Summary:

- The recent genAI gold rush has the potential to shake up the existing corporate tech hierarchy, but Apple should emerge unscathed.

- Apple’s business is not directly impacted by the introduction of knowledge-on-demand apps like ChatGPT.

- The company’s strong market position, user stack advantages, and services distribution leverage insulate the company and make it an attractive investment opportunity.

- Trading at a reasonable price, we think AAPL looks like a ‘Buy’.

Image Source/DigitalVision via Getty Images

Apple (NASDAQ:AAPL) has come a long way in a short time.

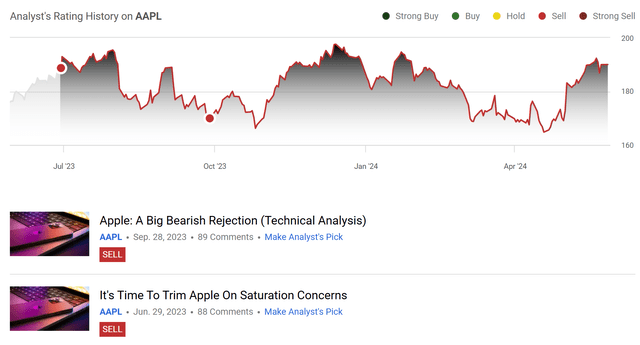

We first covered AAPL in June of last year, when we rated the stock a ‘Sell’ on concerns about the company’s expensive looking valuation and flagging growth prospects:

We then re-iterated this view when the stock rejected a breakout to higher prices in the fall of last year.

While the stock hasn’t materially declined in that time, AAPL shares have massively underperformed the market, up 0.7% vs. the S&P’s performance of 20%+.

However, as time has progressed and ChatGPT and genAI have begun to make their impact on the market, today, we’re beginning to see the stock in a different light.

In our view, now, AAPL is no longer a legacy tech play that’s falling behind, but rather a company with an incredible moat that should be relatively immune from disruption at the hands of new AI tools and applications. Plus, with continued services growth and a potentially improved upgrade cycle with the iPhone 16, we think that the stock could be ready to move higher in the coming months and quarters.

Today, we’ll be diving in and taking a closer look at AAPL’s bulletproof business model, the company’s attractive valuation, and why the stock is our top pick for those who want to remove AI disruption risk from their portfolio.

Sound good? Let’s jump in.

What’s Changing

Since the release of ChatGPT in November 2022, the tech world has fundamentally shifted in some ways.

Companies from across the spectrum have begun to search for generative AI use cases to improve business operations, and many of the largest tech companies, including Google (GOOGL), Meta (META), Amazon (AMZN), and Microsoft (MSFT) have shifted their immediate focus towards securing compute for the next generation of AI apps and developers.

This gold rush has fueled the multi-trillion dollar rise of Nvidia (NVDA), and transformed the public’s expectations when it comes to content, media, and the technological capabilities of apps and experiences in the modern era.

One company that has been virtually silent on this topic? Apple.

While the company does have a number of products that could be affected by changes to the AI landscape, like Siri, the company’s business isn’t directly impacted by the introduction of knowledge-on-demand apps like ChatGPT. AAPL’s hardware remains in high demand, and the company’s unbeatable physical network means that its premium service & content offerings shouldn’t be impacted much by the changes.

Put differently, to us, it remains unclear who the ultimate winners and losers will be when it comes to the genAI opportunity. However, we’d bet money that even a decade from now, users will be accessing these apps through AAPL’s hardware and devices. This stability represents a seriously attractive opportunity.

Apple’s Financials

As you probably know, AAPL’s primary business is the design and sale of personal computing devices, including the iPhone, iPad, Mac, Apple TV, Apple Watch, and most recently, the Vision Pro. These devices cover the gamut of touchpoints between the human experience and technology, whether it’s everyday convenience (iPhone), relaxation and entertainment (Apple TV), exercise and activity (Apple Watch) or productivity (Mac, Vision Pro).

Apple has then built a secondary services business on top of this hardware ecosystem, where it provides access to an apps marketplace, along with financial services, content offerings, productivity apps, and more.

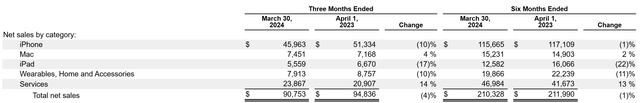

The hardware business is large, but lower growth and lower margin. By contrast, the services business is growing quickly, and the margins are better:

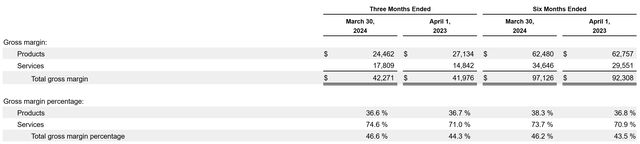

This combined profile leads to a relatively high margin, moderate growth picture:

It’s true that growth has slowed over the last few years, and this is largely due to a slow upgrade cycle with iPhone. Many of iPhone’s updates of late have been extremely incremental, but many are expecting that this coming year’s update to be more substantial, including a much longer battery life, in addition to support for spatial video, thinner bezels, a better display, and more.

In our view, this should be enough to convince many with iPhone 10s, 11’s, 12’s, or 13’s to upgrade to iPhone 16.

Additionally, as the compute requirements of apps increases, newer hardware will be able to run these experiences better, which should also drive demand for upgrades.

Thus, between the potential for iPhone 16 to outperform and continued organic growth in services, we believe that revenue and net income should continue trending up and to the right over the medium term.

Apple’s Insulated Market Position

Competitively, here are the key reasons why we like AAPL’s Market Position.

1.) UX Advantages

As we mentioned at the start, AAPL’s products are front and center in user experience, which is a massive inbuilt advantage that’s bound to endure.

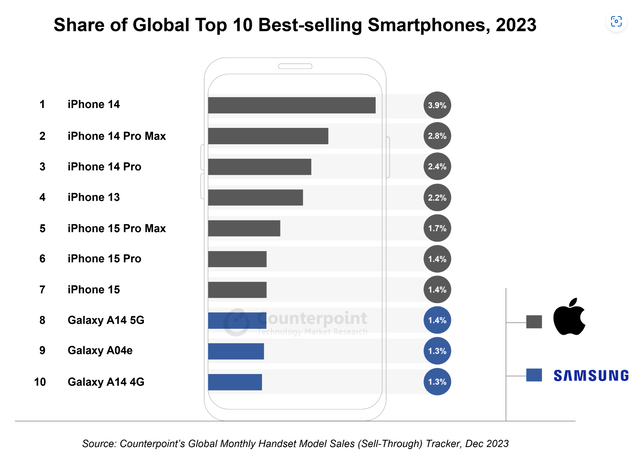

In the phone and computer space, there are a number of competitors, including Acer and Samsung, but the iPhone and Mac’s position remains dominant:

In the spatial computing space, Meta is really the only competitor, and while 3x more Meta Quest 3‘s are expected to be sold in 2024 vs. the Vision Pro, the Vision pro is 7x the price, which leads to a revenue advantage for AAPL in this category.

Everywhere you look, AAPL has a strong position in consumer hardware. Looking ahead, this matters for one key reason – the user experience stack.

When it comes to competition in the genAI space, it’s not clear who the winners will be, as we mentioned before. Maybe GOOG’s massive search business will be disrupted. Maybe MSFT’s investment in OpenAI won’t pan out.

With a tech landscape that’s moving quickly, it’s not clear how things will end up, earnings wise, for large and mega-cap tech companies that focus on apps and services.

However, we expect that no matter where things land in the digital realm, users will still be using these services on AAPL devices.

AMZN, GOOG, and others are playing chess – AAPL is the chessboard.

Right now, this stack advantage can most clearly be seen in that GOOG pays AAPL a massive $20 billion+ every year to be the default search engine in the Safari browser. Going forward, we expect AAPL to push this leverage further. At the very least, we don’t think they’ll experience material downside from being on the back foot, AI wise.

2.) Services Insulation

AAPL’s high margin, high growth services segment shouldn’t see much in the way of disruption from recent genAI advances either.

Apple’s Content suite, which includes Apple TV+, Apple Music, Apple News+, and other apps, has major distribution advantages, which insulate it against encroachment. AAPL’s content heavy approach here is smart, as the company doesn’t compete in any knowledge or functionality apps – just content creation and curation:

Additionally, AAPL’s financial services segment, with Apple Card and Apple BNPL, doesn’t face much in the way of disruption from genAI.

Finally, AAPL is also well poised to take a cut off of new AI market entrants that will monetize their apps through AAPL’s app store.

As new market entrants want to scale their apps and bring them to a large audience, Apple’s App Store remains one of the best ways for them to do that. With AAPL’s monetization model, they’re in a perfect position to take a fee in return for this reach. As AI apps monetize and scale, this could further bolster services revenue growth

These network advantages mean that the company’s service segments are incredibly durable due to AAPL’s distribution & top of funnel leverage.

3.) The Vision Pro

Lastly, Apple’s recent Vision Pro launch shows that the company still has its eye towards the future of computing.

With the phone, tablet, laptop, desktop, watch, and headphone categories saturated, AAPL’s progress in a new frontier, XR (Mixed Reality), is exciting.

While the new device is key for AAPL’s mid-long term consumer computing hardware ambitions and market presence, more importantly, it shows that the company is keen to keep the crown when it comes to being the top of the funnel for the tech industry. Not only will the Vision Pro line keep AAPL at the forefront of consumer hardware for the foreseeable future, but it also shows that the company keeps innovating where it matters most.

A strong hardware presence is important for the aforementioned network advantages and service segment profitability, which is why AAPL’s continued innovation on this front is encouraging.

Apple’s Valuation

But what is AAPL worth? All of this would matter little if the stock was wildly expensive.

Thankfully, we think the company’s valuation is reasonable.

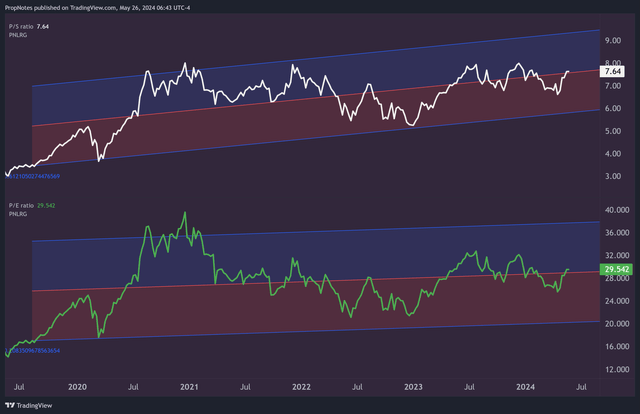

Trading at a 7.6x sales multiple and a 29x earnings multiple, the company isn’t ‘cheap’ by any means, especially when compared nominally with the broader S&P 500:

However, on a historical basis, the stock does appear to be trading at a ‘midpoint’ of sorts, hovering around the 5-year linear regression trend point.

Being in the middle, it’s not a great price, but it’s also far away from being overvalued, or nearing the top of the standard deviation bands shown above.

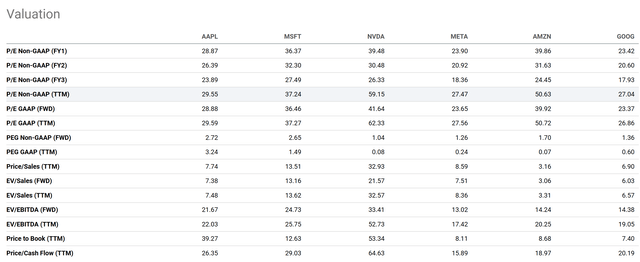

Additionally, when viewed in the context of the other large tech companies of the day, AAPL’s valuation appears modest, showing up in the middle to low end of the pack on most earnings and sales multiples:

This is no doubt due to AAPL’s lower level of anticipated growth, but given the potential durability of AAPL’s earnings, it’s a price we’re willing to pay.

Overall, while AAPL does appear somewhat expensive on a nominal basis, when compared with historical multiples and peer valuations, the stock actually looks reasonable at this point.

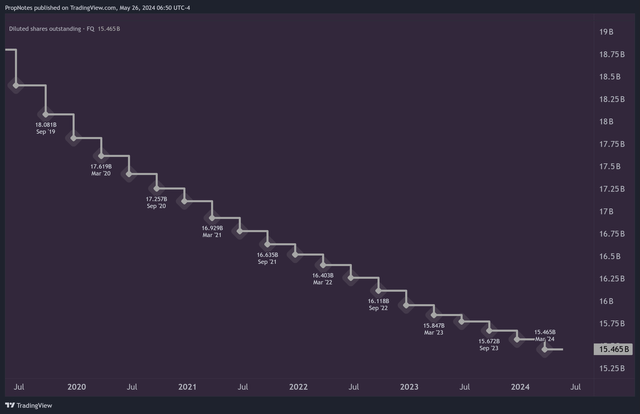

Plus, with an additional $110 billion allocated to the buyback, it’s a strong value proposition on both the demand and supply side for shares:

Risks

There are some risks that come with an investment in AAPL, despite the company’s de-risked market position.

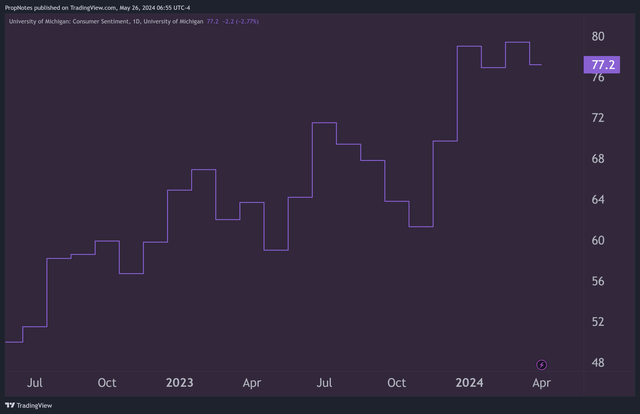

First, AAPL may see a continued slump in iPhone and other hardware sales growth, which could lead to lower profitability than anticipated. We think that this risk is somewhat lessened due to the recent increase in consumer sentiment over the last year, which could boost personal device spending:

However, it’s still a risk to be aware of.

Apple’s top-line growth is also at risk from macro factors that drive demand and supply broadly in the market, including interest rates. If rates keep going up, it could slow corporate spend, which could slow the economy, which would have an impact on both corporate and personal spend on AAPL devices.

Additionally, rates can also dictate market multiples, so if rates move higher, it could hurt AAPL on both the fundamental and multiple fronts. This is a key risk to be aware of.

Finally, there’s a risk that AAPL (and the rest of the market as a whole) is simply ‘too expensive’ right now. Comparing to historical valuations and peers can only do so much, and even a decent ‘buy’ price historically would have been subject to significant drawdown in 2022, when tech multiples came in and interest rates went up.

It appears as though AAPL’s higher multiple is here to stay due to services providing a structurally higher level of profitability, but buying AAPL at nearly 30x earnings and a moderate growth profile could cause issues in the future if the multiple re-rates lower.

Summary

That said, despite the risks, we think that AAPL is a one-of-a-kind opportunity in the market today. With a strong position in personal computing and a powerful top-of-funnel leverage point, it’s hard to see the company losing business as a result of the genAI gold rush.

With a de-risked business model, a strong services business which should power growth and margins, and a new XR product on the shelves, we think that AAPL is positioned to weather the changing tech landscape better than almost anyone.

Therefore, we’re upgrading our AAPL rating to a ‘Buy’.

Good luck out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.