Summary:

- Apple Inc.’s Q2 results show weak iPhone sales but strong growth in their service business.

- The company ended the quarter with $58 billion in net cash and announced a $110 billion shares repurchase plan.

- I reiterate a “Buy” rating for Apple with a fair value of $220 per share.

ozgurdonmaz

I presented my “Buy” thesis for Apple Inc. (NASDAQ:AAPL) in my previous coverage, emphasizing their growth potential in Vision Pro and service business. Apple released their fiscal Q2 results with $110 billion of shares repurchase authorization. Despite a 10% decline in iPhone sales caused by product cycles, I reiterate a “Buy” rating with a fair value of $220 per share.

Weak iPhone Sales and Strong Service Growth

In summary, Apple’s Q2 result shows sluggish iPhone sales offset by robust service growth. Apple ended the quarter with $58 billion in net cash position, and they announced an additional $110 billion share repurchase plan, which was well received by the stock market.

I think the declining iPhone growth was attributed to several factors:

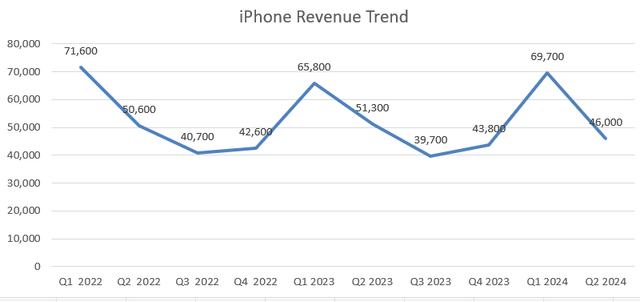

- iPhone revenue increased by 7% in FY22, followed by a -2.4% decline in FY23. In my opinion, iPhone’s growth is now primarily driven by the replacement cycle, with diminished penetration growth from new customers. In other words, it would become increasingly challenging for Apple to gain additional market shares from other competitors. Once a consumer electronic product enters the replacement cycle, growth tends to slow down, as evidenced by computers and printers, among others.

- In the past, Apple benefited from strong growth in China, especially in their iPhone business. Local consumers regard iPhone as a luxury item, and they are very proud of owning an iPhone in China. However, recently, domestic players such as Huawei and Xiaomi (OTCPK:XIACF) have entered the high-end smartphone market with much cheaper prices. In April 2024, Huawei announced their Pura 70 series, set to replace their P series launched in 2012. According to a Counterpoint Research report, Huawei’s smartphone shipments surged by 64% in the first six weeks of 2024, while Apple’s iPhone sales declined by 24% during the same period.

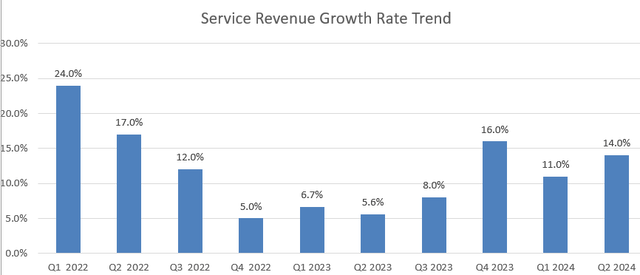

Apple’s service business continued their double-digit growth momentum, increasing by 14% year-over-year. As indicated in my previous reports, Apple’s service business is a significant growth engine for the company. In Q2 FY24, service business represented more than 26% of total revenue. As communicated over the earnings call, Apple was experiencing double-digit growth in subscribers, across both developed and emerging markets.

The strong growth in services reflects Apple’s multi-year’s efforts to establish the Apple ecosystem. With a vast installed base spanning smartphones, computers and iPads, Apple enjoys tremendous competition in expanding their subscription businesses.

Apple TV+ was the fastest growing major SVoD service in terms of subscriber growth in Q1, according to a Kantar report. Given Apple’s extensive ecosystem encompassing streaming, payment, and end devices, I remain confident that Apple will sustain double-digit growth in their service business in the near future.

FY24 Forecast

For their FY24’s growth, I am considering the following:

- iPhone Business constitutes more than half of Apple’s total revenue. While Apple has not provided any official date for the new iPhone launch, the market expects iPhone 16 to be launched in fall 2024, powered by newly designed A-series chips. As such, I expect that iPhone sales will be weak in FY24. As discussed previously, the era of significant iPhone penetration growth has waned. Mordor Intelligence predicts that the smartphone market will grow at a CAGR of 4.1% from 2019 to 2029. I think it makes sense to assume LSD growth for a mature consumer electronics.

- Services: My bullish outlook on Apple stems primarily from their service business. I believe that Apple holds a unique advantage with its massive installed base and ecosystem. In other words, I don’t perceive Apple solely as a smartphone manufacturer, but rather as a software and service company.

- Mac, iPad, Wearables, and others: All the other businesses represent around 25% of group revenues. It would be difficult to forecast the growth rate for each category, as different categories are running on their own replacement cycles. I estimate that the growth of these businesses will align with the overall growth of the consumer electronics market over the long term.

As such, I assume iPhone will decline by 5%, services will grow by 12%, and the rest of the businesses will increase by 5% in FY24. Consequently, the combined revenue growth rate is projected to be 1.5% in FY24, based on my calculations.

Valuation Update

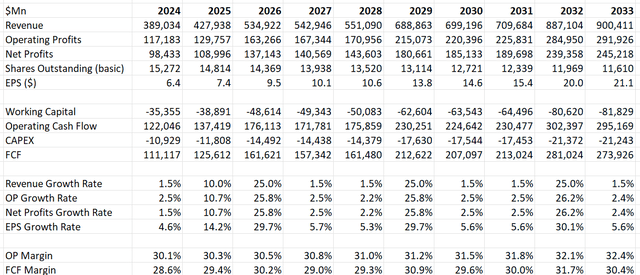

The highlight of their Q2 result is the authorization of $110 billion in share repurchases. Apple has spent an average of $78 billion in annual share repurchases over the past five years. Based on today’s stock price, the share buyback will reduce the total number of shares by 3% annually.

Apple’s revenue growth won’t be linear, as their core business, the iPhone, will be driven by replacement cycles, as discussed earlier. During the periods of new iPhone launches, their revenue growth will accelerate, then start to moderate in the later years, in my opinion. As such, I project their revenue growth under the assumption of a 2-year product launch cycle.

Apple’s margin expansion will be propelled by two main factors: operating leverage and service growth. As the service business carries a much higher operating margin, the rapid growth in services will contribute to margin expansion for Apple. In addition, Apple has the capability to leverage gross profit as they price new products at higher prices than previous generations. I calculate that their total operating expenses growth rate will be 0.5% lower than the topline growth rate.

Apple DCF – Author’s Calculations

The WACC is calculated to be 12.6% for Apple with the following assumptions:

- -Risk free rate: 4.6% (US 10Y Treasury Yield)

- -Beta: 1.19 (SA data)

- -Equity risk premium 7%; cost of debt 7%

- -Current market cap: 2.86 trillion; debt balance, $105 billion

- -Tax rate: 16%

Discounting all the future free cash flow and adjusting the net cash position, the fair value is calculated to be $220 per share, as per my estimates.

Key Risk

I think the biggest risk for Apple lies in their China business, which represents more than 18% of group revenue. Apple used to grow at double-digit in China; however, I am concerned about the potential for local players, especially Huawei, to gain competitive advantages in the high-end smartphone market in the future.

According to CNN, Apple deleted WhatsApp and Threads from the China app store in April 2024, following pressure from local regulators. Both nationalism and rising competition from local players could potentially pose a real threat to Apple’s business in China in the future.

Conclusion

I think the double-digit growth in the service business is quite impressive, and the growing share of their subscription business will make Apple become a software company, less dependent on iPhone sales. I reiterate a “Buy” rating with a fair value of $220 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.