Summary:

- Apple stock continues to exhibit exceptional revenue generation abilities.

- Difficult macroeconomic conditions and unfavorable FX have resulted in a slower start to FY23 than expected.

- Strong business fundamentals combined with excellent device engineering provide a solid foundation for the firm.

- The current share price leaves little room for value-oriented investors to jump in on the action.

- Nonetheless, AAPL remains an attractive company to keep on every investor’s watchlist.

EKIN KIZILKAYA/iStock via Getty Images

Investment Thesis

Apple Inc. (NASDAQ:AAPL) has provided investors with significant returns for a good part of the last decade.

Their continuous ability to maintain operating margins even through the toughest of macroeconomic conditions is remarkable and reflects the outstanding business model on which the firm operates.

Recent successes with new product launches have spurred public sentiment around the stock and suggests Apple’s management is acutely tuned-in to what consumers are demanding.

While competition ramps up and the smartphone market matures, Apple has begun diversification into more and more service oriented products to guarantee future cashflows remain strong.

However, a slight overvaluation means advocating for the building of a position into the stock from a value perspective is difficult.

Company Background

Apple is an American MNC headquartered in Cupertino, California who are currently the largest technology company in the world (by revenue). The economic and social influence their brand has generated over the past two decades has resulted in an incredibly loyal consumer base and desirable corporate image.

Apple Homepage – Ireland

Most of Apple’s revenue arises from their physical technology sales with primary sales coming from their iPhone lineup, Mac personal computer range or from the host of other technological accessories such as smartwatches the brand pursues. All of Apple’s products occupy the luxury end of personal technological devices.

A recent push by management to expand into the provision of digital services to accompany their hardware sales has proven hugely successful with significant revenue generation potential only just starting to be unlocked.

The immense scale on which Apple operates allows the company to exploit significant economies of scale and gives the firm a huge amount of negotiating power with suppliers.

Their streamlined manufacturing contracts, and impressive marketing power allow the company to extract significant margins from product categories in which other tech companies struggle to generate profits.

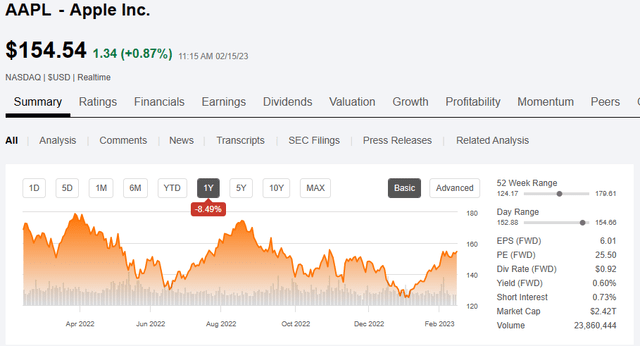

The company has the highest valuation of any company currently being publicly traded. Their current market cap of around $2.4T is truly incomprehensible.

Nonetheless, share prices have taken a not inconsequential hit over the past year proving that even Apple is not immune to the severe market correction that has been taking place since mid 2022.

Economic Moat – In Depth Analysis

From an economic moat perspective, Apple hosts an incredibly broad moat when compared to most other personal electronic device manufacturers. The primary drivers for their moat is their incredibly valuable brand image, extensive proprietary product ecosystem and the innovative nature of their products.

Apple is the market leader when it comes to luxury personal technology devices. Their ability to combine high-quality physical devices with an outstandingly intuitive user interface has allowed the company to create products which customers aspire to own.

Apple complements these products with a large portfolio of Apple-specific auxiliary services such as Apple Music, Apple TV and now, their ultimate collection package named Apple One.

The features these services provide help Apple enhance the eco-system effect of their brand which makes it significantly more difficult (both physically and psychologically) for consumers to switch to competing products.

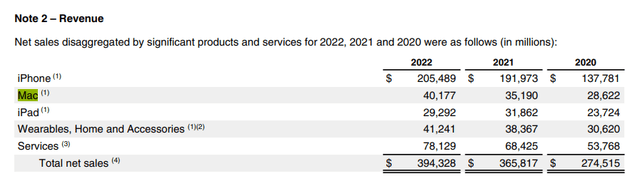

In FY22, Apple generated 16.7% of their total revenues from the provision of these software oriented services which highlights the company’s desires to continue diversifying away from being a pure hardware manufacturer.

Furthermore, the ecosystem Apple has created is closed off to other manufacturers which allows Apple to physically differentiate themselves from the competition’s product offerings. This creates a powerful “us versus them” mindset which is exhibited by a large portion of Apple customers through strong loyalty to the firm.

This focus on creating concrete switching costs to consumers through the development of highly efficient, usable yet proprietary tech solutions allows Apple to generate significant moatiness to their business operations.

Apple Press Release – 02/02/23

The company just achieved an installed base of over 2 billion active devices which represents a great milestone in Apple’s ongoing mission to capture more and more market share. It also suggests their current strategies of ecosystem improvements combined with great devices are working effectively.

Apple’s drive to develop high-quality products which target the upper-end of the consumer electronics market allows the company to charge customers a significant mark-up compared to many competing brands.

Crucially, this allows the firm to benefit from significant operational margins which further permits the firm to develop and deliver the very highest quality products available on the market.

Their core product is undoubtably the iPhone lineup. Apple essentially invented the first mass-popular touchscreen operated smartphone back in 2007 as well as developing the first touchscreen operating system, iOS.

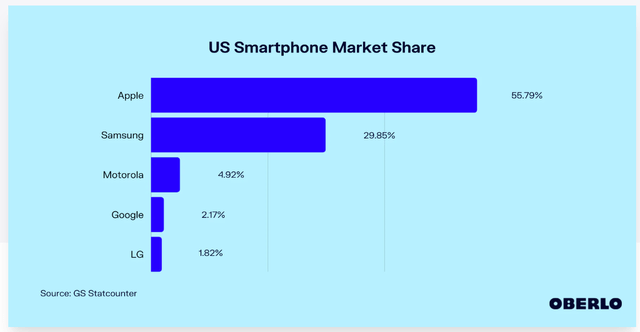

Over the last couple decades, the firm has refined their iPhone/iOS formula culminating in the firm controlling a whopping 55.79% of the US smartphone market’s sales by volume.

iPhone sales constitute approximately 52% of total revenues for the firm. While the iPhone 14 lineup has reportedly sold at slightly lower volumes than previous models, the revenues generated still grew a solid 7.3%.

Apple sells their iPhones at a roughly 110% markup to consumers. This is a truly outstanding example of highly profitable unit economics and illustrates the aforementioned ability for the firm to command truly premium prices for their devices.

The company also produces personal computers under the Mac lineup, consumer tablets under the iPad lineup and smartwatches sold as Apple Watches. These products are almost often the leaders of their respective market segments pushing the boundaries of performance and usability.

This unrivalled performance and usability comes from the extensive and quickly growing knowledge the firm possesses in chip design and manufacturing.

For over a decade Apple has been involved in the design and manufacturing (through a partnership with Taiwan Semiconductor Manufacturing Company (TSMC)) of their “Bionic” ARM-based mobile device chips.

In this time, Apple has become TSMC’s biggest client accounting for approximately a quarter of the chip foundry’s revenue in FY22.

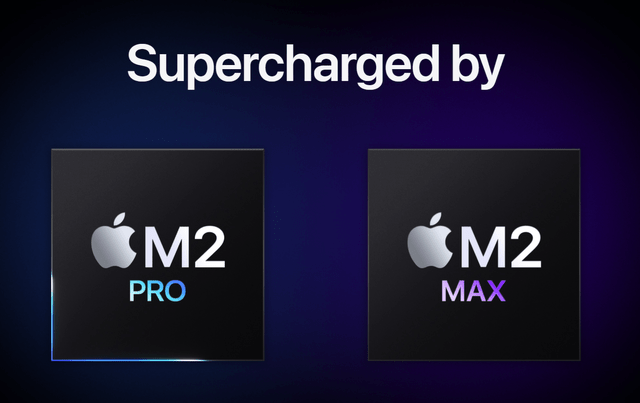

Over the past few years Apple has launched their own line of silicon semiconductor chips (branded as “M” chips) also based on ARM architecture for their Mac computers which has seen over 40% performance gains compared to their Intel counterparts.

This performance leap has boosted sales and popularity of their Mac personal computers with net sales growing a whopping 43% since FY20. User reviews of the products have been hugely positive and have helped rejuvenate the a reputation of innovation for the company.

The ability to design CPU and GPU chips for a specific set of hardware and software allows Apple to achieve huge levels of optimization in their devices. Usually such optimization is presented to consumers through increased performance, decreased power usage and the possibility to create new and innovative features.

The firm is continuing to work closely with TSMC to develop a new lineup of three-nanometer processes which should allow the firm to develop even more performant processors in the coming years. The partnership with the Taiwanese chip manufacturer also allows Apple to benefit from developmental and manufacturing cost-savings through shared resources and technologies.

When considering the company as a whole, it is clear Apple possesses an unrivalled brand image which permits the firm to charge consumers significant premiums for their products. The company is also laser focused on creating high-quality products which provide consumers with superior user-experience both through ecosystem benefits and through excellent hardware.

Therefore, The Value Corner believes Apple harbors a significant economic moat which should see its consumer base not only remain robust in the years to come, but potentially even continue growing as the firm expands further into smart-home devices.

Financial Situation

Apple has been a hugely profitable firm for the greater part of the last two decades. Their consistent EBITDA margins of 33% combined with a 5Y average ROIC of 34% gives just a small insight into the profit generating juggernaut that is Apple.

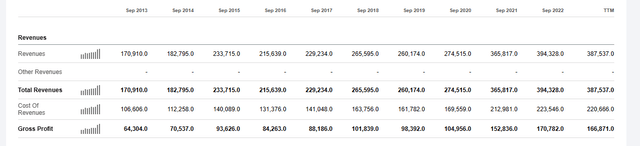

Seeking Alpha – AAPL – Financials

In FY22 Apple generated over $394B in revenues. This represents a growth of 8% compared to the previous year with the firm’s 5Y average revenue growth rate residing at a healthy 14%.

These strong historical revenue statistics illustrate the consistent rate at which Apple is increasing their cashflows year by year.

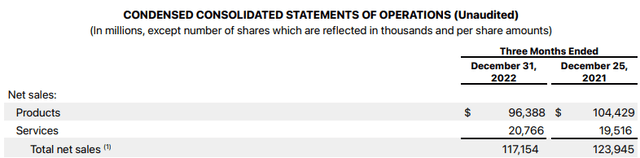

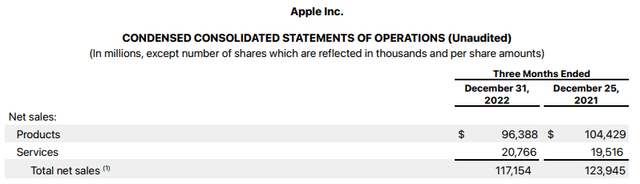

FY23 Q1 results did show a YoY decrease in revenues of 5% down to a total sum of $117.2B. This is the worst quarterly decline since 2016.

This quarterly decrease is the result of a challenging macroeconomic environment resulting in product shortages (such as the iPhone Pro series) and COGS increases.

The company’s CEO Tim Cook was also quick to point out that Apple actually increased total company revenue on a constant currency basis. In this quarter, the company had to endure an FX impact of almost -800 basis points.

Luckily, in the same quarter Apple managed to set an all-time revenue record of $20.8B being generated by their Services business.

Their continued focus on becoming not only a hardware manufacturer, but a digital multimedia and holistic service provider allows the firm to significantly diversify their revenue streams in relation to key rivals.

While Apple’s EPS of $1.88 in Q1 FY23 missed out on consensus estimates by 2.7%, the aforementioned impact significant FX headwinds had on revenues is absolutely to blame.

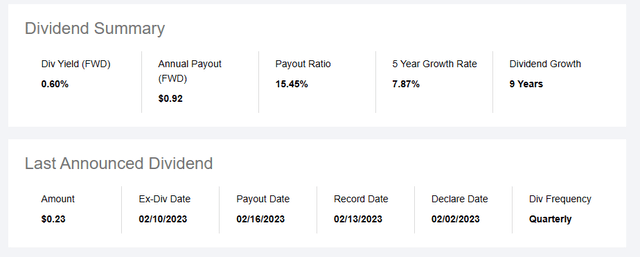

Seeking Alpha – AAPL – Dividend Scorecard

Apple’s board of directors has also declared a cash dividend of $0.23 per share of the Company’s common stock. Their expected FWD Dividend payout is a not unreasonable $0.92 per share.

Considering the incredibly difficult environment technology companies have had to navigate over the past year, the ability for Apple to continue generating strong revenue growth (even if only on a constant currency basis for Q1) is remarkable.

Their strong pricing power has allowed the company to generate 10Y average gross margins of almost 40% with an average net margin for the same time period resting at around 20%. Importantly, if looking back at only the past five years, we can see gross margins of 41% and net margins of 24.5%.

This suggests Apple has managed to find the delicate balance required between streamlining their operations structure while maintain a true dedication to exceptional customer experiences.

Of course, it is important to note that FY22 total net sales were down $6B to just $117B compared to $123B in FY21. This was a result of softening sales in all their regions of operations compounded by an unfortunate 7.7% decrease in net product sales.

However, Apple’s FY22 net Services sales actually increased 6.2% foreshadowing the incredible revenues this business segment produced for them in Q1 of FY23.

Apple’s FY22 also saw significantly lower proceeds from sales of marketable securities compared to FY21. When combined with the huge currency losses the firm encountered from receiving a significant portion of their sales in currencies other than the U.S. dollar, it is still impressive how profitable the company was able to remain.

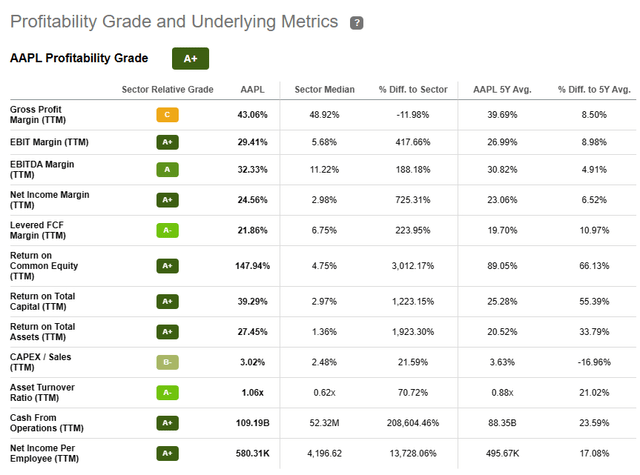

Seeking Alpha – AAPL – Profitability

The revenue and profit generating prowess that Apple holds has earned the company an A+ Profitability rating according to Seeking Alpha’s Quant. I believe this is an absolutely representative snapshot depiction which captures the firm’s continued operational masterclass.

Apple’s balance sheet looks to be in relatively healthy shape too. Their total current assets for FY22 are $135B while current liabilities for the same period amount to $154B. This leaves the company with a debt/equity ratio of 1.96.

Their quick ratio (current assets minus inventory divided by current liabilities) is just 0.77.

While these fiscal stability metrics might indicate that Apple technically faces illiquidity, the possibility of a scenario arising where this becomes an issue is incredibly small.

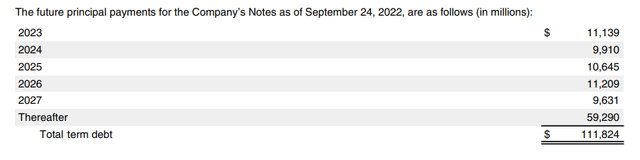

The firm also has $111B in long-term debt as of September 24. 2022. While $11.3B will mature in FY23, around $52.3B (or just under half of their total amount) will mature by the end of 2027.

Furthermore, to manage their interest rate risk on certain U.S. dollar-denominated fixed-rate debts, Apple has entered into interest rate swaps to effectively convert the fixed interest rates to floating interest rates on a portion their total debts.

The firm has also managed foreign currency risk on certain of its foreign currency-denominated debts by entering into foreign currency swaps to effectively convert these debts to U.S. dollar denominated ones.

This all suggests that Apple has been refreshingly conservative with their debt taking which is exactly what investors want to see from hugely profitable firms.

Overall, it is safe to say that the firm does not face any risk from their balance sheets, particularly when considered against their profit generating abilities and huge annual revenues.

Valuation

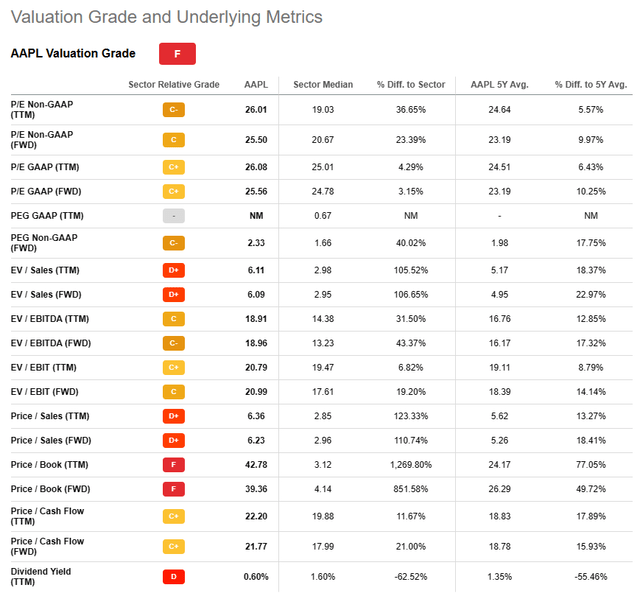

Seeking Alpha – AAPL – Valuation

Seeking Alpha’s Quant has assigned Apple with an F Valuation rating. Unfortunately, I am largely inclined to agree with this assessment as it represents a fair evaluation of Apple’s current share price when considered against traditional valuation metrics.

The firm is currently trading at a P/E GAAP ratio of 25.56 and a P/CF ratio of 22.20. While these figures are not particularly alarming, when considered against a FWD Price/Book ratio of 39.36 and an EV/Sales FWD of 6.09, it is clear that the current share price represents an intrinsic overvaluation of the firm.

Seeking Alpha – AAPL – Summary

From an absolute perspective, Apple shares have decreased on a one-year basis by around 10%. However, it must be noted that the company has managed to maintain an at times significant premium with its share price when compared to the firm’s raw value.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe the stock may begin to exhibit some bearish tendencies moving towards the second quarter of FY23. Thereafter, much depends on the prevailing macroeconomic conditions and the ability of the US and Global economies to achieve a soft landing on inflation to ensure the technology sector avoids a significant gulley.

In the long term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique product offerings combined with the undoubtable branding power places little doubt in my mind over the almost undoubtable returns the company should be able to provide to shareholders.

Therefore, it is almost impossible to argue that the current share price would leave any tangible room for value investors to become involved with the stock. While the firm has supported a historic overvaluation, the risk associated with investing in a company which fails to exhibit any real undervaluation is significant.

Risks Facing Apple

The primary risk facing Apple arises from the simple reality that the firm operates in the consumer electronic industry. This exposes the firm to significant competition and the possibility for failed execution of new products.

The company must continue to focus on innovation while ensuring profit and operating margins remain intact. Simultaneously, the company must ensure that any new products are suitable for the markets they are intended to serve. Even a small failure in the execution of a device of service could leave the firm widely exposed to competition from the likes of Samsung and Google.

From an ESG perspective, Apple must ensure that their desire for a walled ecosystem does not come at the expense of environmental sustainability. Many critics have voiced concerns over the inability for users to easily and cost-effectively repair Apple devices which has undoubtedly hurt the companies ‘friendly’ brand image.

While strict EU regulations on right-to-repair have forced the company to comply with certain standardization requirements and repair mandates, the clear unwillingness from the firm to engage in these actions voluntarily has soured many consumers taste for their products.

Apple also faces the risk of a possible cyber-security breach as the firm holds huge amounts of sensitive customer information on their devices. Recent allegations and misconducts by the firm pertaining to the gathering of user data has also placed significant amounts of scrutiny on Apple’s internal data security standards.

Summary

Apple has had an incredibly impressive history from an investor standpoint. Their robust, premium business model, excellent operational efficiency and iconic brand reputation have allowed the company to become a true profit generation powerhouse. There really is a reason the firm boasts the highest valuation of any company in the world.

Unfortunately for value investors, current share prices have left the company trading somewhere between a fair to overvaluation compared to the company’s intrinsic value. Nonetheless, the promise of strong cashflow generation combined with a diversified revenue generation portfolio suggests significant returns are on the horizon.

As a short-term investment, I believe there is some volatility in-store for the stock as tricky macroeconomic conditions continue to dominate the marketplace. However, in the long-term I believe their undeniable position as a market leader places Apple firmly in position to generate great shareholder value.

While the company is great, the current price simply isn’t. Apple’s current valuation is a prime example of, “the right company at the wrong price”. Their historic value generation abilities combined with an ability to hold a premium share price undoubtedly creates an allure for even the most diligent of value investors to plunge into a position.

However, for the time being, I will not be building a position in the firm.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.