Summary:

- We remain bearish on Apple. We believe investors should wait on the sidelines until the stock dips toward $100.

- Consistent with our expectations, Apple’s revenue dropped nearly 6% Y/Y in 1Q23 due to weaker-than-expected consumer spending and the slowdown in Foxconn’s production.

- We expect the stock to dip lower as we believe macroeconomic headwinds will continue to pressure Apple in the near term.

- We recommend investors hold off on buying Apple until the near-term downside has been factored into the stock.

Nikada/iStock Unreleased via Getty Images

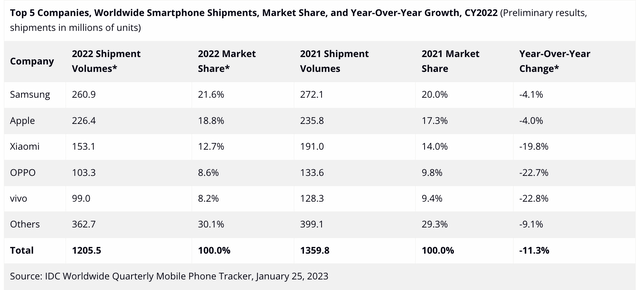

We’re eyeing $100 per share for Apple (NASDAQ:AAPL) stock before we start buying. We’re hold-rated on Apple as we expect the stock has more downside to factor in. We monitor AAPL stock closely and seek to analyze how up-to-date industry trends and the company’s 1Q23 quarter. We downgraded the stock to a hold-back in mid-September based on our belief that despite being the gold standard for smartphones, Apple is not immune to macroeconomic headwinds. Consistent with our expectations, the stock is down 10% since our downgrade. Apple missed both top and bottom lines in its latest quarter, 1Q23; revenue declined 6% Y/Y, and EPS is down from $1.94 to $1.88, almost 11%. We expect weaker consumer spending on smartphones will continue to pressure revenue as inflationary pressures and spiked interest rates persist. Apple reported 226.4M volumes shipped in 2022 while shipping 272.1M in 2021, in comparison, according to IDC. We continue to believe consumers are holding onto their phones longer, and we expect tight-consumer spending will continue into 2023. Gartner forecasts worldwide shipments to drop 4% this year, a total of 1.23B units compared to 1.28B units shipped in 2022. Aside from the demand slowdown, we believe Apple is facing challenges in recovering from the production slowdown in the company’s main factory, Foxconn. Apple needs to not only diversify production but figure out how to set up successful large-scale production that meets that of Foxconn, and we don’t see this happening before 2024. We believe Apple’s latest quarter indicates more downside to come. We expect Apple’s financials to continue to be pressured in the near term and recommend investors wait for the stock to bottom.

Can’t pass on macro headwinds

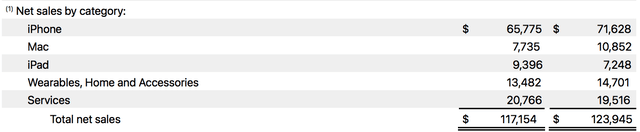

Apple cannot “pass” on the macroeconomic headwinds pressuring the smartphone industry. While analyzing Apple’s near-term stock performance, our primary focus is its iPhone sales, which account for over 53% of its net sales. Apple has other revenue streams, the second largest being its services revenue making up another 17% of total net sales. We believe the other revenue streams cannot offset weaker iPhone sales. Apple’s volume shipments across the board (including iPhone, Mac, iPad and Wearables, Home, and Accessories) have declined significantly over the past year. Apple’s not facing macro headwinds alone; the top five largest smartphone producers reported a year-over-year decline. Samsung’s smartphone shipments declined by 4.1% between 2021 to 2022. The following graph outlines the shipment volumes worldwide in 2022 compared to 2021.

Apple’s shipment decline in 1Q23 is intact with the larger peer group. We expect service revenue to grow sequentially in the near term but expect Apple’s product sales to remain repressed. We believe Apple’s service segment will boost revenues, but don’t expect it to make up for sales declines in Apple’s product line-ups. The following table outlines Apple’s net sales for 1Q23 by category.

Our bearish sentiment is driven by our belief that consumer behavior caused by macro headwinds will continue pressuring Apple in the near term- especially since Apple falls on the high-end side of the smartphone market.

Overdue diversification strategy

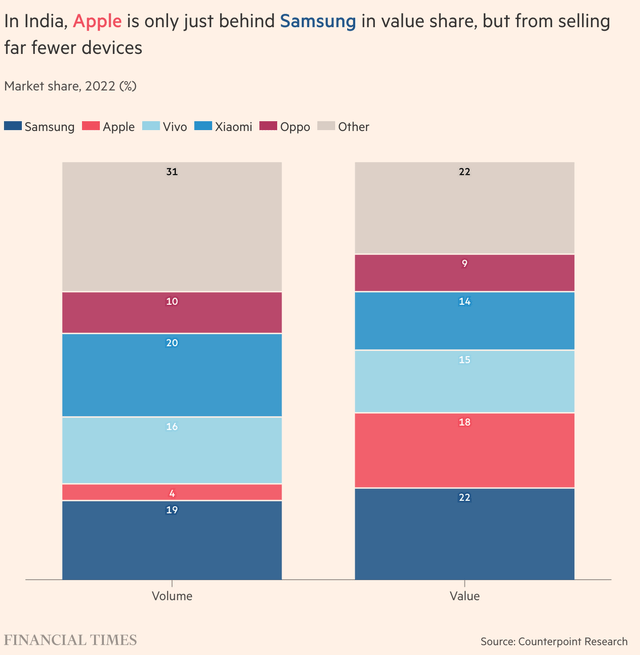

We previously pointed out our concern over Apple concentrating production in China; the company’s main iPhone production factory, accounting for about 85% of iPhone Pro lineups, is in Zhengzhou, China. While we’re more constructive on China’s reopening after authorities took steps to ease Zero COVID policies late last year, we still believe Apple has an eminent need to diversify production. We believe Apple understates the severity of its reliance on China for production needs. The company’s FY2022 annual report stated, “the Company’s manufacturing is performed in whole or in part by outsourcing partners located primarily in Asia, including China mainland, India, Japan, South Korea, Taiwan, and Vietnam,” while in reality around 95% of Apple products are made in China. We’re more constructive on Apple’s efforts to shift more and more production to India. Still, we don’t expect moving more production to India to materialize before 1H24 fully; we believe logistics come into play here as Apple suppliers in an Indian company, Tata, reported that around “one in every two components coming off the production line is in good enough shape….” We believe Apple still needs to find a strategy to boost its value share and devices sold in India to meet the production scale of the Zhengzhou factory. The following graph compares the top smartphone suppliers’ production in India.

We believe the company will continue to face pressures to cut its manufacturing dependency on China. We believe Apple’s sales in 1Q23 were lower in part due to the production slowdown and supply-chain issues late last year.

Valuation

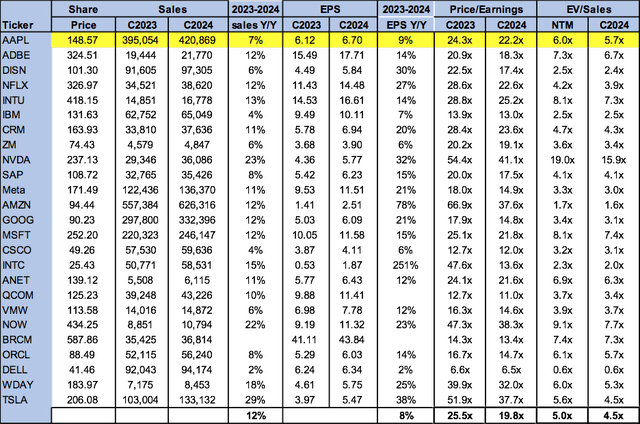

Apple is not relatively cheap, trading at 22.2x C2024 EPS $6.70 on a P/E basis compared to the peer group average of 19.8x. The stock is trading at 5.7x EV/C2024 versus the peer group average of 19.8x. While we’re bullish in the long run, we believe investors should hold off on buying the stock until the near-term downside has been factored in.

The following table outlines Apple’s valuation compared to the peer group.

Word on Wall Street

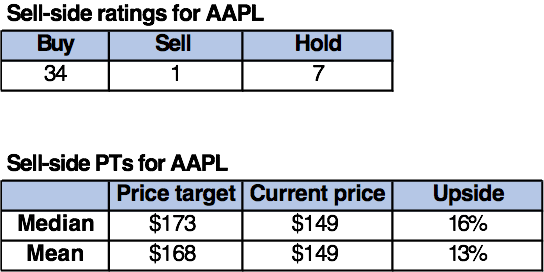

Wall Street is extremely bullish on the stock. Of 43 analysts covering the stock, 34 are buy-rated, seven are hold-rated, and the remaining are sell-rated. We attribute Wall Street’s bullish sentiment to Apple’s leading position as a high-end smartphone manufacturer and the company’s rapidly expanding services segment. Still, we believe the 1Q23 miss on expectations indicates that Apple is not immune to macro headwinds and is facing issues of production concentration.

The stock is currently priced at $149. The median sell-side price target is $173, while the mean is $168, with a potential 13-16% upside. The stock is trading 17% lower than its 52-week-high of $179.61. We expect the stock to creep lower toward $100 and recommend investors wait for a better entry point.

The following tables outline Apple’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We’re hold-rated on Apple. We expect the stock to dip further in 1H23 due to a weaker spending environment and concentrated production risks. We see the stock dipping towards $100 per share and recommend investors wait for the downside to be factored in. We’re also monitoring the stock to see how the strategy to diversify production to India pans out. We’re bullish on Apple in the long run but expect the company’s financials to be pressured in the near term. We believe 1Q23 was a good indicator that there is still more downside ahead. We recommend investors wait on the sidelines toward 2H23.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.