Summary:

- AAPL has outperformed the S&P 500, leaving investors stunned with its impressive performance since hitting its lows in January.

- Bears were left reeling as the Cupertino company’s guidance demonstrated an improved outlook for FQ2.

- AAPL’s valuation surged recently, leaving its reward-to-risk ratio unfavorable at the current levels.

Lobro78

Investors in Apple Inc. (NASDAQ:AAPL) have likely breathed a sigh of relief as AAPL outperformed the S&P 500 (SPX) from its recent January lows, even though its upward momentum has stalled.

Hence, it appears savvy investors likely bought the lows in January, as they anticipated CEO Tim Cook and his team could deliver a performance that’s not as bad as the bears feared.

The media pointed out the “obvious,” with Bloomberg’s Mark Gurman highlighting a “rotten holiday quarter.” However, investors should be reminded that market operators look ahead, as reflected in AAPL’s remarkable 2023 recovery.

Hence, should investors who missed AAPL’s January bottom jump on board now, even as AAPL looks to have formed a short-term top?

We believe it depends on whether you think Apple has the potential to continue gaining share in its services segment as its installed base continues to grow.

Management highlighted that its active device installed base reached 2B, up from 1B seven years ago. That’s a remarkable achievement, lifting the potential for Apple to engage its users further, growing its ARPU and paid subscriptions business.

Hence, it should be reassuring for investors to know that Apple posted more than 935M paid subscribers, up 150M YoY, which also represented a 4x increase over the past four years.

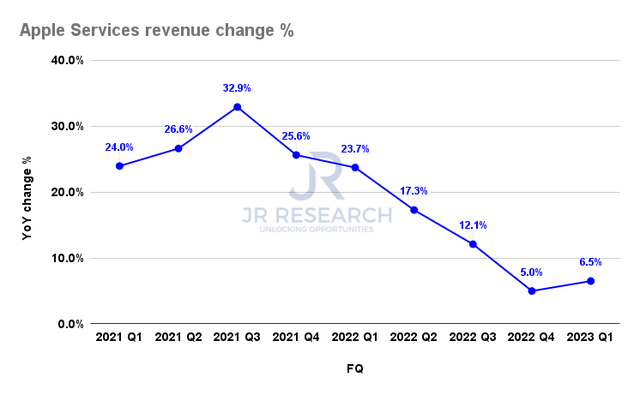

Apple Services revenue change % (Company filings)

As such, investors should pay close attention to whether Apple Services could see an inflection point in FQ4, which should help improve its profitability moving ahead.

Management’s outlook for FQ2 suggests a YoY growth but cautioned for possible “macroeconomic headwinds in areas such as digital advertising and mobile gaming.”

Despite that, CFO Luca Maestri’s commentary on Apple’s gross margins outlook of between 43.5% and 44.5% indicates an inflection from FQ1’s 42.96%. As such, we believe that Apple seems confident that the worst headwinds against its operating performance have likely passed.

As such, we assessed that the optimism in the bottom-fishers in late January as AAPL bottomed is justified, which led to a surge in its valuation.

With the steep recovery, AAPL’s NTM EBITDA multiple of 18.6x has moved past the one standard deviation zone over its 10Y average. Therefore, while we thought its reward-to-risk was well-balanced in early January, we believe AAPL has reached expensive levels again with the recovery.

Investors need to have high conviction at these levels that Apple could define some of the next-gen technologies, such as its mixed-reality headset. However, with Meta (META) facing significant challenges in gaining a wider adoption with its lower-priced version, execution risks are high for Apple to define the category at its current valuation.

Moreover, Apple already has a 2B installed base, as its forays in China proved highly successful. Apple’s performance in CY2022 demonstrated that it held its mettle very well against the Chinese Android competitors, benefiting from its premium positioning and leading to solid profitability. While it wasn’t immune to the macroeconomic and smartphone headwinds, it performed credibly where it mattered.

Hence, with China’s 5G penetration likely hitting a stumbling block, even as China emerges from its COVID lockdowns, Apple needs another material growth vector that could drive its own growth.

Emerging markets, including India, will likely be Apple’s focus over the next few years as it diversifies its production base and starts its retail footprint. We believe it’s a development worth watching, as India wants to drive smartphone production to lift its growing economy.

DIGITIMES reported recently that Qualcomm (QCOM) and MediaTek (OTCPK:MDTKF) are also keen to expand further in India and emerging markets. However, their strategy is likely predicated on lower-priced handsets, which are “key to seizing the market.” Hence, we believe it is a battle worth watching. Apple likely needs to continue its premium positioning to protect its prized profitability and free cash flow margins at its current valuations.

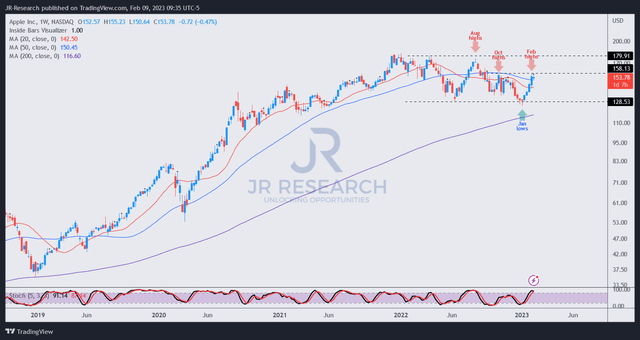

AAPL price chart (weekly) (TradingView)

AAPL has demonstrated its strength in the tech bear market as buyers swarmed its January lows, stanching further downside.

However, we assessed that AAPL could struggle to generate further upward momentum from these levels, as its growth could continue to slow. Execution risks to its supply chain and next-gen platform could return to haunt overly-optimistic investors joining the buying frenzy now.

As such, we parsed that the current levels represent a solid opportunity for investors to cut more exposure and reallocate to beaten-down tech stocks in the early stages of the market recovery.

Rating: Sell (Revise from Hold).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of META, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!