Apple: Street Now Dressed In Red

Summary:

- Unadjusted Q1 revenue estimate average now calls for a decline.

- Demand destruction might be more than some think.

- Valuation remains above average in low growth environment.

CalypsoArt

Throughout most of this year, if you had said that technology giant Apple (NASDAQ:AAPL) would report a sales decline for its all-important holiday quarter, many would have thought you were crazy. The company’s sales have done quite well in most recent quarters, and due to this year’s calendar, Apple will have 14 sales weeks in this period instead of the usual 13. However, with just over half a month left in the quarter, street analysts now see the company reporting a year-over-year decline in revenues.

Due to the covid situation in China, Foxconn’s iPhone plant in Zhengzhou has experienced severe production disruptions. Recently, an analyst at Barclays stated that utilization is back up to 30%, from 20% at the end of November, but he also estimates that things likely won’t get back to normal until late January. He believes that Apple might start to see some demand destruction in the near term instead of the general consensus that purchases will just be delayed until supply comes fully back online. In that same article linked above, an Oppenheimer analyst cut his price target on Apple by $20 due to reduced fiscal 2023 estimates as production ramps back up more slowly than expected.

The idea of demand destruction may be more important than many people are realizing, and it was a key question in the note out by Credit Suisse last week where Apple estimates were cut. If you are looking to buy a new iPhone and it might take a week or two to get, you probably don’t mind the wait. However, if you are being told it might take months to get, perhaps you switch to another brand or find a cheaper iPhone that’s available. Remember, Apple has told us that the supply issue is mainly related to the Pro models, which are the higher-priced models. Don’t forget, Apple really segregated its smartphone offering this year, with the non-Pro models getting less of an upgrade, including not getting the newest chipset. Especially with Christmas and other key holidays like the Chinese New Year coming up, demand deferral may not be an option for some consumers the longer that these delays take.

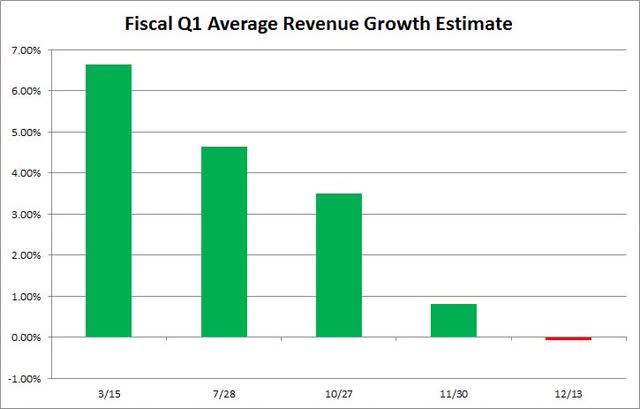

In my previous Apple article a few weeks ago, I detailed how street analysts had begun to cut their revenue estimates. That isn’t a great sign being that we’re still a few weeks away from the quarter’s end, and then it is another roughly 4 weeks until the company actually reports. Well, unfortunately, we hit a key point this week as the chart below shows, with the street average now calling for a year-over-year decline in Apple revenues for the December quarter. Roughly 9 months ago, the street was looking for more than 6.6% growth in this period, which in dollar terms would have been a more than $8.2 billion increase.

Apple Fiscal Q1 Revenue Estimate Average (Seeking Alpha)

There’s still at least one analyst out there calling for more than $130 billion in fiscal Q1 revenues, or growth of about 5%. Taking that number out would drop the overall street average by another roughly 20 basis points. It certainly wouldn’t surprise me to see more estimate cuts come in the coming weeks, especially if reports from the Foxconn plant don’t show dramatic improvement rather soon. Don’t forget that the above revenue estimate average is unadjusted, meaning it includes the help Apple is getting from the extra week in the quarter this year due to the way the calendar falls. Had Apple used the exact same 13-week period this year as last, the analyst average right now could easily be calling for say a 3% decline or perhaps even more.

As analysts cut their revenue numbers, it also means earnings per share growth might be much less than previously thought. 6 months ago, the street was looking for $6.54 for this fiscal year, ending in September 2023, as compared to $6.11 for the prior year period. Now, the street is only calling for a dime per share of growth, which likely means a decline if you factor in the calendar change. Don’t forget that Apple is also seeing about a 3% or so decline in the share count per year right now due to the buyback, so the current estimate average implies that net income for a 52-week year is down in the mid-single digits, percentage wise. This result, if it were to occur, would be Apple’s worst earnings per share growth year in the last four years.

I bring up the idea of earnings per share growth because it gets us a point about valuation. Apple finished Tuesday’s trading session at 23.43 times the current average street estimate of $6.21 in earnings per share for the 2023 fiscal year. If you go back to December 13th, or the closest previously available trading day for the last five years, Apple finished that respective day at 20.08 times the earnings per share figure it ended up reporting once that year’s final results were in. Thus, if earnings per share were to drop to say $6 and you applied a roughly average target multiple of 20, you’d be looking at a share price of $120. I’m not currently calling for Apple to fall that much, rather just showing an example of how you could be bearish on valuation here, especially with earnings per share not exactly expected to grow this year.

In the end, we’ve reached a key point in Apple’s fiscal Q1 as the average street estimate now calls for a year-over-year revenue decline. With the Foxconn iPhone plant in China not expected to get back to full production for several more weeks, analysts are now starting to think about the potential of demand destruction for the smartphone giant. While the headline number now shows a decline, the number is even worse when you consider the extra days in the quarter thanks to the calendar shift. With earnings per share expected to show the weakest growth in years, or perhaps even a decline, we might see more price target cuts coming. That means that unless the market quickly recovers into early 2023, Apple shares may have another leg lower from here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.