Summary:

- Apple tumbled around 30% of its all-time-high market on March 30, 2022 during the ongoing bear market.

- While it could be tempting to buy considering the share price decline, my two fair value calculations indicate further declines.

- Additionally, both from a technical and a macroeconomic point of view, further downward pressure looks highly probable.

Nikada/iStock Unreleased via Getty Images

1. Introduction

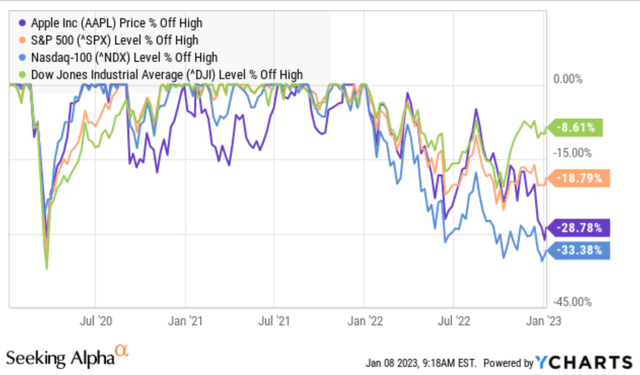

We are in the midst of a bear market and Apple (NASDAQ:AAPL) has lost around 29% from its all-time high of $179.61 on March 30, 2022.

While Apple has still outperformed the Nasdaq, it has vastly underperformed the S&P 500 and Dow Jones (see chart).

Price % off high – Apple vs indices (YCharts)

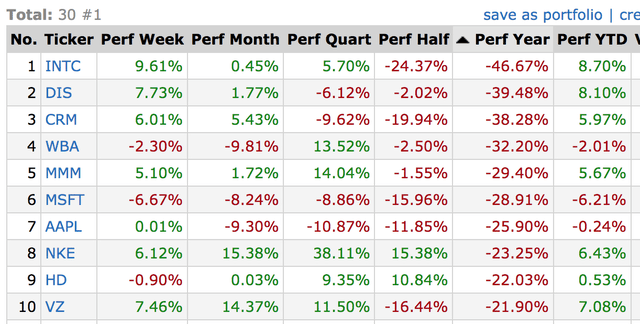

Compared with Dow Jones stocks, it is striking that Apple is among the ten worst performers with a 12-month performance of 26% (see chart).

Performance of Dow Jones stocks (Finviz)

So, is now the time to buy?

2. Fair Value Calculation

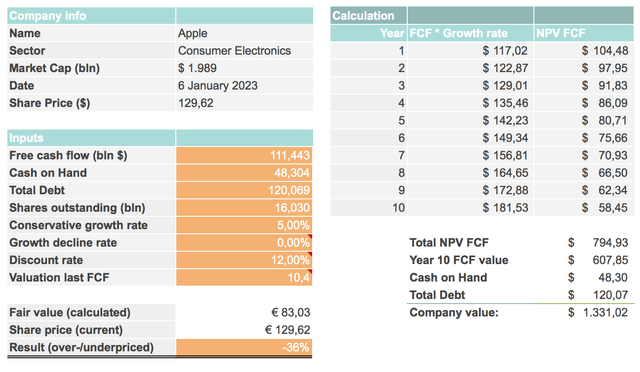

I prepared two valuation models in order to make a more accurate assessment of the valuation. I have chosen a conservative approach due to the monetary tightening phase of central banks on a global scale and the related rapidly rising interest rate environment. Other factors favoring a conservative approach include the uncertain macroeconomic and political environment and rising recession risks, which have probably not yet been fully priced in.

The first valuation method is based on a DCF calculation. In order to choose a conservative approach, I have chosen a growth rate of 5% per year in terms of the free cash flow. Additionally, analysts’ consensus predict FCF decline of 8% in FY 2023 and FCF growth of 10% in FY 2024, according to MarketScreener. In terms of Price/Cash flow multiple, I have chosen a multiple of 10.40 for the last FCF, which represents the 5-year average of the years 2013-2017 and is approximately half of the current 5-year valuation of 19.28 (2018-2022), according to Morningstar.

In the first valuation method based on a DCF calculation, the fair value is $83.03, which corresponds to a current overvaluation of the stock of 36% (see figure below).

Apple fair value calculation based on DCF (Author’s calculation)

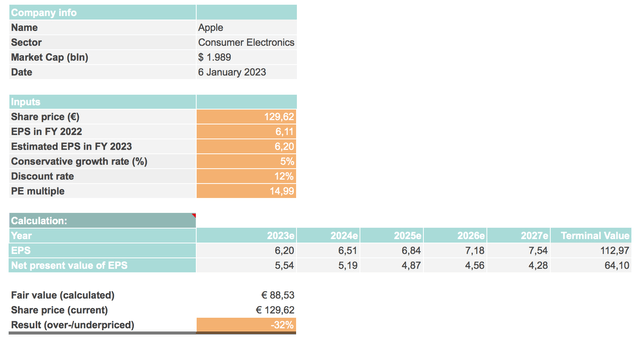

The second valuation method is based on an earnings-per-share calculation. In order to choose a conservative approach, I have chosen a growth rate of 5% per year in terms of EPS growth. The 5-year average EPS growth rate was 22, according to Morningstar. Nevertheless, analysts’ consensus predict EPS growth of just 1.5% in FY 2023, 9.3% in FY 2024 and 6% in FY 2025, according to MarketScreener.

In terms of P/E multiple, I have chosen a multiple of 14.99 for calculating the terminal value, which represents the 5-year average of the years 2013-2017 and is well below the current 5-year valuation of 24.2 (2018-2022), according to Morningstar.

In the second valuation method the fair value is $88,53, which corresponds to an overvaluation of the stock of 32% (see figure below).

Apple fair value calculation based on EPS (Author’s calculation)

3. Technical Analysis

Looking at the chart, it is noticeable that Apple is still stuck in a downtrend and has even broken the support line and marked a new 52-week-low, which favors a further decline in the share price (see following chart).

Apple chart – caught in a downtrend (Finviz)

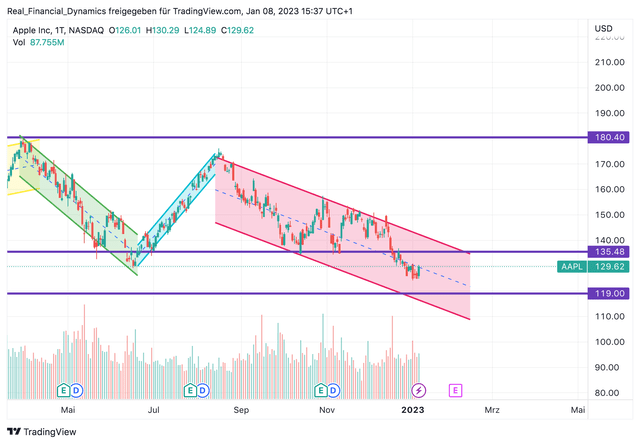

Consequently, Apple could fall to around $119, which could act as a support line, before a significant upward reaction could occur (see following chart).

Apple chart – caught in a downtrend (TradingView)

4. Conclusion

It appears highly probable that Apple will continue to fall, both from a fundamental and a technical point of view.

While Apple is a fundamentally and financially very solid company, my fair value calculation based on a DCF method shows an overvaluation of the stock of 36% and my fair value calculation bases on an EPS method indicates an overvaluation of around 32%.

If Apple were to actually plummet to these levels, it would mean that almost all Post-COVID gains, resulting from the unprecedented monetary supply by central banks and governments, would vanish with it.

Currently, Apple is exposed to further downward pressure, unless the macroeconomic environment and the central banks’ rapid monetary tightening loosen up. This in fact would lead to an update of the fair value and the assumptions behind it.

Until then, investors seem better advised to be patient and wait for the environment and the stock to stabilize.

In summary, it can be stated that while I would not dare to say that one should sell the stock depending on the entry point, it might currently make sense for initial investors to be patient and wait for better entry-level conditions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.