Wells Fargo: Limited Upside In 2024

Summary:

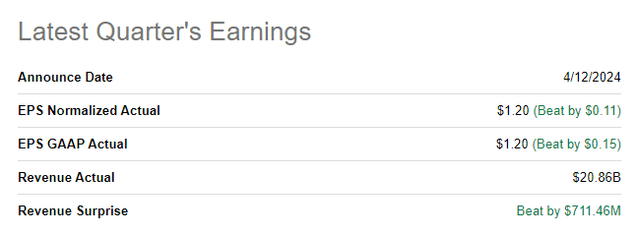

- Wells Fargo beats earnings forecasts for Q1 with adjusted earnings of $1.20 per-share, exceeding estimates.

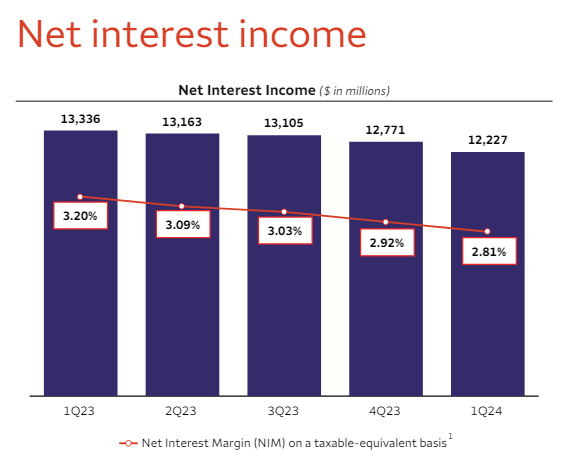

- The bank’s net interest income declined in Q1 and is expected to continue declining in FY 2024.

- Credit quality remains good, with a sequential decline in credit provisions.

- The valuation, however, remains unattractive, especially considering that the Federal Reserve is set to start lowering the federal fund rate later this year.

ablokhin

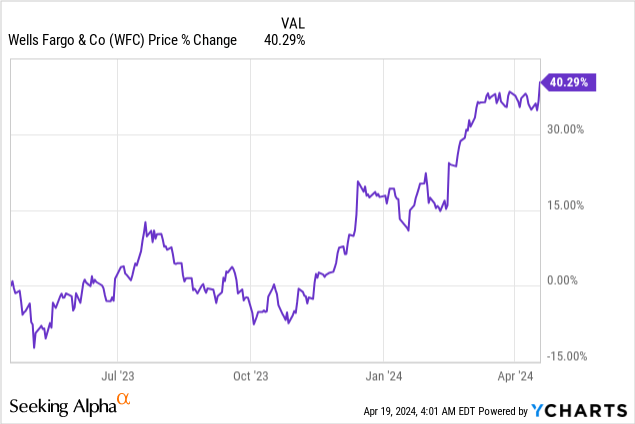

Wells Fargo (NYSE:WFC) beat analysts’ earnings forecasts for the first fiscal quarter last week due to strength in Corporate and Investment Banking. Wells Fargo is also set to be a beneficiary of a higher for longer rate environment due to the bank’s large loan portfolio. The Wall Street bank also did not lower its forecast for net interest income which contributed to shares of Wells Fargo reaching new 1-year highs after earnings. With shares now trading at a considerable premium to net asset value, and above the 3-year average P/E ratio, I do see limited upside potential for Wells Fargo in FY 2024. As a result, I am leaving my rating for Wells Fargo after Q1’24 earnings at sell!

Previous rating

I rated Wells Fargo a sell in December due to what I believed was a deteriorating outlook for net interest income growth in a lower-rate world: The Fed Is Done. However, the recent upsurge in inflation has caused new uncertainty about the Federal Reserve’s willingness to cut the federal fund rate in 2024 which translates into an improved NII outlook. With shares trading at a significant premium to book value, I continue to see an unfavorable risk profile.

Wells Fargo beats earnings by a good margin

Wells Fargo’s adjusted earnings in the first fiscal quarter amounted to $1.20 per-share, which easily beat the consensus estimate of $1.09 per-share. The top line came in at $20.86B, beating the average prediction by $711M.

Robust Q1’24 report, solid net interest income outlook

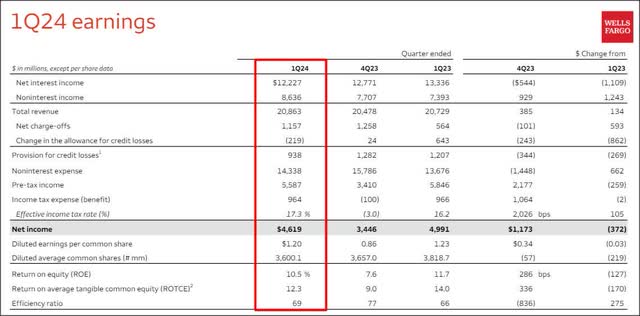

Besides the earnings beat, it was a solid earnings sheet from Wells Fargo which saw strong overall bank profitability, aided by high net interest income. The Wall Street bank generated $5.6B in pre-tax income in Q1’24, showing $2.2B Q/Q growth due to strong performance from the Corporate and Investment Banking segment.

The real take-away with regards to Wells Fargo’s Q1’24 earnings report was the outlook for net interest income.

The Federal Reserve’s reluctance to lower the federal fund rate in the context of up-trending inflation in February and March has resulted in a higher for longer rate environment for the banking sector which benefits chiefly large Wall Street banks with large loan portfolios.

Nonetheless, Wells Fargo’s net interest income declined in the first fiscal quarter, to $12.2B, and, in the absence of new interest rate increases, is set to continue to decline in FY 2023. However, the bank maintained its previous outlook and didn’t lower it, resulting in an uptrend in Wells Fargo’s share price.

According to the bank’s outlook, Wells Fargo still expects a 7-9% decline in its net interest income in FY 2024 (~$52.4B), relative to the previous year, as management expects the Federal Reserve to end its tightening policy in the second half of the year. In a falling-rate market, banks face deteriorating net interest income prospects as they can charge lower rates to their consumers. Therefore, Wells Fargo faces contracting net interest income prospects in FY 2024 and beyond.

Wells Fargo

Solid credit quality

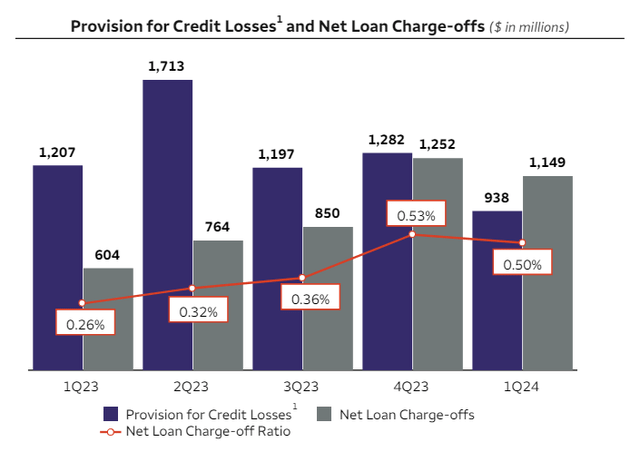

Wells Fargo’s credit quality remained fairly good in the first-quarter as well and the bank saw a sequential decline in its credit provisions, thereby boosting earnings. The bank recognized $938M in credit provision expenses in Q1’24 which was the lowest level in at least a year. Wells Fargo also saw a sequential drop in its net loan charge-off ratio to 0.5%, indicating that the bank’s loans are mostly performing according to expectations and that the bank did not see a deterioration in its overall credit quality in the last quarter.

Wells Fargo’s valuation

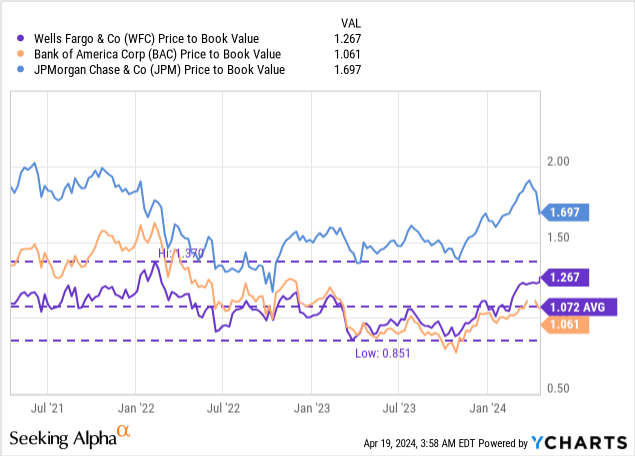

Wells Fargo’s shares are currently trading at a 27% premium to book value and they just reached a new 1-year high after earnings. The 3-year average P/B ratio was 1.07X, so shares are priced 18% above this average right now. Wall Street banks JPMorgan & Chase (JPM) and Bank of America (BAC) trade at price-to-book ratios of 1.69X and 1.06X.

I do see limited upside potential for Wells Fargo, despite a temporarily improved NII outlook, however, as it is only a question of time until the Federal Reserve pushes the button and lowers the federal fund rate. This point should mark an inflection point which can be expected to lead to an accelerating decline in Wells Fargo’s net interest income and lower bank profitability overall. My fair value estimate for Wells Fargo is ~$46.30 which corresponds to the bank’s GAAP book value.

Risks with Wells Fargo

The key risk for Wells Fargo clearly is a cyclical contraction in its net interest income which has been a key earnings driver during the last up-cycle in interest rates. What I also see as a risk is a potential change in the credit provision trend, especially with Wells Fargo having a lot of exposure to the commercial real estate market. What would change my mind about Wells Fargo is if the Federal Reserve were to raise the federal fund rate in the context of further surging inflation rates.

Final thoughts

Wells Fargo delivered a robust earnings sheet for the first fiscal quarter last week. The fact that Wells Fargo did not lower its net interest income outlook and continues to see a 7-9% decline NII this year (the result of an expected decline in the federal fund rate in the second half of the year) was a major win for the bank, providing re-pricing tailwinds. The bank’s credit provisions dropped Q/Q and overall asset quality on Wells Fargo’s balance sheet remained solid as well. As much as I liked Wells Fargo’s first-quarter earnings release, I just don’t like the valuation here and therefore leave my rating for the Wall Street bank unchanged at sell!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.