Summary:

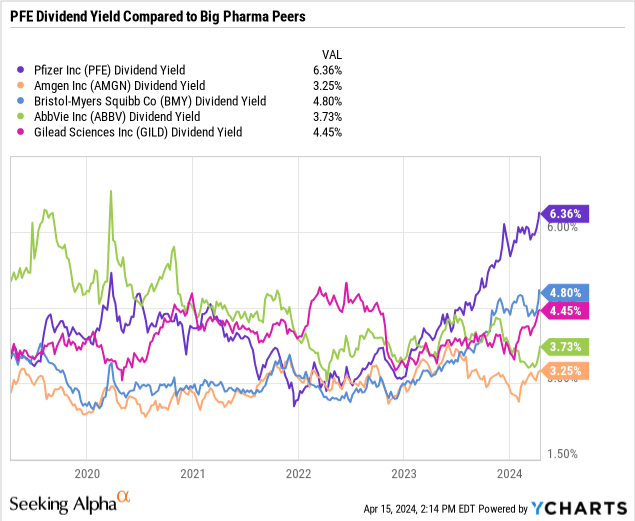

- PFE’s dividend has reached the sky-high (for a biotech) ~6% mark.

- Are the dividend and recent share price decline enough to make PFE an attractive play?

- PFE is following a similar trajectory to GILD in its post-HCV stagnation.

- PFE may be worth buying as the COVID-based product revenues decline and equilibrate.

CatEyePerspective

Introduction:

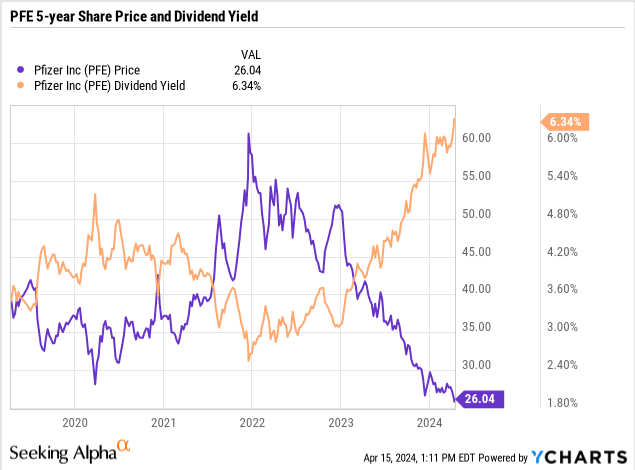

A biotech stock with a large dividend is pretty uncommon since biotechnology and pharmaceutical companies tend to focus more on reinvestment into pipeline growth rather than shareholder returns. But as a biopharma grows larger and there may be a paucity of potential pipeline or partnership opportunities that may be worth investing in, the company may look to return some of its profits to its investors through either dividends or share repurchases. Pfizer (NYSE:PFE) seems to be one of these companies, where the combination of recent share price declines and a steadily growing dividend had caused the company’s yield to eclipse the 6% level.

Bristol-Myers Squibb (BMY) is another company with a higher dividend yield, but one with some challenges due to upcoming losses of patent exclusivity for key products. I’ve looked into BMY in great detail, discussed here. To make a conclusion about investibility of PFE, I’ll consider some similar perspectives. Looking at potential key at-risk product revenue, potential revenue growth, and dividend sustainability/debt, PFE seems like it may be a value stock with the potential to rebound due to the overcoming of potential revenue declines. While I don’t currently own shares, it will be one on my watchlist that I’d consider with a moderate “buy” rating. I’m not considering a strong “buy” rating here, as there are potential risk factors surrounding the efficacy-related performance of some of the company’s COVID products that may potentially emerge in the future as a headwind.

COVID-19 Rise and Fall:

Before 2020, PFE was mostly focused on generating breakthrough therapies, mostly in rare diseases and oncology, as well as the divestment of their generic and off-patent branded segment Upjohn. The company moved in a measured way, befitting a big pharma, making steady and strategic acquisitions to grow where they saw the most accretive programs.

That changed in 2020 as PFE partnered with BioNTech (BNTX) to codevelop a vaccine for COVID-19. In what was then a foray into an almost science-fiction-like technology as no mRNA-based vaccine had yet been successfully deployed, PFE and BNTX (and of course Moderna (MRNA) separately) put forth tremendous efforts to bring their vaccine to market, and administered hundreds of millions of doses over the course of the pandemic. This produced a windfall for PFE, as nations purchased massive amounts of vaccines to distribute to their populations.

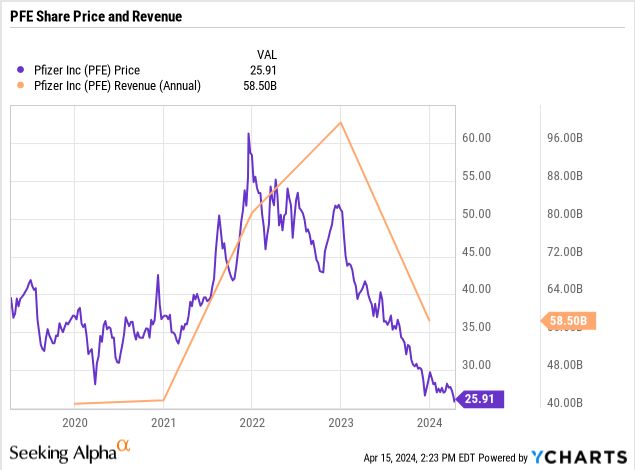

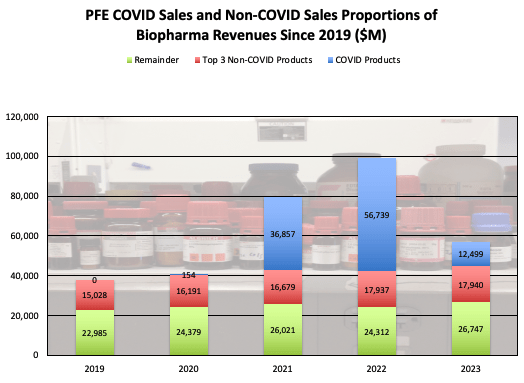

During 2020-2023, PFE had a whole new segment added to its revenue: COVID-19 and related products, bringing company biopharma-only revenue from ~$38B in 2019 (adjusting from Upjohn separation), to a peak of $99B in 2022. This meteoric increase was pandemic-fueled, but has given way to an inevitable decline following the downgrade of COVID-19 from pandemic status as the globe recovered.

As the pandemic subsided, revenue subsequently precipitously dropped, analysts showed their disappointment, and PFE’s stock price followed suit. The company now has revenue from COVID products at further risk from decline in disease significance, as well as some key products with potentially looming losses of exclusivity. That said though, when considering the COVID/con-COVID product revenue split, the non-COVID revenue seems to be growing moderately at an average annual rate of ~4%.

PFE Revenue Breakdown (PFE Corporate Materials)

This ~4% is positive, but not necessarily spectacular, so may have played a part in PFE’s decision to sink some of its COVID windfall into acquiring Seagen in 2023, hoping to drive growth in oncology for the company. The acquisition was expected to contribute ~$10B in risk-adjusted revenue by 2030, which could go a long way in providing a boost to company growth.

What Revenue Might be at Risk?

To consider some of the potential declines that PFE may be facing, there are 2 key segments to look more closely at. One of course is the COVID-related products, which comprise 22% PFE 2023 revenue. The other to consider are the top 3 non-COVID products, and the upcoming LOE (losses of patent exclusivity). In 2023, the top 3 non-COVID products (Eliquis, Prevnar, and Ibrance) made up ~30% of the company’s revenue, with some LOE occurring before 2030.

Table 1: PFE Total Biopharma Revenues and Key Products ($M)

|

Drug |

LOE |

2023* |

Proportion of FY2023 Revenue |

|

Comirnaty** |

2041 |

11,220 |

20% |

|

Paxlovid** |

2041 |

1,279 |

2% |

|

Eliquis |

2026 |

6,747 |

12% |

|

Prevnar |

2026/2033 |

6,440 |

11% |

|

Ibrance |

2027 |

4,753 |

8% |

|

Total |

57,186 |

53% |

*Biopharma sales only, excluding manufacturing partnership revenue; **COVID-dependent sales

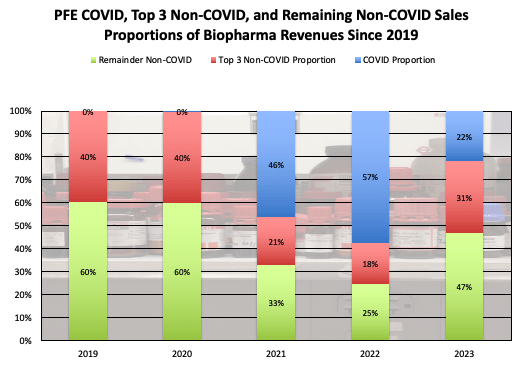

COVID-19 product revenue will be considered first. COVID products have had a huge impact on PFE revenue since 2020, growing to nearly 60% of company biopharma revenue in 2022.

PFE Trailing Revenue Proportions (PFE Corporate Materials)

The COVID contribution to PFE has declined significantly since then, however, and may continue declining further as COVID impact has continued to decline. The 2023 levels of COVID revenue contribution were ~$11B from their COVID vaccine Comirnaty, and ~$1.3B for Paxlovid. We’ll address Paxlovid first, which was initially seen as an effective treatment for active COVID-19, but has recently shown only questionable efficacy in some COVID-19 patient segments. The decline in COVID-19 from pandemic status to endemic (no longer overwhelming hospital systems, and now regularly occurring similarly to a seasonal flu) combined with some of the less-stellar clinical efficacy results of Paxlovid may result in the continued decline of the treatment sales, perhaps as low as $500M annual sales. This estimate accounts for the CDC’s lifting of COVID isolation guidelines and lowered hospitalizations and deaths, while recognizing there may be some higher-risk patients that still find need for the treatment. Comirnaty revenues may have further declines as well. The situation of rapid growth over a short timeframe experienced by PFE seems similar to Gilead Sciences’ (GILD) success in Hepatitis C treatment nearly a decade ago. GILD’s HCV revenues soared on the launches of Harvoni and Solvaldi in 2013 and 2014, peaking in 2015 at ~$19B. However as GILD treated most of the readily-presenting patients, their revenue plummeted over the next 5 years by ~90% to ~$2B in 2020, where it has mostly stabilized, only declining slightly to ~$1.8B in 2023. Using this same estimate, PFE peak Comirnaty revenue was seen peaking in 2022 at ~$38B. A ~90% decline here over the next several years would put potential sales by ~2030 at ~$4B. This would be ~$7B potential decline from the 2023 revenue. On top of another potential $700M decline from Paxlovid, there may be potentially ~$7.8B in future revenue declines for PFE’s COVID-19 segment by 2030.

PFE Top 3 Non-COVID Drug Potential LOE Impacts:

PFE’s top 3 non-COVID products in 2023 were Eliquis (comarketed with Bristol-Myers Squibb ((BMY))), Prevnar (pneumococcal vaccine line), and Ibrance (for some kinds of breast cancer). Collectively the 3 products made up ~31% of 2023 revenues, and each is set to lose some patent exclusivity in 2026 or 2027. The easiest one to address is Eliquis, as we’ve covered it in our previous BMY LOE article (if you read it, many thanks). As a refresher, Eliquis is a small molecule drug, and those may decline ~80-90% from peak sales, when generic competition enters the market and the branded products lose pricing premium. BMY’s topline revenue for Eliquis includes the portion of revenue that will be paid to PFE in alliance revenue, and we previously calculated Eliquis’ potential forward growth rate using the following: the compound annual growth rate of Eliquis sales from 2018 has been ~14%, but may be a bit high to just carry forward through 2026, due to the scale of the treatment. To account for more recent growth rates, 2023 Eliquis growth was ~4% over 2022, down from the ~10% growth seen from 2021 to 2022. It may be reasonable to forecast the Eliquis sales growth at a rate of ~6-7%, accounting for the most recent growth periods. Of course we will be assuming no change to the PFE/BMY Eliquis partnership terms, or any potential impact to Eliquis prices from CMS negotiations as part of the Inflation Reduction Act.

Table 2: Forecast Growth of Eliquis Through 2026 (M USD)

|

2023 |

2024 |

2025 |

2026 |

Post-LOE |

|

6,747 |

7,188 |

7,658 |

8,159 |

1,632 |

Source: PFE, BMY Corporate Materials; Projections by Author

Based on these estimates, it may be possible that there is ~$5B in revenue for PFE at risk for LOE erosion for Eliquis.

Ibrance Erosion Potential:

PFE’s Ibrance is a small molecule inhibitor of CDK (cyclin-dependent kinase) 4 and 6, and is used to treat HR-positive and HER2-negative breast cancers. It’s a small molecule oncology drug, so we’ll use the same estimates of small molecule LOE erosion as above: ~80% potential erosion following LOE. Revenue has been under some pressure due to competition, and some price decreases in international markets. To reflect this trend, the compound annual growth rate from 2019 for Ibrance has been just under 1%. If this trend continues, then it would appear that Ibrance’s peak revenue occurred in 2021 at ~$5.4B. An 80% decline from this point would be ~$1.1B following LOE, which is ~$3.7B lower than 2023 sales.

Prevnar LOE Impact:

Prevnar is a series of pneumococcal vaccines that Pfizer (and previously Wyeth before the 2009 acquisition by PFE) has been marketing for over 20 years. The coverage of this vaccine has been improving, from targeting 7 viral variations, to 13 forms, to the most recent iteration targeting 20 viral forms. While Prevnar 13 LOE hits in 2026, Prevnar 20 LOE doesn’t occur until at least 2033. As the company transitions past potential LOE impact of Prevnar 13, it’s likely that Prevnar 20 will continue to grow and incorporate potential lost sales from Prevnar 13, as Prevnar 20 contains the functionality of Prevnar 13, while incorporating immunization against 7 additional viral variations. The LOE impact before 2030 for PFE’s Prevnar family will likely be minimal, and may not be a significant risk of company revenue, as PFE appears to be continually updating the product line to maintain competitiveness and benefit for patients. So of the top-selling 3 products and remaining COVID-19 lines, PFE has potentially ~$7.8B from COVID lines and another ~$8.7B in non-COVID top 3 revenue at potential risk by 2030.

Table 3: PFE Potential Revenues at Risk for 2023 Top-Selling 3 and COVID-19 Products

|

Drug |

LOE |

Peak Revenue |

Post-LOE/Loss Revenue Level |

Potential Erosion compared to 2023 revenue |

|

Comirnaty |

2041 |

37,806 |

4,077 |

7,143 |

|

Paxlovid |

2041 |

18,933 |

579 |

700 |

|

Eliquis |

2026 |

8,159 |

1,632 |

5,115 |

|

Prevnar |

2026/2033 |

Not before 2030 |

N/A |

N/A |

|

Ibrance |

2027 |

5,437 |

1,087 |

3,666 |

Source: PFE, Corporate Materials; Projections by Author

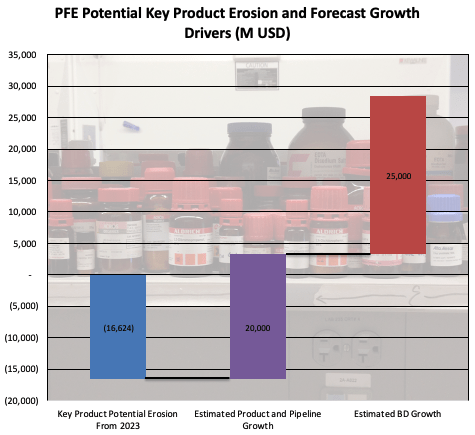

PFE is facing potentially up to ~$16.6B in revenue at risk from key products, which may explain the general lack of enthusiasm from analysts and investors that has brought the company’s share price to its current lows. The company will have to make up the shortfalls through the combination of Seagen or other acquired assets, and its existing clinical pipeline.

PFE Potential Future Growth:

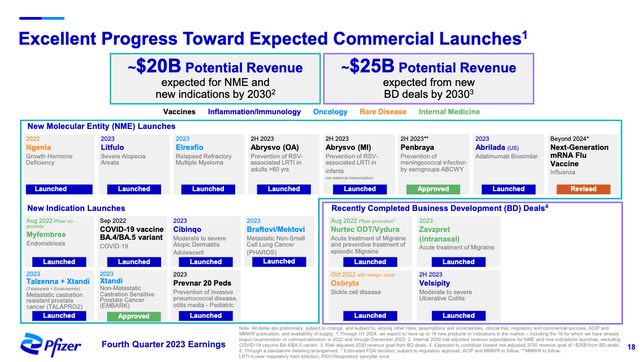

While PFE completed the Arena Pharmaceuticals acquisition in 2022, it was only on the scale of ~$6.7B, and a less potentially transformational transaction than the $43B buyout of Seagen. The Biohaven acquisition also completed in 2022 for ~$11.6B, but Seagen as the largest seems the most significant. PFE has estimated that Seagen products will boost PFE revenues significantly, and $3.1B of that during 2024. We could try to analyze PFE’s pipeline ourselves and would probably get a decent approximation of the potential revenue growth by 2030, but PFE has done those forecasts themselves, and have been kind enough to share the high level views in their Q4 2023 presentation.

PFE Revenue Forecasts (PFE Corporate Materials)

A combined ~$45B in new revenue by 2030 is estimated by PFE (accounting for all appropriate probabilities of clinical success ), from various pipeline programs and recent and new business development deals, including those from Arena, Biohaven, and Seagen. Assuming these products achieve the levels of success PFE has estimated, the company will be able to handily overcome the potential estimated LOE and COVID-related potential erosion by 2030.

PFE At Risk Revenue and Revenue Growth (PFE Corporate Materials, Chart and Erosion Estimates by Author)

This looks pretty good for PFE, so depending on the timing of launches and product growth, their revenue growth potential appears likely to be able to outweigh the key potential negative revenue pressure faced from the reported 2023 data.

Dividend Payout:

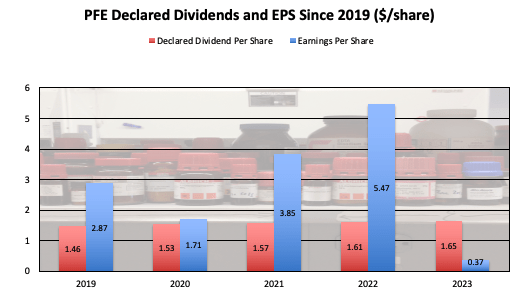

At the current level, the dividend is something that can be inspected further. Over the past several years, the dividend seems to have been well-covered, except for 2023’s decline that was mostly related to decreased COVID segment sales.

PFE Dividends and EPS (PFE Corporate Materials, Chart by Author)

It should be watched moving forward, but as PFE’s revenues improve from other programs, EPS is likely to improve as the company right-sizes its operational scale.

Debt Levels:

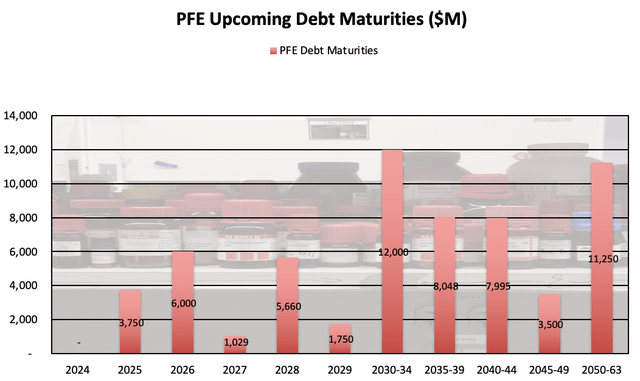

PFE debt is also worth a closer look, as the company has spent significant funds on acquisitions over the past several years. While the company holds ~$12.6B in cash, equivalents, and short term investments, PFE’s short-term borrowings and debt of ~$10B and long-term debt of ~$62B merit a close watch as well. The maturities for long-term debt are fairly well-laddered, with manageable maturities before 2030.

PFE Long term Debt Maturities (PFE Corporate Materials)

While this debt certainly will need to be addressed, it seems to be something the company will be able to handle.

Final Thoughts:

As the COVID-19 pandemic has receded, PFE’s COVID-related revenue has likewise fallen, bringing about the unfortunate decline in share prices. That said, it would appear that most of the main revenue declines have already occurred for PFE’s COVID-related products. PFE’s other key products where LOE is imminent have some significant potential losses to consider, but PFE’s forecast growth for its existing pipeline as well as potential growth from BD transactions may reasonably outweigh the potential at-risk revenue. Overall it would appear that PFE’s revenue will likely begin to rise beyond some of the key losses, and with a revenue rebound, a share price rebound may be possible. Combined with a high dividend that would appear to be mostly sustainable, the shares may be worth acquiring. I would consider them to be a moderate “buy” here, and will keep them on my watchlist to potentially acquire shares when able.

Potential Risk Factors:

While the fundamentals for PFE seem stable and capable of a return to growth, there are a couple factors preventing me from rating a stronger buy. Paxlovid efficacy was not clearly demonstrated compared to placebo in lower-risk patients, although safety was reiterated. This may potentially limit future addressable patient populations. Additionally reports of “Paxlovid rebound“, or return of COVID-19 symptoms in some patients who taken Paxlovid and saw symptom recovery, may further impact potential patients’ perception of Paxlovid, and continue to limit the addressable population.

Comirnaty has had some challenges as well adapting to an evolving pandemic situation. When initially released in late 2020, the vaccine showed ~96% efficacy against hospitalization or death after the 2nd dose, in Alpha variant COVID-19 patients. However, as the virus began to mutate, the efficacy adjusted accordingly.

Table 4: Comirnaty Efficacy Against Several Major COVID-19 Variants

|

Variant: |

Efficacy in adults against symptomatic COVID-19 infection following the 2nd dose |

|

Alpha |

89% |

|

Beta |

87% |

|

Gamma |

88% |

|

Delta |

84% |

|

Omicron |

15% (BA.1 subvariant); 28% (BA.2 subvariant) |

Source: Int. Immunopharmacol.

This reflects the challenge of using a newly-successful technology after a rapid advancement through the clinical trial process during a time of global pandemic impact. However, there may be some that question the decline, and may potentially be a target of litigation, similar to a relatively recent challenge from the state of TX.

Additionally, while most side effects encountered were mild, there have been some accounts of myocarditis or pericarditis (heart muscle or outer lining inflammation, respectively) that have occurred in patients. Given the potential seriousness of these latter occurrences, there may potentially be challenges to PFE here. While vaccine manufacturers are generally not liable for damages in civil actions that are related to a vaccine injury/death, additional protections were extended to protect PFE and MRNA from vaccine side-effect-related lawsuits until at least this year. My caution here is not that PFE may be liable to potential lawsuits regarding potentially reported side effects that may be vaccine-related. My caution is that it is a political/governmental protection extended to PFE here, and as such, the winds of politics shift frequently. Depending on potential future shifts, there may be sentiments that allow future action against PFE, MRNA, or other companies that contributed to the vaccine-related push during the COVID-19 pandemic. While this may be a remote chance that does not impact my consideration of PFE as a “buy”, it’s this potential that causes me to avoid a strong “buy” consideration for PFE.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author relies on external links for some information that may have appeared on this perspective. These external links, although believed to be accurate, have not been verified independently. Therefore the author is unable to guarantee their accuracy. The author is neither a certified investment advisor nor a certified tax professional, and does not claim to be either. The data presented here is for informational purposes only and is not meant to serve as a buy or sell recommendation. Investors and potential investors should do their own research and make their own decisions. In the event that an investor or potential investor does not feel qualified to make such a buy or sell decision on their own, they should consult a certified advisor that they trust or feel comfortable with. Investing may involve losses, including potential loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.