Apple Is Undervalued With Underappreciated Artificial Intelligence Potential

Summary:

- Apple’s stock performance has been lackluster in 2024 due to downgrades, anti-trust concerns, and slowing growth.

- The company’s strong balance sheet, unique culture, and investments in AI make it an attractive long-term investment.

- Apple’s valuation is still favorable compared to its peers, and its services business helps mitigate hardware weaknesses.

- The growth concerns around Apple are overblown given the company’s exemplary track record.

ozgurdonmaz

Wherever smart people work, doors are unlocked.”

-Steve Wozniak

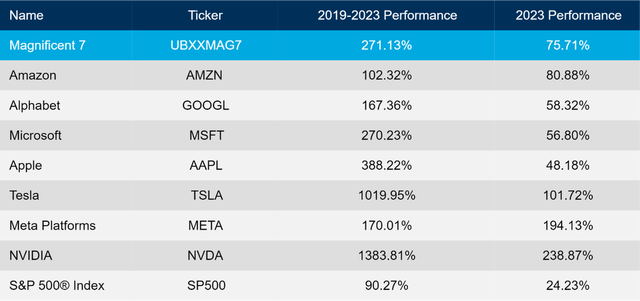

Apple is the world’s largest company. It also has the world’s most valuable brand. The stock’s performance over the last five years has been spectacular, but since 2024 began, Cupertino has been experiencing somewhat of a malaise. Early in the year, the iconic firm received several downgrades based on slowing growth, stiff smartphone competition, and economic woes in China. Recently, antitrust concerns have come to the fore as the DOJ accused Apple of monopolistic practices with its most important product, the iPhone.

DOJ

Of course, these doubts and this malaise are coming off the heels of a period of spectacular performance on a long-term basis, despite some floundering in the last few months. I think this price weakness is an opportunity for long-term shareholders to buy more and lower their cost basis. If you don’t already own Apple, now is a good time to enter. Apple got to the top of the commercial pile with a fierce competitive prowess and strengths that have built over time. Some of the main reasons I am not only comfortable owning Apple but also buying more at current levels are as follows:

- Apple has a pristine balance sheet and piles of cash that can be used to press on promising R&D developments.

- Apple has a unique culture that is a meritocracy and attracts some of Silicon Valley’s most Spartan and valuable talent. The culture of excellence and dedication to the consumer distinguishes Apple from its peers.

- Shutting down projects like the Apple car strikes me as a major positive, not a negative. The world’s largest company not only can afford to be methodical, it is essential to the company’s identity.

- The company has also been investing in AI for years, and I think those investments will make Apple a leader in AI, despite the current perception of it as a laggard.

- Many bears point to hardware weakness or stagnation (iPhones, Macs, and iPads) but the increasing importance of Services helps to mitigate this and stabilize the business. Apple’s multiple has expanded because of the Services story, and the vital segment is currently strong.

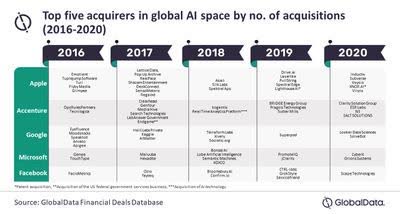

- There is the public perception of AI and the CEOs who are very good at riding a very large wave of public enthusiasm on the issue. Then there is actual AI capability. It’s important to remember that Apple had been leading peers in AI acquisitions long before the world was dazzled by ChatGPT.

The Artificial Intelligence-driven bull market that has defined most of 2023 and the first quarter of 2024 has exceeded most market observers’ expectations. Unlike the internet boom before it, where small companies with little revenue commanded valuations that became divorced from reality, the current technological revolution’s vanguard mostly consists of the largest, most competitive companies on Earth selling lucrative artificial intelligence functionality to both businesses and consumers.

Rather than valuations outpacing sparse or non-existing earnings like in the web boom, for AI mavens like Nvidia the opposite has been occurring; prodigious earnings are getting ahead of Wall Street estimates and making many valuation measures much lower than the nature of recent parabolic rallies would imply to someone not examining the data.

Mellon Investments Corporation

But Apple has missed out on the wave of enthusiasm compared to some more AI-savvy peers. Or are their peers more savvy? I think Apple’s AI potential is dramatically underestimated by the Street. Yes, Apple has not been throwing around buzzwords and saying its AI functionality will revolutionize the human experience. That doesn’t necessarily mean Apple doesn’t have AI chops, the evidence and their acquisition strategies of AI companies suggest that the opposite is true.

What this means to me is that Apple is simply not interested in playing the game of pumping the AI hype the way many CEOs in the trillion-dollar club are, it is interested in delivering AI applications that dazzle the consumer and meet the very high standards that go hand in hand with the world’s most valuable brand. As you can see below, long before the excessive hype of large language models entered the zeitgeist with a bang, Cupertino was silently buying a vast array of AI companies.

Global Data

Apple is not necessarily behind its peers in how to commercialize artificial intelligence, it is just not certain of the optimal strategy. But it has the talent, resources, and existing AI capacity to figure it out. And its large cash pile and formidable commercial characteristics give the world’s largest company the time and luxury to do so, and to do so just right.

Valuation

Apple has performed poorly as of late, and there have been a lot of public detractors. Recent public setbacks like terminating the widely anticipated Apple Car have added to the public malaise from a perception perspective, even though I think this was a positive. The pandemic was a point of strength for Apple, not only did it excel financially it helped billions of people stay sane during the pandemic, but it also grew its user base and made great progress at building up the lucrative services business. Importantly, the growth of Services boosts intrinsic value since it is more stable and countercyclical than hardware revenue. All else being equal, this should continue to support valuation despite the iPhone product beginning to mature.

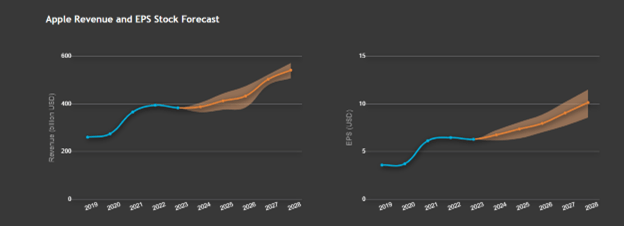

ValueInvesting.IO

If one has truly paid attention to Apple’s pandemic performance, it is easy to see that one of the current sources of investor apprehension, slowing revenue growth, is tough comps. The long-term growth forecasts are pretty healthy, as you can see above, and should prove low if the company exceeds the diminished expectations for its AI prowess. Apple is passing the puppy of extraordinary pandemic growth through the python, so to speak. The ‘weakness’ Apple is experiencing is really just a reflection of the prodigious revenue growth the stock had in COVID. Apple’s problem of slowing revenue growth is more of a problem of bad comps, not an unhealthy business.

Yahoo Finance

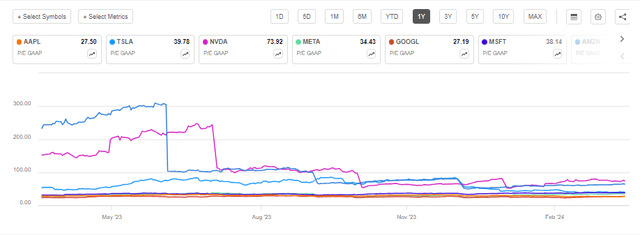

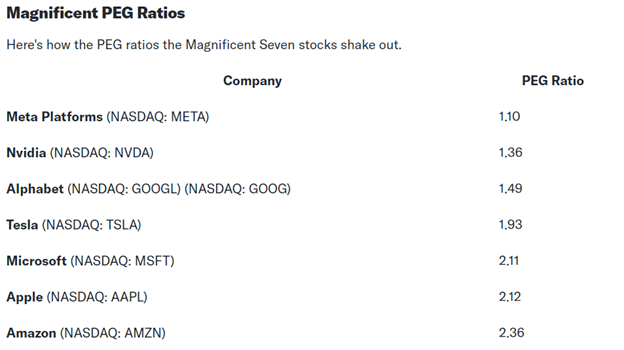

Apple’s PEG Ratio is a little higher than some peers, and part of this is its concentration in maturing hardware products that are subject to economic uncertainty and all the risks that come with being a massive global company. However, the company’s strong brand and proven ability to execute through difficult cycles make me more comfortable owning the firm despite slower growth. I have faith that the company’s growth from AI will come, and I am also comfortable being a long-term owner of this stock.

The company’s excellent management team and track record of delivering in trying circumstances is a major reason why I think a premium in the PEG ratio area is due. However, it’s even more compelling to own the stock when you look at valuation through other metrics. Compared to its Magnificent Seven peers, it is very attractively valued using several different methodologies and metrics.

Furthermore, when you take other important measures of the stock’s valuation and profitability into account, Apple fares much better than its peers. The incredible strengths of the company and the massive network of fiercely loyal customers that it has developed give the stock a well-deserved premium in some areas. However, when you take the growth out of the equation and just measure the stock’s P/E ratio, its relative valuation is much more attractive compared to peers.

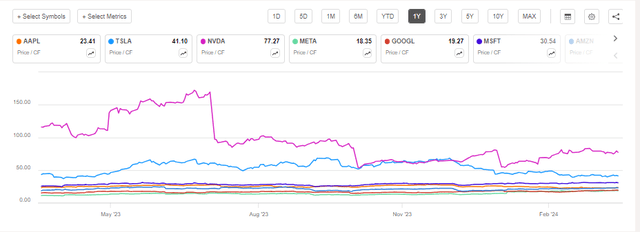

As you can see, when you compare Apple to its mega-cap peers with the metric of price to free cash flow, it is the most cheaply valued stock. Do other stocks on the list have a more coherent AI strategy currently? Yes. Do they have the same quality of Services ecosystem, customer loyalty, and consumer scale that Apple does? Absolutely not. So while they aren’t show-boating on an underdeveloped AI strategy right now since they don’t have to, I wouldn’t exactly consider that a reason to shun the most successful stock in history. I think this company and this management team’s track record have earned the benefit of the doubt from investors. Thus, I am very comfortable adding to or purchasing Apple at these levels.

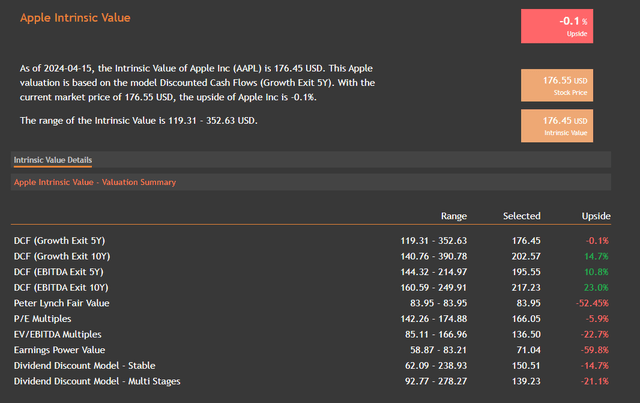

I’ve mentioned you should own Apple and not trade it. This makes me give more weight to a DCF using a longer period. For a company, you want to keep in your portfolio because of its market-leading quality, I am perfectly comfortable using the Growth Exit 10Y and the EBITDA Exit 10Y as my primary intrinsic valuation methods. These two methods are the approximate-implied valuation I would put the most confidence in. Furthermore, I think Apple always has the potential to surprise consumers with R&D progress on new projects. The company is notorious for its secrecy.

Risks and Where I Could Be Wrong

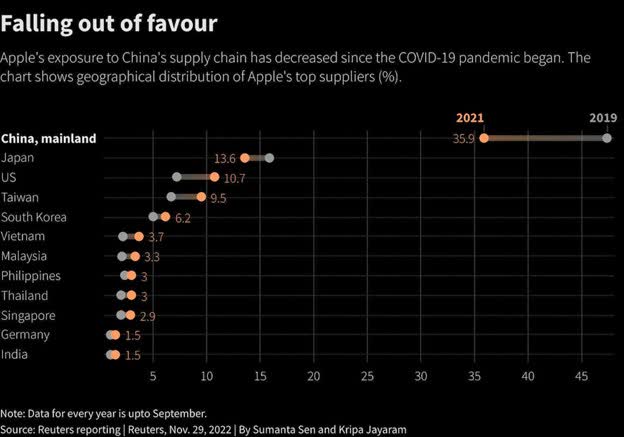

The firm is concentrated in the iPhone product, and one of its major weaknesses was highlighted during the Zhengzhou riots at the end of December 2022. One of the major reasons I am so confident in buying the firm is because of how Tim Cook and his team handled this existential risk. Apple has made impressive progress in shifting a significant portion of hardware production to India, and furthermore, it has dramatically improved the situation in China.

The economic weakness in China has probably shifted the balance of power toward Apple and away from the Chinese Communist Party. Remember, Apple’s economic heft in the country is significant, and economic growth has been anemic, increasing Cupertino’s relative importance.

Bloomberg

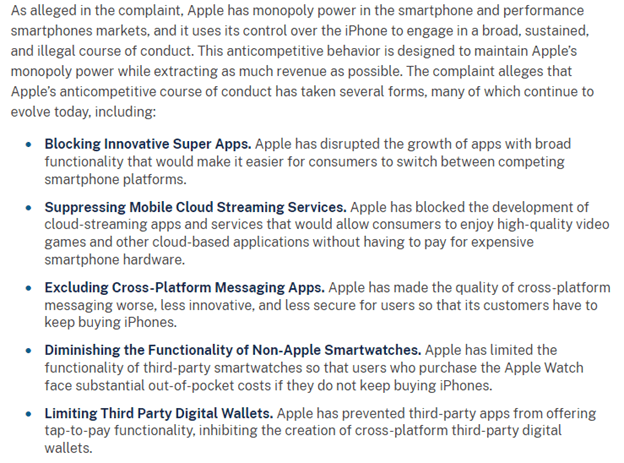

The other major risk that has been stalking Apple for a while now is the antitrust allegations, both at home and abroad. However, the recent DOJ antitrust allegations are particularly worrisome since they affect Apple’s most important product. But any of the following risks could adversely affect Apple if they cause a financial crisis or widespread economic woes that dent consumption.

- Escalation of geopolitical risks in China, Ukraine, or the Middle East.

- Fed policy error.

- The banking crisis worsens.

- Return of inflation.

- CRE meltdown.

- Write-downs of private assets.

Of course, Apple is a massive company and is exposed to the wider economy. The above risks could also have the counterintuitive effect of steering capital toward Apple in certain circumstances. It’s important to remember that Apple became a safety trade during the pandemic because of how prodigious its business and reputation are. The antitrust situation could end up being serious. Apple didn’t get to the top by being the nicest company, and some of its practices of trying to keep consumers in its ecosystem could prove anti-competitive. Yet, the firm can weather all but the worst outcomes, and the Government’s case seems weak in some areas.

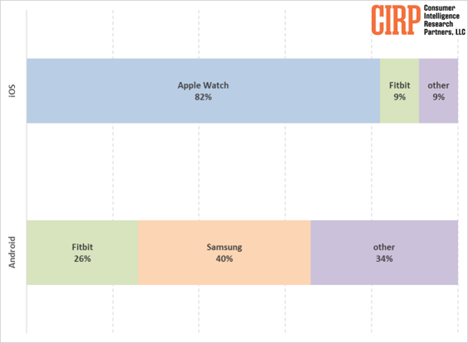

CIRP

Furthermore, it greatly benefitted from the accelerated shift to digitization that other companies had. But when you think of Apple, think of it long-term. For all the risks it is facing, a generation of American kids was also just raised on its technology during the pandemic. And that boosts long-term earnings potential.

Conclusion

Apple is one of the most successful stocks of all time, and it has recently weathered a lot more significant risks successfully than any of the risks it is facing today. Tim Cook is an amazing CEO in my estimation, and I’m convinced his legacy will be intertwined with AI. The truth of the matter is that when you’re operating on the level of these massive Tech giants, creating hype is worth a lot.

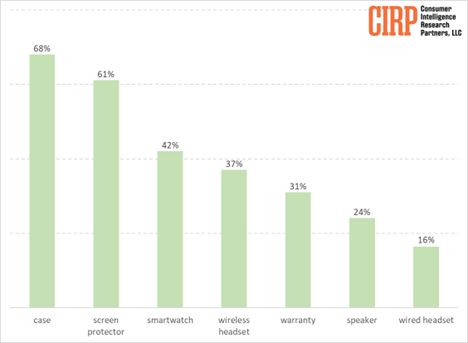

However, I don’t think the people at Apple are interested in generating hyper at all, I think they are interested in creating the best products in the world. Most importantly, though, the thesis that has led to Apple’s multiple expansion is intact. Its services ecosystem is growing, and it will likely be made significantly more lucrative when artificial intelligence is integrated into it in a meaningful way.

CIRP

One easy smell test for a company is to examine its non-monetary mission statement and to see whether the company’s actions and products align with that statement. It seems cheap and like an early business school exercise, but there’s some value to it.

Apple’s achievements are exactly in line with its mission. Apple’s mission to support human development with personal computing and building the world’s best products. The company has done that for decades, and those who doubt it will continue are betting against one of the most competent human organizations of our times. I am happy to let the fears of others drive the price down to help my cost basis and buy Apple at these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.