Summary:

- Apple is a technology behemoth and a member of the FAANG cohort.

- The stock more than doubled in value after its COVID March 2020 lows on the back of a low rates environment.

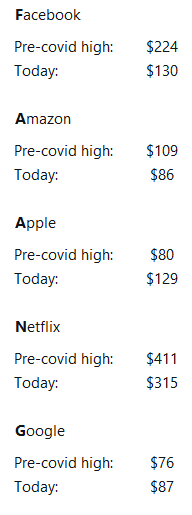

- Technology has been hit hard in the past year, with all the FAANG stocks now below their pre-COVID highs outside Apple and Google.

- Using a historical CAGR methodology, the article derives a price target for Apple in the current recession.

- The article outlines an options strategy with a Q1 2023 maturity that can generate a 4x return with a capped loss profile if Apple goes to the target price.

Scott Olson

Thesis

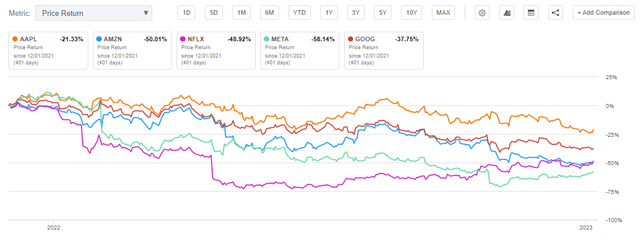

Apple (NASDAQ:AAPL) is a technology behemoth, and one of the vaunted “founding fathers” of the FAANG acronym. Helped by the zero rates environment and individual investors’ preference for technology names, the stock more than doubled in value after its COVID March 2020 lows. While we respect investors’ choices, Apple is not a small-cap stock but a trillion-dollar company (two trillion as of the writing of this article to be exact). These sorts of large capitalization stocks, while still growing, will never have the same explosive, multiples growth seen for smaller names. AAPL, just like other mega-cap names, has a well-established historical CAGR (a high one to be sure) that was significantly overshot during the post-Covid zero rates environment. The market always mean-reverts eventually, and while all its peers in the FAANG cohort have experienced very significant drawdowns since their 2021 highs (-50% on average), Apple is the sore thumb sticking out, being down only -21%.

Similarly, outside Apple and Google (GOOG) (GOOGL), all the FAANG stocks are now below their pre-COVID highs:

History (Author)

In this article, we are going to look at a technical analysis of the stock and present an investor with an options strategy that can take advantage of the stock following its FAANG peers lower. We are going to look at a March 2023 put spread that has a capped loss profile and a 500% gain potential, with the current options pricing (before the market open on January 9, 2023).

FAANG Performance

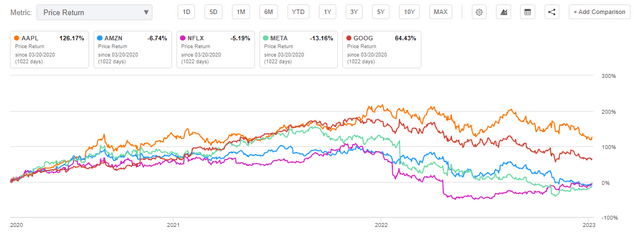

The FAANG cohort was inflated by the post-COVID zero rates environment that saw technology outperform:

We can see how the FAANG cohort provided with 100% to 200% returns from their March lows up to the end of 2021. That breakneck speed was unsustainable, not in line with historical CAGRs, and meant for reversion. Which it did for most of the names:

We can see how most of the FAANG names are down -50% on average since December 2021. The only outlier is Apple, the orange line in the above graph.

Normalized CAGR Implications

If we believe 2020/2021 was an abnormality in terms of the stock growth, then let us have a look at what it should actually be:

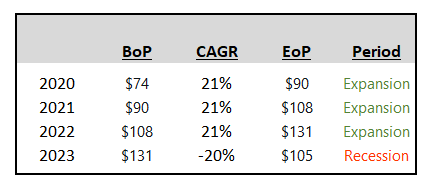

Courtesy of FinanceCharts we can look at normalizing the Apple CAGR. On a long-term basis (i.e., 10 years) we can see the annual growth rate for the stock is around 21%. Long time periods smooth out any abnormal growth or contraction periods. Let us then assume that the normal stock growth rate is 21%. If we apply that CAGR to normalize the past years, we get the following:

Historic CAGR (Author)

The stock started 2020 at around $74/share. If we assume COVID never happened and the Fed never moved rates to zero, we would have expected Apple to grow to around $90/share by the end of 2020, in a normal Expansionary environment. Applying the same logic gets us to a price of $131 by the end of 2022, which is very close to where the stock actually traded. Again, this is a forecasting of the stock price using historic CAGRs and the absence of a zero rate environment.

Following the same logic, in today’s recessionary/bear market, we expect a contraction in the stock price. We are following here the simple semantics of a -20% contraction for a bear market. The implied stock price then is around $105/share.

All that the historic CAGR analysis does is smooth out excessive growth periods, by applying a normalized rate. In a normal economic cycle, the Apple stock would have gained a healthy 21% per year until the end of 2022, and then, as any stock would in a recession, would lose value in a bear market.

What is the trade?

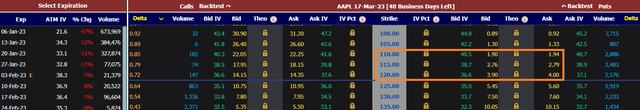

The proposed trade is a Put Spread – namely buying a $120 Put and concurrently selling a $110 Put:

Options Chain (Market Chameleon)

We are putting forward a March 17, 2023 maturity trade, the closest available expiration to the end of Q1 2023. A put spread is a cheaper way to take advantage of a price move down in a stock due to the fact that an investor does not fully pay for implied volatility. With less risk comes less of a reward, with the maximum profit for 1 contract being $10 x 100 shares minus $200 cost = $800 (that is a 400% return or 4x).

We can see from the above table that the cost for the put spread is roughly $2 per contract (we did a rough rounding for the bid/ask figure in the box above).

Scenario 1

- Apple goes below $110 by the end of Q1 2023

- The Put Spread is fully profitable

- The total profit for 1 contract is (120-110) x 100 shares – $200 cost = $800

- The profit is 4x or 400% of the invested amount of $200

Scenario 2

- Apple stays around $130 by end of Q1 2023

- The Put Spread is not triggered

- The investor loses the premium invested, namely $200

- The maximum loss here is only the premium invested

Scenario 3

- Apple ends up in between $110 and $120 by end of Q1 2023

- The investor will make money on the structure depending on where the price ends up exactly

- The breakeven level here is $118

- Below $118 the investor would make a net profit

Conclusion

Apple is a two trillion dollar company and a member of the FAANG cohort. Pumped up by the Fed and zero rates, the company’s equity more than doubled after its COVID lows. While we believe in Apple and its growth, we do not think 100% annual growth rates are appropriate for a company of such size and market penetration. We are of the opinion that Apple will correct, and will revert to a more historically aligned CAGR level, which has been around 21%. Utilizing that figure for the 2020-2022 period, and a normalized bear market drawdown for 2023, yields a $105 price target for the stock. Unlike its FAANG peers, which have on average experienced a -50% drawdown since their December 2021 highs, Apple is down only -21%. We expect Apple to follow its peers shortly. The article outlines a very profitable and secure way to take advantage of such a move, namely via a Put Spread. Unlike short selling, buying an options strategy has a capped loss figure (i.e., the premium paid), and unlike an outright Put, the presented strategy is much cheaper. For our proposed trade, a March 17, 2023 $120/$110 Put Spread, an individual buying 1 contract (i.e., investing $200) can obtain an $800 profit (4x the investment) if the Apple stock price closes below $110 on the trade’s maturity date.

Disclosure: I/we have a beneficial short position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.