360 DigiTech: Still In Transition

Summary:

- 360 DigiTech’s share price jump and positive valuation re-rating in recent months have priced in favorable changes in the regulatory environment for Chinese fintech companies.

- QFIN will require some time to fully transition into a capital-light business model, so I don’t expect a substantial re-rating of the stock’s valuations to happen in the near future.

- I assign a Hold rating to 360 DigiTech, as I think that it is too early to turn bullish on QFIN when its business model transition is still in progress.

VM_Studio

Elevator Pitch

My rating for 360 DigiTech, Inc.’s (NASDAQ:QFIN) [3660:HK] stock is a Hold. Positive regulatory developments are already priced in, and QFIN still has capital-heavy services accounting for a significant part of its loans for now. My take is that 360 DigiTech’s shares will remain range-bound in the near future, while the company continues to pivot towards a capital-light model in the intermediate term. This explains my Hold rating for QFIN.

Company Description

In its 20-F filing, 360 DigiTech calls itself a “Credit-Tech” company or one that offers “solutions that empower and enhance credit services, such as loan facilitation services.” Since the company commenced operations in 2016, QFIN has facilitated RMB1.2 trillion in loans and served 43 million users as indicated in its December 2022 corporate presentation. QFIN also noted in its corporate presentation that it is the third largest “consumer Credit-Tech platform” in the Chinese market after Alibaba’s (BABA) Ant Group and JD.com’s (JD) JD Technology. 360 DigiTech’s shares have been listed on the Nasdaq and the Hong Kong Stock Exchange since December 2018 and November 2022, respectively.

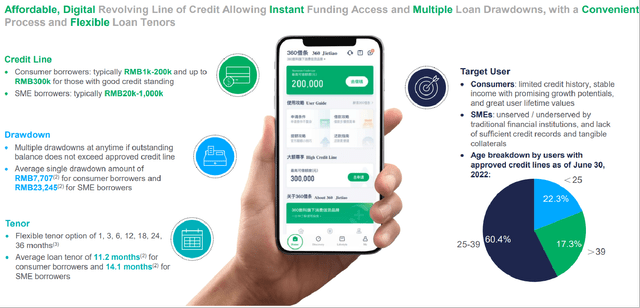

Key Characteristics Of Loan Products Offered By QFIN

QFIN’s December 2022 Corporate Presentation

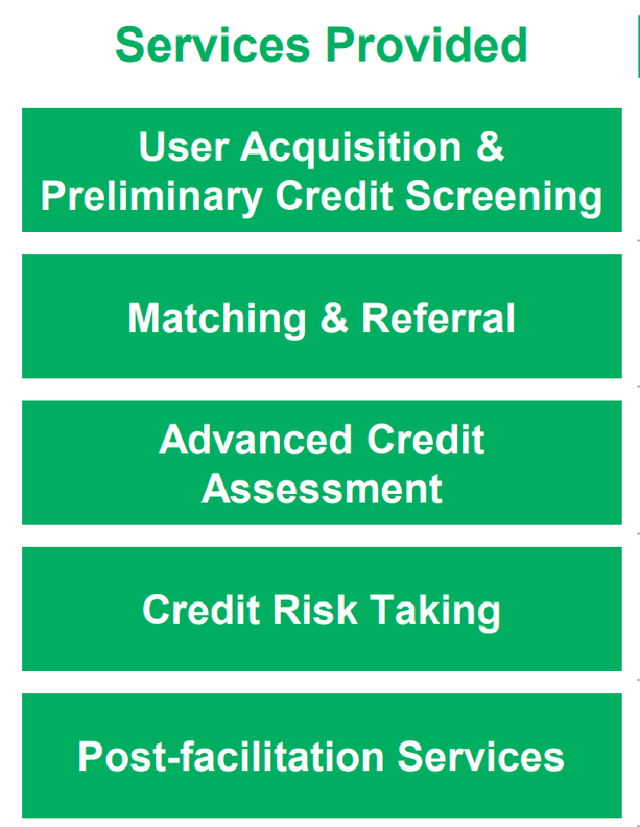

360 DigiTech’s Key Service Offerings

QFIN’s December 2022 Corporate Presentation

QFIN’s Past Valuation De-Rating Was Driven By Regulatory Headwinds

In the last two years, 360 DigiTech has seen the stock’s valuation multiples compress substantially, although there has been a decent recovery in recent months.

Based on valuation data taken from S&P Capital IQ, the market valued QFIN at 8.3 times consensus forward next twelve months’ normalized P/E on February 16, 2021. This was the highest normalized P/E valuation multiple that 360 DigiTech has ever traded at since its IPO on the Nasdaq in December 2018. QFIN traded at a much lower consensus forward next twelve months’ normalized P/E ratio of 2.3 times on October 24, 2022 which was a new two-year trough. Similarly, 360 DigiTech’s consensus forward next twelve months’ price-to-sales multiple has de-rated significantly from its all-time historical high of 2.7 times recorded on June 23, 2021 to 0.6 times (two-year historical low) at the end of the October 24, 2022 trading day.

360 DigiTech’s valuation de-rating in the past two years coincided with a series of new policies introduced by regulatory agencies in China to tighten control of the Chinese fintech sector. In March 2021, Reuters reported that China “banned micro lenders from granting new consumer loans to college students.” New regulations relating to data security and protection came into effect in China in August 2021 as highlighted in a CNBC news article. Subsequently in September 2021, the People’s Bank Of China tightened requirements associated with “credit reporting services” as highlighted in its press release.

But there are signs that the worst is over for Chinese fintech companies such as 360DigiTech in terms of policy headwinds.

A spokesperson from the People’s Bank Of China noted that the “rectification of financial businesses of 14 platforms”, which include BABA’s Ant Group, was concluded as reported by Chinese state media Global Times. Ant Group is arguably China’s most prominent fintech company, and it had to abandon plans for an IPO in November 2020 due to regulatory pushbacks. In other words, this recent development sent a positive signal about the Chinese policymakers’ current regulatory stance on China’s fintech sector.

On the part of the company, QFIN revealed at its Q3 2022 earnings briefing on November 16, 2022 that it has “completed most of the required rectification items and received a positive feedback from regulators” by September last year.

In that respect, it shouldn’t come as a surprise that 360 DigiTech’s share price has performed well in the past three months and QFIN’s valuation multiples have re-rated positively during this period. Since the end of November 2022, QFIN’s share price surged by +39.6%, while the S&P 500 declined by -3.2% in the same time frame. As of March 1, 2023, 360 DigiTech is valued by the market at consensus forward next twelve months’ price-to-sales and normalized P/E valuation multiples of 1.3 times and 4.8 times, respectively, which were higher than what they were in late-October last year.

This suggests that positive regulatory developments have already been factored into QFIN’s current stock price and valuation multiples. 360 DigiTech needs a new catalyst to drive a further expansion of its current valuation multiples, which is discussed in detail in the next section.

Further Valuation Re-Rating Is Dependent On Capital-Light Strategy’s Success

QFIN had made an important move to pivot to a capital-light operating model since 2018. This means that 360 DigiTech has been trying to move away from capital-intensive or capital-heavy services (e.g. credit risk taking services) to capital-light offerings (e.g. credit screening and assessment) in the last couple of years. It also indicates that QFIN’s revenue mix will change for the better going forward with a reduced reliance on interest fees (affected by macroeconomic environment and regulatory caps), and an increase in contribution from fees relating to consulting and technology solutions.

The proportion of new loans originated or facilitated under the capital-light model for 360 DigiTech has increased from 23% for the first quarter of 2020 to 58% in the third quarter of 2022. As a result, the company’s leverage ratio dropped substantially from 9.7 times as of end-2018 to 3.8 times at the end of Q3 2022. This shows that QFIN has made decent progress in its transition to becoming a capital-light business.

But new loans facilitated or originated under the old capital-heavy model still accounted for a meaningful 42% of 360 DigiTech’s total new loans for Q3 2022. Also, a significant 43% of total loans outstanding as of September 30, 2022 were still attributed to QFIN’s legacy capital-intensive services.

At the company’s prior Q3 2022 results call in mid-November of the previous year, 360 DigiTech noted that “we expect to see rather stable leverage ratio for the time being until capital-light contribution grows beyond current range.”

My interpretation of this specific management commentary is that QFIN will most probably take some time to make further headway with its capital-light business model transition. I think that this is a reasonable assumption for two reasons. Firstly, as the macroeconomic environment in China turns for the better with the country’s reopening, 360 DigiTech might be more keen to originate or facilitate a higher percentage of loans under the capital-heavy model with a bigger risk appetite. Secondly, QFIN has already done pretty well in growing the contribution of its capital-light model for the past few years. The company will need to put in much greater effort to either engage new financial institutions or promote more capital-light services to its existing partners so as to drive future growth.

Concluding Thoughts

I have a Neutral view of 360 DigiTech’s shares. QFIN’s stock price performance in recent months has been reasonably good pricing in positive regulatory developments, so it isn’t realistic to expect a big jump in its shares in the near term when the company’s business model transition is still in progress.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!