Summary:

- Salesforce presented strong fourth quarter earnings and a robust margin outlook for FY 2024.

- Salesforce generated free cash flow margins in excess of 20% for its 2023 financial year.

- The software company raised its stock buyback authorization from $10B to $20B.

- Salesforce’s strong free cash flow and growing profitability are two good reasons to buy the stock.

Takako Hatayama-Phillips

Salesforce (NYSE:CRM) sailed past top and bottom line expectations for its fourth quarter yesterday, and the CRM applications provider was surprised to the upside with a very robust earnings forecast for FY 2024. Additionally, Salesforce’s strong free cash flow generation allowed the company to increase its stock buyback authorization from $10B to $20B, which is buoying the company’s shares. CRM soared 11.5% yesterday and given that the company’s fundamentals are strong, I believe the risk profile remains skewed to the upside!

Salesforce is executing well

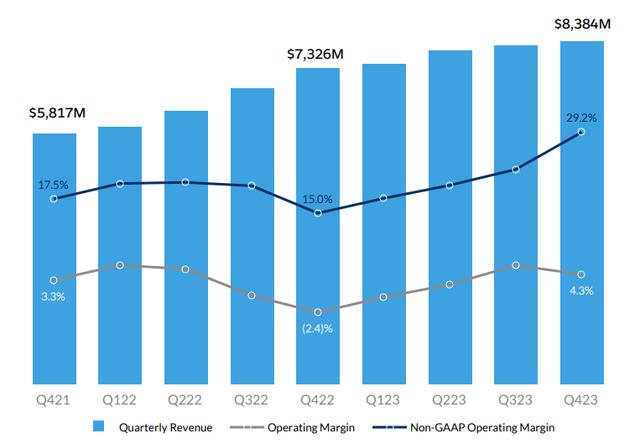

One of the big themes for software companies in the last year has been the possibility of a slowdown in topline growth. Salesforce grew its topline at a rate of more than 20% a year ago, but a post-pandemic slowdown and customers taking longer to make software purchase commitments have led to a major moderation in the CRM provider’s revenue growth. Despite those headwinds, however, Salesforce is still growing revenues at double-digits: in the fourth quarter, the software generated revenues of $8.4B, showing 14% year-over-year growth, with more than 92% of its revenues coming from subscriptions. The company’s full-year revenues increased 18% year over year to $31.4B.

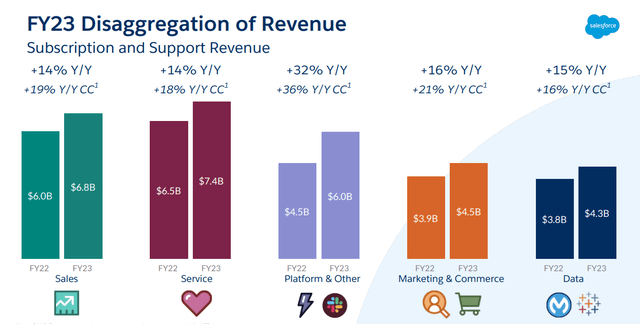

Salesforce executed especially well in its platform business, which once again saw the strongest growth in the company’s portfolio. Platform & Other – which is the segment that builds and customizes applications for enterprise customers – saw its revenues soar 32% year over year to $6.0B in FY 2023. Platform & Other has grown to become Salesforce’s third-largest business and I believe that the segment could grow into Salesforce’s leading revenue source by FY 2025 as long as enterprise adoption remains resilient. Salesforce’s other core businesses also continued to perform well, with Sales and Service seeing topline growth rates of 14% in FY 2023.

Free cash flow and stock buybacks

Most of Salesforce’s enterprise customers make spending decisions at the end of the year, which means the software company is usually seeing a strong uptick in cash flow in FQ4 and in the following first quarter. In the fourth quarter, Salesforce generated $2.57B in free cash flow on revenues of $8.4B, showing 41.6% year-over-year growth. In the last year, Salesforce generated $6.3B in free cash flow and a 20.1% free cash flow margin, meaning Salesforce is running a very profitable software business, despite the customary free cash flow drop-offs in FQ2’23 and FQ3’23.

|

$ millions |

FQ4’22 |

FQ1’23 |

FQ2’23 |

FQ3’23 |

FQ4’23 |

Y/Y Growth |

|

Subscription and Support |

$6,828 |

$6,856 |

$7,143 |

$7,233 |

$7,789 |

14.1% |

|

Professional Services |

$498 |

$555 |

$577 |

$604 |

$595 |

19.5% |

|

Revenues |

$7,326 |

$7,411 |

$7,720 |

$7,837 |

$8,384 |

14.4% |

|

Cash Flow From Operating Activities |

$1,982 |

$3,676 |

$334 |

$313 |

$2,788 |

40.7% |

|

Capital Expenditures |

($167) |

($179) |

($203) |

($198) |

($218) |

30.5% |

|

Free Cash Flow |

$1,815 |

$3,497 |

$131 |

$115 |

$2,570 |

41.6% |

|

Free Cash Flow Margin |

24.8% |

47.2% |

1.7% |

1.5% |

30.7% |

23.7% |

(Source: Author)

A lot of this free cash flow is going to get returned to investors going forward.

Salesforce announced its first-ever stock buyback of $10B last year… and the company has aggressively bought back stock in FY 2023. In Q4’23, Salesforce spent $2.3B on stock buybacks and $4.0B in the entire year. Considering that Salesforce generated $6.3B in free cash flow from software sales last year, the company returned 63% of its free cash flow to shareholders in FY 2023… which is a percentage that could even increase in FY 2024. Because of Salesforce’s strong free cash flow position, the company has now upgraded its stock buyback plan from $10B to $20B. With $16B of its stock buyback authorization remaining, Salesforce could repurchase about 8% of its outstanding shares going forward.

Outlook for FY 2023

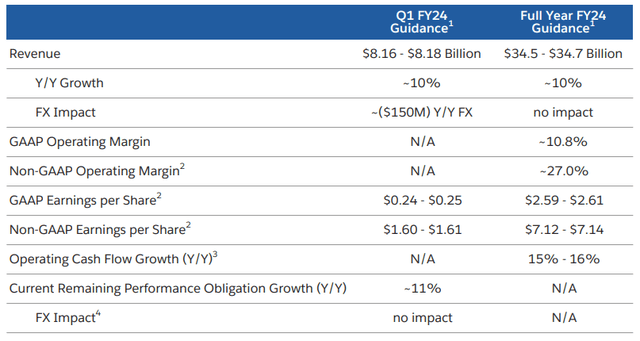

Salesforce submitted a strong profit/margin forecast for FY 2024, despite the fact that the software company expects to see a continual moderation of its revenue growth. Salesforce expects to see about 10% revenue growth for FQ1’24 which compares to a revenue growth rate of more than twice that (24%) in FQ1’23. Salesforce expects the same 10% topline growth rate for FY 2024. But while Salesforce expects headwinds regarding revenues as companies scale back spending on software products, the company is expecting to remain highly profitable.

I believe the most important aspect of Salesforce’s FY 2023 earnings report was that the software company is seeing gradual improvements in its non-GAAP operating margin. Salesforce’s non-GAAP operating margin has nearly doubled from 15.0% in FQ4’22 to 29.2% in FQ4’23, despite slowing topline growth. Growing profitability could be a key catalyst for Salesforce’s shares going forward as investors have waited for a long time to see operating margin improvements. Salesforce’s outlook for FY 2024 calls for a 27% operating margin, implying a 4.5 PP margin improvement year over year. The profitability outlook for FY 2024 and the increase in the stock buyback are two reasons why shares of Salesforce soared on Thursday.

Salesforce’s valuation

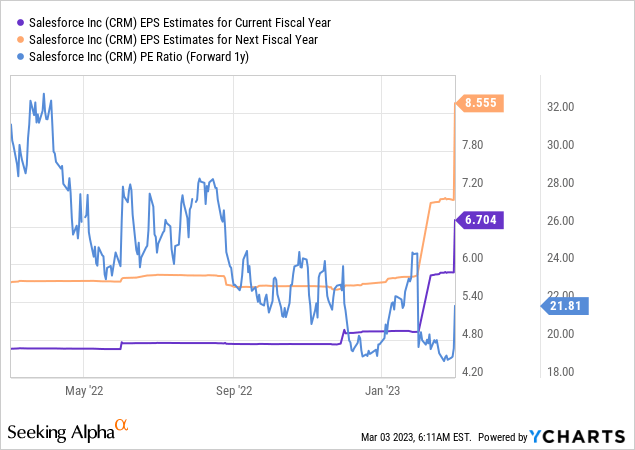

Given Salesforce’s growing profitability and free cash flow strength, I believe shares of the CRM applications provider are actually cheap. Salesforce is currently trading at a P/E ratio of just 21.8 X… which is not a high multiplier for a growth stock that is expected to grow its topline in the double-digits.

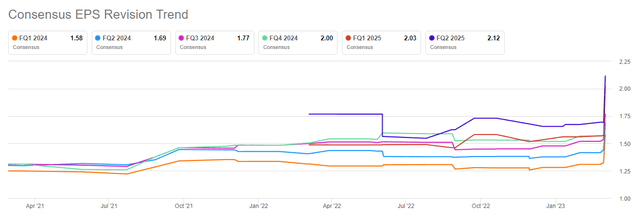

Additionally, EPS estimates are surging to the upside as analysts are rushing to incorporate Salesforce’s improving profit picture into their estimates. Salesforce is now expected to see 28% EPS growth this year and next year.

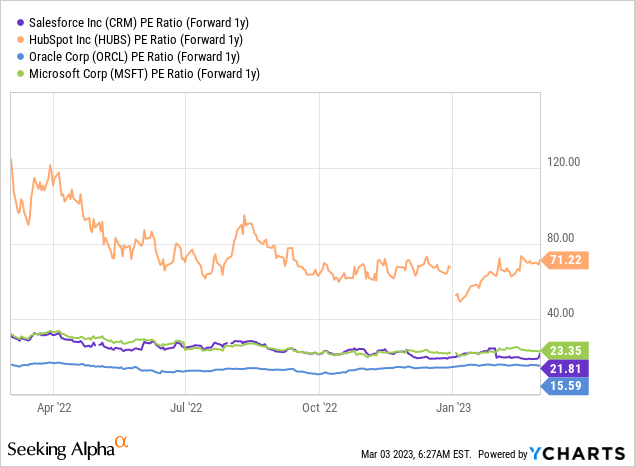

Compared against other software stocks, Salesforce is attractively valued as well. It is not the cheapest stock, but also not the most expensive… which is HubSpot (HUBS) with a P/E ratio of 71.2 X. Considering that Salesforce is already very profitable and yet growing quickly, I believe the stock has continued upside potential.

Risks with Salesforce

The biggest commercial risk for Salesforce remains moderating topline growth regarding its enterprise customers. Salesforce generates 33% of its revenues outside of North America, so a resurgent USD could also be a headwind for Salesforce’s earnings and cash flow growth. What would change my mind about Salesforce is if the CRM applications provider saw a deceleration of its growth in the increasingly important Platform business or its free cash flow margin deteriorated.

Final thoughts

The combination of up-trending operating margins, a strong outlook for FY 2024, and a material increase in Salesforce’s stock buyback authorization caused Salesforce’s stock price to jump more than 11% on Thursday. I believe momentum in Salesforce’s Platform business and strong buyback potential backed by free cash flow are two reasons to buy Salesforce. The firm’s shares are very attractively valued at a P/E ratio of 21.8X and the stock buyback should provide decent support for Salesforce’s shares in 2023!

Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.