Summary:

- Apple’s ecosystem is industry-leading and the core of its moat.

- Apple’s exposure to China is its key risk.

- Apple is a visionary company that is built to last.

Ivan-balvan

Thesis

At a market cap of $2.5T, it’s hard to imagine Apple (NASDAQ:AAPL) maintaining its historic rate of growth well into the future. However, If Apple can harness the next generation of American technology well, I believe it can continue delivering superior returns to shareholders and should compound immensely over time. Apple is a world-class business and is a strong candidate for investment during severe market downturns, and it’s also a great stock to dollar-cost average or to serially dip-buy. I conservatively estimate Apple’s intrinsic value at $151.80/share, and as such, I rate it a Hold at its current level and recommend purchases at any level below that value.

Business Overview

Apple Inc. is a global leader in technology, innovation, and design. Apple is the largest tech company by revenue and the world’s biggest company by market cap. The iPhone is what rocketed Apple to the top, but the company hasn’t rested on its laurels – they have innovative products across the PC (personal computer), tablet, smartwatch, headphones, payments, and streaming markets. Apple is also known for its loyal customer base and distinctive corporate culture, and as such has immense brand value.

I recently read Jim Collins’ book Built to Last, which has drastically altered how I evaluate businesses. Financials are obviously important, but a corporate culture that breeds excellence is what makes a company visionary and long-lasting. Apple’s culture is shaped by its vision to create products that enrich people’s lives and its mission to deliver the best possible customer experience. They fit most of Collins’ criteria for a visionary company:

- Cult-like culture: Apple is known for its internal secrecy, and both Steve Jobs and Tim Cook alike (was) are known to get rid of people that don’t fit the Apple systems and policies.

- Preserve the core and stimulate progress: Apple has a core value of making products that enrich people’s lives and the world and is constantly innovating and challenging the status quo, creating new markets and categories with its products.

- Big hairy audacious goals: Apple sets ambitious and bold goals for itself: it created the first mass consumption personal computer, digital music player, smartphone, and tablet. These goals inspire and motivate employees to continue innovating and producing excellent products.

- Try a lot of stuff and keep what works: Apple has expanded its product ecosystem immensely not by being particularly genius, but by trying out a lot of products. AirPods, introduced in 2016, have become a cultural phenomenon and status signal. Apple Watch is pioneering personal health technology with a variety of health-related functionality. But Apple also shows a willingness to toss aside sub-optimal products: for example, HomePod Original, a smart speaker, (launched in 2018, discontinued in 2020, the 2nd generation has recently been re-released), and Airpower, a wireless charging mat (launched in 2017, canceled in 2019).

Collins says the most important role of the CEO is to be a ‘clock-builder’, not a time-teller. Steve Jobs built a beautiful clock during his tenure and certainly would be proud of the progress made by Tim Cook in my view. Collins also mentions that most visionary companies are not led by money-hungry executives. Tim Cook’s expected total compensation in 2023 is about 40% lower than 2022 total comp according to the 2023 Proxy Statement. I believe that he isn’t leading Apple just to collect the paycheck, but to continue building a wonderful and profitable clock.

Financial Overview

Apple is the richest company in the world. With roughly $50B in cash or cash equivalents, net income of nearly $100B, and about $90B in levered free cash flow, Apple is producing hefty returns for shareholders. Apple has even commanded the attention of the investing colossus Berkshire Hathaway (BRK.A) (BRK.B), which is one of the largest Apple shareholders.

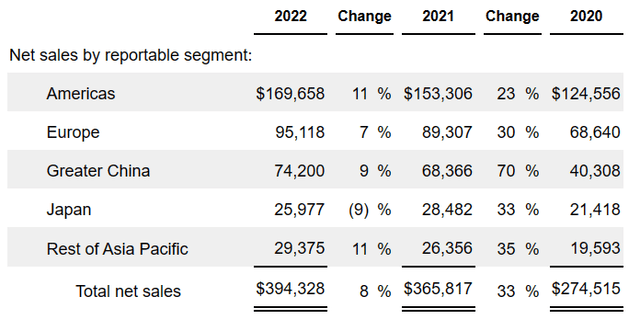

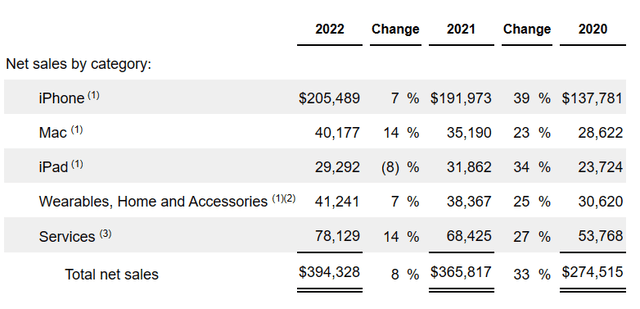

Apple saw a modest 8% growth in sales in 2022 despite downward FX (foreign exchange) pressure. A majority of sales came globally, with only Greater China sales benefitting from the FX environment:

Apple repurchased $90B in stock versus just over $9B in stock-based compensation, so investors today are getting rewarded with more ownership over time. In the past three years, Apple has bought back nearly $250B in stock and paid out $43.3B in dividends. Diluted EPS has grown from $3.28 in 2020 to $6.11 in 2022. According to the 2022 annual report, Apple had roughly $64B in accounts payable versus $28B in accounts receivable, $11B in short-term debt (maturing within 12 months), and $13B in unrealized losses on its balance sheet. Apple’s R&D expense (7% of sales) exceeded SG&A expense (6% of sales) in 2022, demonstrating its commitment to innovation and excellence.

The Apple Ecosystem

The breadth of the Apple Ecosystem is truly impressive. A product ecosystem is the concept of a business offering many interconnected products, in which owning some or all of the products greatly enhances the marginal benefit of owning each individual product. The ownership of an iPhone greatly enhances the value of owning AirPods and the Apple Watch (more so than owning other headphones or smart watches), and vice versa. The consistency of the experience across the different systems, since they all run on the Apple operating system (“OS”), is a net benefit for the user. Apple has amplified the value-add of its offerings and has developed a seriously wide moat as a result. Its chief product is the iPhone, which evolved from the iPod, and comprises just over 50% of total net sales. The iPhone is the starting point of the ecosystem for most customers.

Financial Results by Product Line (Apple 2022 Annual Report)

The seamless integration of its products makes the Apple ecosystem extremely sticky and profitable. Aside from connectivity benefits and OS consistency, Apple sells numerous accessories for all hardware products including charging cables, adapters, cases, keyboards, computer mice, the Apple Pencil, and watch bands, just to name a few. The iPhone also expedites the transition to a cashless society with Apple Pay by allowing for near-field communication (“NFC”) contactless payments with NFC-enabled payment terminals (maybe Apple will offer payment terminals next!). Apple also just recently leaned into the Buy-Now-Pay-Later (“BNPL”) payments scheme, which introduces a bit more complexity to their Payments proposition. These are typically small loans for everyday transactions that can be paid interest-free over a short time period, typically within 3 months. BNPL, if Apple follows the industry standard, requires the loan servicer (in this case Apple) to take the full value of the micro-loan upfront as a liability. In this structure, Apple recognizes the risk of non-repayment. This will also require Apple to compute and report on ECL, or expected credit losses, as a percentage of customers will ultimately default on these micro-loans. Apple only realizes revenue from these loans if customers are late on payments, at which point they are charged a penalty. However, late payments increase default risk and will translate into a higher ECL figure on Apple’s financial reports.

The deeper customers get into the Apple ecosystem, the more likely they are to stay. With short product lifecycles and consistent new-release schedules, Apple has organically grown one of the strongest ecosystems in the business world. Entire households can become ‘Apple families’ because the ecosystem continues delivering more value as more products are added. With the recent addition of 2nd Gen HomePod, Apple has further deepened its move into the ‘Sound’ proposition and further expanded its ecosystem.

This ecosystem is the core of Apple’s moat. When mixed with a fiercely loyal customer base (think: friendships ruined over green bubbles in a group chat), it’s easy to see why Warren Buffett, a value investor, would believe so strongly in Apple. Buffett commonly discusses the value of an economic moat and strong business fundamentals, and Apple exemplifies both of those characteristics.

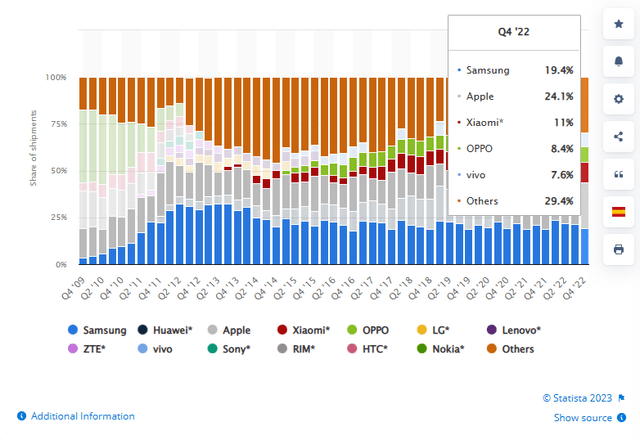

What’s more, Apple has a significant and growing market share in all of these segments. Notably, Apple overtook Samsung as the dominant participant in the global Smartphone market:

Smartphone market share by vendor 2009-2022 (Statista)

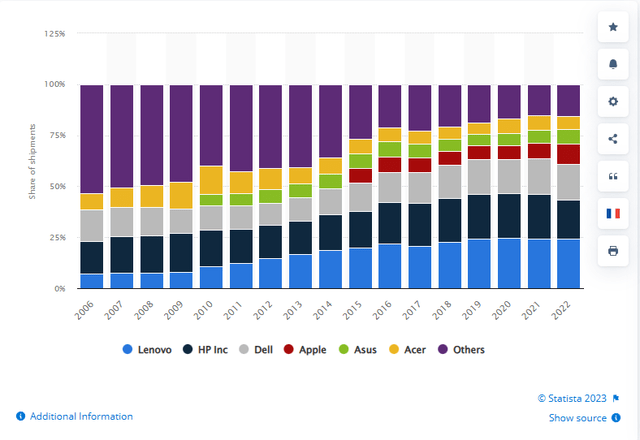

Apple is also a growing contender in the PC market:

PC market share by vendor 2006-2022 (Statista)

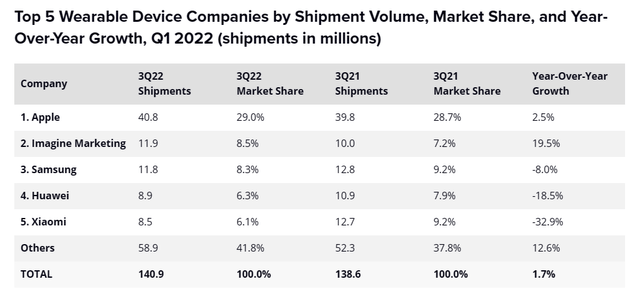

And Apple is the market leader in Wearables:

International Data Corporation

The Next Generation: Artificial Intelligence

Apple has been characteristically quiet recently. ChatGPT has taken the world by storm and has heralded the age of AI. Although it’s far from the first use-case of AI, no other AI application has seen the mass appeal or consumption that ChatGPT has generated. Many major tech companies have since made significant AI-related announcements; including Nvidia (NVDA), Adobe (ADBE), Microsoft (MSFT), Google (GOOG) (GOOGL), among others. Apple has utilized AI in many services like facial recognition on iPhone, sleep tracking on Apple Watch, Handwriting recognition on iPad, and music recommendations on Apple Music, but they haven’t made a major AI-related announcement in the recent ChatGPT-fuelled AI frenzy. Apple did announce the acquisition of the AI company WaveOne which reportedly offers very innovative AI-based video compression technology.

There’s no shortage of opportunities for Apple. It can utilize AI to make Siri more conversational, make a smart home even smarter, budget insights with Apple Pay, Apple Card, and BNPL, and expand further into the augmented and virtual reality landscapes. But that is purely speculation. The product engineers and R&D teams at Apple probably have a bottomless pool of ideas for AI-related innovations to continue delivering value for users and deepening the ecosystem. Ultimately, you’d be remiss to believe Apple is asleep at the wheel during this technological revolution.

Every Titanic Has Its Iceberg – The Risks

The tone of all my preceding comments has been overwhelmingly positive, but at a market cap of $2.5T, Apple may find trouble delivering market-beating long-term returns.

The key risk for Apple is its exposure to China. Apple relies heavily on China for its production, supply chain, and sales. China accounts for about 20% of Apple’s revenue and hosts most of its assembly facilities and suppliers. The rising tensions between China and the US will likely pose significant challenges and uncertainties for Apple. Apple is one of the largest buyers of chips globally, and the risk of severe chip supply disruption is exacerbated with Taiwan as the centerpiece of geopolitical tensions. Although Apple has begun diversifying its manufacturing and has taken steps to develop its own chips and components, the risks persist.

A majority of Apple’s sales are international, so it generally benefits from more international trade. The recent de-globalization narrative, driven by COVID and geo-political tensions, can lead to a material slowdown in international trade and a significant increase in tariffs. Tariffs can significantly compress Apple’s margins, which either leads to an increase in prices (and decrease in demand) or slower profit growth (or profit decline).

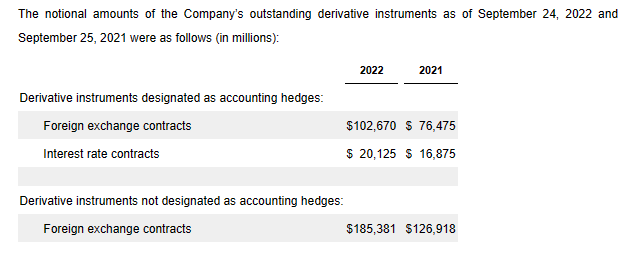

The degradation of global macro conditions can also compress margins, exacerbate the credit and collectability risk of trade receivables, and increase the likelihood of failure of derivative counterparties and other financial institutions. USD strength, which is significantly impacted by rising domestic interest rates, compresses Apple’s margins internationally and leads to a similar increase in prices or threatens profitability. If the USD weakens, as is expected when rates eventually begin to decline, Apple could also lose significant amounts on FX forward and options contracts, of which they’ve dramatically increased their use in 2022:

Hedge and Non-Hedge Derivative Usage (2022 Apple Annual Report)

Any dramatic or otherwise unforeseen rapid changes in the interest rate or FX environment globally could lead to significant write-offs on Apple’s income statement and even generate one-time quarterly losses as a big surprise to investors. This would cause volatility across the entire market which would not be specific to Apple, but the volatility experienced by Apple would naturally be much larger in magnitude.

A quick note on the relationship between interest rates and FX: rising rates domestically tend to increase USD strength in FX markets. However, this effect has been offset by other factors in the CNY-USD FX rate throughout 2022. Since the Yuan is loosely pegged to the USD, Chinese interest rates are influenced by US monetary policy. China’s economic growth relative to other countries that have USD-pegged currencies has contributed to the appreciation of the Yuan against the USD in 2022, despite the US hike cycle. China is also seeking to increase the global use of the Yuan, which may support its value relative to USD.

Apple has also faced data privacy headwinds and has come under pressure for monopolistic characteristics of the App Store. As the regulatory landscape continues shifting, Apple could be required to drastically alter its operating processes, which can be costly and introduce a lot of inefficiencies. Further, as a global business, Apple’s regulatory compliance requirements will become increasingly costly as more countries adopt stricter native data privacy laws.

Discussion on Valuation

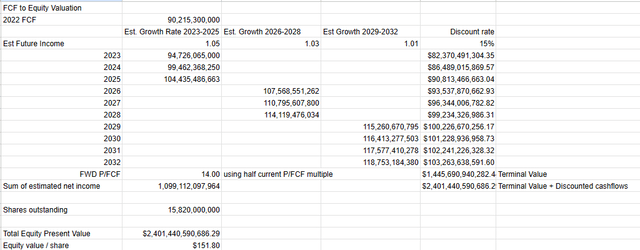

Apple’s valuation case is tricky. On one hand, my very simple and conservative discounted cash flow yields a valuation of $151.80 at current levels of free cash flow and half of the current price / FCF multiple.

On the other hand, it feels odd to conduct such a simple valuation of a behemoth like Apple. This ignores the subjective measures of brand value, network effects, and the economic moat, which are not immaterial for Apple. Those certainly demand a higher multiple than the value of 14 which I am using, however, valuation is a supremely subjective process and I believe strongly in using conservative metrics to reflect a margin of safety in the estimated price.

Simple DCF Valuation (Authors Calculation)

This assumes conservative growth rates of 5%, 3%, and 1% of levered free cash flow across the defined time periods and a very high discount rate. The 10-year CAGR of this sequence would be just under 3%, which I believe is a fair estimate in the face of the considerable risks Apple faces.

As previously discussed, rising geopolitical tensions will likely cause a material slowdown in sales growth in China. With a majority of foreign sales booking to China, this significantly impacts my future growth expectations. China has indicated intent to use its domestic business landscape as a lever for retaliation against potential Western aggression. Apple faces domestic competition in China which will likely be able to undercut prices due to tariffs and political actions. This can and likely will cause a material slowdown in Greater China sales growth, and wider foreign sales growth, in the future. Apple has shown really healthy growth in the European region, but Greater China is far and away the largest non-US market for Apple and a recent growth engine for the company.

Additional tariffs by either the US or China can materially impact the price of iPhones globally which will significantly impact the demand for the entire ecosystem. The iPhone is the central thread of the ecosystem, and a material increase in the price of the core device will not only reduce the demand for that device but also impact the demand curve of all downstream products. Further, although Apple can continue generating revenue from the existing stock of iPhones in circulation, this is not the case for all their other products. The existing stock of wearables does not produce material revenue, so the flow of new product sales significantly impacts the revenue growth of these segments. If this flow is materially impacted by demand reduction or price increases of upstream products, Apple could face severe margin compressions and sales slowdowns. In the event of a global recession, which seems to have an ever-increasing probability, Apple’s ecosystem could become a double-edged sword. If component costs increase, geo-political tensions rise, or a myriad of other risks are realized and the price of iPhone materially increases, the demand for both iPhone and all downstream ecosystem products will be severely impacted.

Apple has leaned deeper and deeper into its product ecosystem, with the iPhone as the chief introductory product. Apple has healthy price discrimination in its pricing structure, with the base model being $799 and the Pro Max coming in at a minimum of $1099 (more storage also increases prices, these are assuming 128GB storage). The 15 Pro Max is rumored to be increasing in price to $1299, with Apple seeking to generate more revenue from its higher-end customers. There are also rumors of a subscription model which would shift Apple toward an Annual Recurring Revenue model. This could allow Apple to generate growth by adopting the price discrimination model of bundling, with more expensive subscription options offering AppleCare, iCloud Storage, Apple TV or Music subscriptions, or a variety of other services included in larger product/service bundles. If Apple leverages this model successfully, it will make the ecosystem even stickier and strengthen its new product lifecycle to increase the flow of new product models in circulation. Apple can also offer much cheaper options to introduce a lower-income customer base. Apple resellers, typically retailers of cell services (Verizon, AT&T, T-Mobile, etc), periodically offer impressively low pricing for trade-ins and brand switches (switching from Samsung to Apple, for example).

The key to Apple’s future growth is two-tiered: 1) the flow of new and innovative products and 2) the deepening of existing customer relationships. Apple has shown extremely impressive and consistent growth in product sales historically and is continuing to sell new products at an impressive rate, as discussed briefly above. Continued relationship deepening is the next critical piece for Apple’s consistent growth, as we’ve discussed in length the importance of pushing customers deeper and deeper into the Apple ecosystem.

Conclusion

Apple is a global leader in technology, innovation, and design, with an immense economic moat. It has revolutionized many high-tech fields and has richly rewarded shareholders throughout the journey. Apple is clearly a world leader in business, which means it has a massive target on its back and countless competitors copying its business model and product innovations. Its brand value and economic moat provide a significant organic margin of safety, but Apple is not invincible. Ongoing challenges and risks such as regulatory pressures, supply chain disruptions, and geopolitical tensions can materially impact Apple’s revenue growth in the future and should be top of mind for any investor. As a whole, I believe Apple is a phenomenal business that is built to last.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.