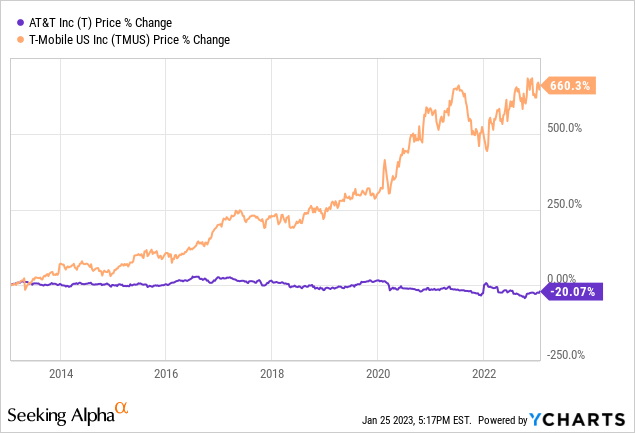

T-Mobile Vs. AT&T: 10 Years Of Growth Vs. 10 Years Of Stagnation

Summary:

- The last 10 years have been very different for AT&T and T-Mobile, telling a standard history of growth and stagnation.

- AT&T’s future doesn’t look so bleak, but the company’s valuation doesn’t reflect that.

- T-Mobile is likely to remain an industry leader in the future with a huge free cash flow.

- Both T and TMUS are Buys.

Nazan Akpolat/iStock via Getty Images

Main thesis

10 years ago the outlook for AT&T (NYSE:T) seemed pretty bright as the company seemed strong enough to outweigh the slowdown in subscriber growth. At the same time, T-Mobile (NASDAQ:TMUS) was a relatively small company that didn’t even hope to claim leadership in the industry. However, things have changed and T-Mobile’s market cap has already surpassed AT&T’s, reflecting an amazing organic growth that the company has been facing.

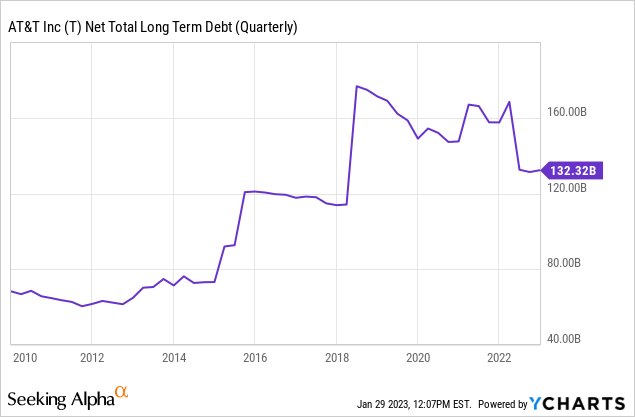

In fact, the situation in the industry has not changed much: there is still an oligopoly, and AT&T is still the largest company in terms of the number of subscribers. However, management’s actions in an attempt to diversify the business placed a huge burden on the company in the form of $136 billion in debt and slashed earnings growth. At the same time, T-Mobile has benefited from the rival’s troubles and attracted a large amount of customers with a massive Sprint acquisition.

AT&T: 10 years of value destruction, stagnation and management mistakes

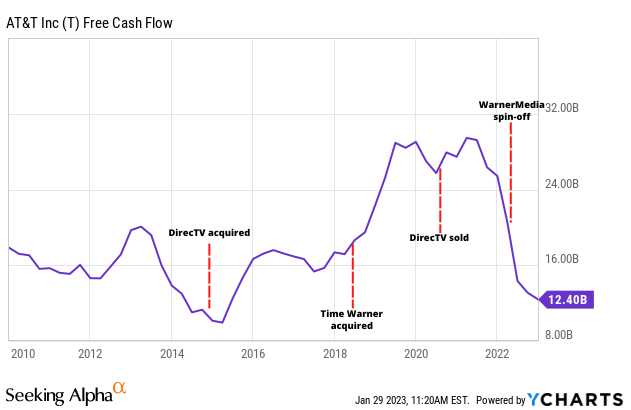

For the whole past decade, AT&T’s free cash flow and earnings were mainly flat as the whole industry faced a slowdown.

YCharts

It became clear that the company could no longer rely solely on its historically strong position in relation to competitors, action was required on the part of management.

Randall Stevenson, ex-CEO, wanted to transform AT&T into a media holding company by buying DirecTV and Time Warner for $153 billion ($200 billion including debt). This decision turned out to be a failure for two main reasons:

1) The strategy just didn’t make sense since there was no synergy.

2) They overpaid. Massively.

And we all know what happened next: the company lost 9 million subscribers and fired 50,000 people. Well, thanks to that, the debt burden increased several times, making AT&T one of the largest corporate non-bank borrowers in the world. The price paid for this failure is astonishing. AT&T burned huge sums of money due to mismanagement and bad strategy. And the aftermath of this mismanagement will follow the company for this whole decade. What makes this tragic is that while it was a time of consolidation for the industry, it was an incredibly important time for the company as it was still unclear after the 20th century if the company would follow the Verizon’s (VZ) path of slow development of its telecom segment or turn into something bigger.

Failed strategic deals didn’t just take a huge chunk of money from the company, they took away a decade the company could spend on reducing costs, improving margins and strategic deals that bring real value.

This huge debt has taken its toll on the company over the last 5 years and there is no guarantee that AT&T will be able to reduce the credit line. The company’s liquidity is very low as it only has $3.7 billion in cash, which is not enough for the development of the telecommunications segment and the purchase of new enterprises. AT&T has already followed the path of General Electric, which has sold its valuable assets just to normalize its debt burden.

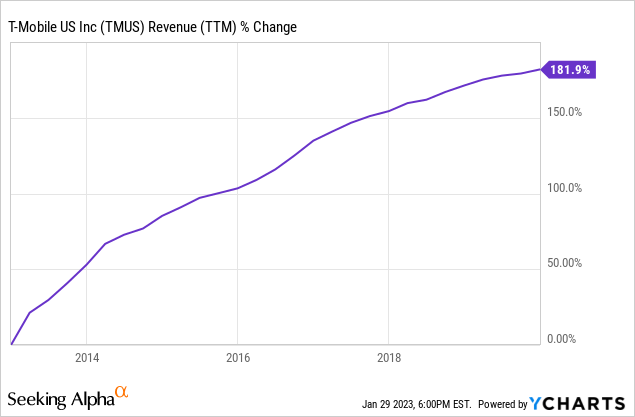

T-Mobile: 10 years of brand strengthening and rapid growth

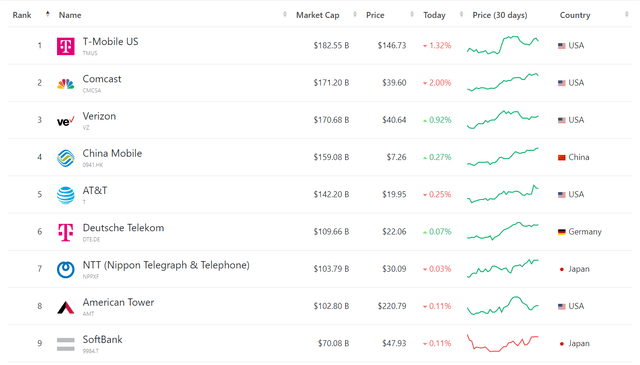

Nearly acquired by AT&T, T-Mobile’s story is truly amazing as it came all the way from nearly bankrupt to reaching a $182 billion valuation and claiming the first spot in the entire sector.

companiesmarketcap

The company got a boost in late 2012 when John Leger was hired as the new CEO. Under his leadership, the company managed to increase revenue by almost 3 times. T-Mobile decided to take advantage of the weakness of competitors and develop its own brand by offering something that AT&T and Verizon had not even thought of, such as not charging extra for exceeding the data limit.

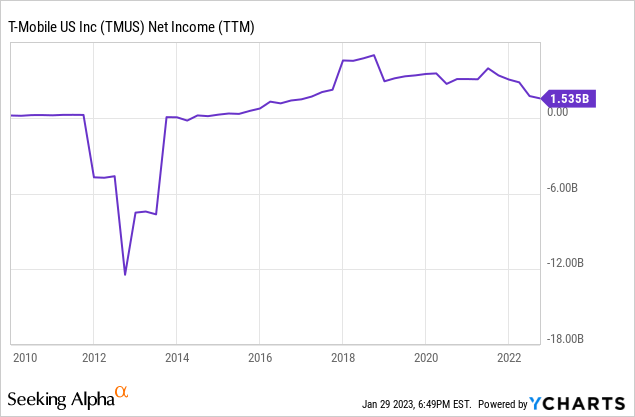

But most importantly, the company entered the zone of confident profitability.

The winning strategy has been to attract new customers by a flexible range of tariff plans with various bonuses and discounts. The company offers unlimited access to its networks at high speed (with a speed limit after 50 GB of traffic) for only $70 per month, while the same plan in Verizon costs $100 per month with 50 GB limit, while AT&T asks $85. This is reflected in lower ARPU.

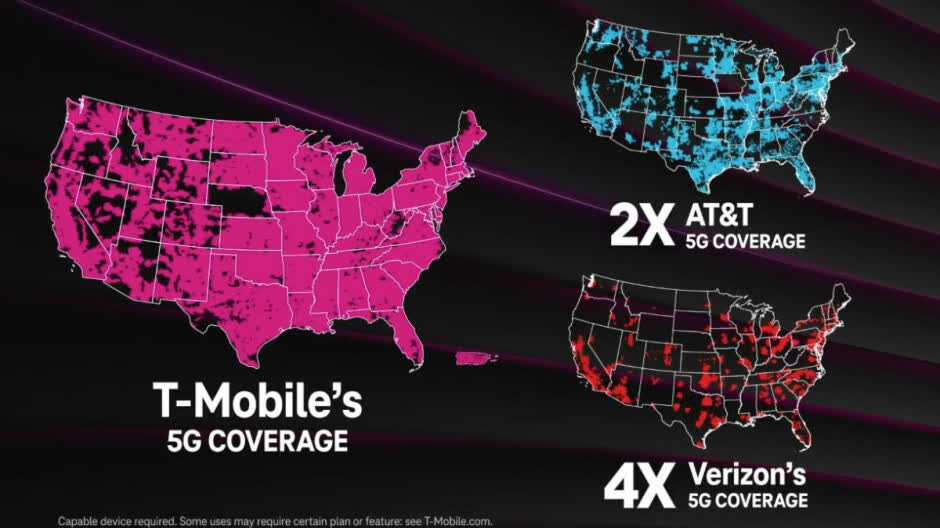

But the real turning point was the merger with Sprint, which added 55 million new customers to TMUS, bringing the total subscriber count to 102 million. The main value of the deal was that T-Mobile was able to roll out one of the first nationwide 5G networks in America at an accelerated pace. It is currently covering 260 million people with fast Ultra Capacity 5G.

PhoneArena

The company achieved this coverage through a merger in 2020 with Sprint, which at that time ranked 4th in terms of the number of subscribers in the country. As part of the $26 billion acquisition, T-Mobile significantly strengthened its market position by gaining access to networks on the 800, 1900 and 2500 MHz bands, increasing coverage by 33% to 94% of the US population and becoming the unrivaled leader in the controlled low-to-mid frequency bands (averaging 1.514 GHz) – more than AT&T and Verizon combined.

T-Mobile estimates that it will take another 2 to 4 years for competitors (AT&T, Verizon) to achieve similar coverage due to a general lack of midrange network development. In addition, the company boasts faster data transfer rates than competitors, averaging 55.1 Mbps across all frequencies in 2021, compared to Verizon’s 40.8 Mbps and AT&T’s 38.1 Mbps. In 5G networks, the gap is even greater: 118.7 Mbps vs 56 Mbps and 51.5 Mbps for competitors.

The company’s achievements are confirmed by independent research agencies. For example, Ookla ranked T-Mobile number one in their report on network performance, speed, and overall availability.

Which can bring more value?

The future

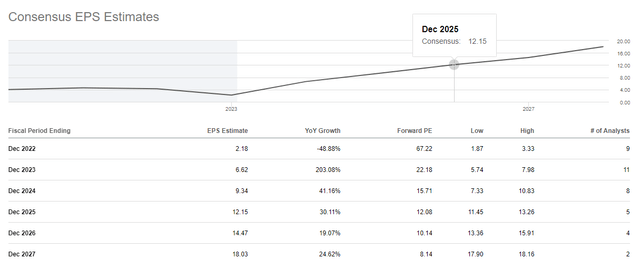

Going forward, T-Mobile’s revenue growth will occur due to the expansion of the subscriber base of postpaid tariffs by expanding the presence in megacities and strengthening positions in rural areas. The growth in the number of users, combined with the increase in revenue per user, provides an opportunity for rapid growth in the coming years. Tariff price hikes are also possible, given that ARPU is 11.8% lower than that of AT&T ($48.9 vs $55.43).

There is huge scope for EBITDA and profit margins growth due to modest growth in operating costs relative to revenue (as they simply have less to do in the network building) and reduced Sprint integration costs.

Seeking Alpha

As for AT&T, with recent deleveraging, the company is slowly embarking on its own development path. Explosive growth in capital expenditures is an attempt to get out of an eternally stagnant company. This is a positive signal, but you need to understand that competitors have been doing this all the time for many years and are not going to give away their share just like that. Now the task of AT&T is rather not to give up its market share, and not to take away someone else’s. At the same time, we will begin to observe the results of today’s investments no earlier than in a year and a half. The fiber segment looks promising, it is actively growing, but so far it is too small in the total operating income. But still, from a strategic point of view, the management is taking the right steps, which in the future will allow changing the image and finances of the company.

Valuations & Dividend

T-Mobile has a huge potential to pay dividends or repurchase its shares. The company expects to generate $13-14 billion in FCF in 2023 and $17 billion in 2024. If a company, at least like Verizon, pays 50% of FCF, then the dividend yield to the current market cap will be 4.6%.

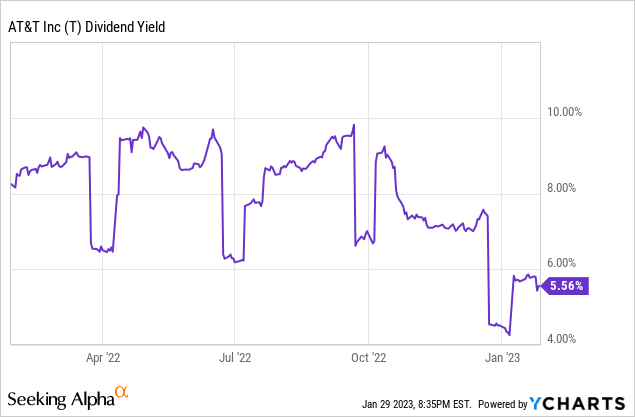

Despite the negative attitude of investors to dividends cut, this is the right strategic decision. Dividends hit the company’s balance sheet very hard, for example, in 2022 AT&T had to take out a $5.5 billion loan to pay off shareholders, and the payout ratio reached 104%. Reducing payments will allow businesses to direct funds for development and debt repayment, which will definitely play into the hands of investors over the 10-year horizon. At the same time, the company will still continue to pay impressive dividends. The management generated $14 billion in FCF in 2022 and expects to deliver $16 billion this year. This does not call into question the reliability of future dividend payments and their possible increase after 2023. The current yield is 5.5%.

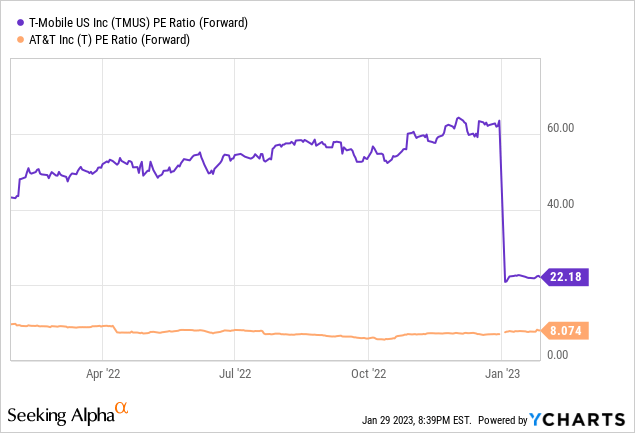

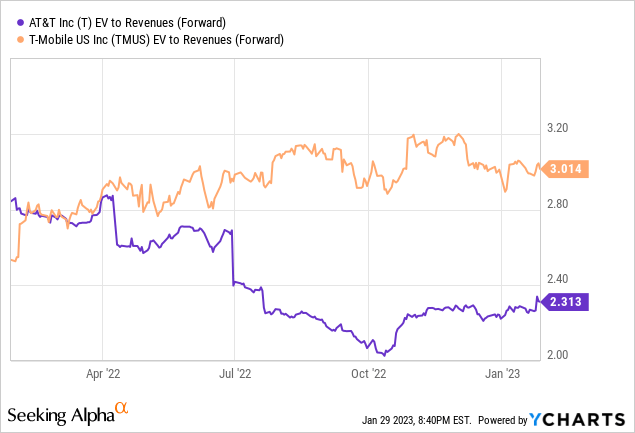

At the same time, T-Mobile is trading with a huge premium to AT&T reflecting future outlook and past performance.

Despite all problems, everything has its price and near-20-year lows at $19-$20 are in any case promising entry points for the company, especially since this is the first report in many years that shows some recovery. In the future, the discount will narrow both due to the growth of TMUS profits and revenue and due to the growth of T.

Conclusions

AT&T has consistently disappointed investors throughout the decade. Failed mega-deals were superimposed on the slow growth of the core business segment. At the moment, the company has taken the right steps to reduce its debt burden. And the situation no longer looks as deplorable as six months ago. However, the company’s problems remain, competition in this sector is growing, and T-Mobile is pulling ahead. Further development of 5G, cost reduction, and possible price increases will help turn T-Mobile into a real cash machine in the future.

Due to a huge discount, T is a Buy. Due to an amazing business outlook for the future, TMUS is a Buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.