not unattractive. The stock’s relative strength index (‘RSI’) has recently hit 31, which indicates a relatively oversold condition. The combination of these factors — an undemanding valuation, a compelling dividend yield, and the fact that shares are oversold — suggest that now could be a good time to enter or expand a position in AbbVie. The stock undoubtedly is a better buy today versus the highs seen just a couple of weeks ago, thanks to a higher starting yield and a lower valuation.

Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!