Summary:

- Apple hardware expected to struggle with iPhone shipments in focus on Q1 ’23 earnings with IDC survey data suggesting a -15% decline in shipments in Q4 ’22.

- We anticipate Apple to beat expectations, a combination of foreign exchange, inventory burn, and pricing to deliver above consensus figures and survey figures.

- Our model implies modest upside as we’re limited to a $155 price target, but find ourselves recommending the stock given the strength of the business versus peers.

- We don’t expect layoffs to be that significant but a more generous capital return policy in the form of share buybacks could add upside to our price target.

- We expect gross margins and operating margins to trend higher on the greater contribution of internally sourced components driving the bill of materials lower across the product stack over time.

Media Lens King/iStock Editorial via Getty Images

Apple investment thesis

We’re heading into the Apple (NASDAQ:AAPL) quarter with mixed indications from analysts and other companies on hardware particularly smartphone shipments heading into Q1 ’23 earnings results. That being said, we anticipate that the Chinese consumer might return even with macro uncertainty tied to the Russian and the Ukrainian War, which has put a drag on Chinese themes throughout the year. Despite the somewhat hazy outlook from the consensus we try our best to piece together some of the more useful points heading into the quarter.

Apple is expected to report Q1 ‘23 earnings results on February 2nd, 2023 after the market closes. Apple is expected to report revenue of $121.67 billion and dil. EPS of $1.94 for Q1 ‘23. We think there’s room for surprises on consumer hardware, particularly the iPhone though we’re in the middle of a mid-refresh year, indications from the sell-side suggest that diminished expectations imply a beat on hardware with continued strength in services and software revenue helping to offset the weakness in PC hardware cycle. We want to note that smartphones might be able to escape the malaise in computer hardware given the low correlation to mining hardware trends.

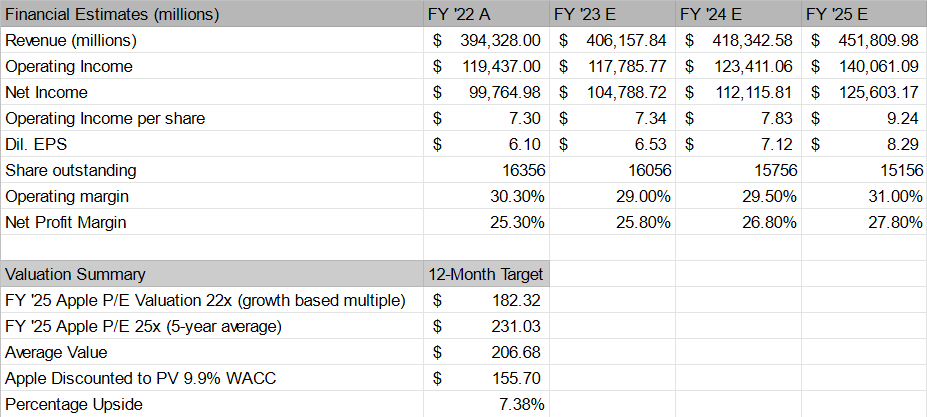

Furthermore, we expect AAPL to deliver revenue of $406.15 billion FY ’23 and dil. EPS of $6.53 for FY’ 23, which is higher than consensus at $402.54 billion and dil. EPS of $6.17 admittedly. We expect the company to deliver a beat mostly on better than expected iPhone channel sell-in, above expected contribution from services, and heightened gross margin contribution from using the company’s in-house silicon. We anticipate profitability trends to remain neutral to slightly positive depending on the degree to which AAPL layoffs workers.

We value the stock at $155.70, FY’25 estimated $8.29 dil. EPS, which implies an 18.78x forward earnings multiple to FY ‘25 results after factoring a 9.9% discount based on the firm’s WACC. We expect modest upside in the stock of +7.38% mirroring the types of returns a Dow component stock is likely to generate in this environment. An earnings result surprise in the form of better than expected outlook, or above consensus hardware shipments would make us incrementally positive.

We also recommend Apple to our readers as a Buy rated stock, though we believe upside is somewhat limited, we also find the stable dividends, growth, and diversification of portfolio sufficient in mitigating the downside argument, and would be one of the better blue chips to accumulate in the event of any recession or growth pullback in the economy.

Key Apple news items heading into the quarter

The recent update to the iMac and MacBook Pro or the PC line-up has been much needed given the lagging performance of Intel processors, and the need for differentiated hardware via the M2 Pro and M2 Max chipset. The drop-off in consumer PC shipments, which Intel (INTC) just reported and how much of that decline in shipments was tied to Apple simply moving on from the X86 ecosystem will be disclosed via the earnings release.

Foreign exchange could have a positive impact on the quarterly results, at least according to UBS analyst David Vogt:

“On January 21st, our estimates do not reflect the strength of four key currencies (EUR, GBP, YEN, and CNY) relative to the US dollar in the December quarter. Based on Apple’s revenue mix, the ~10% FX headwind guide for the Dec qtr is too conservative by 400-500bps (4-5 percentage points), mitigating rev and EPS risk ahead of earnings on Feb 2.”

The company will reference Chinese shipment results throughout the quarterly earnings call, and we anticipate that the near-term results will be fueled by Chinese sell-through and an improvement in product outlook, or expansion into new categories. We think the Mac refresh was much needed, and efforts to transition the company towards gaming and VR will be helpful in mitigating the negative sentiment tied to hardware this upcoming quarter.

Apple layoffs will be another question likely raised by analysts and members of the news media following the announcement of earnings. There could be a minor layoff, perhaps less than 5% of the workforce as Apple doesn’t really need to lean down right now, but given the fact that other companies are opting to shrink workforce in favor of enabling productivity it could give AAPL some added air cover when pertaining to costs. We anticipate that Apple has benefited from being disciplined with its cost structure throughout much of Tim Cook’s tenure as CEO of the company with operating margins in OEM hardware the highest in the segment, and company level operating margin hovering 29%-30% over FY ‘21 and FY ‘22, further drives that point home.

We think the weakness in labor force participation tied to Covid-19 has led to different companies employing different policies to bring workers back to the office whether digitally or to the corporate office. Furthermore, company culture, and an emphasis on profitable business units has kept many workers safely employed at AAPL whereas other tech companies are making cuts, but mainly in non-performing business segments, which Apple doesn’t have a non-profit contributing segment to speak of. Even legacy businesses like older accessories are thought to add contribution to profits in the form of on-going services and repair related revenue.

It’s also difficult to argue why Apple should reduce its retail footprint when it establishes further verticality in Apple’s distribution aside from its e-commerce channel and is instrumental in generating revenue from service and warranty agreements for hardware. It’s hard to imagine where Apple could make cuts aside from using the usual MBA approach of unloading the bottom 5% of performers at a business, assuming the cuts are made strategically, and the bottom 5% of performers are in areas of the company where cuts could be made.

Data on inventory and channel creates some concern among managers

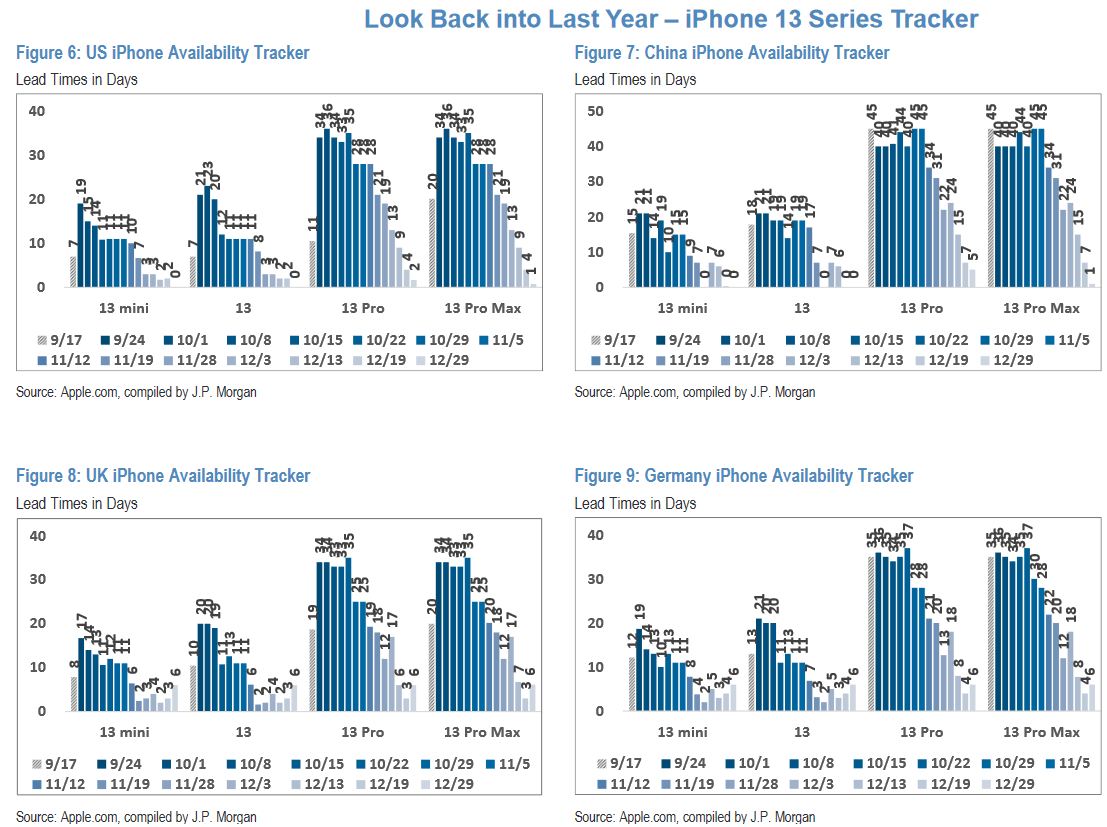

We also expect the data on inventory drain in the channel, or the availability of hardware components to be noteworthy. Analyst sentiment tied to inventory, and the lack of availability in certain markets could cause some anxiety, though the bias is on whether or not Apple was able to deliver enough devices for Q1 ’23, which is the seasonally strong quarter of the year.

Figure 1. J.P. Morgan Apple availability tracker

J.P. Morgan Apple Availability (J.P. Morgan)

Heading into the end of the year it seems supplies started to thin as we started to exit the year, though the days of available inventory, or availability tracker suggests that trends are kind of moderating when compared to prior-year according to the analyst who released the survey. Meaning, like much of the hardware data suggests from third-party reports, smartphone shipments are supposed to be bad this year, but the degree to which they’re bad is determined by the amount of phones that exit the inventory channel, and we think Apple did a fairly solid job heading into the close of the year clearing inventory thus pulling as much revenue forward into its Q4 seasonally strong quarter.

It’s not clear what analysts will say in response to some inventory clearing to deliver millions of units above consensus. For the most part, we haven’t heard a whole lot of news from other semiconductor names aside from Intel, and given its company-specific weakness, we have to look for the differences in computing sector performance to determine where businesses could outperform.

We think smartphones could buck the trend when compared to conventional PC hardware, but with Apple decoupling from x86 hardware, classifying Apple volumes in third-party reports becomes more difficult. The argument favors shareholders, as Apple can sustain higher margin PC shipments while working on IC (integrated circuit) or hardware design level improvements to its M-based architecture for desktop/notebook taking share away from the enthusiast segment of the PC market all while hiding the impact on industry data given the pull into ARM-based silicon for even more advanced graphical applications.

It’s why we’re hoping for added clarity on Apple shipments tied to computer hardware as we think the transition towards better hardware drives the arguments for better margins over time, more so than the impending job cuts that do little to drive variable costs lower. The reduction from hardware bill of materials and added control over hardware and software is what differentiates Apple.

It’s also worth noting that because Samsung (OTCPK:SSNLF) hasn’t reported earnings at the time of writing this article, we have no idea how well the component side of the business is doing out of Samsung, nor do we know if the decline in shipments was as indicated by the Q4’22 mobile smartphone shipment tracker by IDC. Based on the data from the third-party survey, device shipments for iPhone are supposed to decline by -14.9% for Apple and also -15.6% for Samsung.

Financial model notes to consider

Keep in mind analyst models embed like 79 million to 82 million iPhone shipments in Q1 ‘23 earnings quarter, which compares to the 85 million shipment figures released in the IDC report. Much of the positives are anticipated in other hardware categories and continued service revenue contribution.

Figure 2. Apple financial model

Trade Theory Financial Model on Apple (Trade Theory)

We think upside remains somewhat limited unless there’s something we haven’t already captured in our model. We anticipate revenue and earnings to swing marginally favorably by 2-3 percentage points on the basis of foreign exchange impact, and because the firm reports on GAAP basis, the FX impact of weaker dollar in the quarter helps with generating a surprise on results.

Furthermore, we acknowledge that survey data is mostly above consensus iPhone shipment figures, which means estimates are beatable on survey data alone, and also channel sell-in.

Our homework points to a better than expected quarter

We think, the stock will report a minor beat on earnings and revenue to exit FY ’23, and we expect gradual operating margin growth through FY ‘25, and estimate a weak environment for sales in FY ‘24 with modest growth of $418 billion FY ‘24 versus consensus revenue estimates $425 billion for FY ‘23. We think estimates might be difficult to meet this upcoming year given the overwhelming negativity heading into this part of the PC cycle, but because Apple operates a separate and independent ecosystem we think the exposure is limited, and Apple can deliver above x86 ecosystem in terms of returns.

In terms of blue chip hardware names, Apple likely recovers and generates positive revenue growth of 10%-12% in a major iPhone refresh year, i.e., iPhone 15 paired with stronger macro sentiment from China and less darker skies tied to U.S. macro makes us more optimistic and give us room to revise estimates up in our valuation model. For now, based on the inputs we’re working with, we expect modest upside of 7.38%, and recommend the stock at “buy” based on its strong track record of paying dividends, returning capital, and weathering economic storms given diversification of business portfolio and geographic mix along with a stellar balance sheet.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.