Summary:

- Apple has arguably one of the widest moats in the corporate world. But now it’s going through one of the toughest business cycles in its history.

- The expected increase in CAPEX to revenue adds pressure on FCF, and it’s probably due to Apple’s aim to reduce reliance on China.

- I calculate AAPL’s equity value per share at around $123 – that’s 17.9% below yesterday’s closing price.

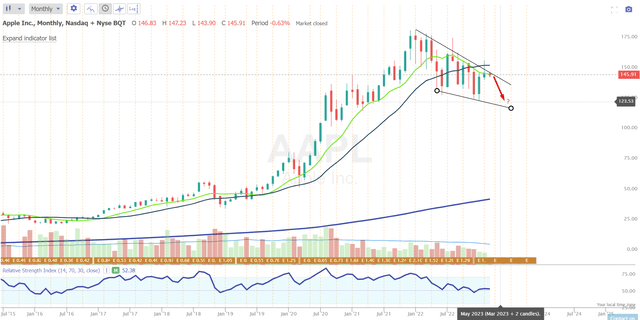

- The longer-term monthly chart shows that the fair price estimate I arrived at in today’s article is right at the support of the descending price channel.

- In my opinion, a downward move is more likely than an upward move if all other factors remain the same.

Rob Daly

Intro & Thesis

Since starting to cover Apple Inc. (NASDAQ:AAPL) stock in mid-December 2021, I have written 8 articles – including this one – all of which were rated as Neutral. The total return since my first article was published is now -18.44%, compared to a change in the S&P 500 Index (SPX) of -15.48%. Most of the time the stock was flat, so I consider my calls relatively successful.

Seeking Alpha, my coverage of AAPL

I try to update my thesis once a month, observing events and trying to be as open-minded as possible about their impact on AAPL in the foreseeable future.

In my article today, I conclude that AAPL has not become less risky in recent weeks. On the contrary, the relief rally we have seen since early 2023 [+16.66% YTD] has eaten up all of the stock’s growth potential and margin of safety. I come to this conclusion based on the business cycles, the exhaustion of buybacks, and the relatively high valuation of the business. Let’s go through everything in order.

Tough Business Cycle

Apple has arguably one of the widest moats in the corporate world, not just in America, but globally. Switching from an iPhone to a non-Apple device is a significant undertaking for users. They have to familiarize themselves with a new device, a new user interface, and a new ecosystem, including a new music library, new apps, and video chats. The strength of the Apple platform lies in the fact that customers who purchase an Apple device do not just buy a device, they accept the entire Apple ecosystem, which adds a lot of value. Even add-on products that do not come from Apple, such as headphones or cases, have to be licensed by Apple to ensure compatibility, which further strengthens customer loyalty and represents a formidable hurdle for competitors to overcome. It is thanks to the focus and development of its ecosystem, Apple can afford to sell as many phones as it did in 2015, while steadily increasing revenue and FCF through the expansion of other complementary businesses such as services and wearables. For example, according to Seeking Alpha, AAPL’s revenue per share has grown at a CAGR of 13.27% since 2015, while FCF per share has had a CAGR of 12.41% over the same period.

Unfortunately for investors, no company can experience continuous growth without any setbacks. Businesses tend to experience cycles of ups and downs, which are affected by various factors such as economic conditions, changes in demand, and competition. These factors can cause periods of decline, but strong-moat companies typically strive to recover and perform well during periods of economic growth/recovery.

Each downturn cycle brings a series of changes to the operating part of the business that, while not fatal to the company, resulting in leaner shareholder returns. For example, from 2015 to 2016, AAPL’s total return was -3% with a very high variation – while (SPY) closed 1.25% higher than a year ago. At the time, the company saw a decline in iPhone sales for the first time in 15 years, leading to a 14% year-over-year drop in net income, according to The Guardian. The stock’s annual P/E ratio fell from 12.9x to 12.4x, while its ratio to the S&P 500 Index remained about the same at 0.6x. Without going into the valuation at this point, it should be noted that the business model was completely different in 2015/2016 and the rather marginal and fast-growing additional revenues were a much smaller part of the business, which could explain the low multiples in those years.

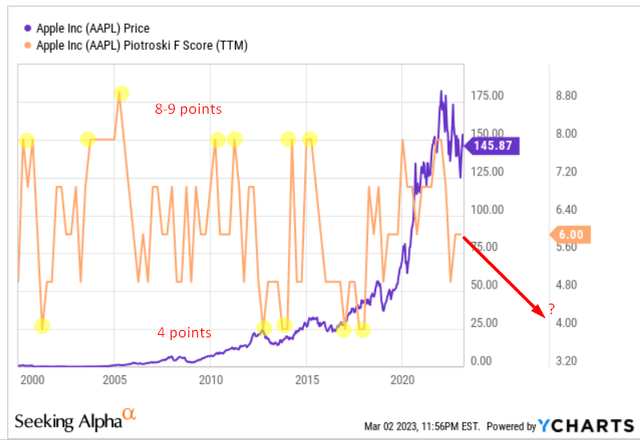

Something similar has been observed before – this is even more evident in the example of the change in Piotroski’s F-score over time. In my opinion, this metric is exactly what one needs to evaluate the cycle – it evaluates a company in terms of its profitability, leverage, liquidity, and operational efficiency, and is initially designed to identify companies with strong financial performance that are likely to outperform the broader market.

AAPL’s Piotroski F-Score has historically risen to 8-9 points [out of max 9] during upswings and business expansions. When the business cycle reversed and growth slowed, this indicator dropped to 4 points. Today it is only 6 points, which could indicate that we have not yet reached the bottom of the current downward cycle.

YCharts, Seeking Alpha, author’s notes

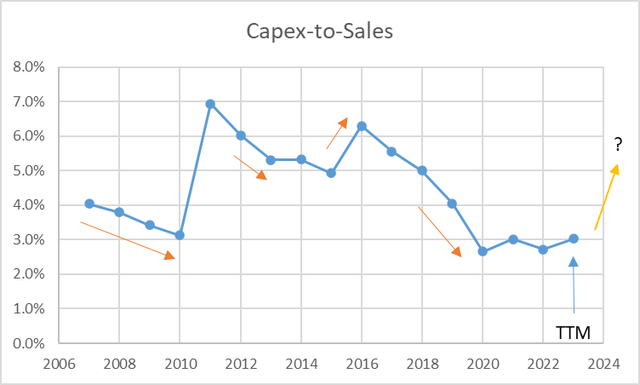

In difficult times for the company, Apple Inc. has actively reduced its capital expenditures – this is logical because when FCF drops, you need to adapt and change quickly. 2015-2016 were an exception – the decrease in revenue in that year went beyond the usual level and lowered the denominator. Here you can see the actual dynamics of Capex-to-Sales ratios in times of crisis at Apple:

Author’s calculations, based on Seeking Alpha

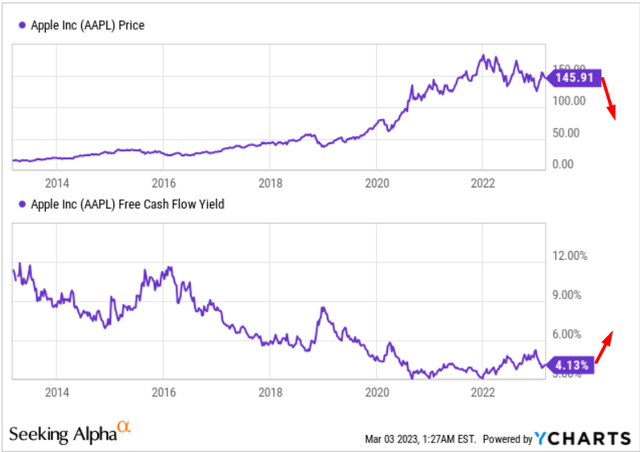

The prospective increase in the CAPEX ratio to revenue that I draw above – more pressure on FCF for the foreseeable future – is most likely explained by the company’s desire to move away from dependence on China. Apple partners such as GoerTek and Foxconn are actively reorienting their manufacturing facilities toward Vietnam and India. While such a realignment is beneficial to Apple in the long run [lower China risks], it requires additional CAPEX from the company that could have been avoided in a different geopolitical environment. New costs that were not critical before, but are necessary now, will be a serious headwind to FCF generation in my opinion – the FCF yield, already at near-minimum levels, will need to be revised upward, and the most logical way to do that for AAPL stock is a significant correction.

Buybacks Are At Risk

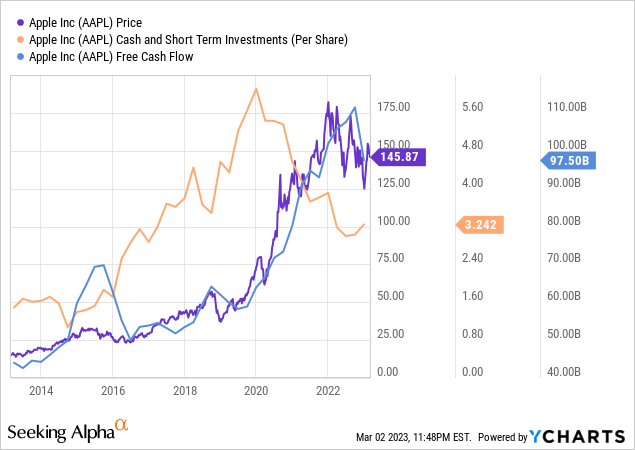

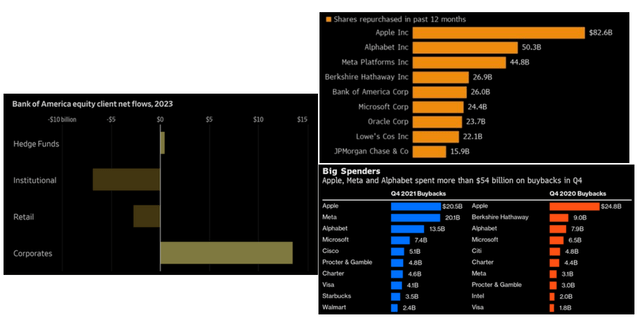

If you want a concise answer to the question of why Apple, at its current valuation of 24.25x non-GAAP price-to-earnings ratio, does not even fall at its consensus forecast of a -1.92% EPS decline in FY2023 [which continues to be revised downward] just look at the following chart:

The lion’s share of buying activity in recent months appears to be due to share buybacks – Apple remains the undisputed leader in this regard. But this is data from the past, and the past, as we know, is not always a good friend to know the future of the stock market.

The math on buybacks has changed a lot in the past 12 months as the cost of financing has increased a lot, and the equity risk premium is still quite low. The median forward earnings yield is 5.8%, the median cost of debt is 5.8% for S&P 500 companies that do buybacks, excluding Financial and Utilities (debt cost as proxied by S&P credit rating and using latest yield on that credit rating (e.g. BofA corporate bond index)). A year ago, the earnings yield was much higher than the cost of debt, making buybacks a wise choice. Given the environment has changed, GIR [ Goldman Sachs] expects buyback activity to decline 10% next year, on the assumption of zero earnings growth. In a recession scenario, buybacks have historically declined 40%. A theme worth watching.

Source: Goldman Sachs [proprietary source – February 27, 2023], emphasis added by the author

Goldman Sachs’ proposal ideally matches the current trend of Apple’s free cash flow and cash reserves at their local levels:

Barclays supports this thesis in its March 2 note [proprietary source], saying buybacks are unlikely to see much of a boost this year given muted earnings growth expectations.

In my opinion, a safe path for the company going forward is to cut buybacks and focus funds on investment activities and logistics channels restructuring. Under this scenario, AAPL is likely to lose its liquidity support, which will benefit operations but risk investors increasing their allocation at the current valuation.

Valuation – Still Far From Norm

In preparing for this article, I came across a Twitter thread by @InvestSpecial that specializes in special situations. In that thread, the author provided a screenshot of his model, according to which AAPL has a price target of $95.2 by the end of 2023:

That is, a decline in gross profit of only 8.4% in FY2023 with continued growth in R&D and S&G costs will result in a 15.9% year-over-year decline in EBIT, according to this model. At the same time, the exit multiple will fall to 18x – the ongoing buyback will not save AAPL from a decline, which is logical given the presented inputs. The “AAPL current stock price” in the table above is a bit outdated – if the author is right, the downside risk is about 52% from yesterday’s close. That’s huge.

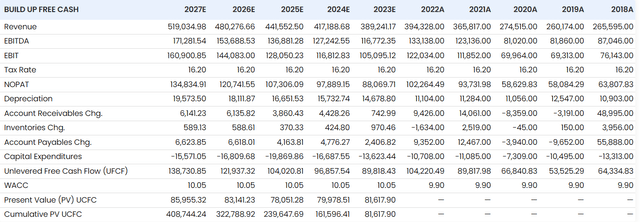

However, I am more optimistic about AAPL’s future [end of FY2023]. My assumptions have not changed since the publication of my January article. With one exception, I now expect CAPEX-to-sale to increase. Here’s what the projected financials look like:

stratosphere.io, author’s inputs

Using a fairly conservative WACC of around 10% and looking at longer-term EV/EBITDA multiples [5-7-10 years], I estimate AAPL’s terminal value to be 14 times by E2027. Then TV is $1,485,553 million and total enterprise value = almost $1.9 trillion. Per the latest report, the company’s net debt is -$54,340 million, so the equity value per share is around $123 – that’s 17.9% below yesterday’s closing price.

Your Takeaway

Once again, I conclude that AAPL stock has a rather unfavorable risk-reward ratio for potential buyers. This is due to the tough business cycle, the risk to FCF [potentially smaller buybacks in the future], and the high valuation that is out of touch with reality.

I expect the AAPL price to continue to keep on surfing below the 200-day moving average. The longer-term monthly chart shows that the fair price estimate I arrived at in today’s article is right at the support of the descending price channel. In my opinion, a downward move is more likely than an upward move if all other factors remain the same.

TrendSpider, AAPL (monthly), author’s notes

As always, your comments are welcome! Thanks for reading!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!

![Twitter [@InvestSpecial]](https://static.seekingalpha.com/uploads/2023/3/3/49513514-1677827112214825.png)