Apple Should Climb The Wall Of Worry

Summary:

- Apple has raised the dividend for twelve years and is likely to hike it once again next month — probably by 4%.

- Apple’s history shows that periods of lower growth are good opportunities to add the stock to your portfolio.

- Exciting releases like the Vision Pro and potential in the home robotics market make Apple a promising investment.

- Investors can expect double-digit annual returns in the years to come.

ymgerman

Apple (NASDAQ:AAPL) is one of an elite group of companies with a market capitalization above $2 trillion. When I last wrote about the company a year ago, the valuation was $2.7 trillion, slightly higher than the current level. That is one key reason I think the name is a buy today, as opposed to a sell last year.

If we look at Apple’s history, it does have these intermittent periods with lower growth, increased pessimism about its future growth trajectory and a general feeling that the best days are behind it. These periods have proven to be good times to add the name to your portfolio, and I also believe that to be the case this time around.

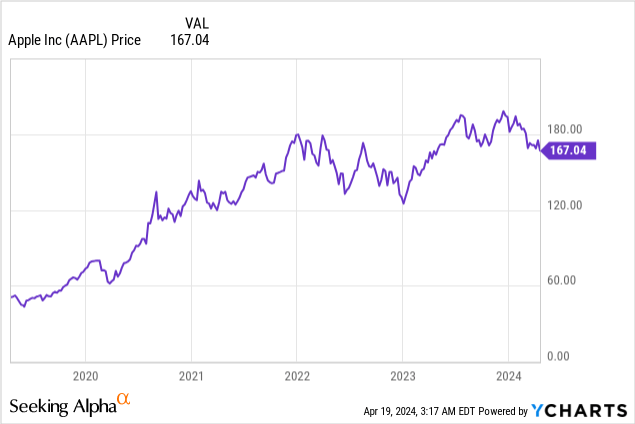

As can be seen on the five-year chart above, investors have enjoyed more than decent capital appreciation, with the stock up 228% — before dividends. That is a 27% average annual return from one of the world’s most recognizable brands.

The astute reader will see, however, that most of that return happened in the first half of the period. Since late 2021 the stock has barely moved. In fact, it is actually lower today than it was more than two years ago. This is a reflection of the headwinds this company has been facing, from heightened China-related risks, to even tougher competition, and worries that the company is not at the forefront when it comes to artificial intelligence. The good news for investors is that these worries are well publicized and thus accounted for by the market.

Apple’s Dividend History

To what might come as a surprise to many of today’s investors, Apple actually did pay a dividend way back in the 1980’s. These were the previous heydays of the company. These didn’t last too long unfortunately and the dividend was duly suspended in late 1995. It wasn’t until many years after the successful turnaround by Steve Jobs and after he passed away, that the dividend was reintroduced in 2012. This means that the company is now almost halfway toward becoming a Dividend Aristocrat.

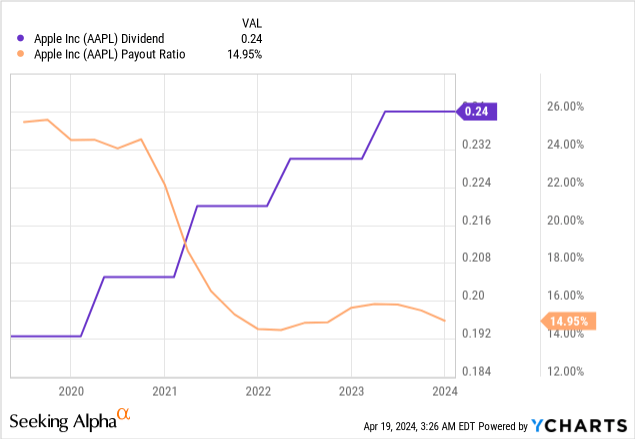

If we take a look at the five-year dividend history, we can see that it has been consistently raised every year at approximately the same date. Five years ago the quarterly dividend stood at a split-adjusted $0.1825 whereas currently the dividend stands at $0.24 — 31.5% higher. The average annual growth rate is a moderate 5.6%. The growth has been steady, but rather conservative.

Speaking of conservative, look at that payout ratio! I am used to seeing this being steady or increase slightly for mature companies, but at Apple it has fallen from approximately 25% to the current level of just 15%. I am quite confident when I state that this dividend is safe. There is not a chance this dividend will be cut. Even if earnings were to fall in half, the payout ratio would be conservative. This naturally gives us comfort that the dividend will continue to be raised in the future as well, as the Board is not at all constrained by the payout ratio.

If we adjust the number above for share repurchases, it does not look quite as overly conservative. Last quarter, dividends paid amounted to $3.8 billion while share repurchases amounted to $20.5 billion. Total capital returned, including net share settlement, was a full 7.1x more than the dividend. Then we are suddenly at above 100% of earnings. It is important to remember, though, that bringing down the enormous cash balance has been a stated goal for about a decade. Additionally, buybacks are a lot more flexible than dividends and can easily be cut if earnings were to hit a rough patch. It seems the Board quite prefers to adjust capital returns at their own discretion, and not be tied up in a dividend that the market has come to expect. Fair enough, but there are other ways to do this. There is nothing wrong by doing it the Costco (COST) way, that is announcing a special dividend every four years or so. The stock seems to be doing just fine, and I haven’t heard investors complaining. But I won’t hold my breath. As long as Apple’s stock is reasonably priced during buybacks, I am just fine holding an ever-increasing share of this magnificent company.

Apple’s Fundamentals and Upcoming Dividend Hike

There has been exciting releases from Apple recently, the most famous of which is the Vision Pro. Initial reviews have been mixed, with some users reporting neck pain. Even so, other sources report high initial sales numbers. It’s obviously too early to tell how it will play out, especially since this is after all a pretty groundbreaking product.

In more downbeat news, a little over a month ago, the Apple car project was shut down. A lot of money and high-quality engineers have been tied up in this project for years, and now nothing will ever come of it. If one chooses to look at the bright side, at least the competent engineers can now be used for development of other exciting projects, like AI ventures or Apple robots. After all, the electric vehicle space is experiencing intense competition — witness the rivalry between Tesla (TSLA) and its Chinese competitors — so leaving that highly competitive space to focus instead on robotics for people’s homes is probably a smart thing. The home robotics market should have long term potential, and there are currently no company occupying that space. If Apple becomes the first mover, this space could have huge revenue potential. There should also be a lot of accrued knowledge from the Apple car research that can be applicable to robotics, especially when it comes to vision, the recognition of objects, receiving voice commands, avoidance of collision and probably many more factors I haven’t thought of. Investing in ventures that don’t pay off is a cost of doing business, and Apple is no exception. What is important, is to utilize the best of what has been done, and invest in new possibilities. If Apple’s history is any guide, eventually the money and labor invested will pay off, paving the way for many more years of growth.

Apple’s Q1 2024 numbers were fairly solid with EPS growth of 16 percent to a new all-time high and quarterly revenue of almost $120 billion. If we look underneath the hood, we see that product revenue was relatively flat compared to last year while services were up 11.3%. Geography wise, the western hemisphere did the heavy lifting this time around with both the Americas and Europe growing while Greater China was the black sheep this time with sales declining 12.9%. Both Japan and Asia Pacific grew, with the former posting solid growth of 15%. It therefore seems like Apple is doing just fine all around the world, except China. With its charm offensive in India and the Pacific region, there is a high chance that this region can help Apple’s growth going forward. After all, countries in this region are growing rapidly with an expanding middle class that craves high-quality products.

In order to be a reasonable investment, Apple should be able to grow earnings per share by 10% per year. Over the last year the share count has been reduced by 2.4% due to buybacks. This boosts the EPS number by as much. Moreover, its net margin increased from 25.6% to 28.4%. This kind of improvement can probably not last over the long term, but we can conservatively assume that it is able to improve earnings by 1 percentage point more than revenue each year by way of efficiency gains and bargaining power towards suppliers — which gets us to approximately 3.5% EPS growth. The residual 6.5% will have to come from revenue growth. Considering that Apple has one of the strongest brands in the world and what it has been able to achieve historically in terms of price increases, it is not a stretch to say that price increases alone could easily increase revenues by 4% on average annually. That leaves us with a needed volume increase of 2.5% annually. I am quite confident it can achieve this over the long term considering how much it is investing in product improvements and new innovations. If it gets some of these initiatives right and remain competitive with its existing products, this will be achieved — most likely more than achieved. We also have to remember that a part of this volume growth comes from services, the growth of which is to a large extent organic. When people constantly increase their photo libraries, they need more storage space. So the necessary volume increase from products is really quite limited.

In all, therefore, I see it as likely that Apple will be able to post an average annual EPS growth rate of at least 10% over the long term, thereby laying the foundation for double digit returns for shareholders.

When EPS grows, so can the dividend. As we have seen above, the dividend has grown more slowly than earnings, hence the falling payout ratio. In recent years, the rule has been an increase of $0.01. That would be the absolute minimum potential increase that could be expected to be announced in conjunction with its Q2 earnings release on May 2. That would represent an increase of just 4.2%, in line with U.S. inflation. There should therefore be room for a potential $0.02 increase, or 8.3%. Given that EPS was up 16% in the latest earnings report and that this company has the potential for at least 10% growth going forward and with the low payout ratio, such an increase is definitely possible and prudent. However, the last time the Board approved such a high percentage wise increase was back in May 2018. Considering that the Apple Board is very conservative when it comes to the dividend, my prediction is therefore — sadly I must say — an increase of just 1 cent for a new quarterly dividend of $0.25.

Risk Factors

Well, where to start? Let’s look to China. iPhone sales were down 24% year-on-year due largely to intensified competition from domestic rivals. Add the U.S.-China trade rivalry, and the future does look a little uncertain for Apple in China, to put it mildly. Recently, Tim Cook visited Vietnam. Although it was certainly a sales pitch delivered in a fast-growing emerging market, it was also a risk-mitigation trip. The company seeks to invest heavily in its suppliers in the country in order to diversify its manufacturing base. You don’t invest $16 billion in a country for fun. So I guess the good news is that being too reliant on China for the supplies of its products, is too risky and that it is doing something about it. That said, worsening conditions between the U.S. and China will hurt both Apple’s sales and supply chain severely.

Currency risk is a risk for most companies. Apple has a certain level of pricing power, but is definitely not immune. When selling in countries with wildly fluctuating currencies, earnings when converted back to U.S. dollars can take a beating. Lastly, I would say that artificial intelligence is both a threat and an opportunity. A threat because the future top companies within AI might be able to come to market with such a compelling software experience that Apple will be left behind. If iPhones are not able to deliver the same kind of experience as competitors, even loyal customers will switch over time. It is also an opportunity, though, as Apple might take over an even larger share of people’s daily lives. If it somehow can combine the data of Vision Pro, home robotics, the iPhone and more, the total product offering might be worth a lot more than today, opening up the potential for even more revenue down the road.

Current Valuation

Before buying a stock, one should always look at valuation. Both on its own and compared to its closest peers. As such, I have chosen Samsung (OTCPK:SSNLF) for its smartphones and Microsoft (MSFT) for its software.

| Apple | Samsung | Microsoft | |

| Price/Sales | 6.7x | 1.8x | 12.5x |

| Price/Earnings | 25.6x | 34.8x | 35.2x |

| Yield | 0.6% | 1.9% | 0.7% |

Source: Seeking Alpha

On Price/Sales there is no doubt that Samsung is the cheaper option, not entirely surprising since it is predominantly a hardware firm. Apple is in the middle of the pack with Microsoft by far the most expensive. When it comes to the earnings multiple, Apple is actually the cheapest. The multiples of Microsoft and Samsung has baked in fairly high expectations of growth, whereas Apple’s expectations are lower. And lower expectations are easier to beat. I don’t find this multiple worrying at all, when we consider the quality of the underlying business.

None of these are high yielders, and Apple has the lowest yield of all. As I have alluded to, Apple has the potential to offer a more compelling yield, but it has chosen not to use the yield in order to entice income investors. More of future returns will come in the way of capital gains instead. In all, I think Microsoft and Samsung are slightly expensive while Apple is decently priced.

Analysts on Wall Street seem to agree with me that Apple is likely to achieve at least 10% EPS growth over time, as their long term EPS growth forecast sits at 10.2%. If we assume no change to the already decent valuation multiple and add in the 0.6% dividend yield, we arrive at an expected total long term shareholder return of 10.8%. Double-digit long term returns from one of the best brands on the planet is a definite buy in my book.

Conclusion

Apple has been producing shareholder value for a long time, both by way of capital gains and through the dividend. There are presently several prominent risk factors and uncertainties surrounding Apple, this manifests itself in its lagging share price. This should be considered good news for new potential investors, as they can get a wonderful business at a decent price. The long term earnings potential of this company remains intact, and it will not take much to surpass expectations. Double-digit expected returns from one of the best businesses on the planet is a definite buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.