Summary:

- Mastercard is the world’s second-largest payment processing corporation netting over $22.2B in revenue in FY22.

- Their excellent “middle-man” business model has allowed the company to become a crucial element of today’s digital payment environment.

- Competition from Visa means Mastercard must continue innovating and expanding its payment network to ensure a profitable future.

- Excellent historic net margins and strong growth metrics suggest the future value is on the horizon for the company.

- Currently deserves a Buy rating, despite being fairly priced thanks to the company’s stellar future potential.

jbk_photography

Investment Thesis

Mastercard (NYSE:MA) is the world’s second largest transaction processing corporation. Their proprietary payment processing network combined with innovative and lucrative global partnerships have allowed the company to become a cornerstone of all economic transactions across the globe.

Fierce competition from Visa (V) and a constantly evolving market environment create for a difficult industry environment. Nonetheless, Mastercard has historically extracted significant margins from their business operations and yielded excellent results to shareholders.

A difficult macroeconomic environment has placed increased pressures on the company which have been exacerbated in recent years by the increasing adoption of cryptocurrencies and alternative forms of digital payments.

Therefore, a fundamental analysis from an intrinsic enterprise value perspective is required to assess any potential opportunities that may exist for investors with this blue chip stock.

Company Background

Mastercard Homepage

Mastercard is an American payment-processing corporation. They are the second largest in the world coming only second to rivals Visa and are one of the classic companies that come to mind when discussing long-oriented blue chips stocks.

Their principal products and services include payment processing between banks, merchants and credit unions and the provision of credit, debit and prepaid cards to consumers.

The company has been a major player since the late 60s and continues to be a crucial organization responsible for a huge number of global economic transactions daily.

The firm’s primary revenue streams arise from their global payments technology solutions and the transaction fee’s the company charges from transactions occurring on their networks.

Mastercard operates on an immense scale and has become one of the most trusted names in the payment processing industry. The business has become a global staple in payment transactions with Mastercard now serving over 210 countries and 150 currencies.

The last decade has presented Mastercard with a sudden potential competitor in the form of cryptocurrencies which undoubtedly hold the power to disrupt the global payments industry. However, the established, secure and trusted profile Mastercard has formulated for themselves over the past 50 years might make it difficult for any other companies to truly become formidable competitors.

While the company continues to deliver attractive financial results, it is important to conduct a comprehensive fundamental analysis of Mastercard’s value to deduce whether or not an investment opportunity exists at the present time.

Economic Moat – In Depth Analysis

Mastercard has a very strong and wide economic moat. The primary drivers for this moatiness are their immense scale and established profile in the payments processing industry.

The company is one of the market leaders when it comes to processing payments both internationally and domestically (from a U.S. perspective). Mastercard handles payments between a huge variety of market participants such as consumers, merchants, enterprises, financial institutions and governments.

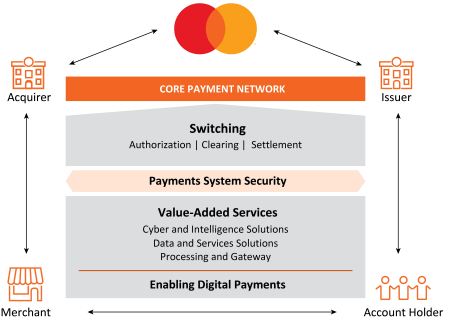

To process transactions, Mastercard operates a “four-party” multi-rail payments network which can process up to 5000 transactions per second.

Mastercard 10-K FY22

The primary method in which Mastercard completes transactions is through a process called “switching” in which the company authorizes, clears and settles transactions between entities. This process often includes around five separate entities including themselves: the paying account holder, their issuer bank, a merchant and their acquirer bank.

In return for completing this complicated process, Mastercard is paid a transaction fee for every authorization, clearing and settlement.

The image above illustrates a typical payment made on Mastercard’s payment network which helps to build an understanding into the service they provide. Essentially, Mastercard is a payment facilitator who act as an important middle-man (responsible particularly for payment security and speed) linking payers with payees.

While Mastercard’s payment capacity is estimated at around 5000 transactions per second, it is important to note that their primary competitor Visa claims their network is capable to handling over 65000 transactions per second.

However, even Mastercard’s 5000/s rate of processing is faster than any other rivals and their impressive levels of system security mean the replication of Mastercard’s payments processing network by a new entrant into the market would be incredibly difficult.

Mastercard 10-K FY22

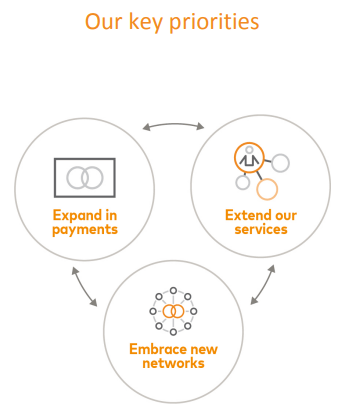

The company has highlighted three key strategic priorities moving forward to ensure they retain their competitive advantage in the payments processing industry. These three goals are to expand their payments solutions, extend their provision of value-added services and embrace new network opportunities.

To expand their payments network, the company is looking to accelerate digitization of payments across the globe. This makes sense as the company’s core business revolves around digitally processed transactions rather than cash-based ones.

According to research completed by McKinsey, between 2018 and 2021 the number of non-cash retail transactions increased at a rate of 13% per annum. Some emerging markets in Africa and Asia saw annual growth rates of 25%.

To harness this growth, Mastercard hopes to expand their payments network through providing a more efficient and capable multi-rail network which should be able to facilitate transactions quicker and more efficiently.

The company also hopes to lean into new payment innovations such as “buy-now-pay-later” solutions as well as supporting the growing digital currency and blockchain applications.

Mastercard’s management appears to be acutely aware of the need for the company to continue innovating within the payments processing space to ensure their oligopolistic market position remains intact moving forwards.

The company has outlined to investors that they are developing new adjacent network capabilities designed to power commerce and payments with new, value-added services imbedded into these networks.

A key business segment the company is currently focused on developing is their innovative open banking solutions network which is designed to enable a reliable exchange of consumer-permissioned data between institutions and individuals. This focus on ensuring Mastercard remains the most secure mass-use payments processing platform will be pivotal to guarantee their success in the future.

Thanks to the huge scale on which Mastercard operates – generating a Gross Dollar Volume (GDV) of over $8.2T in FY22 – the firm enjoys a significant network effect in their business operations which helps to significantly widen the company’s economic moat.

Mastercard has some of the largest banks, enterprises and credit unions as their partners both from a domestic and international perspective. This strategy of pursuing fundamental integration into the finance, payments and banking sectors over the past 50 years has allowed the firm to become a household name across the globe.

Therefore, at present it is highly unlikely that any competitor other than Visa could realistically pose as a replacement or alternative product to Mastercard.

Overall, it is clear to see that Mastercard has spent the last 50 years developing a product which has become an integral part of our day-to-day lives. Their payments processing network is truly world-class and the company continues to innovate by offering new products to the market.

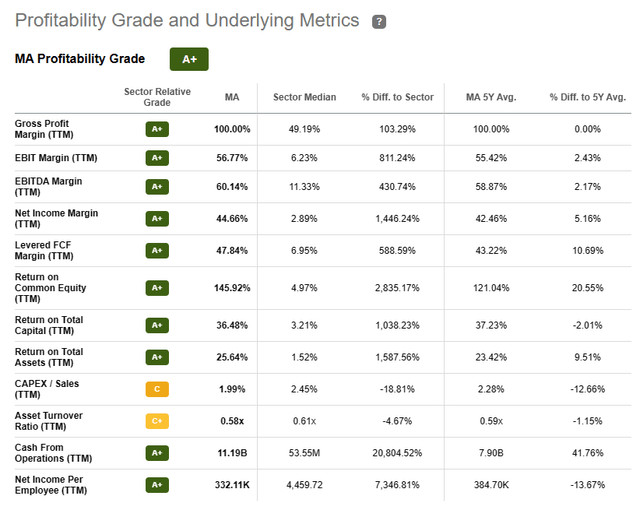

Financial Situation

Mastercard has been a hugely profitable firm for the greater part of their existence. Their consistent EBIDTA margins of 56.77% combined with a 5Y average ROIC of 47.77% only begin to illustrate the outstanding returns the company is capable of generating.

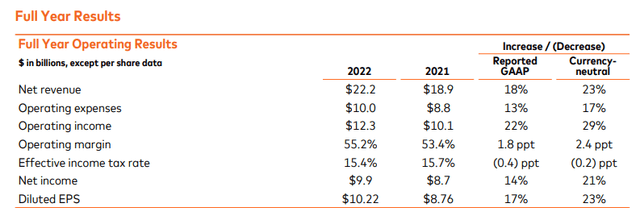

Mastercard Earnings Release FY22/FY22 Q4

In FY22, Mastercard generated $22.2B in net revenue. This represents a huge growth of 18% compared to the previous year with the firm’s total revenue having grown a healthy 77.6% since 2017.

These strong historical revenue statistics illustrate the consistent rate at which Mastercard has been able to extract increased value from their business operations.

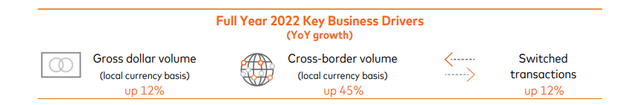

FY22 annual results illustrated strong growth in all three of their key business drivers: GDV, Cross-border volume and switched transactions.

Mastercard Earnings Release FY22/FY22 Q4

GDV increased 12% in FY22 compared to FY21 (on a local currency basis) despite the company’s suspension of operations in Russia in March of 2022. Cross-border volumes increased 45% compared to the previous year while switched transactions completed increased 12%.

This illustrates Mastercard has managed to continue expanding their operations and reach on the payments processing industry.

The company also saw a 16% increase in other revenue streams driven primarily by the company’s Cyber & Intelligence and Data & Services solutions segments. These products are broadly classified under the company’s “value-added” services.

During FY22, Mastercard reported their operating expenses increased by 13% (including special items). In particular, a 4 percentage point increase was due to the firm’s acquisition of Dynamic Yield, a consumer engagement platform previously owned by McDonald’s.

The remaining 9% was due to higher personnel costs, travel and meeting costs and unfavorable foreign exchange activity. None of these factors have set-off any alarm bells in my mind, as they largely depict the greater unfavorable macroeconomic situation currently impacting economies across the globe.

This has left Mastercard with a net margin of 44.66% in FY22, a contraction of 1.34% compared to FY21. Importantly, the firm managed to increase their operating margin by 3.05% in the same period which illustrates the company’s undoubtedly robust business model.

Considering the incredibly difficult bear market currently facing the U.S. economy, the ability for Mastercard to generate not only a healthy double-digit value of revenue growth, but also an increase in operating margins is more than impressive.

On a longer time-frame, the company has managed to generate 10Y average gross margins of around 77% with average net margins for the same period resting at around 40%. Compared to other blue-chip stocks, these values are truly phenomenal from an investor standpoint.

Seeking Alpha | MA | Profitability

Seeking Alpha’s Quant assigns Mastercard with an “A+” Profitability rating which I am absolutely in agreement with. Their strong profitability metrics are fundamental proof that the company has a robust business model and therefore could be an attractive pick for investors.

Mastercard’s balance sheets look to be in healthy shape too. Their total current assets for FY22 are $16.6B while current liabilities for the same period amount to just $14.1B. This leaves the firm with a fantastic quick ratio (current assets minus inventory divided by current liabilities) of just 0.76.

Thanks to the nature of Mastercard’s payment processing business, the company is not liable to the same financial risks that credit card issuers such as Discover of AmEx face. By only processing transactions, the company is able to simply act as an indispensable middle-man.

These fiscal stability metrics illustrate the healthy nature of Mastercard’s business from a balance sheet perspective. S&P award Mastercard an A+ Foreign Currency LT Credit Rating along with A+/A-1 long- and short-term issuer credit ratings. The outlook is stable.

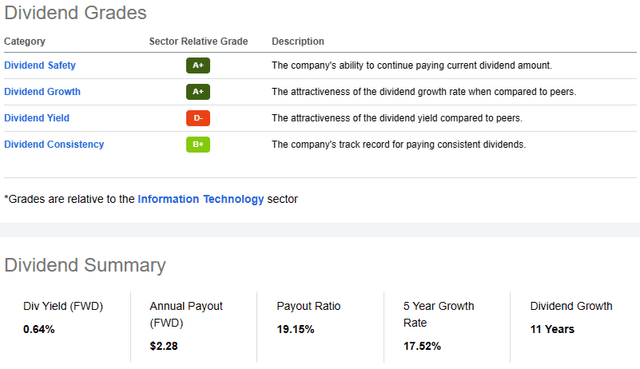

Seeking Alpha | MA | Dividends

During the full year 2022, Mastercard repurchased 25.7 million shares at a cost of $8.8B and paid $1.9 billion in dividends. The company’s 5Y dividend growth rate is an impressive 17.52% with the expected annual payout being $2.28 per share.

The company also saw unlevered FCF increase to $10.9B in FY22, up an impressive 25% from FY21.

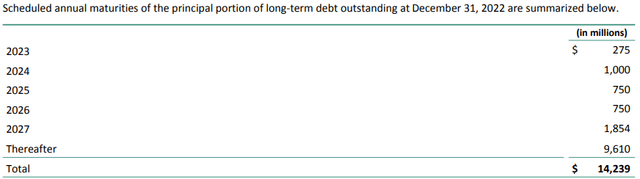

Mastercard’s total long-term debt amounts to just $14.2B. This is welcomed news for investors and illustrates the conservative style the firm’s management has applied in their financial planning.

Furthermore, the debt has been financed very strategically leaving a majority to be maturing beyond 2027.

Overall, it is safe to say that from a long-term perspective, Mastercard has an incredibly solid financial platform to build upon. Their strategic debt management, strong growth in FCF and chunky net margins illustrate that the company has managed to curate a fantastic profit-generating business model.

Valuation

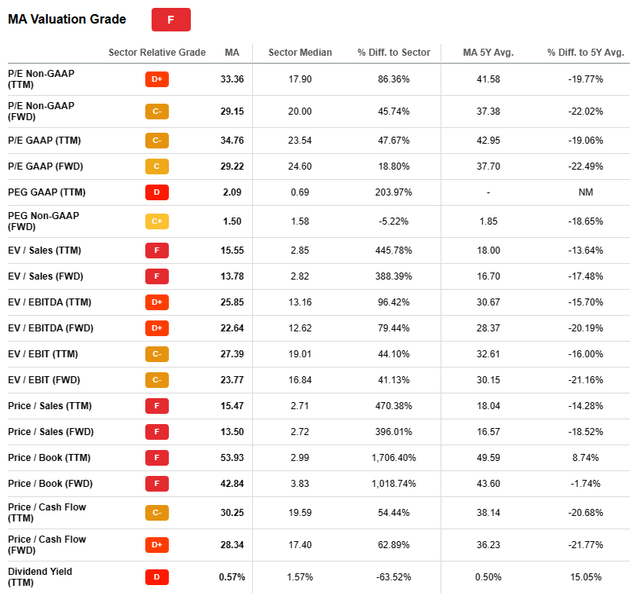

Seeking Alpha | MA | Valuation Metrics

Seeking Alpha’s Quant has assigned Mastercard with an F Valuation rating. I am largely inclined to disagree with this assessment as it suggests the firm’s shares are materially overvalued which I do not fully believe to be the case.

The firm is currently trading at a FWD P/E GAAP ratio of 29.15 and a TTM P/CF ratio of 30.25. Their FWD Price/Book ratio is quite high at 42.84 and the companies EV/Sales FWD is 13.78. While these valuation metrics do suggest an overvaluation may be present in shares, I don’t believe they tell the full story.

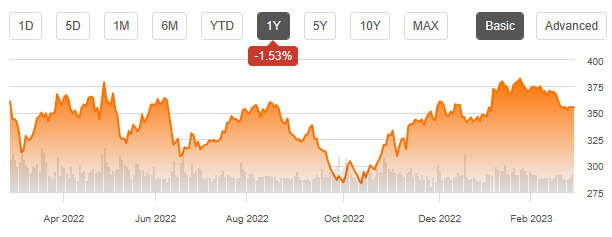

Seeking Alpha | MA | YoY Chart

From an absolute perspective, Mastercard’s shares have remained largely stable on a one-year basis falling only by around -1.53%. Over the past five years, the company has returned investors a respectable 104%.

This means Mastercard shares have outperformed the Nasdaq-100 by 13.82% and the S&P 500 by 7.72%. Fundamentally, this is due to simply integral nature of Mastercard’s business offering to today’s society.

With more and more transactions occurring digitally each year, Mastercard stands to benefit almost regardless of the prevailing macroeconomic conditions. Of course, this does not mean Mastercard is immune to general bear markets or pessimistic consumer sentiment.

Still, the company should be significantly less impacted than its tech or consumer discretionary blue-chip counterparts thanks to its incredibly wide and strong economic moat.

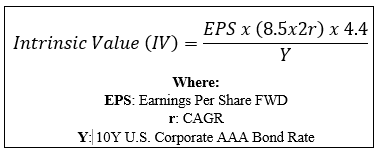

By accomplishing a simple financial valuation based on the calculation below and using an EPS of $10.22, an ultra-conservative r value of 0.06 (6%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive an IV for Mastercard of $332.

Even with this ultra conservative CAGR value for r, Mastercard would appear to only be intrinsically overvalued by about 6% (given a current share price $355). Furthermore, when considering the absolute profit generating abilities of the company combined with their rapid growth in revenues, the expectations for future value generation are high.

The Value Corner

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe the stock may begin to exhibit some bearish tendencies moving towards the midpoint of FY23, simply due to the prevailing theme of a recession later in the year. A drop in valuations in the short-term could absolutely be a possibility.

In the long term (4-10 years) I fully expect their position as a leader in the industry to become even stronger. Their strong payment processing network combined with continued innovation and adoption of new technologies within the sector should allow Mastercard to continue growing sustainably while delivering healthy results to investors.

While entering into a position in the stock from a deep-value perspective is currently not possible, the company remains incredibly attractive, even to the most value-oriented investor like myself. The fundamental nature of this company’s business model suggests significant future growth is absolutely on the horizon.

Risks Facing Mastercard

The primary risk facing Mastercard is the emergency of a new, innovative payment solution which would render their multi-rail payment network obsolete.

To avoid this becoming a possibility, the company must continue to focus on innovation in the payment processing industry while simultaneously focusing on developing ancillary networks to further diversify their revenue streams.

The company’s strong commitment to digital currencies and partnerships with cryptocurrency companies such as Binance illustrates Mastercard’s motivation to remain relevant and at the cutting-edge of transaction processing solutions.

The firm also faces risk from Visa continuing to increase their dominance over Mastercard. Rival Visa enjoys slightly bigger margins and can process over 65000 transactions a second. However, Mastercard is undoubtedly the faster growing of the two firms.

While the theoretical possibility exists that Visa would push Mastercard out of the market entirely, this seems incredibly unlikely given the current situation at both firms. Equally, Mastercard has all the potential and management ability to continue excelling in new and emerging markets which present a crucial opportunity for the firm to beat Visa to the punch.

The firm also harbors a significant cyber-security risk given the truly huge amounts of sensitive payment data, information and details the firm holds. Luckily, Mastercard is strongly devoted to ensuring their network is the most secure platform currently available and has highlighted this risk as one that requires on-going mitigation and prevention strategies.

The potential and real consequences resulting from antitrust breaches whereby Mastercard has blocked or restricted merchants’ access to cross-border card payment services. Such anticompetitive behavior is a shame and could place some of managements ethical boundaries into question.

From an ESG perspective, Mastercard is relatively well protected. They have pledged to be carbon neutral by 2040 and have transitioned to using 100% renewable energy in their operations since 2018.

Summary

Mastercard is an impressively profitable, robust blue-chip company which continues to excel year after year. Their excellent business model, operational efficiency and continued innovation has allowed the company to yield investors with market-beating results.

In my opinion, current share prices represent a fair valuation in the company from an intrinsic value perspective. The promise of strong future cashflows and a truly diverse set of revenue streams suggests significant returns could be on the horizon for Mastercard.

As a short-term investment, I believe there is some volatility in-store for the stock as tricky macroeconomic conditions continue to dominate the marketplace. However, in the long-term I believe their undeniable position as a market leader places Mastercard firmly in position to generate great shareholder value.

I therefore believe Mastercard warrants a Buy rating, even though shares are overvalued. However, while I believe the company is a decent buy even at its current prices ($355), I will personally wait to see what the second half of 2023 brings along with it with particular regards to the possibility of a recession.

Ideally for me, an undervaluation of 15% (share prices around $300) would provide a satisfactory margin of safety to begin building a position from a pure value perspective, ignoring all speculative growth estimates.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.